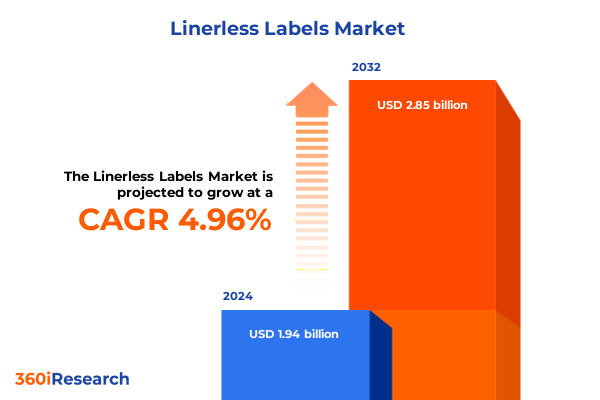

The Linerless Labels Market size was estimated at USD 2.03 billion in 2025 and expected to reach USD 2.12 billion in 2026, at a CAGR of 5.00% to reach USD 2.85 billion by 2032.

Introduction to the Revolution in Sustainable and Efficient Labeling with Linerless Technologies Transforming Packaging Operations Worldwide

The linerless label industry has emerged as a pivotal enabler of sustainable packaging practices and operational efficiency across multiple sectors. By eliminating the traditional release liner, linerless labels significantly reduce material waste and logistics costs, a factor that has resonated with both brand owners and regulatory bodies. The accelerated shift toward circular economy principles has prompted manufacturers to seek labeling solutions that align with ambitious recyclability and waste-reduction targets, particularly in regions like Europe where stringent environmental mandates are in effect.

In addition to regulatory drivers, the growing prevalence of e-commerce and on-demand production models has intensified the demand for flexible, variable-length labeling systems. Digital printing platforms and thermal technologies enable high-resolution, personalized labels without the need for pre-cut liner stocks, streamlining order fulfillment and reducing downtime. As such, linerless solutions are increasingly viewed not only as eco-friendly alternatives but also as strategic investments that enhance supply chain responsiveness and brand differentiation in a crowded marketplace.

Transformative Shifts Driving the Linerless Label Landscape from Regulatory Mandates to Technological Innovation and Operational Automation

Over the past few years, the linerless label landscape has been reshaped by powerful transformative forces, chief among them a wave of regulatory frameworks aimed at curtailing packaging waste. The European Union’s Packaging and Packaging Waste Regulation has set binding recyclability requirements and waste-reduction targets that have accelerated the adoption of linerless labels as one of the few immediately deployable solutions to eliminate liner scraps at scale. Parallel initiatives in North America and Asia-Pacific are targeting extended producer responsibility and single-use plastic bans, reinforcing the case for linerless implementations that cut disposal costs and simplify compliance.

Simultaneously, advancements in digital printing and smart label technologies have revolutionized the way businesses view labeling. High-speed digital and thermal systems now support variable data printing, while UV-cured ink and water-based coating innovations enhance durability and substrate compatibility. Coupled with the integration of RFID and QR-code traceability features, linerless labels are no longer considered basic pressure-sensitive films but sophisticated data carriers that drive operational automation, particularly in high-volume logistics and quick-service restaurant environments where on-demand kitchen labeling is now routine.

Assessing the Cumulative Impact of United States 2025 Trade Tariffs on Linerless Label Supply Chains and Packaging Material Sourcing Strategies

In 2025, newly escalated U.S. tariff measures-stemming from broad Section 301 investigations and retaliatory actions-have introduced significant cost pressures on packaging components, including linerless label materials and printing equipment. The threat of increased duty rates on imported adhesives, specialty facestocks, and digital printers has disrupted global supply chains, compelling label converters to reevaluate sourcing strategies and supplier portfolios. These heightened trade tensions have underscored the vulnerabilities inherent in concentrated manufacturing geographies and have driven many to diversify production into tariff-exempt jurisdictions.

Compounding these tariff risks, U.S. businesses have responded with innovative cost-mitigation tactics, such as optimizing substrate thickness, streamlining label formats to conserve material, and renegotiating logistics contracts to absorb higher duties. Some manufacturers are substituting niche polymers with locally produced paper blends or transitioning to thinner, single-coated liners to reduce landed costs. These adaptations highlight the resilience of the linerless label sector but also signal a need for closer collaboration between material science experts, equipment suppliers, and brand owners to buffer against ongoing geopolitical and trade volatility.

Key Segmentation Insights Revealing How Technology, Materials, Adhesive Types, Composition, End Use Industries, and Distribution Channels Shape Market Adoption

Detailed analysis of market segmentation reveals that each axis of classification-from printing technology to distribution channel-plays a defining role in how linerless labels are adopted across industries. Digital, flexographic, inkjet, rotogravure, and thermal technologies each offer distinct trade-offs between setup speed, print resolution, and substrate compatibility, shaping converter investments and end-user preferences. Similarly, the choice between film-based materials, paper-based substrates, or synthetic alternatives hinges on performance requirements such as moisture resistance, recyclability, and cost profile.

Adhesive selection further influences application outcomes, with permanent formulations dominating scenarios where durability and tamper evidence are critical, while removable and repositionable systems unlock scheduling flexibility for retailers and logistics operators. The core composition of a linerless label-comprising adhesive, facestock, and topcoat layers-must be engineered to balance adhesion strength, print fidelity, and release properties. End use industries drive specialized demand patterns: cosmetics and personal care brands integrate linerless labeling across fragrance, hair care, makeup, and skincare lines to enhance shelf appeal; food and beverage companies leverage them in bakery, beverage, dairy, and processed food segments to ensure regulatory compliance and reduce waste; healthcare and pharmaceutical enterprises rely on tailored solutions for medical devices and specimen labeling; logistics and transportation providers optimize parcel, shipping, and warehousing operations through seamless tagging; and retail segments spanning apparel, electronics, grocery, and home and personal care adopt linerless labels to streamline checkout and inventory management. Finally, the distribution channel dichotomy between offline and online sales environments dictates packaging formats, labeling speed requirements, and integration with point-of-sale and warehouse management systems.

This comprehensive research report categorizes the Linerless Labels market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Material

- Adhesive Type

- Composition

- End Use Industry

- Distribution Channel

Key Regional Insights Highlighting the Unique Drivers, Challenges, and Opportunities for Linerless Labels Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics are equally influential, with the Americas, Europe, Middle East & Africa, and Asia-Pacific each presenting unique growth drivers and hurdles for linerless label adoption. In the Americas, strong consumer demand for sustainable packaging, coupled with progressive state-level recycling mandates, has spurred investments in linerless solutions, especially within e-commerce logistics and quick-service restaurant chains. North American converters are capitalizing on local material innovations to mitigate recent tariff challenges and meet corporate ESG commitments.

The Europe, Middle East & Africa region is characterized by the most rigorous environmental regulations, where directives such as the EU’s packaging waste framework have catalyzed the migration to linerless technology as a cost-effective compliance tool. Leading multinationals streamline operations across multiple countries by standardizing on linerless specifications, reducing complexity and waste while enhancing brand consistency in diverse markets.

Meanwhile, Asia-Pacific boasts the fastest adoption curve, driven by exponential growth in retail, food and beverage, and logistics sectors. Countries such as China, India, and Southeast Asian economies are rapidly embracing linerless labels to manage burgeoning urban populations and supply chain scale-up. Regional manufacturers are innovating with locally sourced film and paper materials to meet cost-sensitive market requirements, positioning Asia-Pacific as a hub for both production and consumption of next-generation linerless label technologies.

This comprehensive research report examines key regions that drive the evolution of the Linerless Labels market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Insights into the Market Strategies, Technological Innovations, and Sustainability Initiatives of Leading Linerless Label Manufacturers

The competitive landscape of the linerless label market is shaped by a blend of established conglomerates and specialized innovators. Avery Dennison Corporation has emerged as a frontrunner, leveraging a robust R&D pipeline and global production footprint to scale water-based and UV-curable adhesive solutions tailored for food, beverage, and healthcare applications. Its emphasis on sustainable formulations and linerless product lines underpins its leadership position across North America and Europe.

CCL Industries Inc. maintains a strong presence in the market through targeted acquisitions and strategic partnerships, notably in RFID-enabled linerless labels under its Checkpoint Systems banner. This capability enhances inventory visibility and traceability for retail and logistics clients. UPM Raflatac stands out for its focus on circular economy principles, advancing low-energy curing processes and high-performance “RAFLEX” products that reduce material waste in demanding healthcare environments. Fuji Seal International drives growth in Asia-Pacific with cost-efficient manufacturing processes and digital printing integrations, while Sato Holdings expands applicator technologies and auto-ID solutions globally. Emerging players are forging niche advantages through collaborations on decorative liners and specialized topcoats, indicating a vibrant and innovation-driven competitive arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Linerless Labels market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Avery Dennison Corporation

- Barcode Factory

- Conver Autoadhesivos S.A.

- Coveris Management GmbH

- Diversified Labeling Solutions

- DuraFast Label Company by Sector Nine Distribution Limited

- Dykam A.C.A. Ltd.

- General Data Company, Inc.

- HERMA GmbH

- Hub Labels, Inc.

- Libra Labels

- Loparex International B.V.

- NAStar Inc. by Outside Inc.

- Nordvalls Etikett AB

- ProPrint Group

- R.R. Donnelley & Sons Company

- Ravenwood Packaging Ltd

- Rotolificio Bergamasco

- SATO Holdings Corporation

- Shenzhen Johnson New Materials Co.,Ltd

- Skanem AS

- Specialty

- The Reflex Group

- UPM-Kymmene Corporation

Actionable Recommendations for Industry Leaders to Capitalize on Emerging Linerless Label Trends through Innovation, Collaboration, and Regulatory Engagement

To capitalize on the accelerating adoption of linerless labels, industry leaders should prioritize investments in next-generation printing technologies that support rapid changeover, variable data operations, and high print quality at scale. Partnering with material science specialists to refine adhesive chemistry and topcoat formulations will unlock new applications in temperature-sensitive and pharmaceutical packaging contexts.

Engagement with regulatory bodies and active participation in standards committees can ensure early alignment with emerging waste-reduction mandates, positioning companies as preferred suppliers for sustainability-driven tenders. Moreover, diversifying manufacturing and raw-material sourcing across multiple geographies will mitigate geopolitical and tariff-related risks, safeguarding supply continuity. Collaborative pilots with major end users in sectors such as e-commerce logistics, quick-service restaurants, and beauty brands can co-create tailored linerless solutions, fostering long-term partnerships and new revenue streams. Strategic alliances with automation and software providers will further enhance labeling workflows, driving productivity gains and reinforcing competitive advantage.

Research Methodology Outlining the Comprehensive Approach of Data Collection, Expert Engagement, and Analytical Rigour Underpinning the Market Study

This market study is underpinned by a rigorous dual-track research methodology combining extensive secondary intelligence gathering with targeted primary engagements. Secondary data sources include published regulatory frameworks, industry white papers, corporate sustainability reports, and trade association releases, ensuring a comprehensive baseline of market drivers and regulatory trends.

Primary research comprised in-depth interviews with senior executives and technical experts across material suppliers, equipment manufacturers, brand owners, and converters. These discussions contextualized evolving end-user requirements, operational challenges, and technology adoption patterns. Data triangulation techniques were employed to validate quantitative estimates and reconcile diverging viewpoints, while segmentation frameworks were refined through iterative expert consultation. The resulting analysis integrates structured qualitative insights with robust market segmentation, delivering actionable findings calibrated to current industry conditions and near-term regulatory horizons.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Linerless Labels market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Linerless Labels Market, by Technology

- Linerless Labels Market, by Material

- Linerless Labels Market, by Adhesive Type

- Linerless Labels Market, by Composition

- Linerless Labels Market, by End Use Industry

- Linerless Labels Market, by Distribution Channel

- Linerless Labels Market, by Region

- Linerless Labels Market, by Group

- Linerless Labels Market, by Country

- United States Linerless Labels Market

- China Linerless Labels Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Conclusion Summarizing Strategic Implications, Market Drivers, and Future Outlook for Stakeholders in the Evolving Linerless Label Industry

As the linerless label market continues to gain momentum, stakeholders across the value chain must adapt their strategies to align with sustainability imperatives, technological advancements, and shifting trade landscapes. Regulatory mandates in major economies are converging on waste-reduction targets that favor linerless implementations, while digital and automation technologies are expanding the functional boundary of labeling beyond simple identification to integrated data and traceability platforms.

The cumulative impact of evolving tariffs, raw material constraints, and competitive innovation underscores the importance of agility and collaborative ecosystem approaches. Companies that invest in specialized adhesive and facestock formulations, diversify sourcing footprints, and cultivate strategic partnerships will be best positioned to capture growth opportunities. Ultimately, linerless labels represent not just a packaging evolution but a strategic enabler of circularity, operational efficiency, and brand differentiation in a fast-moving global marketplace.

Take the Next Step: Engage with Ketan Rohom to Access the Full Linerless Labels Market Research Report and Drive Strategic Growth Initiatives

For organizations committed to staying ahead in the rapidly evolving linerless label market, securing the full insights and strategic analysis contained in the comprehensive market research report is paramount. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore licensing options, receive tailored customizations, and unlock detailed action plans designed to guide your organization’s growth and innovation initiatives. Accessing this report will empower your team with in-depth data, competitive benchmarking, and forward-looking scenarios that are essential for making informed strategic decisions and driving sustainable success in the dynamic labeling industry.

- How big is the Linerless Labels Market?

- What is the Linerless Labels Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?