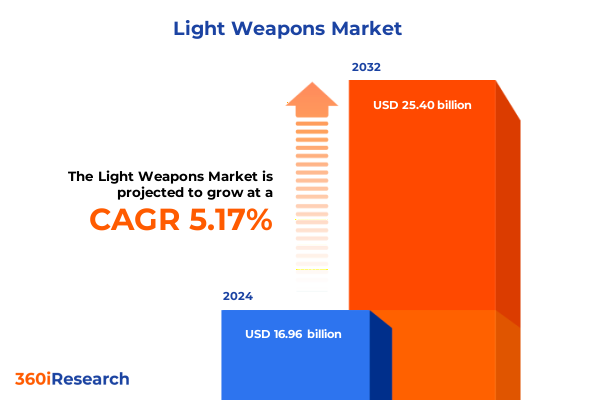

The Light Weapons Market size was estimated at USD 17.86 billion in 2025 and expected to reach USD 18.85 billion in 2026, at a CAGR of 5.15% to reach USD 25.40 billion by 2032.

Setting the Stage for Light Weapons Industry Evolution by Highlighting Prevailing Drivers, Stakeholder Priorities, and Emerging Technological and Regulatory Forces

The landscape of light weapons demands careful examination as it intersects with evolving security imperatives, technological breakthroughs, and shifting procurement philosophies. Understanding this multifaceted domain begins with recognizing the convergence of stakeholder priorities, where manufacturers, end users, and regulators each bring unique perspectives to the table. An introduction to this subject must capture how the intricate interplay of rising geopolitical tensions and rapid innovation cycles shapes decision-making at every level. As policymakers emphasize deterrence and domestic resilience, industry participants respond by accelerating research and refining production methodologies.

Stakeholder dynamics are equally influenced by civilian demand for enhanced personal security solutions, law enforcement’s requirements for tactical versatility, and military forces’ pursuit of superior force projection capabilities. Within this confluence, regulatory frameworks evolve to balance public safety concerns with operational effectiveness. Each stakeholder group presses for distinct performance characteristics, driving manufacturers to pursue modular platforms, digital-enhanced targeting systems, and lightweight materials. These developments underscore the urgency of charting current trends, as they form the foundation for anticipating future trajectories.

In addition, rapid advances in additive manufacturing and digitalization disrupt traditional production paradigms, while global supply chain uncertainties compel firms to explore nearshoring and strategic partnerships. This executive summary sets the stage to reveal transformative shifts, analyze the cumulative impact of recent tariff measures, illuminate segmentation intricacies, and derive regional and competitive insights. Ultimately, it equips decision-makers with a holistic understanding required to navigate a high-stakes market characterized by relentless innovation and rigorous regulatory scrutiny.

Reimagining the Light Weapons Landscape Through Technological Disruption, Strategic Shifts in Procurement, and Geopolitical Realignments Impacting Supply Chains

The light weapons sector has undergone a profound transformation driven by breakthroughs in materials science, digital integration, and precision engineering. Cutting-edge polymers and alloy combinations now enable significant weight reductions without compromising structural integrity, empowering end users to carry equipment longer and operate with greater agility. Furthermore, the integration of artificial intelligence into sighting and fire control systems enhances target identification and engagement accuracy, fundamentally altering tactical doctrines. As a result, manufacturers are increasingly embedding sensor suites and connectivity options into their platforms to meet the growing demand for data-driven decision-making on the battlefield.

Moreover, the procurement strategies adopted by military and law enforcement agencies are shifting toward capability-based assessments, prioritizing flexible architectures that can be rapidly reconfigured to address emerging threats. This emphasis on modularity extends beyond individual weapons to encompass ancillary systems such as unmanned aerial vehicle payloads and networked squad-level communications. Consequently, light weapons development no longer exists in isolation but functions as a critical node within an integrated ecosystem designed to optimize situational awareness and operational tempo.

In addition, global supply chains have adapted to these technological imperatives through the proliferation of digital manufacturing techniques, including additive processes that reduce lead times and inventory dependencies. Nearshoring initiatives, driven by a desire for increased resilience and regulatory compliance, have reshaped the distribution of critical components across allied regions. At the same time, shifting geopolitical fault lines have prompted nations to reassess defense partnerships and seek diversified sourcing strategies. Taken together, these forces herald a new era in which agility, interoperability, and supply chain robustness serve as the defining metrics of success in the light weapons landscape.

Unraveling the Cumulative Effects of Recent United States Tariff Measures on the Light Weapons Ecosystem and Global Supply Chain Dynamics

In 2025, cumulative tariff measures instituted by the United States introduced a complex layer of cost pressures and strategic recalibrations for light weapons manufacturers. Building on earlier steel and aluminum levies, recent Section 301 actions extended duties to encompass certain weapon component imports, amplifying raw material costs for key assemblies such as barrel forging and slide machining. Direct manufacturers across allied and non-allied regions now grapple with elevated input expenditures, compelling a reassessment of sourcing architectures.

Furthermore, these tariff actions have reverberated through global supply networks, prompting firms to identify alternate suppliers in tariff-exempt jurisdictions or to accelerate investments in domestic production capabilities. Amid rising labor and energy expenses, players have explored advanced manufacturing techniques including high-precision forging and electron beam welding to offset incremental tariff burdens through operational efficiencies. Consequently, organizations have enhanced collaboration with government entities to secure incentives aimed at bolstering domestic defense industrial bases.

Transitioning to a longer-term view, the confluence of trade barriers and shifting regulatory requirements has generated a more fragmented industrial landscape. While some manufacturers have successfully passed increased costs to downstream purchasers, others face margin compression that restrains R&D allocations for next-generation systems. Yet this environment has also catalyzed innovation in lightweight materials and additive processes designed to streamline part consolidation and reduce machining operations.

Ultimately, the cumulative impact of 2025 tariff measures underscores the critical importance of supply chain diversification and strategic manufacturing resilience. As the industry recalibrates to absorb these duties, stakeholders are focusing on collaborative frameworks that align procurement objectives with national security priorities and economic competitiveness, setting the stage for a more domestically anchored light weapons ecosystem.

Deciphering Core Market Segmentation Dimensions Revealing End Users, Product Variants, Application Niches, Action Mechanisms, Distribution Pathways, and Caliber Preferences

A nuanced understanding of market segmentation reveals distinct drivers and opportunities within each dimension of the light weapons industry. Examining end users shows how the civilian sector’s emphasis on personal defense and sport shooting diverges from law enforcement’s demand for reliability under extreme conditions and the military’s rigorous performance requirements in diverse combat environments. These variations shape product development roadmaps and influence certification protocols across jurisdictions.

Equally significant are the differing complexities inherent in product categories. Handguns prioritize concealability and rapid deployment, with revolvers offering simplicity and semi-automatic pistols delivering higher capacity. Machine guns must balance sustained fire capabilities with portability, drawing on heavy machine guns for fixed positions and light variants for squad support. Rifles range from close-quarters assault models to specialized sniper platforms engineered for long-range precision. Shotguns and submachine guns each fulfill niche use cases, with configurations optimized for urban operations or specialized marksmanship.

Application-focused segmentation further clarifies market dynamics, as defense procurement cycles depend on demonstration of combat readiness and interoperability, while hunting and sporting segments are driven by ergonomic refinement and aesthetic customization. Personal security applications, spanning civilian self-defense to private security services, demand discreet yet effective solutions. Sporting disciplines such as competition shooting and target practice prioritize consistency, adjustability, and aftermarket accessories.

Action type and sales channel dimensions add additional layers of differentiation. Weapon mechanisms-from gas-operated automatics to bolt action systems-require specialized machining and testing protocols. Distribution pathways encompass direct government contracts, OEM partnerships, and retail sales through both brick-and-mortar outlets and digital platforms. Finally, caliber preferences, whether large, medium, or small, impact logistical considerations, recoil management, and overall user acceptance. Collectively, these segmentation insights provide a strategic framework for stakeholders seeking to align product offerings and go-to-market strategies with precise end-user requirements.

This comprehensive research report categorizes the Light Weapons market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Action Type

- Caliber

- End User

- Application

- Sales Channel

Examining Regional Variations in Demand, Regulation, and Competitive Drivers Across the Americas, Europe-Middle East-Africa, and Asia-Pacific Geographies

Regional dynamics in the light weapons sector vary markedly across the Americas, Europe-Middle East-Africa, and Asia-Pacific, reflecting distinct security concerns, regulatory environments, and procurement priorities. Within the Americas, the United States maintains a central position driven by robust domestic manufacturing capabilities and a well-established civilian market. Meanwhile, Latin American nations prioritize border security and counter-narcotics operations, leading to targeted acquisitions of versatile platforms suited for high-mobility operations.

Moving to Europe, stringent export controls and legislative oversight have fostered a focus on interoperability within defense alliances and adherence to evolving human rights standards. The Middle East’s geopolitical volatility sustains high demand for rapid-deployment systems and munitions resupply, while select African markets emphasize portable, low-maintenance designs that accommodate austere operating conditions. Across these regions, the ability to meet divergent regulatory frameworks and support multinational training initiatives has become a key competitive differentiator.

Asia-Pacific presents a mix of mature and emerging markets. Australia’s rigorous licensing procedures drive demand for technologically advanced solutions that align with strict safety standards, whereas Southeast Asian nations pursue modernization efforts to enhance maritime and ground force capabilities. Simultaneously, regional supply chains leverage advanced manufacturing hubs to serve both domestic needs and export markets. This geographic mosaic underscores the strategic imperative for manufacturers to tailor product portfolios and compliance approaches to the unique requirements and policy landscapes of each region.

This comprehensive research report examines key regions that drive the evolution of the Light Weapons market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Movements by Leading Manufacturers Highlighting Innovation Initiatives, Partnership Alliances, and Competitive Positioning in Light Weapons Arena

Leading manufacturers in the light weapons arena are increasingly defining competitive advantage through targeted innovation investments and strategic partnerships. Companies focusing on integrative digital systems have secured market leadership positions by embedding advanced optics, remote diagnostics, and predictive maintenance capabilities into their platforms. Collaborations with defense technology startups have enabled rapid prototyping of novel materials and AI-driven targeting solutions, accelerating time-to-market and enhancing field adaptability.

Strategic alliances and mergers have also reconfigured the competitive landscape. Joint ventures between established arms producers and electronics firms have expanded product portfolios to include networked soldier systems and airborne payload integrations. Through these collaborations, companies gain access to specialized expertise while mitigating capital risk. Concurrently, acquisitions of niche specialists in ammunition, suppressor technology, and precision firearms have allowed larger firms to offer end-to-end capability bundles that appeal to integrated procurement programs.

Service-based differentiation has emerged as another vital strategic vector. Providers offering comprehensive lifecycle support-ranging from on-site training and simulation to global maintenance networks-are capturing recurring revenue streams and deepening customer loyalty. This shift towards solution-oriented offerings underscores the importance of after-sales engagement, as end users increasingly evaluate total cost of ownership and sustainment efficiency alongside upfront acquisition costs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Light Weapons market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems plc

- Browning Arms Company

- Bushmaster Firearms International LLC

- China North Industries Group Corporation Limited

- Colt's Manufacturing Company, LLC

- Daniel Defense, Inc.

- Fabbrica d'Armi Pietro Beretta S.p.A.

- FN Herstal S.A.

- General Dynamics Ordnance and Tactical Systems

- Heckler & Koch GmbH

- Israel Weapon Industries Ltd.

- Kalashnikov Concern JSC

- RemArms, LLC

- Rheinmetall AG

- Savage Arms, Inc.

- SIG SAUER GmbH & Co. KG

- Smith & Wesson Brands, Inc.

- ST Engineering Land Systems Ltd

- Thales S.A.

- Česká zbrojovka a.s.

Delivering Clear and Impactful Action Plans to Guide Industry Leaders in Optimizing Operations, Innovation Roadmaps, and Regulatory Engagement Strategies

Industry leaders can fortify their market positions by adopting a multifaceted approach centered on supply chain resilience, technological advancement, and proactive engagement with regulatory bodies. To begin, diversifying sourcing strategies reduces exposure to trade uncertainties and material shortages. Establishing dual or triple supplier relationships for critical components and expanding additive manufacturing capabilities ensures production continuity when traditional channels face disruptions.

Concurrently, organizations should invest in innovation roadmaps that prioritize modular open-architecture platforms capable of rapid upgrades. Integrating AI-driven fire control and sensor fusion technologies not only enhances operational effectiveness but also aligns product offerings with the growing demand for networked warfare capabilities. Moreover, developing customizable variant kits caters to the divergent needs of civilian, law enforcement, and military end users, creating incremental revenue opportunities and fostering brand loyalty.

Engagement with policymakers and industry consortia is equally essential. By contributing to the formulation of export control policies and technical standards, companies can shape regulatory environments that support responsible proliferation while safeguarding competitive interests. Collaboration with government-sponsored innovation programs also opens avenues for co-development initiatives and funding support.

Finally, enhancing customer engagement through digital platforms and value-added services is imperative. Employing data analytics to predict maintenance needs and offering comprehensive training modules not only improves user satisfaction but also deepens aftermarket revenue potential. Collectively, these recommendations provide a strategic blueprint for organizations seeking to thrive in a dynamic light weapons ecosystem.

Detailing Rigorous Research Methodology Combining Comprehensive Data Collection, Stakeholder Interviews, and Multi-Source Validation Protocols for Robust Insights

Our research methodology blends rigorous secondary intelligence gathering with targeted primary investigations to ensure comprehensive and balanced insights. Initially, extensive secondary research was conducted through analysis of industry journals, governmental publications, regulatory filings, and peer-reviewed technical papers. This foundational layer provided historical context, technology roadmaps, and policy frameworks that informed subsequent investigative phases.

Building on this, primary research comprised in-depth interviews with key opinion leaders, including procurement officers from defense and law enforcement agencies, senior engineers at manufacturing facilities, and frontline operators. These qualitative engagements yielded nuanced perspectives on operational requirements, procurement decision criteria, and emerging capability gaps. To enhance representativeness, interview subjects were selected across diverse geographic regions and end-use segments.

Data triangulation played a pivotal role in validating findings. Quantitative data points, such as manufacturing throughput rates and production cycle times, were cross-referenced with anecdotal evidence and supplier feedback. This multi-source verification process ensured that insights reflect real-world operational constraints, technological adoption rates, and supply chain dynamics. Scenario analysis further enriched the assessment by exploring the resilience of various procurement strategies under hypothetical trade and regulatory shifts.

Finally, our study adhered to strict ethical guidelines, ensuring confidentiality and objectivity throughout. Peer reviewers with deep domain expertise conducted independent assessments of the findings, reinforcing the robustness of the conclusions. This integrated methodology guarantees that the insights presented herein are both empirically grounded and strategically actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Light Weapons market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Light Weapons Market, by Product Type

- Light Weapons Market, by Action Type

- Light Weapons Market, by Caliber

- Light Weapons Market, by End User

- Light Weapons Market, by Application

- Light Weapons Market, by Sales Channel

- Light Weapons Market, by Region

- Light Weapons Market, by Group

- Light Weapons Market, by Country

- United States Light Weapons Market

- China Light Weapons Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Synthesizing Insights and Forward-Looking Reflections That Illuminate Critical Themes and Strategic Imperatives Shaping the Light Weapons Sector

The light weapons industry stands at a crossroads defined by accelerating innovation, geopolitical realignments, and regulatory recalibrations. Technological disruptions, from additive manufacturing to AI-enabled targeting systems, present unprecedented opportunities to enhance platform performance and operational flexibility. Yet these advancements coincide with heightened scrutiny of trade policies and supply chain integrity, amplifying the imperative for resilient procurement strategies.

Segmentation analysis reveals the necessity of tailoring solutions to a diverse array of end users and applications, each governed by distinct performance criteria and regulatory demands. Regional insights further underscore the complexity of navigating varied legislative landscapes, from the restrictive export regimes in Europe to the modernization drives in Asia-Pacific and the heterogeneous security requirements across the Americas. In parallel, leading manufacturers illustrate how strategic partnerships and service-driven models can unlock new value streams and strengthen customer relationships.

Looking ahead, industry players must embrace an integrated approach that harmonizes technological investments with agile supply chain frameworks and proactive policy engagement. By doing so, they will be better positioned to capitalize on emerging defense and civilian security needs while safeguarding operational continuity amid global uncertainties. The collective insights outlined throughout this executive summary provide a strategic compass for stakeholders aiming to maintain competitive relevance and drive sustainable growth in this dynamic domain.

Mobilize Strategic Advantage by Engaging with Associate Director for Exclusive Access to the Definitive Light Weapons Industry Research Report

To seize a competitive edge in this rapidly evolving sector, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to unlock comprehensive insights and strategies embedded in the full light weapons industry report. Engaging with Ketan Rohom provides direct access to in-depth analysis that delves into emerging technological advances, detailed regional assessments, and tailored recommendations designed for decision-makers who demand precision and foresight. Partnering with him ensures you receive exclusive briefings on critical trends, expert commentary, and supporting data visualizations that drive confident strategic planning. Elevate your understanding of procurement dynamics, supply chain resilience, and segmentation opportunities by securing a personalized walk-through of the report’s key findings. Contact Ketan Rohom today to transform your approach to innovation, compliance, and growth in the light weapons domain and empower your organization with the actionable intelligence necessary for navigating complex market forces and regulatory environments

- How big is the Light Weapons Market?

- What is the Light Weapons Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?