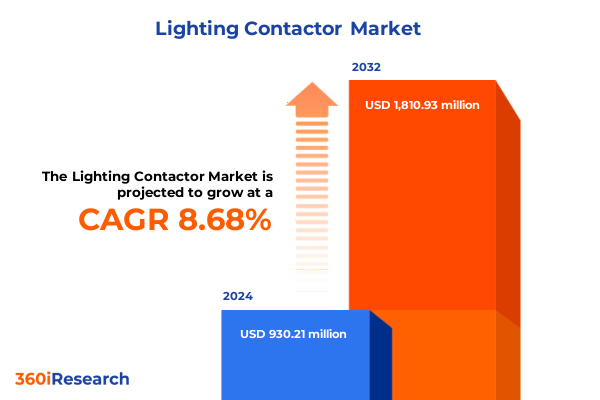

The Lighting Contactor Market size was estimated at USD 1.00 billion in 2025 and expected to reach USD 1.08 billion in 2026, at a CAGR of 8.79% to reach USD 1.81 billion by 2032.

Discover the Critical Role of Lighting Contactors in Modern Electrical Infrastructure and Their Influence on Efficiency Safety and Operational Flexibility

Lighting contactors serve as the pivotal switching mechanism that bridges power sources and lighting loads, ensuring the reliable activation and deactivation of lighting circuits across a wide array of environments. These electromechanical devices are engineered to handle high current capacities while safeguarding electrical systems against overload, short circuits, and other fault conditions. Their robust construction and rapid switching capabilities have rendered them indispensable in modern electrical infrastructure, where uninterrupted illumination is critical for safety, operational continuity, and occupant comfort.

In commercial facilities, automated control through contactors can significantly reduce energy consumption by facilitating scheduled activation and dimming protocols. Industrial operations leverage these devices to integrate safety interlocks with production line lighting, thus enhancing workplace security and compliance with stringent regulations. Meanwhile, in residential settings, contactors are increasingly incorporated into smart home ecosystems to provide remote-controlled lighting, bolstering convenience and energy management for homeowners.

As the industry navigates evolving regulatory landscapes and technological advancements, understanding the core functions and universal applications of lighting contactors is essential. This analysis establishes foundational context by outlining the intrinsic value and operational significance of these devices, setting the stage for a deeper exploration of transformative trends, segmentation dynamics, and strategic imperatives that will shape future adoption and innovation.

Explore the Technological Innovations and Sustainability Regulations That Are Reshaping the Lighting Contactor Industry and Driving Unprecedented Industry Growth

Technological innovation and sustainability imperatives are converging to redefine expectations for lighting contactors across every application domain. The proliferation of smart building systems, underpinned by the Internet of Things (IoT), has elevated contactors from simple relays to integral nodes within connected ecosystems. In this new paradigm, manufacturers are embedding communication interfaces and data analytics capabilities into contactor designs, enabling real-time monitoring, predictive maintenance, and dynamic load management. Consequently, facility managers can optimize energy usage patterns by leveraging usage data to identify inefficiencies and implement targeted interventions.

Simultaneously, global and regional sustainability regulations are imposing stricter energy performance standards that directly influence contactor specifications. Green building certifications now frequently mandate integration of advanced switching devices capable of facilitating dimming protocols and occupancy-driven controls. In response, producers are innovating with low-loss designs and advanced coil materials that minimize power draw during standby, thereby aligning product portfolios with environmental objectives and lifecycle cost reductions.

Moreover, the transition toward electrified infrastructure-driven by the rise of electric vehicles and renewable energy integration-has spurred demand for contactors that can handle variable current profiles and bi-directional power flows. This shift has prompted collaboration between contactor specialists and power electronics firms, leading to hybrid solutions that seamlessly integrate switching, sensing, and circuit protection. Such partnerships underscore the accelerating pace of convergence between traditional electromechanical engineering and digital intelligence within the lighting contactor arena.

Examine the Far-Reaching Effects of 2025 United States Tariff Adjustments on the Cost Structures Supply Chains and Competitive Dynamics of Lighting Contactors

The implementation of revised tariff schedules by the United States in early 2025 has introduced a new set of cost considerations and strategic recalibrations for manufacturers and end users of lighting contactors. By raising import duties on key component categories and finished assemblies, these measures have elevated landed costs for foreign-produced contactors, prompting buyers to reassess procurement strategies. Many organizations have faced immediate margin pressures, necessitating adjustments in pricing models, renegotiations with suppliers, and a reexamination of total cost of ownership to balance initial capital outlays with long-term operational savings.

In response to the heightened cost backdrop, several manufacturers have accelerated plans for domestic production or nearshoring initiatives, seeking to offset tariff impacts through localized assembly and leveraging regional trade agreements. Simultaneously, procurement teams have begun qualifying alternative sources in lower-tariff jurisdictions and exploring collaborative sourcing alliances to secure volume-based discounts. This shift toward diversified supply bases not only mitigates exposure to unilateral trade policy changes but also enhances resilience against broader geopolitical uncertainties.

Looking ahead, the cumulative impact of the 2025 tariff adjustments is likely to influence the competitive dynamics of the lighting contactor market by creating opportunities for domestic players to capture incremental market share. However, it will also place pressure on established international brands to innovate in cost reduction, streamline logistics, and strengthen customer value propositions. As trade policy continues to evolve, stakeholders will need to balance supply chain agility with product performance and reliability to sustain growth trajectories in a more policy-driven market environment.

Uncover How End User Categories Type Control Modes Applications Rated Currents Poles and Coil Variations Drive Dynamics within the Lighting Contactor Market

A multifaceted segmentation framework reveals nuanced market dynamics shaped by end user categories, contactor types, control methodologies, application environments, rated current ranges, pole configurations, and coil performance characteristics. Commercial facilities often prioritize high-cycle durability and integration with building management systems, while industrial sites emphasize tolerance for extreme operational conditions and closed-loop safety interlocks. Conversely, residential end users increasingly seek seamless connectivity and aesthetic integration within smart home platforms, prompting suppliers to offer compact, low-profile contactor designs with wireless control capabilities.

From a voltage perspective, alternating current contactors remain the mainstay in traditional lighting circuits, delivering reliability under fluctuating load demands, whereas direct current contactors have gained traction in specialized applications such as solar-powered systems and electric vehicle charging stations. This divergence underscores the importance of aligning product engineering with the unique electrical profiles and regulatory requirements of each sector.

Control mode variations further deepen the segmentation, with automatic switching solutions offering scheduled and sensor-based activation to conserve energy and enhance occupant comfort. In contrast, manual control options-spanning remote actuation and tactile toggle-switch interfaces-provide fail-safe mechanisms and user-driven flexibility. Application contexts bifurcate into indoor environments, where hospitality venues demand silent operation and retail spaces call for dynamic dimming, and outdoor scenarios that require robust architectural fixtures or street lighting solutions with extended service life and weather-resistant enclosures.

Rated current thresholds-from up to 60 amps through the mid-range 61 to 100 amps and beyond 100 amps-enable precise alignment with circuit demands, while two-pole and three-pole configurations accommodate single-phase and three-phase supply systems. Finally, coil type distinctions between low-noise and standard variants address acoustic sensitivity thresholds in noise-critical settings. This comprehensive segmentation lens aids stakeholders in tailoring product roadmaps and go-to-market strategies to meet the differentiated requirements of each subsegment.

This comprehensive research report categorizes the Lighting Contactor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Control Mode

- Rated Current

- Number Of Poles

- Coil Type

- End User

- Application

Gain Comprehensive Regional Insights Focused on the Americas EMEA and Asia-Pacific Lighting Contactor Markets Highlighting Drivers Challenges and Opportunities

Regional analysis underscores distinct market drivers, regulatory landscapes, and technology adoption patterns across the Americas, Europe Middle East and Africa, and Asia-Pacific regions. In the Americas, infrastructure modernization programs and retrofit initiatives are fueling demand for advanced contactor technologies, with federal energy efficiency incentives encouraging the deployment of sensor-based and scheduled switching systems. As a result, North American facility operators are increasingly prioritizing lifecycle cost optimization and compliance with stringent regional codes.

Meanwhile, the Europe Middle East and Africa region is characterized by a mosaic of regulatory frameworks that emphasize carbon reduction and renewable integration. In many European markets, sustainable building certifications have become de facto requirements, prompting a surge in demand for low-loss contactors and high-reliability solutions. Across the Middle East, large-scale urban development projects are driving significant volumes of outdoor and architectural lighting installations, while African markets are benefiting from international funding for rural electrification and smart grid pilots.

In the Asia-Pacific landscape, rapid urbanization and industrial expansion are creating robust pipelines for both indoor and outdoor lighting contactor applications. Countries with aggressive smart city agendas are adopting integrated platforms that combine contactor-level controls with broader IoT infrastructure, thereby elevating expectations for real-time data analytics and interoperability. Concurrently, manufacturing hubs in the region are scaling operations to serve both domestic consumption and export demand, leveraging cost efficiencies and regional trade partnerships.

These regional insights highlight the importance of localized strategies that account for regulatory nuances, competitive intensity, and infrastructure priorities, enabling market participants to allocate resources effectively and harness cross-border synergies.

This comprehensive research report examines key regions that drive the evolution of the Lighting Contactor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze the Strategic Positioning and Innovation Trajectories of Leading Players Shaping Competition and Technological Progress in the Lighting Contactor Industry

The competitive landscape in the lighting contactor industry features a blend of established multinational corporations and specialized niche providers, each deploying unique strategies to capture market share and foster innovation. Leading electrical equipment manufacturers have adopted platform-based approaches, standardizing core contactor modules while offering configurable control and communication add-ons to address diverse customer requirements. Many have also forged strategic alliances with building automation and power electronics firms, combining domain expertise to co-develop hybrid switching solutions that integrate protection relays with data monitoring capabilities.

Mid-sized and regional players differentiate through agility and customization, often partnering with local system integrators to deliver turnkey control packages for specific verticals such as hospitality or industrial automation. By maintaining lean product portfolios and rapid product development cycles, these suppliers can respond swiftly to regulatory shifts and emerging technology requirements, securing footholds in high-growth subsegments.

Investment in research and development remains a key competitive lever, with firms channeling resources into advanced coil materials, compact form factors, and low-inrush technologies that reduce mechanical stress and extend service life. In parallel, digital transformation initiatives are enabling enhanced customer support services, ranging from remote diagnostics to predictive maintenance platforms, thereby reinforcing long-term relationships through value-added offerings.

Collectively, the strategic positioning and innovation trajectories of these companies underscore an industry in flux, where differentiation hinges not only on core performance metrics but also on the ability to deliver integrated, intelligent solutions that align with broader electrification and automation trends.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lighting Contactor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Chint Group Corporation

- Eaton Corporation plc

- Hager Group

- Legrand SA

- LS Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

Implement Actionable Strategic Recommendations to Maximize Resilience Innovation and Market Penetration for Lighting Contactor Manufacturers and Stakeholders

To navigate the evolving complexities of the lighting contactor market, industry leaders must adopt a series of targeted strategies that enhance resilience, spur innovation, and accelerate market penetration. First, prioritizing modular and scalable product architectures will enable rapid customization to meet the distinct requirements of diverse end user applications, from high-cycle industrial environments to architecturally sensitive outdoor fixtures. By adopting open communication standards and interoperable platforms, manufacturers can foster seamless integration within building management and IoT ecosystems, thereby creating stickier customer relationships.

In parallel, diversifying supply chains through regionalization or nearshoring initiatives will mitigate exposure to tariff volatility and transportation disruptions. Establishing assembly or final testing hubs in key end markets can reduce lead times and improve responsiveness to shifting policy landscapes. Moreover, forging strategic partnerships with local system integrators and service providers will enhance market access and facilitate bundled offerings that combine hardware, installation, and digital maintenance contracts.

Investing in next-generation coil materials and low-inrush designs will address growing demand for energy-efficient switching devices, while concurrent deployment of advanced analytics and remote monitoring services will unlock new aftermarket revenue streams. Finally, embedding sustainability metrics into product development roadmaps-such as lifecycle carbon assessments and end-of-life recycling programs-will resonate with environmentally conscious stakeholders and support compliance with emerging regulatory frameworks.

By executing these measures in concert, companies can strengthen their competitive positioning, foster long-term customer loyalty, and capture growth opportunities arising from the increasing electrification and digitalization of built environments.

Detail a Rigorous Research Methodology Combining Multisource Data Collection Expert Interviews and Analytical Frameworks for Comprehensive Market Insights

This analysis is underpinned by a rigorous research methodology designed to ensure comprehensive and objective insights. The primary phase involved extensive consultations with industry experts, including engineers, procurement managers, and regulatory authorities, to validate market drivers, identify technology adoption patterns, and gauge tariff impact scenarios. These qualitative inputs were triangulated with secondary data sources, encompassing technical white papers, government trade publications, and peer-reviewed journals, to corroborate key findings and capture emerging trends.

Quantitative analysis was performed by aggregating transactional data from leading distributors and original equipment manufacturers, supplemented by anonymized feedback from end user surveys. Advanced analytical frameworks, such as scenario modeling and sensitivity analysis, were employed to assess segmentation dynamics across control modes, application environments, and rated current thresholds. This structured approach allowed for the construction of a robust segmentation matrix that underlies the strategic insights presented.

To ensure the highest standards of data integrity, multi-tier validation processes were implemented, including cross-verification of regulatory information with official governmental portals and consistency checks against market intelligence platforms. The research team adhered to strict ethical guidelines, maintaining full transparency in data sourcing and respecting confidentiality agreements with proprietary informants.

Through the integration of these methodologies, the report delivers a holistic perspective that empowers stakeholders to make informed strategic decisions grounded in a balanced synthesis of empirical evidence and expert judgment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lighting Contactor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lighting Contactor Market, by Type

- Lighting Contactor Market, by Control Mode

- Lighting Contactor Market, by Rated Current

- Lighting Contactor Market, by Number Of Poles

- Lighting Contactor Market, by Coil Type

- Lighting Contactor Market, by End User

- Lighting Contactor Market, by Application

- Lighting Contactor Market, by Region

- Lighting Contactor Market, by Group

- Lighting Contactor Market, by Country

- United States Lighting Contactor Market

- China Lighting Contactor Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Conclude with Key Takeaways and Strategic Perspectives Emphasizing the Future Trajectory and Sustainable Integration of Lighting Contactors in Evolving Systems

In conclusion, the lighting contactor market stands at the intersection of technological innovation, regulatory evolution, and shifting supply chain paradigms. The core function of reliably switching lighting loads remains paramount, even as devices become infused with digital intelligence and integrated within broader automation frameworks. Evolving sustainability mandates and energy efficiency targets are driving the adoption of advanced contactor designs, while trade policy adjustments-such as the 2025 tariff revisions-are reshaping procurement strategies and competitive positioning.

Segmentation analysis reveals a complex tapestry of requirements across end user categories, voltage types, control modes, application settings, and performance specifications. Regional insights further underscore the need for localized strategies that address unique regulatory environments and infrastructure priorities in the Americas, EMEA, and Asia-Pacific. Meanwhile, leading companies are differentiating through platform-based product portfolios, strategic partnerships, and value-added digital services.

By synthesizing these findings, decision-makers can align product roadmaps, supply chain configurations, and go-to-market strategies with the multifaceted dynamics of the contemporary lighting contactor landscape. This executive summary offers a strategic lens through which to interpret emerging trends, calibrate investments, and harness opportunities presented by the ongoing electrification and digitalization of built environments.

Ultimately, embracing the recommendations and insights highlighted throughout this analysis will equip stakeholders to navigate uncertainty, capitalize on innovation, and drive sustained growth in a market defined by both technical rigor and transformative change.

Engage with Associate Director Sales and Marketing Ketan Rohom to Access the Lighting Contactor Market Report and Drive Informed Strategic Decisions

Engaging with Ketan Rohom will empower you to leverage expert guidance and secure timely access to the most comprehensive market intelligence available for lighting contactors. As Associate Director of Sales and Marketing, he can tailor a package that meets the unique strategic requirements of your organization, whether you are aiming to optimize procurement processes, refine product roadmaps, or deepen your competitive analysis. By partnering with him, you gain a direct portal to in-depth data and personalized insights that catalyze proactive decision making.

Furthermore, initiating this collaboration ensures prioritized support and a seamless acquisition experience, enabling your team to translate sophisticated research into actionable plans without delay. Ketan’s expertise in aligning analytical frameworks with business objectives will translate into a clear roadmap for integrating findings into your operational and strategic initiatives. Contacting him today positions your organization at the forefront of market developments, empowering you to outpace competitors and respond swiftly to emergent trends.

Don’t miss the opportunity to transform raw intelligence into tangible outcomes that drive profitability and innovation. Reach out to Ketan Rohom now to secure your copy of the lighting contactor market report and unlock the strategic clarity required to navigate an increasingly complex market environment with confidence and precision.

- How big is the Lighting Contactor Market?

- What is the Lighting Contactor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?