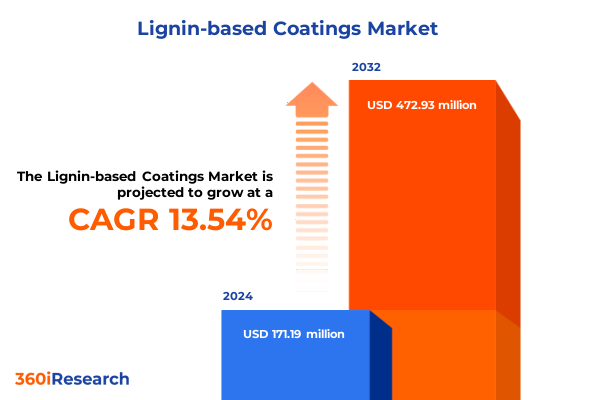

The Lignin-based Coatings Market size was estimated at USD 192.72 million in 2025 and expected to reach USD 217.57 million in 2026, at a CAGR of 13.68% to reach USD 472.93 million by 2032.

Unveiling the Transformative Potential of Lignin-Based Coatings as Sustainable Game-Changers Across the Global Coatings Industry Landscape

The emergence of lignin-based coatings represents a pivotal moment in the pursuit of sustainable materials within the surface protection and decoration sector. Derived from the complex aromatic polymer found in plant cell walls, lignin offers a renewable feedstock with intrinsic UV resistance, antioxidant properties, and compatibility with diverse formulation chemistries. These characteristics unlock opportunities for manufacturers to reduce dependency on fossil-derived resins while enhancing performance attributes such as weatherability and chemical resistance.

Driven by intensifying regulatory pressures to curtail volatile organic compound emissions and minimize carbon footprints, the coatings industry is actively exploring bio-based alternatives. Lignin’s ubiquity as a byproduct of paper and biofuel operations positions it as an economically viable candidate for large-scale adoption, provided that cost-competitive extraction and purification processes continue to mature. At the same time, advances in resin modification techniques and crosslinking strategies have propelled lignin from a niche additive to a core component in high-value coating systems.

Looking ahead, the strategic integration of lignin into coating formulations promises to reshape product portfolios across architectural, automotive, industrial, and protective applications. Stakeholders are now conducting rigorous lab trials, pilot projects, and field assessments to optimize lignin’s functionality and unlock novel end-user benefits. As the market transitions, early adopters stand to gain a leadership position in sustainability-driven innovation without sacrificing the performance standards demanded by discerning customers.

Exploring the Major Technological and Market Shifts Driving Lignin-Based Coatings Adoption in Today’s Competitive Environment

Over the past several years, the coatings industry has witnessed transformative shifts catalyzed by converging environmental mandates, technological breakthroughs, and evolving end-user expectations. As global sustainability targets tighten, demand for low-emission, bio-derived binders has surged, propelling lignin from a waste-stream curiosity to a mainstream development priority. This transition underscores a broader shift toward circular economy principles, in which industrial byproducts are valorized to close resource loops and reduce lifecycle impacts.

Concurrently, innovations in fractionation and modification techniques have unlocked novel resin structures with tunable molecular weights and functional groups. Organosolv and sulfonation processes, once reserved for pulp and paper applications, are now being optimized to produce lignin fractions with enhanced solubility, reactivity, and compatibility with waterborne or UV-curable systems. These advances have led to performance parity with conventional petrochemical resins, thereby dissolving longstanding barriers to substitution in critical segments like industrial and protective coatings.

Moreover, strategic alliances between chemical producers, technology developers, and end users are accelerating commercialization pathways. Through co-development agreements and joint pilot installations, stakeholders are sharing risk and pooling expertise to refine formulations, streamline scale-up, and validate real-world performance. Collectively, these shifts signify a turning point in which lignin-based systems are poised to deliver both environmental and economic gains at commercial scale.

Assessing the Cumulative Influence of United States Tariff Measures Enacted in 2025 on the Lignin-Based Coatings Supply Chain

In early 2025, the United States implemented a series of tariff adjustments on imported lignin-derived feedstocks and related intermediates, recalibrating competitive dynamics across the coatings value chain. The cumulative effect of these measures has been to raise landed costs of key resin precursors, incentivize domestic sourcing, and spur investment in local processing capacities. As a result, coating formulators and resin producers are reevaluating their supply networks to mitigate exposure to import duties and associated logistical complexities.

This policy shift has driven a two-pronged response. On one hand, multinational chemical suppliers have expanded North American production footprints, scaling pilot fractionation facilities and pursuing strategic acquisitions of regional lignocellulosic assets. On the other hand, end users-particularly in the architectural and industrial coatings sectors-have intensified partnerships with domestic biorefineries to secure long-term offtake agreements. These alignments not only provide tariff avoidance but also support traceability and sustainability credentials increasingly demanded by institutional buyers.

Looking forward, the ripple effects of the 2025 tariff landscape are poised to reshape R&D priorities, with greater emphasis on feedstock flexibility and cost-efficient conversion routes. Companies that swiftly adapt by integrating alternative lignin sources or investing in in-house extraction capabilities will be best positioned to capitalize on the emerging competitive landscape, while those reliant on singular import channels may encounter margin compression and supply uncertainty.

Uncovering Critical Segmentation Insights Revealing Application, Resin, End User, Technology, and Form Dynamics Shaping the Lignin-Based Coatings Market

A granular examination of market segmentation reveals the nuanced ways in which lignin-based coatings are gaining traction across diverse application, resin, end-user, technology, and form dimensions. In architectural coatings, both exterior and interior systems are integrating lignin for enhanced UV protection and color stability, addressing consumer demand for greener building materials. The automotive sector is exploring lignin’s antioxidant properties to augment corrosion resistance and extend service life, while industrial and protective coatings markets are valuing its thermal stability and barrier performance under harsh conditions.

Diving deeper into resin types, alkali lignin remains the most mature option, prized for its cost-effectiveness and easy availability. Kraft lignin follows closely with widespread industrial infrastructure from pulping operations, while organosolv variants are garnering interest for their higher purity and lower inorganic load. Sulfonated lignin, with superior water solubility, is increasingly leveraged in waterborne and UV-curable formulations, unlocking new realms of low-VOC product development.

The end-user industry breakdown further underscores construction’s commercial and residential subsegments as early adopters seeking eco-friendly coatings to meet green building codes. Packaging applications are exploring lignin for barrier coatings on paperboard, and wood products manufacturers are capitalizing on lignin’s adhesion properties for furniture lacquers and flooring finishes. Across technologies, powder coating continues to attract attention for solvent elimination, while solventborne platforms-both acrylic and alkyd-remain integral to high-performance systems. UV-curable and waterborne processes, the latter split into dispersion and emulsion streams, each leverage lignin to balance reactivity, film formation, and environmental compliance. Finally, the choice of form-liquid, paste, or powder-allows formulators to tailor processing parameters, with solventborne and waterborne liquids providing ease of spray application, and powder pastes and powders enabling diverse curing profiles.

This comprehensive research report categorizes the Lignin-based Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- End User Industry

- Technology

- Form

Illuminating Regional Nuances Highlighting Opportunities and Challenges Across Americas, EMEA, and Asia-Pacific for Lignin-Based Coatings

Regional dynamics are playing a decisive role in how lignin-based coatings evolve as an alternative to conventional systems. In the Americas, strong government incentives for bio-based materials and the presence of integrated pulp and paper facilities are driving robust innovation pipelines. The United States, in particular, is witnessing pilot collaborations between chemical producers and co-ops to refine lignin extraction, while Canada is leveraging its vast forestry resources to attract downstream coating formulators.

Across Europe, Middle East, and Africa, regulatory stringency on VOC emissions and a commitment to the European Green Deal are fostering demand for lignin-enhanced solutions, especially in high-visibility sectors like architectural and automotive coatings. Western Europe is pioneering certification frameworks to verify bio-based content, whereas the Middle East and Africa are exploring lignin applications in protective marine and oil-and-gas coatings to balance extreme environmental demands with sustainability targets.

In the Asia-Pacific region, rapid industrialization and infrastructure expansion in China and India are fueling interest in cost-effective, high-performance binders. Japan, with its advanced materials ecosystem, continues to push the envelope on UV-curable and waterborne technologies that integrate lignin for improved durability. Australia and Southeast Asia are emerging hotspots for pilot projects in wood coatings, driven by the furniture and flooring manufacturing clusters seeking low-impact resins. Collectively, these regional variations underscore the need for localized strategies that align feedstock availability, regulatory frameworks, and market expectations.

This comprehensive research report examines key regions that drive the evolution of the Lignin-based Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Players Revolutionizing the Lignin-Based Coatings Arena Through Research and Collaboration

A growing roster of companies is catalyzing the transition to lignin-based coatings through targeted investments in technology development, strategic partnerships, and capacity expansion. Traditional pulp and paper giants are leveraging their lignin streams to co-develop pilot-scale resin purification plants. Specialty chemical firms have established joint ventures with biorefinery operators to secure feedstock supply and scale novel lignin derivatives tailored for waterborne and UV-curable systems.

Innovative start-ups are disrupting conventional value chains by offering proprietary fractionation platforms that yield high-purity lignin fractions with consistent molecular architectures. These entrants collaborate with coating formulators to integrate lignin into high-value, low-VOC formulations, demonstrating that sustainability need not compromise performance. Meanwhile, equipment manufacturers and additive producers are aligning their roadmaps to accommodate lignin resins, ensuring compatibility across mixing, application, and curing stages.

As patent filings in modified lignin chemistries accelerate, companies with robust IP portfolios are gaining negotiating leverage in co-development agreements and licensing deals. This competitive landscape is characterized by alliances that span from raw material sourcing to end-use application trials, highlighting the importance of cross-sector collaboration to drive commercial scale-up and market penetration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lignin-based Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aditya Birla Group

- Ataman Kimya A.S.

- Biosynth Ltd.

- Borregaard AS

- Burgo Group S.p.A.

- Domtar Corporation

- Green Agrochem

- Henan KIngsun Chemical Co., Ltd.

- Hosokawa Alpine AG

- Ingevity Corporation

- Lignopure GmbH

Strategic and Actionable Roadmap for Industry Leaders to Harness the Power of Lignin-Based Coatings in Pursuit of Sustainable Innovation

Industry leaders looking to capitalize on the momentum behind lignin-based coatings must adopt a multifaceted approach that balances innovation with practical implementation. First, diversifying supply chains by forging partnerships with regional biorefineries can mitigate tariff-related risks and secure consistent access to diverse lignin feedstocks. Concurrently, investing in modular fractionation technologies enables rapid tuning of molecular weights and functional groups to meet specific performance criteria.

Second, companies should collaborate closely with end users to conduct joint pilot trials that validate formulation performance under real-world conditions. This hands-on engagement accelerates feedback loops, refines processing parameters, and builds customer confidence in bio-based alternatives. Third, prioritizing R&D efforts on compatibility with existing manufacturing lines-especially in powder coating and solventborne facilities-can reduce capital expenditure barriers and expedite market entry.

Lastly, proactive engagement with regulators and industry associations is essential to shape emerging standards around bio-based content and sustainability metrics. By contributing to certification frameworks and supporting transparent lifecycle analyses, organizations can differentiate their offerings and drive broader acceptance of lignin-based systems across end-user industries.

Detailing Rigorous Research Methodology Employed to Analyze Material Properties, Market Drivers, and Technological Trends in Lignin-Based Coatings

This research integrates both secondary and primary methodologies to ensure a comprehensive and rigorous assessment of the lignin-based coatings landscape. Secondary research encompassed a deep dive into technical journals, patent databases, industry white papers, and regulatory publications to establish baseline understanding of extraction processes, resin modification techniques, and performance benchmarks. Publicly disclosed corporate filings and sustainability reports were analyzed to map investment trends and strategic partnerships.

Primary research involved structured interviews and workshops with key stakeholders across the value chain, including chemical producers, coating formulators, equipment manufacturers, and end users in architectural, automotive, and industrial sectors. Expert panels provided qualitative insights into challenges, adoption barriers, and performance criteria. In parallel, proprietary laboratory evaluations assessed the physicochemical properties of various lignin fractions, measuring parameters such as molecular weight distribution, hydroxyl content, and compatibility with common crosslinkers.

Data triangulation techniques were employed to reconcile findings from disparate sources, ensuring robust validation of market drivers and technological trajectories. Geographic analyses were conducted to identify regional variations in feedstock availability, regulatory drivers, and end-user priorities. The resulting framework blends quantitative evidence with expert opinion to deliver actionable intelligence for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lignin-based Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lignin-based Coatings Market, by Resin Type

- Lignin-based Coatings Market, by End User Industry

- Lignin-based Coatings Market, by Technology

- Lignin-based Coatings Market, by Form

- Lignin-based Coatings Market, by Region

- Lignin-based Coatings Market, by Group

- Lignin-based Coatings Market, by Country

- United States Lignin-based Coatings Market

- China Lignin-based Coatings Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Forward-Looking Perspectives to Emphasize the Strategic Value of Lignin-Based Coatings in Future Industry Applications

In synthesizing the core findings, it becomes evident that lignin-based coatings stand at the confluence of sustainability imperatives and performance-driven innovation. The unique chemical structure of lignin not only supports a reduction in petrochemical reliance but also introduces functional benefits such as UV shielding, antioxidant activity, and thermal stability across a spectrum of coating applications. These attributes are amplified by technological advancements in lignin fractionation, enabling tailored resin properties that align with regulatory and end-user demands.

The analysis underscores how the 2025 tariff landscape in the United States has accelerated the reshaping of supply chains, prompting greater domestic production and strategic partnerships. Segmentation insights reveal that architectural and protective coatings are leading demand, while automotive, packaging, and wood products segments are rapidly exploring specialized use cases. Regional assessments highlight distinct drivers and obstacles across the Americas, EMEA, and Asia-Pacific markets, emphasizing the need for localized strategies.

Looking forward, the convergence of strategic investments, collaborative R&D efforts, and evolving policy frameworks positions lignin-based coatings as a transformative solution for the coatings industry. Stakeholders that embrace this shift, adopt flexible manufacturing approaches, and engage proactively with regulatory bodies will be best situated to deliver sustainable, high-performance products that meet the exigencies of tomorrow’s market.

Engage with Ketan Rohom to Unlock Comprehensive Insights and Secure Your Lignin-Based Coatings Market Research Report Today

To delve deeper into how lignin-based coatings can revolutionize your product portfolio and meet evolving market demands, reach out to Ketan Rohom at Associate Director, Sales & Marketing. Ketan brings a wealth of experience in guiding stakeholders through the complexities of emerging bio-based materials and can provide tailored insights to align with your strategic priorities. By engaging directly, you’ll gain access to the full breadth of the market research report, enabling you to benchmark against industry peers, identify untapped opportunities, and craft a robust go-to-market strategy.

Securing the comprehensive report will equip your team with empirical data on resin technologies, application dynamics, regional landscape, and key corporate activities. It will also include detailed profiles of innovative players, regulatory updates, and actionable use cases demonstrating successful implementations. Ketan can walk you through the report’s structure, spotlight sections most relevant to your objectives, and arrange a personalized consultation to translate findings into tangible business outcomes.

Don’t miss the opportunity to position your organization at the cutting edge of sustainable coatings innovation. Contact Ketan Rohom today to unlock strategic intelligence, accelerate decision-making, and solidify your competitive advantage in the rapidly evolving lignin-based coatings market.

- How big is the Lignin-based Coatings Market?

- What is the Lignin-based Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?