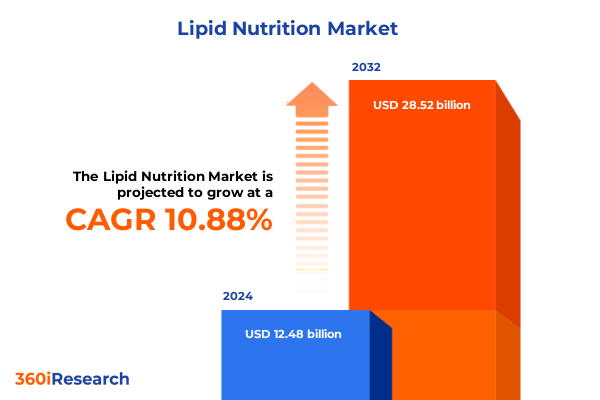

The Lipid Nutrition Market size was estimated at USD 13.64 billion in 2025 and expected to reach USD 14.92 billion in 2026, at a CAGR of 11.10% to reach USD 28.52 billion by 2032.

Charting the Future of Lipid Nutrition: Unveiling Market Drivers, Innovations, and Strategic Pathways in a Rapidly Evolving Nutraceutical Landscape

The lipid nutrition discipline has become a cornerstone of the functional ingredient sector, driven by deepening scientific understanding of how specific fatty acids contribute to human health. In recent years, awareness around the unique metabolic pathways and bioavailability of medium chain triglycerides has spurred innovation across sports nutrition and weight management products. Meanwhile, omega-3 fatty acids such as EPA and DHA have transitioned from niche cardiovascular supplements to mainstream ingredients in functional foods and beverages, reflecting their validated roles in brain and prenatal health. Foam-technology encapsulation and micro-emulsion platforms have further broadened the application range for these oils, enhancing sensory profiles and oxidative stability within complex formulations. As a result, ingredient suppliers, contract manufacturers, and brand marketers are collaborating more than ever to integrate lipid components into next-generation nutraceuticals and fortified foods, forging new product categories in the quest to meet evolving consumer health priorities.

Identifying Transformative Shifts That Are Reshaping Product Innovation, Consumer Preferences, and Supply Chain Sustainability in Lipid Nutrition

Innovations in lipid sourcing and processing are redefining the competitive terrain and unlocking new avenues for value creation. Novel extraction techniques, such as supercritical CO₂ fractionation and enzymatic transesterification, have improved yields and purity levels while reducing solvent usage. These advances bolster the appeal of plant-derived lipid fractions, underscoring a shift toward sustainable ingredient procurement. Concurrently, the proliferation of personalized nutrition platforms has elevated demand for tailored lipid blends, enabling formulators to target individual metabolic profiles and health objectives. Digital supply chain tracking solutions also offer unprecedented transparency, enabling brands to authenticate origin claims for marine-derived oils and certify compliance with emerging ESG standards. Such transformative forces are catalyzing cross-sector partnerships that span biotechnology, food science, and data analytics, thereby accelerating the translation of lipid science into commercially viable innovations and aligning with broader wellness and sustainability mandates.

Assessing the Cumulative Impact of 2025 United States Trade Policies and Reciprocal Tariffs on Lipid Ingredient Supply Chains

United States trade policies enacted in early 2025 have introduced new layers of complexity for lipid ingredient sourcing and cost management. Industry stakeholders are monitoring a pending Section 232 national security investigation into pharmaceutical imports, which may inadvertently envelop omega-3 rich oils and related fatty acid derivatives under tariff classifications originally designed for active pharmaceutical ingredients. Parallel to this, a 10 percent tariff on a broad array of dietary ingredients, including animal and vegetable fatty acids, was imposed on imports from China, the world’s dominant supplier of key nutritional lipids and precursor feedstocks. Collectively, these measures threaten to disrupt established procurement channels for fish oil, algae oil, and plant-derived lipid fractions, prompting ingredient buyers to reevaluate near-sourcing alternatives, negotiate revised long-term contracts, and consider vertical integration to secure access and price stability.

Revealing Key Segmentation Insights Across Product Types, Forms, Sources, Applications, Distribution Channels and End Users in Lipid Nutrition

A nuanced understanding of market segmentation reveals multiple dimensions that are shaping product strategies and supply chain configurations. Within the product type segment, medium chain triglycerides are sub-categorized into capric, caprylic, and lauric acid fractions, each with distinctive metabolic and functional attributes, while omega-3 fatty acids encompass alpha-linolenic, eicosapentaenoic, and docosahexaenoic acid moieties. Phospholipids such as lecithin, sphingomyelin, and cephalins offer emulsification and cellular health benefits, and sterols like beta sitosterol, campesterol, and stigmasterol provide proven cholesterol-modulating effects. Form considerations range from softgels to oil and powder systems, each requiring tailored stabilization and encapsulation technologies to maintain bioactivity. Source diversity spans from dairy-derived phospholipids to fish, algal, and krill oils, as well as plant-based streams like canola, flaxseed, palm, and soybean, fostering ongoing R&D investments in alternative feedstocks. Application lenses capture end-use in animal feed, dietary supplements targeting cardiovascular, cognitive, and weight management outcomes, as well as functional foods, infant formulas, and pharmaceutical formulations, while distribution channels traverse direct sales, pharmacy outlets, e-commerce platforms, grocery and specialty retailers. Finally, end-user classification delineates distinct procurement patterns across animal feed producers, food and beverage manufacturers, pharmaceutical firms and direct-to-consumer brands, each guided by unique regulatory, quality and certification requirements.

This comprehensive research report categorizes the Lipid Nutrition market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Source

- Application

- Distribution Channel

- End User

Uncovering Regional Dynamics and Market Drivers Spanning the Americas, EMEA and Asia-Pacific to Illuminate Growth Opportunities in Lipid Nutrition

Regional dynamics exert a profound influence on strategic imperatives for lipid ingredient providers and end-use industries. In the Americas, robust consumer demand for performance nutrition and heart-health products is buttressed by leading North American contract manufacturers and marine oil processors, with local regulatory harmonization facilitating rapid product introductions and label claims. Across Europe, Middle East and Africa, sustainability frameworks and traceability regulations are driving offshore investments in algae cultivation and molecular distillation capacities, while established pharmaceutical ingredient clusters in Ireland and Germany anchor high-purity phospholipid production. In the Asia-Pacific region, rising incomes coupled with growing awareness of prenatal and pediatric nutrition form the backbone of demand, creating opportunities for domestic plant-oil refiners and strategic alliances with European and North American technology licensors.

This comprehensive research report examines key regions that drive the evolution of the Lipid Nutrition market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Presenting Key Corporate Strategies and Innovation Highlights from Leading Global and Regional Lipid Nutrition Players to Drive Competitive Advantage

Leading industry participants are deploying a spectrum of strategic maneuvers to fortify their competitive positioning. Koninklijke DSM N.V. has leveraged targeted acquisitions and expanded its Life’sDHA algal oil portfolio to solidify its presence in brain and maternal health segments, backed by integrated R&D tax credits and cross-functional development teams. BASF SE has prioritized sustainability by advancing novel enzymatic fractionation processes and introducing geo-certified MCT fractions, underpinned by a global distribution network and partnerships with major beverage and bakery brands. Archer Daniels Midland has scaled its plant-oil refining platforms, focusing on purity grades for dietary supplement applications, while forging dual-sourcing agreements to mitigate tariff-driven supply disruptions. Nordic Naturals continues to emphasize product transparency through blockchain-enabled traceability, and Croda International has broadened its phospholipid offering via a joint venture in Eastern Europe, illustrating the proliferation of co-development and equity alliances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lipid Nutrition market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- BASF SE

- Bunge Limited

- Cargill, Incorporated

- Croda International Plc

- Enzymotec Ltd

- GC Rieber Oils AS

- Koninklijke DSM N.V.

- Lecico GmbH

- The Stepan Company

Outlining Actionable Recommendations for Industry Leaders to Navigate Emerging Regulatory Challenges, Supply Disruptions and Evolving Consumer Expectations

Industry leaders must adopt a proactive posture to navigate the evolving regulatory and supply chain landscape. First, diversifying procurement sources beyond single-origin suppliers will dilute exposure to tariff escalations and Section 232 investigations, while long-term off-take agreements can serve as cost-containment instruments. Second, investing in advanced R&D capabilities, including precision enzymology and nanoencapsulation, will differentiate product offerings and meet heightened consumer expectations for quality and performance. Third, forging strategic alliances with logistics providers and certification bodies will ensure seamless compliance with sustainability indexes and traceability mandates, enhancing brand integrity and consumer trust. Fourth, calibrating product portfolios to address personalized nutrition trends and emerging therapeutic claims will expand market reach and create higher-value applications, positioning companies to lead the next wave of functional lipid innovation.

Detailing a Rigorous Research Methodology Combining Primary Interviews, Data Triangulation and Comprehensive Secondary Sources for Unbiased Market Analysis

This analysis employs a rigorous, multi-phase approach to ensure validity and reliability of findings. The research commenced with an exhaustive secondary literature review, including publicly filed regulatory documents, corporate financial disclosures, patent databases and scientific journals, to map the competitive and technological landscape. Subsequently, qualitative primary interviews were conducted with C-suite executives, formulation scientists, procurement specialists and regulatory advisors across ingredient suppliers, contract manufacturers, and brand owners to gather firsthand perspectives on market drivers and challenges. Data triangulation methods were applied to reconcile quantitative and qualitative inputs, with emphasis on consistency checks and outlier identification. Finally, internal workshops facilitated synthesis of strategic themes and actionable insights, bolstered by expert peer review to mitigate potential bias and validate interpretive frameworks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lipid Nutrition market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lipid Nutrition Market, by Product Type

- Lipid Nutrition Market, by Form

- Lipid Nutrition Market, by Source

- Lipid Nutrition Market, by Application

- Lipid Nutrition Market, by Distribution Channel

- Lipid Nutrition Market, by End User

- Lipid Nutrition Market, by Region

- Lipid Nutrition Market, by Group

- Lipid Nutrition Market, by Country

- United States Lipid Nutrition Market

- China Lipid Nutrition Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Conclusion Summarizing Critical Insights and Strategic Imperatives to Leverage Emerging Trends and Strengthen Market Positioning in Lipid Nutrition

In conclusion, the lipid nutrition sector stands at a pivotal juncture characterized by accelerating innovation, heightened regulatory scrutiny, and dynamic trade environments. Advances in extraction and stabilization technologies underpin the development of differentiated lipid ingredients, while consumer demand for health-promoting functional foods and personalized nutraceuticals continues to grow. Trade policies and tariff measures in 2025 present both challenges and catalysts for supply chain realignment, urging industry stakeholders to adopt diversified sourcing strategies and deeper collaboration. By integrating data-driven segmentation insights, regional market intelligence, and strategic imperatives outlined herein, companies can position themselves to capitalize on emerging trends, fortify supply chain resilience, and unlock new pathways to sustainable growth in the lipid nutrition landscape.

Take the Next Step Toward Actionable Market Intelligence by Connecting with Ketan Rohom to Access the Comprehensive Lipid Nutrition Research Report

To take full advantage of this in-depth exploration of lipid nutrition market dynamics and actionable insights, readers are invited to engage directly with Ketan Rohom, Associate Director of Sales & Marketing at our firm. By reaching out to Ketan, stakeholders can discuss bespoke requirements, clarify methodological nuances, and secure immediate access to the comprehensive report that underpins this executive summary. This conversation will also cover additional data segments, custom forecasts, and strategic consulting services designed to support product launches, market entry strategies, or portfolio optimizations within the lipid nutrition space. Prospective clients will benefit from a streamlined procurement process and an opportunity to ask targeted questions about how emerging trends, regulatory shifts, and supply chain considerations directly affect their business objectives. Whether the goal is to identify new partnership prospects, explore innovative ingredient applications, or navigate complex tariff landscapes, Ketan Rohom will facilitate the acquisition process and ensure rapid delivery of the report’s full analytical depth, empowering decision-makers with the intelligence necessary to drive growth and competitive differentiation.

- How big is the Lipid Nutrition Market?

- What is the Lipid Nutrition Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?