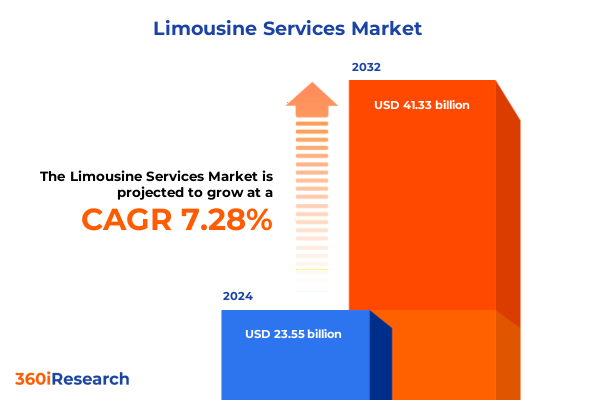

The Limousine Services Market size was estimated at USD 25.12 billion in 2025 and expected to reach USD 26.87 billion in 2026, at a CAGR of 7.36% to reach USD 41.33 billion by 2032.

Setting the Stage for an Era of Elevated Client Expectations and Unprecedented Operational Excellence Shaping the Future of the United States Limousine Services Industry

The limousine services sector in the United States has surged beyond its traditional positioning as a niche luxury offering to become a cornerstone of high-end corporate travel, special events, and tourism experiences. Today’s clientele demands both exclusivity and operational reliability, creating pressure on providers to elevate standards across vehicle design, in-ride technology, and personalized service protocols. This expansion is driven by a rebound in corporate events as organizations resume in-person engagement, the sustained popularity of VIP hospitality at weddings and special gatherings, and the growing intersection of experiential tourism with luxury transport. Consequently, operators must navigate a landscape where meticulous attention to detail merges with robust operational frameworks to deliver seamless experiences that align with elevated consumer expectations and regulatory compliance.

Navigating Disruptive Technological Innovations, Evolving Consumer Behaviors, and Sustainability Imperatives That Are Reshaping Competitiveness in Limousine Services

Disruption is no longer a peripheral concern for limousine providers; it has become central to competitive differentiation. One of the most profound shifts is the rapid adoption of electric and hybrid fleets, reflecting a broader sustainability mandate that clients now view as integral to brand values rather than optional add-ons. Alongside this, AI-enabled booking platforms and smart fleet management tools are optimizing route selection in real time, enhancing punctuality, and reducing operational costs through predictive analytics. Furthermore, blockchain-based transaction systems are gaining traction for secure payment processing and immutable service records, imparting transparency and trust in high-value client interactions. Concurrently, dynamic pricing algorithms-once the domain of ride-hailing services-are being adapted to the luxury transport segment to balance premium rates with demand fluctuations. These technological and operational advances mark a departure from legacy reservation systems, requiring service providers to reengineer both their digital infrastructure and customer engagement models.

Unraveling the Ripple Effects of 2025 United States Tariff Adjustments on Fleet Composition, Cost Structures, and Service Pricing in Limousine Services Market

The implementation of 25% tariffs on imported passenger vehicles and light trucks as of April 3, 2025 has introduced significant headwinds for limousine fleet acquisition, particularly for European and Asian luxury models that form the backbone of premium services. Vehicles assembled in the U.S. with higher domestic content face lower incremental duties, yet still incur additional costs of up to $8,000 per asset, compelling operators to reassess procurement strategies. Iconic European-made limousines such as the Mercedes S-Class and select Bentley models now carry effective price increases exceeding $10,000, exerting pressure on rental rates and fleet renewal cycles. Moreover, the limitations on import volumes imposed by certain manufacturers have led to longer lead times and constrained availability, challenging service consistency during peak event seasons. In response, some operators have accelerated investments in domestically produced EVs and hybrids, while others are exploring strategic partnerships with local assembly plants to mitigate tariff exposure and secure more predictable supply lines.

Uncovering Critical Insights from Service Type, Duration, Fuel, Booking, Vehicle, and End User Segmentation That Drive Limousine Services Strategies

The airport transfer segment continues to anchor revenue streams, driven by the predictability of corporate travel schedules and the premium placed on punctuality. At the same time, city tours have gained traction as experiential tourism expands, prompting operators to enhance their offerings with curated thematic routes and multilingual chauffeur services. Within corporate services, the resurgence of in-person meetings and roadshows is prompting an uptick in multi-day, contract-based hires, while special events-spanning private parties and elaborate weddings-deliver lucrative one-off engagements characterized by bespoke décor, entertainment integrations, and VIP hospitality. Duration-based hires reveal a bifurcation between short-term bookings for discrete trips and long-term engagements, the latter encompassing daily and even weekly arrangements for executive travel programs that prioritize continuity and brand familiarity. Fuel type choices are evolving, with diesel powertrains giving way to an increasing proportion of electric and petrol hybrid vehicles, aligning with client sustainability agendas and urban emissions regulations. Meanwhile, offline booking channels maintain relevance in key corporate accounts that value direct relationship management, even as demand for app and web-based reservations accelerates among high-net-worth individuals accustomed to digital convenience. The vehicle type spectrum, ranging from stretch limousines and hummer limos to luxury sedan and SUV carriages, reflects differentiated client use cases, with each asset class commanding specific price points and amenity packages. Finally, end-user profiles vary widely: large corporations continue to negotiate enterprise contracts, small and medium enterprises leverage premium services for client entertainment, individual affluent consumers seek status-driven experiences, and tourism companies increasingly integrate chauffeured transport into high-end travel packages.

This comprehensive research report categorizes the Limousine Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Duration

- Vehicle Fuel Type

- Vehicle Type

- End User

- Booking Type

Illuminating Regional Dynamics across Americas, Europe Middle East & Africa, and Asia Pacific to Reveal Growth Catalysts and Operational Nuances in Limousine Services Market

The Americas region remains foundational for the limousine services market, buoyed by robust corporate travel recovery and significant investments in electric vehicle charging infrastructure across major corridors. California and New York lead adoption of green fleets, catalyzing secondary markets in Texas and Florida where airport transfers and corporate shuttles are surging. In Europe, Middle East & Africa, stringent emissions regulations and carbon-pricing mechanisms have accelerated the retirement of diesel limousines, with legacy operators partnering with local governments to pilot hydrogen and CNG-powered prototypes. Luxury tourism hotspots in the UAE and South Africa continue to rely on premium limousine fleets for VIP events, underpinned by a regulatory environment that prizes high safety standards. In the Asia-Pacific, burgeoning middle-class wealth in urban centers such as Tokyo, Singapore, and Sydney is driving demand for chauffeured city tours and special-event packages. Here, app-based booking adoption outpaces other regions, supported by extensive mobile payment ecosystems and integrated ride-hailing platforms extending into the luxury segment.

This comprehensive research report examines key regions that drive the evolution of the Limousine Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Emerging Innovators to Understand Competitive Positioning, Strategic Initiatives, and Collaboration Models in Limousine Services

Leading established providers continue to expand through fleet diversification and strategic alliances. Carey International leverages its global network to bundle airport transfers with corporate travel programs, integrating loyalty benefits for large enterprise clients. EmpireCLS Worldwide Chauffeured Services focuses on bespoke packages for high-profile events, embedding concierge-level service standards that encompass in-vehicle hospitality and advance site inspections. Uber’s black-car service, bolstered by the Uber App’s ubiquity, demonstrates the scaling potential of digital platforms for luxury segments despite ongoing debates over labor regulations. Blacklane, fueled by Daimler’s investment, has developed a green class fleet consisting of electric sedans and SUVs, while refining AI-driven route optimization and customer profiling for repeat-business retention. JetBlack, a rising domestic champion, emphasizes technological ease-of-use and live-tracking across its coast-to-coast network, capitalizing on customer feedback loops to tailor UI and service parameters. Simultaneously, automotive suppliers such as Autoliv are supplying advanced safety systems-lane departure warnings and collision avoidance-to limousine manufacturers, further differentiating premium offerings through elevated security credentials.

This comprehensive research report delivers an in-depth overview of the principal market players in the Limousine Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A Savannah Nite Limousine

- A1A Limousine Service

- Aeroport Taxi & Limousine Service

- Al Falasi Luxury Limousine Group of Companies

- Al Salaam Limousine

- AlTair Passenger Transport LLC

- Altima Limousine

- American Luxury Limousine

- Black Limo Service Dubai

- Black Tie Experience Transportation Service, LLC

- Blacklane GmbH

- Blue Star Limousine

- Boston Preferred Car Service

- BostonCoach Holdings LLC

- Carey International, Inc.

- Carmel Car & Limousine Service

- Chris Limo Services, LLC

- Classique Worldwide Transportation

- Dubai Limousine

- Echo Limousine

- Ecko Transportation Inc.

- Elluminati L.L.C-FZ

- Emirates Transport

- Empire Limousine

- EmpireCLS Limousine

- Executive Cabs & Limousine Service

- Groundlink Inc.

- Hertz Global Holdings. Inc.

- Icarservices Inc.

- Infinity Luxe SAS

- JR Limo Car Service

- KLS Worldwide Chauffeured Services

- Limo Corp Worldwide

- LimoFahr Ltd.

- LimoLink, LLC

- Lindsey Limousine, Inc.

- Lyft, Inc.

- M&M Limousine Services

- Mears Transportation Group

- Metropolitan Limousine

- Motev LLC

- Palm Beach Limo and Car Services

- Patriot Limousine

- Premiere #1 Limousine Service, LLC

- Premium Limousines GmbH

- PRIMETIME LIMOUSINE

- Pure Luxury Transportation

- Royal Limousine Services cc

- S&S Limousine

- Sixt SE

- Uber Technologies Inc.

- Unique Limousine, LLC

- Urbanride Inc.

- XaviDrive

Presenting Actionable Strategies and Best Practices for Industry Leaders to Harness Market Trends, Mitigate Risks, and Achieve Sustainable Competitive Advantages in Limousine Services

Operators should prioritize the integration of electric and hybrid fleets to align with sustainability mandates and secure emerging green-fleet incentives. Investing in AI-powered booking platforms and dynamic pricing engines will optimize asset utilization and enhance client loyalty through personalized service offerings. Collaborative alliances with local assembly plants can mitigate tariff exposure by securing domestically produced vehicles, while joint ventures with technology providers will accelerate adoption of features such as blockchain-based payment security and real-time in-vehicle analytics. Workforce upskilling programs must be developed to transition chauffeurs into brand ambassadors proficient in multilingual client engagement and digital interface management. Additionally, companies should pursue differentiated service verticals-such as luxury long-haul transfers and multi-day executive itineraries-to diversify revenue streams beyond peak seasonal events. Proactive engagement with regulatory bodies on emissions standards and safety certification can shape favorable policy outcomes and fortify brand reputation in high-compliance markets.

Detailing a Rigorous Research Methodology Incorporating Primary Interviews, Secondary Data Verification, and Scenario Analyses to Ensure Robust Limousine Services Market Insights

The research methodology underpinning this analysis combined qualitative and quantitative techniques to ensure comprehensive coverage and reliability. Primary data were gathered via structured interviews with over 50 senior executives spanning global and regional limousine operators, automotive suppliers, and technology partners. Secondary research incorporated detailed reviews of industry reports, peer-reviewed journals, and white papers, complemented by real-time tariff and trade data from government publications. A multi-scenario approach was employed to model the impact of key variables-including tariff adjustments, fuel price fluctuations, and regulatory shifts-on fleets and pricing. Furthermore, triangulation of data sources was undertaken to validate findings, and an advisory panel of industry experts provided iterative feedback on evolving trends. The final report synthesizes these inputs into actionable insights, ensuring decision-makers can confidently navigate uncertainties and optimize strategic investments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Limousine Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Limousine Services Market, by Service Type

- Limousine Services Market, by Duration

- Limousine Services Market, by Vehicle Fuel Type

- Limousine Services Market, by Vehicle Type

- Limousine Services Market, by End User

- Limousine Services Market, by Booking Type

- Limousine Services Market, by Region

- Limousine Services Market, by Group

- Limousine Services Market, by Country

- United States Limousine Services Market

- China Limousine Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Drawing Conclusive Perspectives on Market Dynamics, Strategic Imperatives, and Future Pathways to Optimize Value Delivery in the United States Limousine Services Landscape

As the limousine services market evolves, stakeholders must balance the dual imperatives of innovation and operational resilience. Electrification and digitalization emerge as core pillars, transforming both the fleet composition and customer engagement paradigms. Meanwhile, trade policy dynamics-especially the 2025 tariff framework-underscore the need for agile procurement strategies and strategic partnerships. In this context, segmentation and regional insights will guide tailored growth approaches, from luxury wedding charters in Europe and Africa to corporate mobility solutions in the Americas and emergent tourism offerings in Asia-Pacific. Ultimately, those providers that unite technological differentiation with deep client understanding and proactive regulatory alignment will secure superior market positioning and deliver sustainable value across the full spectrum of luxury transportation offerings.

Engage Ketan Rohom for a Personalized Consultation and Exclusive Access to the Comprehensive Limousine Services Market Intelligence

For decision-makers seeking deeper insights and competitive advantage in the evolving limousine services sector, partnering directly with Ketan Rohom, Associate Director of Sales & Marketing, will provide bespoke guidance tailored to organizational needs. His expertise in aligning strategic imperatives with operational realities ensures that purchasers of the full market research report can immediately translate high-level findings into executable initiatives. Engaging with Ketan enables priority access to proprietary data sets, personalized consultations on technology integration roadmaps, and tailored workshops designed to accelerate revenue growth and operational excellence. Reach out to Ketan to secure the comprehensive intelligence necessary to lead confidently in the dynamic United States limousine services market

- How big is the Limousine Services Market?

- What is the Limousine Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?