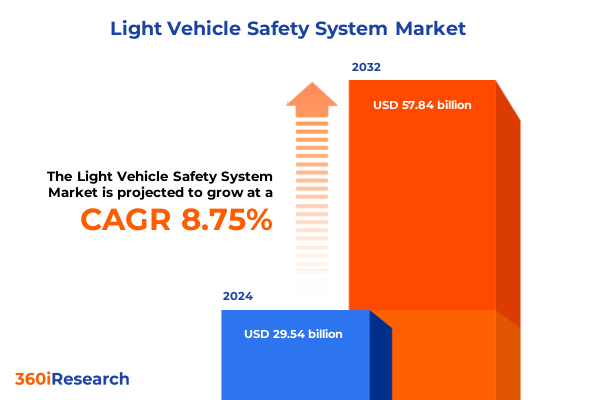

The Light Vehicle Safety System Market size was estimated at USD 32.14 billion in 2025 and expected to reach USD 34.46 billion in 2026, at a CAGR of 8.75% to reach USD 57.84 billion by 2032.

Exploring the emergence of advanced light vehicle safety technologies and their pivotal influence on bolstering driver protection and automotive innovation

The landscape of light vehicle safety systems has evolved into a critical arena where technology innovation, regulatory mandates, and consumer expectations converge to redefine automotive risk management. As manufacturers integrate increasingly sophisticated safety architectures, stakeholders across the value chain are compelled to understand the driving forces that accelerate adoption. Safety solutions once considered premium features are now baseline requirements, reshaping purchasing behavior and engineering priorities alike.

Against a backdrop of stringent crash-test protocols and rising attention to accident prevention, the automotive industry is witnessing a paradigm shift. Active safety functions such as collision avoidance and lane-keeping assistance complement traditional passive measures like airbags and occupant restraints. This dual focus amplifies the potential to reduce fatalities and insurance costs while enabling advanced driver assistance systems (ADAS) to serve as building blocks for autonomous mobility.

By charting the technological, economic, and regulatory vectors influencing light vehicle safety, this report equips decision-makers with a clear understanding of market dynamics. The introduction outlines key themes that underpin subsequent sections, setting the stage for an in-depth analysis of transformative shifts in the competitive landscape.

Examining the major technological, regulatory, and consumer behavior shifts reshaping the trajectory of light vehicle safety systems worldwide

Technological progress has become the cornerstone of modern vehicle safety, with sensor fusion platforms marrying radar, lidar, and camera data to deliver unprecedented situational awareness. Moreover, advances in artificial intelligence enable predictive analytics that can anticipate hazardous scenarios and initiate preemptive braking or steering corrections. This convergence of hardware and software elevates system reliability, reducing false positives and enhancing user trust.

At the same time, regulatory bodies worldwide are tightening performance requirements. In North America, guidelines issued by the National Highway Traffic Safety Administration (NHTSA) mandate automatic emergency braking for all new vehicles, while in Europe, Euro NCAP’s five-star rating now hinges on comprehensive ADAS integration. These directives not only safeguard road users but also compel original equipment manufacturers (OEMs) to accelerate feature rollouts and validate system effectiveness under diverse driving conditions.

Consumer awareness represents a third transformative force. With rising insurance incentives for vehicles equipped with advanced safety packages, buyers increasingly perceive these technologies as value drivers rather than optional extras. As a result, automakers are investing heavily in branding and educating end users, ensuring that the availability of adaptive cruise control or blind-spot detection is communicated in a manner that underscores both safety and convenience.

Analyzing the compounded repercussions of United States import tariffs implemented in 2025 on the supply chain and cost dynamics of light vehicle safety system components

In early 2025, the United States instituted additional import tariffs on critical automotive components sourced from select regions, a move that has reverberated through the global supply chain. These levies have incrementally increased the landed cost of sensor modules and electronic control units, putting pressure on OEM procurement strategies. Consequently, manufacturers are recalibrating sourcing models to mitigate expense inflation while preserving component quality and reliability.

The immediate repercussion has been an uptick in localized manufacturing initiatives. Tier 1 suppliers with existing U.S. footprint have enhanced production capacity, thereby reducing exposure to cross-border duties. Meanwhile, smaller aftermarket suppliers face margin compression, leading many to explore domestic partnerships or value-engineering alternatives. Although some cost impact is absorbed internally, end customers may encounter moderate price escalations for retrofit safety kits.

Beyond direct pricing effects, the tariffs have catalyzed broader strategic shifts. Industry participants are accelerating efforts to qualify alternative supply sources in Latin America and Southeast Asia, regions that benefit from trade agreements and competitive labor costs. This reorientation underscores the need for agility in supplier networks, ensuring continuous innovation cycles and uninterrupted component availability despite evolving tariff regimes.

Uncovering pivotal segmentation insights across system type, embedded technologies, distribution channels, and vehicle classes driving market differentiation

A comprehensive view of market segmentation reveals how product architecture influences adoption patterns. By system type, Active Safety Systems-comprising adaptive cruise control, anti-lock braking systems, automatic emergency braking, blind spot detection, electronic stability control, and lane departure warning-drive technological differentiation. In parallel, Passive Safety Systems such as airbags, crash sensors, occupant detection systems, and seatbelts form the essential backbone that continues to evolve through materials innovation and sensor integration.

Delving into technology segmentation further highlights divergent investment trends. Camera-based systems excel in object recognition under varied lighting conditions, whereas radar platforms offer robust performance in adverse weather. Lidar-based solutions provide high-resolution mapping at a premium, and ultrasonic sensors serve critical proximity detection roles. The interplay among these modalities underscores a future where multi-sensor architectures become standard, balancing cost and performance to meet diverse vehicle requirements.

Channel dynamics also play a defining role. While OEM channels focus on seamless integration with vehicle platforms and rigorous validation protocols, aftermarket providers capitalize on retrofit demand, especially in regions where regulatory mandates lag. Lastly, the dichotomy between light commercial vehicles and passenger cars shapes feature prioritization: cost sensitivity drives a pragmatic approach in commercial fleets, while consumer-facing passenger segments continue to adopt the latest ADAS functionalities to enhance brand appeal and perceived safety.

This comprehensive research report categorizes the Light Vehicle Safety System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System Type

- Technology

- Sales Channel

- Vehicle Type

Delving into regional variations in light vehicle safety adoption patterns and regulatory frameworks across the Americas, EMEA, and Asia-Pacific markets

Regional nuances shape both the pace and nature of safety system adoption. In the Americas, the United States leads with comprehensive mandates and strong insurance incentives, driving widespread integration of both active and passive technologies. Canada closely follows, aligning its regulatory framework with cross-border standards, while Mexico’s emerging production base supports cost-effective manufacturing, catering to OEMs seeking to optimize North American content requirements.

Across Europe, Middle East, and Africa (EMEA), stringent crash-test protocols by Euro NCAP and regional safety directives have elevated consumer expectations. In Western Europe, advanced ADAS suites are increasingly standard, whereas Middle East fleets emphasize vehicle durability and remote sensing for harsh environments. In Africa, adoption remains nascent, constrained by cost considerations and infrastructure challenges, though select markets are beginning to embrace enhanced passive safety measures.

The Asia-Pacific region exhibits dynamic growth, led by China’s aggressive safety regulations and rapidly maturing domestic suppliers. Japanese and South Korean OEMs maintain a stronghold through robust R&D and established supply chains. Meanwhile, India’s GSR (Global Safety Regulation) mandates have catalyzed a retrofit wave, prompting both local and international players to introduce cost-optimized solutions. Southeast Asian markets, driven by rising consumer incomes and expanding urban mobility projects, hold significant upside potential for both active and passive safety enhancements.

This comprehensive research report examines key regions that drive the evolution of the Light Vehicle Safety System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the competitive strategies and innovation trajectories of leading global light vehicle safety system providers shaping industry benchmarks

The competitive landscape is anchored by a coalition of global suppliers, each leveraging unique strengths to advance safety system innovation. Autoliv, a pioneer in passive restraint technologies, continues to refine airbag deployment algorithms and occupant detection sensors. Bosch distinguishes itself through radar and stability control platforms, integrating domain controllers that support multi-sensor fusion for real-time hazard evaluation.

Continental deploys modular hardware architectures that facilitate rapid feature upgrades and cross-platform scalability, while Denso capitalizes on its deep OEM ties in Asia to co-develop camera-based vision systems and thermal sensors. ZF’s strategic acquisitions have broadened its footprint in lidar integration and electric braking modules, enabling a more holistic safety portfolio. Specialized players such as Mobileye focus on AI-driven vision processing, commanding notable mindshare in the camera-based ADAS segment, and Veoneer continues to push the boundaries of lidar accuracy and machine learning algorithms.

Collaborations between these suppliers and technology start-ups are reshaping investment flows, with joint ventures dedicated to cybersecurity, over-the-air software updates, and digital twin simulations. This ecosystem-driven approach accelerates time to market, fosters interoperability, and establishes new benchmarks for reliability and performance across light vehicle safety systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Light Vehicle Safety System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aptiv PLC

- Autoliv Inc.

- Continental AG

- DENSO Corporation

- Hella GmbH & Co. KGaA

- Hitachi Astemo, Ltd.

- Hyundai Mobis Co., Ltd.

- Infineon Technologies AG

- Joyson Safety Systems

- Koito Manufacturing Co., Ltd.

- Lear Corporation

- Magna International Inc.

- Mobileye N.V.

- NXP Semiconductors N.V.

- OSRAM GmbH

- Robert Bosch GmbH

- Valeo SA

- Varroc Engineering Limited

- Veoneer AB

- ZF Friedrichshafen AG

Formulating actionable strategies for industry leaders to capitalize on emerging safety technologies and navigate evolving regulatory and economic landscapes

Industry leaders should prioritize investment in sensor fusion platforms that seamlessly integrate radar, lidar, camera, and ultrasonic data streams. By adopting open architecture domain controllers, manufacturers can ensure that new safety features are deployed with minimal disruption to existing vehicle electronic systems. Furthermore, developing scalable software frameworks enables over-the-air updates, maintaining feature relevance over the vehicle lifecycle and reducing dependency on physical recalls.

Supply chain diversification emerges as a critical strategy to mitigate tariff-induced cost pressures. Establishing regional manufacturing nodes in duty-free zones and forging alliances with local suppliers can stabilize component availability and optimize lead times. In parallel, value engineering initiatives should focus on modular sensor packaging, allowing tiered feature sets to address both cost-sensitive commercial fleets and premium passenger segments.

Engaging with regulatory bodies and standards organizations early in the development cycle ensures alignment with evolving safety requirements. By contributing to working groups and pilot programs, companies can anticipate compliance milestones and influence shape testing protocols. Moreover, targeted partnerships with fleet operators and insurance companies can validate performance outcomes, driving broader market acceptance and unlocking incentive-based pricing models.

Lastly, cultivating cybersecurity protocols to safeguard data integrity and privacy is no longer optional. Embedding encryption, intrusion detection, and secure boot processes within safety controllers protects against malicious attacks that could compromise system reliability. Concurrently, investing in user education programs will increase end-user trust, fostering higher adoption rates and facilitating the transition toward semi-autonomous driving capabilities.

Detailing the rigorous research methodology employed to analyze data sources, validate findings, and ensure the credibility of light vehicle safety system

The research methodology underpinning this analysis combines primary and secondary sources to deliver robust, actionable insights. Primary inputs were gathered through in-depth interviews with senior executives at top automakers, tier-one suppliers, and specialty safety component manufacturers. Complementing this qualitative data, surveys conducted among fleet managers and aftermarket distributors provided quantitative metrics on adoption drivers and perceived barriers.

Secondary research involved a comprehensive review of policy documents released by the NHTSA, Euro NCAP protocols, and regional regulatory filings. Patent databases and technical whitepapers were examined to track innovation trajectories, while industry journals and conference proceedings offered context on emerging technologies. Trade statistics from customs and industry associations were analyzed to ascertain shipment trends and tariff impacts over time.

Data triangulation was achieved by cross-referencing findings across these diverse sources, ensuring consistency and uncovering discrepancies. Analytical frameworks-including SWOT assessments and impact modeling-were applied to synthesize insights and validate assumptions. Finally, a panel of independent experts reviewed the draft findings to confirm objectivity, relevance, and practical applicability for strategic decision-making within the light vehicle safety domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Light Vehicle Safety System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Light Vehicle Safety System Market, by System Type

- Light Vehicle Safety System Market, by Technology

- Light Vehicle Safety System Market, by Sales Channel

- Light Vehicle Safety System Market, by Vehicle Type

- Light Vehicle Safety System Market, by Region

- Light Vehicle Safety System Market, by Group

- Light Vehicle Safety System Market, by Country

- United States Light Vehicle Safety System Market

- China Light Vehicle Safety System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing key insights into the future trajectory of light vehicle safety systems and their role in driving sustainable automotive industry advancements

The collective insights from this report underscore a transformative era for light vehicle safety systems. As sensor technologies converge and regulatory thresholds tighten, the industry moves toward an integrated safety architecture that blends active prevention with passive protection. Companies that harness this duality-by marrying hardware excellence with adaptive software-will lead the advancement of vehicular safety and unlock new value propositions.

Navigating complex tariff landscapes and regional variations demands agility and foresight. Manufacturers who decentralize production, engage with policy influencers, and cultivate local partnerships will minimize exposure to trade disruptions. At the same time, end users will continue to demand transparent performance validation, incentivizing stakeholders to invest in real-world testing and data-driven proof of concept.

Looking ahead, the trajectory of light vehicle safety systems will be shaped by the interplay of evolving consumer expectations, digital transformation, and regulatory harmonization. Those who act decisively-embracing open platforms, advanced analytics, and collaborative ecosystems-will not only elevate safety benchmarks but also reinforce their competitive positioning in an increasingly safety-centric automotive market.

Engage with Ketan Rohom to explore how this comprehensive analysis can empower strategic decisions and secure a definitive market advantage today

To uncover the full depth of insights, competitive intelligence, and implementation frameworks, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, who will guide you through the report’s comprehensive findings and facilitate access to tailored solutions for your strategic objectives.

- How big is the Light Vehicle Safety System Market?

- What is the Light Vehicle Safety System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?