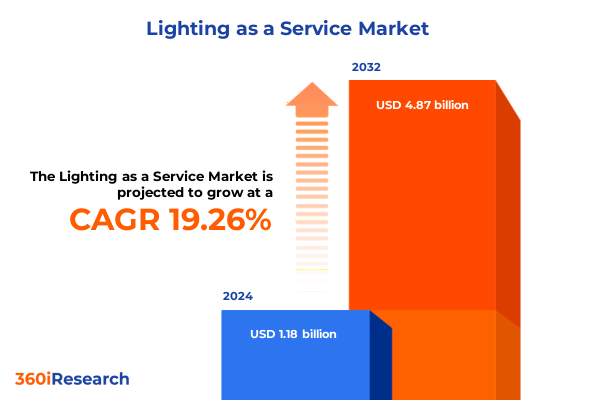

The Lighting as a Service Market size was estimated at USD 1.40 billion in 2025 and expected to reach USD 1.65 billion in 2026, at a CAGR of 19.47% to reach USD 4.87 billion by 2032.

Unlocking the Potential of Lighting as a Service: A Comprehensive Overview of Market Drivers, Innovations, and Strategic Landscape

Lighting as a Service introduces a subscription-based approach where specialized third-party providers retain ownership of lighting infrastructure while delivering design, financing, installation, maintenance, and performance guarantees under an ongoing service model. Unlike traditional operating leases, this model ensures that equipment remains under provider stewardship throughout the contract lifecycle, fostering extended product life and reducing waste through multiple light engine upgrades rather than complete replacements.

Energy efficiency and breakthrough advances in LED efficacy have been pivotal in propelling this service model. Today’s LEDs convert electrons to photons with unprecedented efficiency-well over 150 lumens per watt in the latest commercial chip-on-board modules-enabling building owners to realize energy savings of 80–90 percent compared to incandescent sources and up to 60 percent versus fluorescent alternatives. Retrofit projects can achieve payback in as little as four months, a critical driver in the widespread transition to service-based lighting solutions.

Moreover, integration with smart controls and Internet of Things platforms has transformed lighting from a static infrastructure element into a dynamic, data-driven asset. Sensors, cloud analytics, and automated dimming now enable real-time energy management, occupancy-based illumination, and seamless lighting orchestration across facilities. This technological convergence not only lowers operational costs but also supports occupant well-being through human-centric lighting strategies that adapt color temperature and illuminance to circadian rhythms.

In addition, the shift from capital-intensive investments to predictable, operational expenses aligns with corporate sustainability mandates and budgetary flexibility. By eliminating large upfront expenditures and embedding performance guarantees into service contracts, organizations can reallocate capital toward core business initiatives while leveraging the latest lighting technologies under guaranteed service-level agreements. This financing innovation has become a cornerstone in the accelerated adoption of Lighting as a Service across commercial, industrial, municipal, and residential market segments.

Navigating a New Illuminated Era Where Digital Integration, Sustainable Design Practices, and Business Model Innovation Redefine the Lighting as a Service Landscape

The lighting industry is in the midst of a digital metamorphosis characterized by the integration of intelligent controls, real-time analytics, and connected ecosystems. Sensors and cloud-based platforms now converge to transform static fixtures into adaptive nodes that respond to occupancy, daylight, and environmental data. As a result, lighting systems not only illuminate spaces but also generate operational intelligence-enabling predictive maintenance, dynamic scheduling, and seamless interoperability with broader smart-building frameworks.

Simultaneously, environmental, social, and governance imperatives are reshaping procurement strategies and product lifecycles in the sector. With ambitious net-zero commitments driving policy frameworks worldwide, stakeholders are prioritizing circular economy principles. Lighting as a Service supports this transition by extending equipment lifespans through modular light-engine upgrades, enabling take-back programs for end-of-life recycling, and reducing material waste. These service-oriented models align supplier incentives with sustainability goals, as providers maintain ownership and thus bear responsibility for optimizing environmental performance across the asset lifecycle.

Moreover, new commercial models are emerging that decouple consumption from ownership, offering pay-as-you-go flexibility, performance-based contracts, and outcome-oriented service agreements. These innovations enable customers to scale illumination on demand, transfer technological obsolescence risk to providers, and align lighting investments with operational outcomes rather than static asset depreciation. Consequently, organizations can pilot advanced lighting solutions-such as tunable white systems or presence-detection arrays-without bearing the full financial burden of hardware ownership.

Policy landscapes are also adapting to accelerate energy efficiency adoption. Minimum energy performance standards, rebates, and tax incentives are increasingly harmonized across regions, while emerging frameworks mandate higher efficacy thresholds and integrate lighting into building performance codes. Such regulatory momentum not only incentivizes migration to LED and smart systems, but also elevates Lighting as a Service offerings as compliant, turnkey pathways to meet stringent performance requirements.

Looking ahead, disruptive technologies like Light Fidelity (Li-Fi), visible-light wireless communications, and advanced human-centric lighting systems are poised to further expand service portfolios. Li-Fi’s promise of ultra-fast, secure indoor connectivity over illuminated surfaces may unlock new service layers-blending connectivity infrastructure with illumination-while novel material innovations and advanced optics will continue to push efficiency boundaries and human well-being metrics in lighting service offerings.

Assessing the Far-Reaching Consequences of Recent United States Tariff Policies on Lighting as a Service Supply Chains, Costs, and Market Dynamics

In early 2025, a sweeping executive order imposed a 25 percent levy on Canadian and Mexican imports alongside an additional 10 percent duty on Chinese goods, reshaping cost structures overnight and thrusting the lighting supply chain into a state of rapid reconfiguration. This policy, effective February 1, 2025, compelled manufacturers and distributors to reassess pricing frameworks, with immediate ramifications for fixtures, controls, and component sourcing.

Tariffs on core raw materials, including aluminum and steel-essential for fixture housings, heat sinks, and mounting hardware-have elevated production costs by an estimated 15 to 20 percent. These surcharges cascade through procurement channels, prompting organizations to implement price adjustments or explore alternative material blends to maintain budgetary discipline. With Canada and Mexico traditionally serving as key metal suppliers, North American producers have faced higher domestic costs and supply chain bottlenecks, further exacerbated by retaliatory duties on U.S. exports to Canada.

Notably, leading brands have already announced price increases in response. Philips Hue’s parent company confirmed up to a 10 percent hike on select smart lighting products in the U.S., directly attributing the change to new tariffs on Chinese imports. Similarly, Acuity Brands enacted a second round of price increases in April 2025, warning that up to 20 percent of its portfolio manufactured domestically could face ongoing pricing pressure without further operational shifts. These adjustments underscore the immediate pass-through of elevated import costs to end users in both commercial and residential channels.

In reaction, supply chain diversification strategies have accelerated. Firms are relocating assembly to tariff-exempt jurisdictions such as Vietnam, India, and select Southeast Asian hubs while expanding domestic or nearshore production footprints. Some service providers are negotiating cost-sharing agreements with clients to mitigate cash-flow impacts, while others leverage tax credits under domestic sourcing incentives like the Build America Buy America Act-even as those provisions can add five to ten percent to project budgets due to stringent compliance requirements.

Over the longer term, construction and retrofit budgets have absorbed moderate cost uplifts-typically three to five percent-driven not only by material surcharges but also by extended lead times and logistical complexities. Organizations are recalibrating investment timelines, consolidating procurement contracts, and accelerating forward orders to lock in legacy pricing. While some manufacturers may elect to absorb select tariff increases to preserve market share, the cumulative impact has crystallized as a new baseline cost structure for lighting services in the United States, demanding agile financial modeling and proactive client engagement to maintain project viability.

In-Depth Segment Analysis Reveals How Diverse End Uses, Component Offerings, Advanced Technologies, Flexible Payment Models, and Distribution Channels Shape Market Opportunities

End-use segmentation reveals that commercial applications-spanning education, healthcare, hospitality, office, and retail environments-remain the primary revenue driver, as organizations invest in turnkey service solutions to meet energy reduction targets and occupant comfort standards. Industrial settings, encompassing logistics, manufacturing, and warehousing, prioritize robust lighting systems with minimal downtime and predictive maintenance, leveraging service agreements that include uptime guarantees and rapid response maintenance protocols. Municipal use cases-public facilities and street lighting networks-are transforming under smart-city initiatives, where remotely managed streetlight networks drive both energy and operational efficiencies. In the residential domain, multifamily complexes often adopt community-wide service contracts for common areas, while single-family homes increasingly embrace subscription-based models for retrofit packages to avoid upfront costs and secure ongoing support.

This comprehensive research report categorizes the Lighting as a Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End Use

- Component

- Technology

- Payment Model

- Distribution Channel

Regional Dynamics Unveiled as Americas, Europe Middle East Africa, and Asia Pacific Markets Exhibit Unique Drivers, Adoption Rates, and Growth Opportunities in Lighting Services

In the Americas, especially the United States and Canada, mature regulatory frameworks-such as robust minimum energy performance standards-and incentive schemes for energy efficiency have spurred rapid uptake of Lighting as a Service offerings across commercial, industrial, and municipal segments. Corporate sustainability mandates and tax credits for retrofits have driven large-scale deployments in data centers, campuses, and city infrastructures, even as new tariffs introduce short-term cost pressures that service providers offset through flexible contract structures and local sourcing.

This comprehensive research report examines key regions that drive the evolution of the Lighting as a Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Landscape Insight Spotlighting Leading Global and Regional Players Driving Innovation, Partnerships, and Growth Trajectories in Lighting as a Service Sector

Leading global players have adopted differentiated strategies to cement their positions. Signify has emphasized diversified manufacturing footprints in Mexico and India to mitigate tariff impacts while advancing its connected lighting platform with enhanced data analytics and cybersecurity features, reflecting confidence in its limited exposure to Chinese imports and ability to reallocate production. Acuity Brands, leveraging a strong domestic assembly base, has balanced price adjustments with expanded design and financing services, fostering deeper client partnerships and long-term contracts. Meanwhile, GE Current and Philips Lighting Services are forging strategic alliances with system integrators and IoT specialists to bundle lighting, controls, and building-management services into unified solutions. Emerging regional specialists-such as Amaris Lighting in North America and Zumtobel in EMEA-are capitalizing on niche expertise in human-centric lighting design and circular economy solutions to differentiate their service portfolios.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lighting as a Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuity Brands, Inc.

- Current Lighting Solutions, LLC

- Eaton Corporation plc

- ENGIE SA

- Hubbell Incorporated

- OSRAM GmbH

- Schneider Electric SE

- Siemens AG

- Signify N.V.

- Zumtobel Group AG

Proactive Strategic Imperatives for Industry Leaders to Capitalize on Emerging Technologies, Optimize Service Models, and Navigate Regulatory and Supply Chain Challenges

Industry leaders should accelerate investment in scalable digital platforms that deliver real-time utilization data and predictive analytics, ensuring both operational excellence and new service revenue streams tied to performance outcomes. In tandem, diversifying supply chains through a balanced mix of domestic, nearshore, and low-tariff offshore manufacturing reduces exposure to policy volatility and ensures continuity of service commitments. Furthermore, embedding circularity into product lifecycles-via modular light-engine upgrades, take-back programs, and extended performance warranties-aligns service models with sustainability objectives while controlling total cost of ownership. Finally, providers must refine their financial frameworks, offering a spectrum of leasing, pay-as-you-go, and subscription options tailored to client risk profiles, thus reinforcing competitive differentiation and deepening long-term customer engagement.

Robust Mixed Methodology Approach Combining Expert Interviews, Proprietary Data Triangulation, and Rigorous Analytical Techniques Underpinning Market Intelligence and Insights

This research employs a rigorous mixed-method approach. Secondary research entailed systematic reviews of government publications, regulatory filings, industry association reports, and peer-reviewed literature to establish contextual baselines and trend trajectories. Primary research encompassed in-depth interviews with executives at leading service providers, system integrators, end users, and policy stakeholders to capture nuanced perspectives on adoption barriers, technology integration, and contractual best practices. Data triangulation ensured consistency and reliability, while qualitative insights were integrated with quantitative observations to develop a comprehensive, multidimensional market intelligence framework.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lighting as a Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lighting as a Service Market, by End Use

- Lighting as a Service Market, by Component

- Lighting as a Service Market, by Technology

- Lighting as a Service Market, by Payment Model

- Lighting as a Service Market, by Distribution Channel

- Lighting as a Service Market, by Region

- Lighting as a Service Market, by Group

- Lighting as a Service Market, by Country

- United States Lighting as a Service Market

- China Lighting as a Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Critical Insights on Technological Evolutions, Market Segmentation, Tariff Implications, and Strategic Pathways to Illuminate the Future of Lighting as a Service

Lighting as a Service continues to redefine how organizations procure, manage, and optimize illumination across diverse applications by blending technological innovation with outcome-oriented service models. The convergence of LED efficiency gains, smart control ecosystems, and ESG mandates has catalyzed a shift from transactional asset purchases to subscription-based contractual engagements, unlocking new value propositions for providers and end users alike. While recent tariff policies have introduced cost headwinds, the industry’s agile response-through supply chain diversification, flexible financing structures, and elevated service guarantees-underscores its resilience and adaptability. Strategic segmentation insights reveal targeted opportunities across commercial, industrial, municipal, and residential domains, further enriched by region-specific dynamics spanning the Americas, EMEA, and Asia-Pacific. As leading companies intensify investments in digital platforms, circular economy solutions, and strategic partnerships, the Lighting as a Service market is poised for continued expansion, delivering measurable energy savings, operational intelligence, and sustainability outcomes in the years ahead.

Engage with Ketan Rohom to Secure Comprehensive Market Intelligence and Tailored Strategic Guidance on Lighting as a Service Trends, Opportunities, and Solutions

To take advantage of these comprehensive market insights and gain personalized guidance tailored to your organization’s strategic objectives, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep expertise in lighting industry trends, service-based business models, and competitive landscapes. He will work closely with you to understand your unique challenges, recommend the most relevant sections of the report, and provide a customized proposal that aligns with your operational priorities and investment criteria. Engage with Ketan today to ensure your leadership team is equipped with actionable intelligence, optimized strategies, and foresight into emerging opportunities in the Lighting as a Service market.

- How big is the Lighting as a Service Market?

- What is the Lighting as a Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?