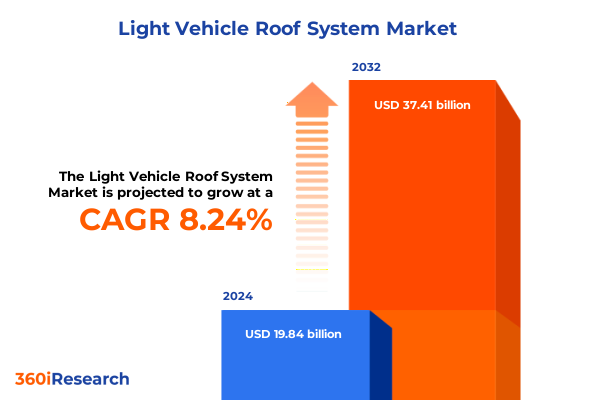

The Light Vehicle Roof System Market size was estimated at USD 21.47 billion in 2025 and expected to reach USD 22.94 billion in 2026, at a CAGR of 8.25% to reach USD 37.41 billion by 2032.

Opening Perspectives on the Evolution and Strategic Significance of Light Vehicle Roof Systems in Modern Automotive Design

The light vehicle roof system has transcended its traditional role as a mere structural component to become a focal point of innovation, design, and consumer engagement within the automotive industry. As consumer preferences evolve toward enhanced visibility, seamless connectivity, and sustainable materials, roof systems are increasingly engineered to deliver aesthetic appeal alongside functional excellence. This shift underscores the critical importance of understanding the multifaceted dynamics that drive product development and adoption across global markets.

With advances in lightweight composites, integrated electronics, and adaptive glazing, the roof assembly now contributes to vehicle performance, safety, and customer satisfaction in unprecedented ways. OEMs and aftermarket suppliers alike are challenged to balance the demands of cost management with the imperative for high-performance, durable solutions that meet stringent regulatory standards. This growing complexity highlights the necessity for a holistic overview that captures technological trajectories, competitive landscapes, and regulatory frameworks shaping the future of roof systems.

Transitioning from traditional steel and aluminum constructs to sophisticated hybrid assemblies, this analysis sets the stage for a deep dive into the transformative forces at play. By examining key market drivers, barriers, and emerging trends, this introduction frames the strategic context for the subsequent exploration of tariffs, segmentation insights, regional dynamics, and actionable recommendations that will guide stakeholders in steering their organizations toward sustained growth and differentiation in the evolving light vehicle roof system arena.

Unveiling the Revolutionary Technological and Consumer-Driven Disruptions Reshaping Light Vehicle Roof System Architectures and Functionalities

Rapid progress in materials science, electric mobility, and digital connectivity has precipitated fundamental shifts in the design, manufacturing, and application of light vehicle roof systems. Where once a rigid metal panel sufficed, today’s roofs are sophisticated platforms that integrate photovoltaic elements for energy harvesting, sensor arrays for occupant safety, and adaptive shading technologies that respond to environmental conditions. This convergence of functionality necessitates a departure from legacy design paradigms toward modular architectures that support seamless integration of emerging components and features.

Moreover, consumer expectations for expansive glass surfaces and panoramic views have driven significant growth in multi-pane and single-pane panoramic sunroof solutions. At the same time, stringent CO₂ emissions targets and fuel efficiency standards amplify the demand for lightweight composites such as carbon fiber and fiberglass. These materials not only reduce overall vehicle weight but also enhance rigidity and durability, prompting manufacturers to rethink production processes and supply chain configurations.

Innovation extends beyond product form factors to encompass digital engineering tools that accelerate prototyping and validation cycles. Virtual reality and computational fluid dynamics, for instance, enable rapid iteration of roof geometries and material thicknesses, ensuring optimal acoustic performance and aerodynamic efficiency. Collectively, these technological and consumer-driven disruptions are redefining the competitive landscape and establishing new benchmarks for performance, sustainability, and user experience in the light vehicle roof system domain.

Assessing the Comprehensive Effects of 2025 United States Tariff Policies on Supply Chains Material Costs and Industry Competitiveness

In 2025, an array of United States tariff adjustments targeting steel, aluminum, and select composite inputs has had a tangible ripple effect on the global light vehicle roof system supply chain. Increased duties on primary metals have elevated raw material costs, compelling original equipment manufacturers and tier-one suppliers to reassess sourcing strategies. This has spurred a gradual shift from traditional aluminum and steel toward higher-value composite solutions, even as the latter remain subject to their own import levies.

The imposition of additional tariffs on fiberglass and carbon fiber precursors has introduced complexity in regional production footprints, with many suppliers opting to relocate partial manufacturing operations closer to end-market assembly plants. This realignment aims to minimize cross-border transport expenses and circumvent punitive duty rates. However, it also introduces heightened operational risk in regions lacking established infrastructure or skilled labor pools, underscoring the need for diversified procurement channels.

Downstream, the pass-through effect of tariff-induced cost increases has influenced OEM pricing strategies and product mix decisions, particularly in segments where cost sensitivity is paramount, such as mainstream passenger cars. Conversely, premium vehicles featuring panoramic sunroofs or advanced hybrid roof systems have maintained more stable pricing structures, reflecting consumer willingness to absorb incremental costs for enhanced functionality. In sum, these tariff measures have prompted a comprehensive reevaluation of procurement networks, manufacturing footprints, and pricing models across the light vehicle roof system industry.

Illuminating Market Dynamics through Application Distribution Operation Material and Product Segmentation Perspectives Driving Growth Opportunities

Market dynamics within the light vehicle roof system sector are best understood through a detailed examination of application, distribution, operation, material, product, and vehicle type dimensions. Commercial use cases, for example, prioritize durability, ease of maintenance, and cost efficiency, driving preference for manual roof systems in fleet vehicles and light commercial pickups. In contrast, personal use applications increasingly demand electric roof mechanisms and panoramic glazing for enhanced user experience, prompting OEMs to prioritize advanced hybrid and electric roof solutions.

From a distribution channel perspective, original equipment manufacturing remains the dominant avenue for integrating roof assemblies into new vehicle platforms, while the aftermarket segment continues to expand, fueled by retrofit opportunities for sunroof and moonroof installations. Operation type segmentation reveals distinct growth trajectories: electric roof systems are gaining traction through improved actuator technologies, hybrid roof systems balance manual reliability with automated convenience, and manual roof systems maintain a presence in cost-sensitive models.

Material type plays a pivotal role in performance and cost considerations. Composite alternatives, notably carbon fiber and fiberglass, offer superior strength-to-weight ratios, whereas laminated and tempered glass solutions deliver premium aesthetic and safety features. Aluminum and steel roof components persist as foundational materials, particularly in fixed roof applications and pop-up sunroofs, where structural integrity is paramount. Product type segmentation highlights diverse customer preferences, with fixed roofs prevalent in sedans and hatchbacks, flush-mount sunroofs in compact coupes, and moonroofs-both tilt-and-slide and electric variants-found across premium passenger cars. Lastly, vehicle type analysis underscores the rising prominence of electric vehicles, including battery electric and plug-in hybrid variants, alongside continued demand from SUVs, MPVs, and light commercial vehicles, each shaping roof system specifications in unique ways.

This comprehensive research report categorizes the Light Vehicle Roof System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Distribution Channel

- Operation Type

- Material Type

- Product Type

- Vehicle Type

Comparative Analysis of Regional Adoption and Innovation Trends Across Americas Europe Middle East Africa and Asia-Pacific Markets

The Americas market for light vehicle roof systems is characterized by robust demand in the United States and Canada, underpinned by consumer affinity for premium sunroof features and growing adoption of electric vehicle platforms. Regional OEMs are increasingly collaborating with domestic tier-one suppliers to establish localized production hubs for composite roof assemblies, mitigating tariff exposure and reducing lead times. Latin America, while more price sensitive, presents retrofit potential for aftermarket sunroof installations, driven by urbanization trends and a burgeoning middle class.

In Europe, Middle East, and Africa, regulatory drives toward carbon neutrality and stringent safety mandates have accelerated the uptake of lightweight materials and advanced glazing technologies. European automakers lead in integrating panoramic sunroofs and adaptive shading systems as standard or optional equipment, leveraging mature supply networks in Germany, Italy, and Eastern Europe. Middle Eastern markets are embracing premium roof solutions in luxury SUVs, while African adoption remains nascent, constrained by economic volatility but poised for future growth alongside infrastructure development initiatives.

The Asia-Pacific region stands out for its rapid expansion in electric vehicle manufacturing and a strong aftermarket culture for sunroof and moonroof retrofits. China’s domestic OEMs are investing heavily in automated roof assembly lines, capitalizing on economies of scale to offer high-performance hybrid roof systems at competitive price points. Japan and South Korea continue to innovate in glass technology, with laminated and tempered solutions enhancing safety and comfort. Meanwhile, Southeast Asian markets are emerging as strategic low-cost manufacturing bases, attracting investments from global suppliers seeking to diversify production footprints and address rising labor costs in traditional centers.

This comprehensive research report examines key regions that drive the evolution of the Light Vehicle Roof System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Competitive Differentiators of Leading Manufacturers Influencing the Light Vehicle Roof System Ecosystem

Leading players in the light vehicle roof system ecosystem are distinguished by their strategic investments in advanced materials, digital integration, and global footprint optimization. Major tier-one suppliers have forged partnerships with automotive OEMs to co-develop modular roof platforms that seamlessly integrate solar cells, noise-cancelling technologies, and heads-up displays. These alliances facilitate early alignment on design parameters and streamline validation processes, reducing time to market while enhancing product differentiation.

Furthermore, several established manufacturers have initiated joint ventures in Asia and North America to establish high-capacity production lines for composite roof panels, leveraging localized supply chains to mitigate tariff impacts and transportation costs. Others are leading the charge in in-house R&D, pioneering hybrid roof concepts that combine manual override capabilities with electric actuation, thereby offering a transitional solution for markets balancing modernization with cost constraints.

Mid-tier suppliers and niche innovators are carving out competitive advantage by focusing on specialized product segments such as panoramic sunroofs and multi-pane configurations, embedding smart sensors for real-time structural health monitoring and predictive maintenance. Concurrently, new entrants specializing in advanced glazing solutions are gaining traction through collaborations with vehicle electrification initiatives, offering laminated and tempered glass variants that enhance occupant safety while supporting weight reduction objectives. Collectively, these strategic maneuvers underscore a landscape of intense competition and continuous innovation among roof system stakeholders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Light Vehicle Roof System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACS France

- Aisin Seiki Co., Ltd.

- ASC, Inc.

- BOS GmbH & Co. KG

- Cieplastic S.p.A.

- GAHH LLC

- Inalfa Roof Systems Group B.V.

- Inteva Products, LLC

- Johnan America Inc.

- Magna International Inc.

- Valmet Automotive Inc.

- Webasto SE

- Yachiyo Industry Co., Ltd.

Imperative Strategic Initiatives for Industry Leaders to Capitalize on Emerging Technologies and Market Transitions in Roof System Development

To thrive amid accelerating change, industry leaders must adopt a proactive, integrated approach that bridges material innovation, digital transformation, and resilient supply chain strategies. By forging cross-functional teams that unite engineering, procurement, and market intelligence, organizations can more effectively identify emerging materials and fabrication techniques, rapidly validate prototypes, and scale promising solutions across global production networks.

Diversification of sourcing channels is equally critical. Establishing strategic partnerships with suppliers in multiple regions will mitigate the impact of trade policy fluctuations and material shortages. Simultaneously, investing in flexible manufacturing platforms capable of accommodating composite, glass, and metal roof modules will enhance responsiveness to shifting customer demands and regulatory requirements.

Digitalization initiatives should extend across the value chain, from virtualized design and simulation tools to integrated quality monitoring systems on the factory floor. Implementing advanced analytics for predictive maintenance of production equipment and real-time supply chain visibility will reduce downtime and support just-in-time inventory management. Finally, embedding sustainability metrics into product development roadmaps-such as recyclability, embodied carbon reduction, and lifecycle assessments-will resonate with environmentally conscious consumers and comply with tightening global emissions standards, positioning organizations for long-term success.

Comprehensive Research Framework and Methodological Approach Ensuring Robust Data Integrity and Actionable Insights for Market Intelligence

The research underpinning this report combines primary and secondary methodologies to ensure comprehensive coverage and data integrity. Primary research involved in-depth interviews with C-suite executives, engineering directors, and procurement leads across OEMs, tier-one suppliers, and aftermarket specialists. These discussions provided firsthand insights into technology roadmaps, procurement strategies, and regional operational challenges.

Secondary research encompassed a systematic review of industry publications, regulatory frameworks, patent filings, and trade association reports. This desk‐based analysis was augmented by data from government trade statistics, enabling an accurate portrayal of tariff impacts and cross-border material flows. Market intelligence was further enriched through participation in key industry conferences and virtual symposiums, where emerging trends and case studies were analyzed in real time.

Data triangulation was employed to reconcile findings from multiple sources, ensuring that qualitative insights aligned with quantitative indicators such as production volumes, import-export balances, and material pricing indexes. A rigorous validation process, featuring peer reviews with subject matter experts in automotive engineering and materials science, confirmed the reliability of interpretations and recommendations. By integrating these methodological pillars, this research delivers an authoritative foundation for strategic decision-making in the light vehicle roof system sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Light Vehicle Roof System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Light Vehicle Roof System Market, by Application

- Light Vehicle Roof System Market, by Distribution Channel

- Light Vehicle Roof System Market, by Operation Type

- Light Vehicle Roof System Market, by Material Type

- Light Vehicle Roof System Market, by Product Type

- Light Vehicle Roof System Market, by Vehicle Type

- Light Vehicle Roof System Market, by Region

- Light Vehicle Roof System Market, by Group

- Light Vehicle Roof System Market, by Country

- United States Light Vehicle Roof System Market

- China Light Vehicle Roof System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Synthesis of Critical Insights and Future Trajectory Considerations Guiding Stakeholders in the Evolving Light Vehicle Roof System Landscape

The landscape of light vehicle roof systems is undergoing a period of profound transformation, driven by technological breakthroughs, evolving consumer expectations, and shifting regulatory imperatives. This report has highlighted how electrified and hybrid roof mechanisms, advanced composites, and smart glazing solutions are redefining performance benchmarks while reshaping supply chains in response to trade policy changes. The interplay of segmentation dimensions-from application and distribution channel to material and vehicle type-reveals nuanced growth pockets and emerging opportunities for targeted product development.

Regionally, the Americas, Europe, Middle East, Africa, and Asia-Pacific each exhibit distinct adoption curves, influenced by local regulatory landscapes, consumer preferences, and manufacturing capabilities. The competitive arena is marked by strategic alliances, joint ventures, and relentless innovation among tier-one suppliers and component specialists, all vying to deliver differentiated value propositions. Through a combination of primary interviews, secondary data analysis, and rigorous validation protocols, this study provides a cohesive narrative of market forces and future trajectories.

Ultimately, stakeholders equipped with these insights are empowered to make informed investments in research and development, optimize supply networks, and align product portfolios with the most compelling growth vectors. As the industry marches toward ever-greater integration of sustainability, connectivity, and automation, the strategic priorities outlined herein will serve as a compass for navigating complexity and capturing long-term value in the dynamic realm of light vehicle roof systems.

Accelerate Strategic Decision-Making and Unlock Competitive Advantages by Securing the Comprehensive Light Vehicle Roof System Market Research Report Today

For organizations seeking to sharpen their competitive edge and confidently navigate the complex terrain of the light vehicle roof system market, securing a comprehensive market research report is an essential next step toward strategic success. Contact Ketan Rohom, Associate Director of Sales & Marketing, to gain immediate access to the full suite of insights, detailed segmentation analyses, and region-specific outlooks that will empower your decision-making process.

By partnering directly with our expert team, you will benefit from personalized guidance on tailoring the data to your unique business objectives, enabling you to swiftly capitalize on emerging technologies, mitigate supply chain risks, and optimize product portfolios. With timely delivery and customizable options, this report serves as a foundational resource for identifying high-impact growth opportunities and reinforcing stakeholder alignment.

Reach out today and embark on a journey to transform raw data into actionable strategies that will fuel your organization’s advancement in the dynamic and fast-evolving light vehicle roof system landscape.

- How big is the Light Vehicle Roof System Market?

- What is the Light Vehicle Roof System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?