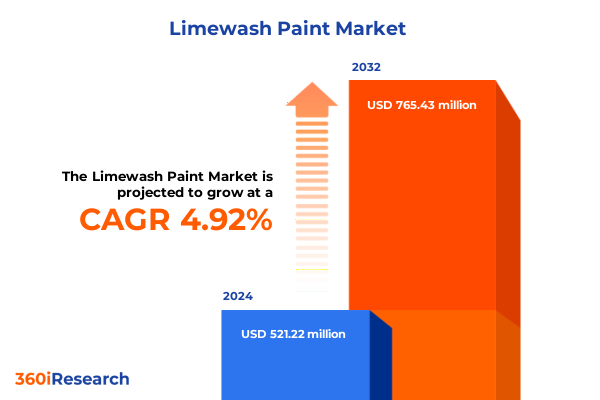

The Limewash Paint Market size was estimated at USD 542.32 million in 2025 and expected to reach USD 572.54 million in 2026, at a CAGR of 5.04% to reach USD 765.43 million by 2032.

Discover How Limewash Paint Is Redefining Architectural Aesthetics with Sustainable, Breathable Finishes That Bridge Tradition and Innovation

Limewash paint has experienced a remarkable resurgence as architects, designers, and property owners rediscover its unique blend of heritage charm and contemporary relevance. Unlike conventional paints, this mineral-based coating offers a naturally breathable finish that helps regulate moisture and maintain healthier indoor environments. As environmental considerations take center stage, limewash’s eco-friendly profile-free of volatile organic compounds and derived from aged limestone-has elevated its appeal among sustainability-driven projects.

The introduction to this report outlines the fundamental characteristics that differentiate limewash paint from modern synthetic alternatives. We explore its historical lineage dating back centuries, its modern reengineering to meet rigorous performance standards, and its growing acceptance in both restoration of heritage structures and new builds seeking an authentic aesthetic. By setting the stage with a clear understanding of material properties, application requirements, and market drivers, this section equips stakeholders to appreciate the strategic importance of limewash solutions in an evolving architectural and design landscape.

Unveiling the Major Transformative Shifts in the Limewash Paint Landscape Driven by Sustainability, Technological Advances, and Evolving Consumer Demands

The limewash paint market is undergoing profound shifts catalyzed by broader industry transformations. Primary among these is the intensifying demand for sustainable materials, with developers and municipalities imposing stricter environmental standards. This has spurred research into advanced formulations incorporating bio based additives and eco friendly formulations that deliver enhanced durability and color retention without compromising breathability.

Concurrent technological advances have also shaped the landscape. Digital color-matching tools and augmented reality visualization platforms enable designers and end users to preview limewash finishes in situ, reducing uncertainty and accelerating decision cycles. Meanwhile, manufacturing innovations-ranging from precision batching to low-energy calcination processes-are improving consistency and reducing carbon footprints. Urbanization trends and the renovation of aging building stock further amplify this momentum, as both new construction and heritage restoration projects seek coatings that combine aesthetic authenticity with modern performance criteria.

As consumer preferences evolve toward material transparency and origin traceability, the market is witnessing the emergence of direct-to-consumer platforms and subscription services that offer curated limewash collections. These channels are transforming supply chains and challenging traditional distribution models, setting the stage for dynamic competition and collaboration among established brands and new entrants.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Limewash Paint Supply Chains, Cost Structures, and Market Dynamics

The cumulative impact of United States tariffs instituted in 2025 presents a complex challenge for stakeholders across the limewash paint value chain. Originally imposed to protect domestic lime producers and address perceived import imbalances, these duties have led to higher raw material costs for manufacturer and formulators. As traditional sourcing channels from Europe and Asia become more expensive, companies are exploring nearshoring opportunities to mitigate exposure and ensure supply continuity.

Rising input costs have exerted upward pressure on end prices, prompting distributors and applicators to reassess procurement strategies. Some market participants are negotiating long-term contracts to hedge against further tariff escalations, while others are reformulating proprietary mixes to incorporate a greater share of locally sourced ingredients. These adaptations have highlighted the importance of geographic diversification in procurement, as well as the strategic value of inventory management systems that optimize order timing relative to tariff review cycles.

Moreover, the ripple effects of tariffs extend beyond cost structures to influence market dynamics. Smaller producers have faced heightened barriers to entry, while larger integrated players have leveraged scale to absorb a portion of extra charges, preserving margin stability. Meanwhile, project developers are scrutinizing life-cycle cost analyses more closely, factoring in total ownership expenses that account for both initial outlays and longer-term maintenance requirements under changing trade regulations.

Key Insights into Limewash Paint Segmentation Revealing How Product Types, End Uses, Distribution Channels, Application Methods, and Packaging Drive Market Growth

Insight into market segmentation reveals nuanced patterns that drive strategic decision-making for product development and channel investment. Based on product type, natural limewash remains the dominant choice for restoration projects, whereas synthetic limewash offers enhanced durability for high-traffic commercial applications. At the same time, future innovations are attracting significant R&D focus, with bio based additives and eco friendly formulations designed to meet stringent green building certifications and consumer demand for sustainable coatings.

When considering end use, residential applications benefit from limewash’s unique patina and moisture-regulating properties, yet commercial and industrial segments present larger scale opportunities. In particular, retail outlets and boutique hospitality projects are embracing limewash finishes to create distinctive brand experiences, while industrial facilities value its antimicrobial and breathable characteristics for maintenance-sensitive environments.

Distribution channels further underscore strategic imperatives. Offline retail in home improvement stores and specialty outlets continues to serve established customer segments, but online retail platforms and innovative direct-to-consumer models are facilitating broader market reach. Subscription services for curated color collections are emerging as a growth avenue, enabling recurring revenue streams. Both brush application and spray application methods dictate equipment investments and training programs, influencing end-user preferences. Finally, packaging types range from traditional dry mix offerings to pre mixed pails, while future packaging in bulk or custom configurations caters to large project specifications and sustainability goals.

This comprehensive research report categorizes the Limewash Paint market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application Method

- Packaging Type

- End Use

- Distribution Channel

Evaluating Regional Market Dynamics for Limewash Paint Across the Americas, Europe Middle East & Africa, and Asia Pacific to Uncover Growth Opportunities

Regional markets for limewash paint exhibit distinct characteristics shaped by regulatory landscapes, architectural traditions, and economic development patterns. In the Americas, stringent green building codes and renovation incentives have bolstered adoption in both commercial and residential sectors. North American demand is further stimulated by a focus on wellness-oriented design, where limewash’s natural composition supports healthier indoor air quality. Latin American markets are following suit, albeit with a longer adoption curve driven by infrastructure investments and local manufacturing capacity.

Europe, Middle East & Africa present a tapestry of heritage preservation initiatives and modern urban renewal projects. Western Europe leads in premium segment applications, supported by robust artisanal networks skilled in traditional limewash techniques. Meanwhile, the Middle East is witnessing a surge in high-luxury developments that seek authentic finishes, driving imports and local joint ventures. In Africa, infrastructure constraints have slowed uptake, but growing awareness of sustainable building materials is creating new openings.

Asia-Pacific stands as the fastest-growing region, propelled by rapid urbanization, expanding construction pipelines, and rising disposable incomes. In mature markets such as Australia and Japan, designers value limewash for its aesthetic flexibility and environmental credentials. Emerging economies in Southeast Asia are adopting limewash progressively as part of broader efforts to modernize construction practices and reduce reliance on high-VOC coatings.

This comprehensive research report examines key regions that drive the evolution of the Limewash Paint market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Moves and Competitive Positioning of Leading Limewash Paint Manufacturers to Identify Innovation, Partnerships, and Market Leadership Trends

Leading players in the limewash paint market are deploying differentiated strategies to secure competitive advantage and capture emerging opportunities. Established heritage-brand manufacturers have leveraged decades of formulation expertise to expand into eco-certified product lines, partnering with sustainable raw material suppliers to reinforce their value propositions. Concurrently, agile challengers are disrupting distribution models by offering direct sale platforms and subscription-based color services that streamline procurement and foster customer loyalty.

Strategic partnerships have emerged as a common growth theme. Several companies have allied with architectural firms and conservation societies to co-develop exclusive color palettes and application techniques tailored to historic restoration. Others have invested in proprietary technology platforms that integrate digital visualization tools with ordering systems, shortening lead times and improving customer experience.

Mergers and acquisitions activity reflects industry consolidation pressures. Larger integrated chemical companies are acquiring specialized limewash formulators to diversify product portfolios and bolster sustainability credentials. Meanwhile, niche operators are focusing on regional expansion, establishing local production facilities to mitigate trade risks and enhance service responsiveness. These strategic moves underscore the importance of innovation, scale, and supply chain resilience in shaping market leadership trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Limewash Paint market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd.

- Chaux de Bourgogne SA

- Kansai Paint Co., Ltd.

- KEIM Mineral Coatings of America, Inc.

- KREIDEZEIT Naturfarben GmbH

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- Romabio Supplies LLC

- RPM International Inc.

- The Sherwin-Williams Company

Actionable Recommendations for Industry Leaders to Capitalize on Limewash Paint Trends Through Innovation, Sustainability, Digital Channels, and Partnerships

Industry leaders seeking to thrive in a dynamic limewash paint market can adopt a set of targeted actions. First, accelerating development of bio based additives and eco friendly formulations will align product lines with tightening environmental regulations and consumer expectations. By partnering with material scientists and certification bodies, companies can secure categorizations such as low-impact product or carbon-neutral certification, differentiating offerings in a crowded landscape.

Second, expanding distribution through digital channels and subscription models can capture new revenue streams and enhance customer engagement. Investing in user-friendly online configurators and predictive replenishment services will foster stickiness while collecting valuable usage data that inform iterative product improvements. In parallel, forging alliances with home improvement retailers and specialty design boutiques will maintain presence in traditional sales outlets and support hybrid channel strategies.

Third, prioritizing supply chain resilience through geographic diversification of raw material sourcing and nearshoring initiatives will mitigate tariff exposure and logistical disruptions. Deploying advanced inventory management systems that adapt to changing trade policies will further optimize cost structures. Finally, equipping applicators with specialized training programs on both brush and spray application enhances quality consistency and end-user satisfaction, reinforcing brand reputation and supporting premium pricing strategies.

Outlining a Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Proprietary Frameworks to Deliver Comprehensive Market Insights

This research integrates a multi-tiered methodology to deliver a holistic view of the limewash paint market. Secondary research encompassed examination of industry reports, trade association publications, regulatory filings, and patent databases to establish a foundational understanding of market dynamics and technological innovations. Concurrently, tariff schedules and customs data were analyzed to quantify trade flows and assess the implications of 2025 duty measures.

Primary research involved structured interviews with senior executives from raw material suppliers, manufacturing firms, distribution partners, and end users such as architects and facility managers. These qualitative insights provided context on strategic priorities, application challenges, and emerging preferences. To validate findings, survey data from a cross-section of commercial and residential specifiers were triangulated with installer feedback, ensuring balanced representation of demand-side perspectives.

Analytical frameworks were applied to segment the market by product type, end use, distribution channel, application method, and packaging, identifying correlations between strategic initiatives and performance outcomes. Data integrity was upheld through cross-verification and quality control protocols, while thematic analyses distilled overarching trends. Together, these approaches underpin a comprehensive, reliable set of insights that inform actionable strategies for stakeholders across the value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Limewash Paint market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Limewash Paint Market, by Product Type

- Limewash Paint Market, by Application Method

- Limewash Paint Market, by Packaging Type

- Limewash Paint Market, by End Use

- Limewash Paint Market, by Distribution Channel

- Limewash Paint Market, by Region

- Limewash Paint Market, by Group

- Limewash Paint Market, by Country

- United States Limewash Paint Market

- China Limewash Paint Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Insights on the Future Trajectory of the Limewash Paint Market Emphasizing Sustainability, Innovation, and Growth Imperatives for Stakeholders

The collective journey through this report underscores the transformative potential of limewash paint within contemporary building and design sectors. As sustainability imperatives intensify, formulations that marry traditional mineral chemistry with cutting-edge additives will command premium positioning. Market segmentation reveals diverse opportunities across residential, commercial, and industrial applications, while channel innovations and packaging developments are reshaping customer engagement and supply chain models.

Regulatory developments, particularly the 2025 United States tariffs, have prompted strategic recalibrations in procurement and pricing, highlighting the value of supply chain agility. Regional analyses demonstrate that while mature markets continue to refine product standards, emerging economies present significant growth corridors fueled by urbanization and rising environmental awareness. Competitive landscapes are defined by partnerships, digital transformation, and consolidation as companies vie for market leadership.

Ultimately, success in the limewash paint market will hinge on the ability to integrate sustainability credentials, operational resilience, and customer-centric innovation. Stakeholders equipped with the insights and recommendations presented herein will be well-positioned to navigate evolving dynamics and capture value across the entire lifecycle of limewash paint applications.

Take the Next Step in Unlocking Comprehensive Limewash Paint Market Intelligence with Associate Director Ketan Rohom Today

To take full advantage of the in-depth insights presented in this market research report and explore how the latest developments in the limewash paint sector can inform your strategic decisions, reach out today to Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings extensive expertise in aligning product innovations with market requirements and can guide you through the report’s findings, helping you tailor solutions to your organization’s unique needs. Whether you seek to deepen your understanding of emerging tariffs, refine your segmentation strategies, or develop actionable plans for regional expansion, Ketan will provide a personalized consultation.

Act now to secure a comprehensive analysis that integrates sustainability imperatives, competitive intelligence, and practical recommendations. Engage with our team to receive a detailed proposal, arrange a sample briefing, and discuss bespoke research extensions. By partnering directly with Ketan, you ensure that your investment generates maximum return through targeted insights and strategic roadmaps designed for immediate implementation. Contact Ketan Rohom today and position your enterprise at the forefront of the limewash paint market.

- How big is the Limewash Paint Market?

- What is the Limewash Paint Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?