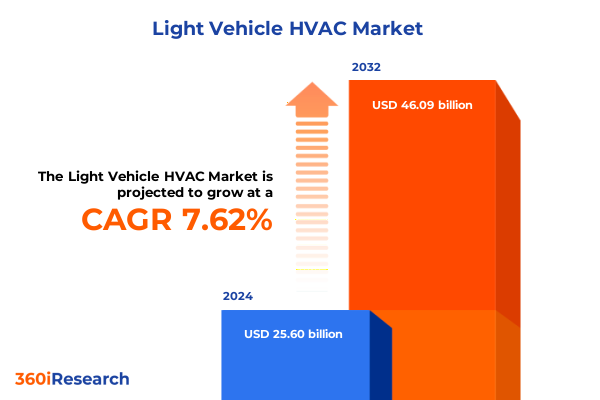

The Light Vehicle HVAC Market size was estimated at USD 27.53 billion in 2025 and expected to reach USD 29.25 billion in 2026, at a CAGR of 7.63% to reach USD 46.09 billion by 2032.

Unveiling the Underlying Dynamics Redefining Light Vehicle HVAC Systems in an Era of Rapid Technological Advancements and Regulatory Evolution

The landscape of light vehicle HVAC systems has undergone profound transformation as automakers and component suppliers strive to meet evolving expectations for sustainability, passenger comfort, and energy efficiency. In addition to the traditional focus on heating and cooling performance, modern automotive HVAC units now integrate advanced controls, lightweight materials, and eco-friendly refrigerants that align with stricter emissions and environmental regulations. Electrification trends have propelled redesigns of compressor architectures and power management strategies, ensuring that HVAC functions remain seamless in hybrid and fully electric platforms. Moreover, shifting consumer preferences toward personalized cabin climates and connectivity features have driven the adoption of smart sensors and predictive algorithms, enabling adaptive climate control systems that optimize thermal comfort while conserving energy.

As a result, research and development efforts are increasingly centered on modular architectures, scalable control platforms, and multi-zone capabilities. Regulatory frameworks in North America, Europe, and Asia Pacific continue to impose stringent efficiency thresholds and refrigerant phase-down schedules, mandating innovation across every component-from blowers and condensers to control units and evaporators. Against this backdrop, stakeholders must navigate a complex interplay of technological advancements, policy mandates, and competitive dynamics to develop HVAC solutions that deliver reliability, performance, and regulatory compliance. This introduction serves as a foundation for understanding the critical forces shaping the trajectory of the light vehicle HVAC market today.

Exploring Pivotal Technological, Regulatory and Market Shifts Transforming the Landscape of Light Vehicle HVAC Systems in 2025 and Beyond

In recent years, the light vehicle HVAC sector has experienced a paradigm shift driven by the growing prominence of electrified powertrains and the imperative to reduce carbon footprints. Electric and hybrid vehicles require HVAC systems that minimize parasitic power consumption, prompting innovations such as variable-speed electric compressors and advanced heat pump integration. Simultaneously, the push for connected mobility has led to the emergence of cloud-enabled climate control modules capable of preconditioning cabins based on remote smartphone commands and real-time weather forecasts.

Regulatory landscapes have likewise undergone transformative change, with governments implementing more aggressive fuel economy standards and refrigerant regulations. The phase-out of high-global-warming-potential refrigerants under the Kigali Amendment has accelerated the transition to alternatives such as R1234yf and emerging low-GWP blends. In parallel, consumer awareness of particulate emissions has spurred demand for cabin air quality enhancements, including high-efficiency filtration and ionization features. These technology and regulatory shifts are reshaping supply chains, compelling raw-material suppliers and component manufacturers to embrace light-weighting, modular platforms, and sustainable manufacturing practices. As these transformative currents converge, industry participants must adapt their strategies to harness new opportunities and address the emerging complexities in the light vehicle HVAC ecosystem.

Assessing the Comprehensive Cumulative Impact of 2025 United States Tariffs on Light Vehicle HVAC Supply Chains, Costs and Industry Strategies

The United States’ imposition of tariffs on imported automotive components in 2025 has exerted a multifaceted impact on the light vehicle HVAC industry. Under a March 26 proclamation by the White House invoking Section 232 of the Trade Expansion Act of 1962, a 25% tariff was applied to passenger vehicles and key automobile parts, including engines and powertrain assemblies, thereby extending the levy to critical HVAC components sourced from global suppliers. Concurrently, Section 301 tariffs on goods from China reached rates of up to 20%, while a doubling of initial levies has amplified costs for electronic controls, blower assemblies, and specialized motors integral to modern climate systems.

These measures have translated into elevated landed costs for raw materials such as steel and aluminum-essential for condensers, evaporator housings, and heat exchanger cores-which are now subject to up to 25% additional import duty. Component manufacturers face the dilemma of absorbing tariff-related expenses or passing them along the supply chain, potentially eroding margins or driving price increases for vehicle OEMs and aftermarket distributors. Moreover, heightened customs inspections and documentation requirements at U.S. borders have introduced logistical delays, complicating just-in-time inventory strategies during peak production cycles.

In response, supplier networks are reevaluating sourcing models, with some investing in reshoring initiatives or diversifying procurement to non-tariffed regions. Manufacturers are also exploring tariff engineering approaches-such as separating subcomponents to reclassify duty codes-and advancing local content certification under USMCA provisions to mitigate levy impact. Collectively, these adaptive strategies underscore the resilience of the HVAC supply ecosystem, yet highlight the strategic challenges imposed by the cumulative weight of U.S. tariffs in 2025.

Illuminating Key Segmentation Insights Revealing How Component Types Vehicle Classes and Sales Channels Drive Innovation in Light Vehicle HVAC

Component specialization continues to redefine competitive differentiation within the light vehicle HVAC landscape. Blowers now incorporate brushless direct-current motor technology and precision fan blades that balance airflow uniformity with acoustic thresholds. Compressors are segmented across centrifugal, reciprocating, rotary, and scroll designs, each selected to optimize efficiency across diverse duty cycles and vehicle architectures. Similarly, condensers leverage microchannel, plate-fin, and tube-fin geometries to achieve light-weighting and enhanced heat transfer, while evaporators integrate microchannel and combined plate-fin-and-tube configurations to support both single-zone and multi-zone applications. Control units have evolved from manual dials to advanced automatic climate control modules that utilize machine-learning algorithms to anticipate thermal loads and adjust compressor frequencies accordingly. Heaters, too, are adapting through compact electric resistance elements and high-efficiency heat-pump integration to serve both cold-climate operations and rapid cabin warm-up protocols.

The vehicle type axis further accentuates divergent HVAC requirements. Passenger cars demand compact, high-efficiency units optimized for urban driving cycles, whereas sports utility vehicles and light commercial vehicles emphasize robust performance under heavier payloads and variable external conditions. Vans, with extended cabin volumes, necessitate larger evaporator cores and multi-zone control architectures to ensure uniform comfort. Fuel type segmentation-covering gasoline, diesel, electric, and hybrid platforms-introduces unique thermal management challenges. Diesel and gasoline drivetrains rely on waste-heat recovery for cabin heating, while EV and hybrid systems require external heating sources and sophisticated thermal pumps to maintain efficiency and range. Mild and plug-in hybrids occupy an intermediary space, demanding flexible HVAC interfaces capable of transitioning between internal combustion and electric drive modes.

Temperature-zone segmentation has spurred the deployment of single, dual, tri, and multi-zone systems, with each incremental zone adding complexity to ducting, actuator controls, and refrigerant circuit balancing. Finally, the aftermarket and OEM sales channels present distinct value propositions. While original equipment manufacturers focus on seamless integration and validated system performance, the aftermarket favors refurbished units, replacement components, and retrofit systems that extend service life and support fleet maintenance operations. These segmentation insights reveal the rich tapestry of design trade-offs, performance objectives, and cost structures that define the contemporary light vehicle HVAC market.

This comprehensive research report categorizes the Light Vehicle HVAC market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Vehicle Type

- Fuel Type

- Temperature Zone

- Sales Channel

Navigating Regional Dynamics Highlighting Divergent Growth Drivers and Regulatory Influences Across Americas EMEA and Asia Pacific HVAC Markets

Regional dynamics impart unique contours to the light vehicle HVAC market, shaped by local regulations, climate profiles, and automotive industry structures. In the Americas, stringent fuel economy standards and ambitious greenhouse gas targets stimulate demand for high-efficiency thermal management solutions. North American assembly plants increasingly source HVAC components that comply with U.S. steel and aluminum content requirements, while regulatory incentives encourage adoption of low-GWP refrigerants. Mexican and Canadian operations leverage integrated supply networks under USMCA to optimize component flows and minimize tariff exposure, reinforcing the region’s resilience to global trade disruptions.

Across Europe, the Middle East, and Africa, the market is influenced by unified regulatory frameworks such as the EU MAC Directive, which mandates phased refrigerant transitions and sets stringent leakage thresholds. European OEMs and suppliers prioritize microchannel condenser technologies and advanced heat-pump systems to meet both environmental compliance and growing consumer expectations for cabin comfort. In the Middle East, extreme ambient temperatures accelerate the uptake of dual-and-multi-zone HVAC architectures in luxury vehicle segments. Sub-Saharan Africa presents an emerging opportunity, as rising vehicle ownership and aftermarket demand drive the expansion of service infrastructure and component distribution networks.

The Asia-Pacific region remains the largest production hub for light vehicle HVAC systems, with China, Japan, South Korea, and India spearheading cost-competitive manufacturing and rapid technological adoption. Domestic regulations in Japan and South Korea advance energy efficiency standards, while China’s push for local content and EV integration propels heat-pump innovation. India’s market growth is underpinned by rising vehicle electrification incentives and a burgeoning aftermarket for retrofit climate-control systems. These regional insights underscore the multiplicity of regulatory, climatic, and industrial factors that shape the global light vehicle HVAC ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Light Vehicle HVAC market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives Shaping the Competitive Landscape of Light Vehicle HVAC Systems Globally

Leading industry players are investing heavily in research, strategic partnerships, and capacity expansions to secure competitive advantage in the light vehicle HVAC domain. Denso has intensified its focus on electric compressor modules and integrated heat-pump systems, leveraging its expertise in automotive thermal management to support major OEM electrification roadmaps. Valeo is championing modular climate control platforms that incorporate sensor fusion and AI-driven algorithms, enabling adaptive airflow distribution and predictive maintenance alerts. Mahle has expanded its condensers and evaporators footprint in North America, aligning production capacity with regional content requirements and localized sourcing strategies.

Hanon Systems continues to build on its global footprint by establishing joint ventures in emerging markets to accelerate component localization and mitigate tariff exposure. Modine is advancing its thermal storage and phase-change material technologies, targeting both improved cabin comfort and enhanced energy efficiency in electric and hybrid vehicles. Meanwhile, Calsonic Kansei’s integration of lightweight materials and microchannel heat exchangers exemplifies the drive to reduce system mass and enhance packaging flexibility. These companies are also cultivating alliances with software vendors and semiconductor suppliers to develop end-to-end HVAC architectures that integrate seamlessly with vehicle electronics networks. Collectively, these strategic initiatives underscore the emphasis on innovation, localization, and collaboration that defines the competitive landscape of light vehicle HVAC systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Light Vehicle HVAC market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air International Group

- Behr-Hella Thermocontrol GmbH

- Calsonic Kansei Corporation

- Delphi Technologies

- Denso Corporation

- Duckling Industry Co. Ltd.

- Eberspächer Group

- Hanon Systems

- Hubei Meiyang Auto Parts Co. Ltd.

- Johnson Controls International plc

- Mahle GmbH

- Mitsubishi Heavy Industries Ltd.

- Sanden Holdings Corporation

- Subros Limited

- Tata AutoComp Systems Ltd.

- Valeo S.A.

- Visteon Corporation

- Webasto Group

Delivering Actionable Strategic Recommendations Empowering Industry Leaders to Optimize Supply Chains Innovate Products and Strengthen Market Position

To navigate the evolving complexities of the light vehicle HVAC market, industry leaders should prioritize localized manufacturing and supply chain diversification. Establishing regional production hubs and forging strategic partnerships with local suppliers can mitigate tariff risks and reduce logistics lead times, while certification under trade agreements ensures preferential duty treatment for high-value components. Simultaneously, investment in advanced manufacturing techniques-such as additive manufacturing for heat-exchanger prototypes and digital twins for system validation-can accelerate product development cycles and reduce physical testing requirements.

Leaders must also cultivate cross-functional collaboration between thermal systems, software, and vehicle electrification teams to deliver cohesive HVAC architectures. Integrating AI-driven controls and cloud connectivity will elevate cabin comfort experiences while enabling real-time performance analytics. Furthermore, expanding modular platform approaches that support single, dual, tri, and multi-zone configurations enables rapid customization across diverse vehicle segments. Strengthening aftermarket engagement through predictive maintenance services and retrofit climate-control solutions will unlock recurring revenue streams and reinforce brand loyalty among fleet operators and consumers.

Finally, a proactive approach to refrigerant management-embracing low-GWP refrigerants, leak detection sensors, and eco-friendly lubricants-will align product portfolios with global environmental mandates. By combining supply chain resilience, technological collaboration, and sustainability leadership, HVAC system providers can secure long-term differentiation and drive value creation in an increasingly competitive marketplace.

Detailing Rigorous Research Methodology Combining Primary Interviews Secondary Data and Triangulation Techniques to Ensure Analytical Robustness

This research leverages a rigorous methodology that combines primary interviews with senior executives at leading OEMs, tier-one suppliers, and aftermarket distributors, with secondary data drawn from industry associations, trade publications, and regulatory filings. Primary data collection involved structured interviews and online surveys administered to thermal management engineers, supply chain directors, and market analysts to capture nuanced perspectives on technology adoption, material sourcing, and tariff mitigation strategies.

Secondary research sources included publicly available documents from government agencies such as the U.S. Department of Commerce, White House proclamations on trade policy, and international standards bodies overseeing refrigerant regulations. Company reports, investor presentations, and technical white papers provided detailed insights into product roadmaps, R&D investments, and capacity expansion plans. Data was triangulated through cross-validation of insights from multiple stakeholders, ensuring consistency and reliability.

Quantitative analysis employed a mix of trend extrapolation and comparative benchmarking across regions and segmentation variables. Qualitative evaluations assessed technological readiness, regulatory alignment, and supply chain adaptability. All findings underwent peer review by subject-matter experts to validate assumptions and refine the final narrative. This comprehensive approach ensures robust, fact-based insights to inform strategic decision-making within the light vehicle HVAC ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Light Vehicle HVAC market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Light Vehicle HVAC Market, by Component Type

- Light Vehicle HVAC Market, by Vehicle Type

- Light Vehicle HVAC Market, by Fuel Type

- Light Vehicle HVAC Market, by Temperature Zone

- Light Vehicle HVAC Market, by Sales Channel

- Light Vehicle HVAC Market, by Region

- Light Vehicle HVAC Market, by Group

- Light Vehicle HVAC Market, by Country

- United States Light Vehicle HVAC Market

- China Light Vehicle HVAC Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Reflections on the Evolving Light Vehicle HVAC Market and Strategic Imperatives for Stakeholders to Navigate Emerging Opportunities

In summary, the light vehicle HVAC sector is at the intersection of electrification, sustainability mandates, and evolving consumer expectations. Technological breakthroughs in electric compressors, heat-pump integration, and AI-enabled control units are reshaping system architectures, while regulatory imperatives are accelerating the phase-out of high-GWP refrigerants. Concurrently, the cumulative impact of U.S. tariffs in 2025 has underscored the importance of supply chain agility and regional manufacturing strategies. Segmentation insights reveal that component design, vehicle classes, fuel types, temperature-zone configurations, and sales channels each present distinct performance and cost considerations, necessitating tailored solutions.

Regional variations-from North American content rules and EU environmental directives to the growing manufacturing prowess of Asia Pacific-highlight the need for localized approaches and global collaboration. Leading companies are responding through strategic investments in capacity expansion, modular platform development, and sustainability initiatives. To capitalize on emerging opportunities, industry participants must adopt integrated product development processes, diversify procurement networks, and embrace digital transformation across the HVAC lifecycle. These converging trends affirm that the future of light vehicle thermal management will be defined by innovation, operational resilience, and unwavering commitment to environmental stewardship.

Engaging Call To Action: Connect with Ketan Rohom to Unlock In-Depth Market Insights and Accelerate Decision Making for Light Vehicle HVAC Solutions

Ready to explore the full depth of market intelligence and proprietary analysis on light vehicle HVAC systems? Engage with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive report. Through direct collaboration, you will gain exclusive access to detailed regional breakdowns, segmentation deep dives, and strategic insights tailored to your enterprise objectives. Don’t miss the opportunity to leverage this in-depth research to inform your product development roadmap, supply chain decisions, and competitive positioning. Reach out today to initiate a conversation and accelerate your strategic planning with actionable data that drives results.

- How big is the Light Vehicle HVAC Market?

- What is the Light Vehicle HVAC Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?