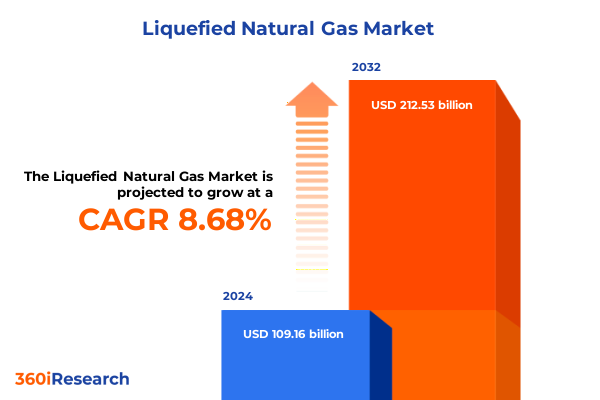

The Liquefied Natural Gas Market size was estimated at USD 118.26 billion in 2025 and expected to reach USD 128.28 billion in 2026, at a CAGR of 8.73% to reach USD 212.53 billion by 2032.

A comprehensive overview of global liquefied natural gas markets, outlining supply trends, evolving demand drivers, and strategic industry catalysts

The global liquefied natural gas (LNG) market is navigating a pivotal moment in its evolution, marked by supply constraints, shifting demand patterns, and evolving policy frameworks. In 2024, incremental LNG supply grew by a modest 2 percent or 6 billion cubic meters, a testament to tight upstream foundations and the limited commissioning of new facilities. The Plaquemines LNG facility in Louisiana, which commenced operations late in 2024, was responsible for nearly half of this growth, underscoring the United States’ leading role in incremental capacity additions. Looking ahead, 2025 is poised to witness a marked acceleration, with expected supply growth of 5 percent or 27 billion cubic meters as multiple projects come online. Notably, North America is projected to contribute approximately 85 percent of this increase, driven by expansions at Plaquemines, Corpus Christi Stage 3, and LNG Canada.

Identifying the pivotal shifts reshaping the liquefied natural gas landscape, from decarbonization initiatives to technological breakthroughs and trade dynamics

Parallel to supply dynamics, global demand growth is moderating. After robust expansion in 2024, global natural gas demand is forecast to slow to around 1.5 percent in 2025. Asia’s demand growth remains the most significant driver, though it is expected to decelerate to just over 2 percent amid softer industrial activity and increased competition from renewable energy sources. Europe, which experienced an 18 percent decline in LNG imports in 2024 due to high storage levels and pipeline inflows, has reversed this trend in early 2025. LNG imports in Europe increased by over 20 percent year-on-year in Q1, driven by storage refill requirements and reduced piped gas supplies, setting the stage for near-record import levels this year.

Assessing how United States trade measures in 2025 have cumulatively influenced global LNG supply chains, pricing structures, and competitive trade flows

Looking beyond the immediate balance of supply and demand, industry leaders anticipate a profound transformation by mid-century. Shell projects global LNG demand to surge by approximately 60 percent by 2040, propelled by economic growth in Asia, stringent emissions reduction targets in heavy industries, and the fuel’s role as a transition energy source in power generation and transport. This outlook builds on strategic investments in long-term contracts linked to crude oil indices and highlights the critical need for supply diversification to mitigate geopolitical risks. As global markets brace for expanded consumption, the interplay between decarbonization imperatives and reliable energy supply will intensify.

Unveiling critical segmentation insights that delineate the liquefied natural gas market across infrastructure, types, applications, and distribution channels

In parallel with macro supply and demand trends, global LNG trade volumes exhibited resilience in 2024, growing by 2.4 percent to a record 411.24 million tonnes. The United States led exports with 88.4 million tonnes, followed by Australia (81.0 million tonnes) and Qatar (77.2 million tonnes), underscoring the increasingly multipolar supply base. China emerged as the single largest importer, boosting imports by 7.45 million tonnes to reach 78.6 million tonnes amid efforts to diversify energy sources. Conversely, European imports contracted by 21.2 million tonnes, reflecting robust renewable output and ample pipeline gas availability. This shifting trade topology lays the groundwork for strategic capacity expansions and contractual innovations in the years ahead.

This comprehensive research report categorizes the Liquefied Natural Gas market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Infrastructure

- Liquefaction Technology

- Capacity Size

- Application

- Distribution Channel

Illuminating key regional dynamics across the Americas, EMEA, and Asia-Pacific that are driving unique liquefied natural gas market transformations

The LNG market is dissected through multiple strategic lenses to uncover nuanced growth vectors. Infrastructure segmentation spans bunkering infrastructure, liquefaction and regasification terminals, shipping including conventional carriers, ice-class vessels and LNG bunkering vessels, as well as storage solutions comprising onshore depots and floating storage units. From a product perspective, the market bifurcates into large-scale and small-scale LNG, each addressing distinct demand profiles and investment thresholds. Application segmentation further distinguishes industrial use, power generation (both backup and off-grid), residential and commercial heating, and transportation fuel, the latter covering both marine and road modalities. Finally, distribution channels encompass bunkering barges, ISO tank containers, mini LNG carriers and virtual pipelines, with virtual pipelines extending through road transport and skid-mounted units. This richly layered segmentation framework facilitates targeted analysis across value-chain nodes.

This comprehensive research report examines key regions that drive the evolution of the Liquefied Natural Gas market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic initiatives and competitive positioning of leading liquefied natural gas companies driving innovation, capacity expansion, and partnerships

Regional dynamics underscore differentiated growth trajectories and strategic imperatives. In the Americas, the United States solidified its position as the world’s largest LNG exporter, shipping nearly 12 billion cubic feet per day in 2024 with significant volumes directed to Europe, Japan, South Korea and India. The Port of Corpus Christi set a new record handling 8.5 million tonnes of LNG in H1 2025, following infrastructure enhancements and expanded pipeline linkages to Permian Basin production zones.

This comprehensive research report delivers an in-depth overview of the principal market players in the Liquefied Natural Gas market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abu Dhabi National Oil Company

- ADNOC Gas PLC

- BP PLC

- Cheniere Energy, Inc.

- Chevron Corporation

- China National Offshore Oil Corporation

- China National Petroleum Corporation

- China Petroleum and Chemical Corporation

- ConocoPhillips Company

- Engie SA

- Eni S.p.A.

- Equinor ASA

- ExxonMobil Corporation

- Galileo Technologies S.A.

- Mozambique LNG

- Novatek JSC

- Oman LNG LLC

- Petroliam Nasional Berhad

- Petronet LNG Ltd.

- PJSC Gazprom

- QatarEnergy LNG

- Repsol S.A.

- Santos Limited

- Saudi Arabian Oil Company

- Sempra Energy

- Shell plc

- TotalEnergies SE

- Woodside Energy Group Ltd

Actionable strategies for industry leaders to navigate evolving liquefied natural gas market challenges and capitalize on emerging growth opportunities

Europe’s LNG landscape is defined by the pivot away from Russian pipeline gas. LNG imports rebounded sharply in Q1 2025 as storage refill obligations and policy mandates to phase out Russian supplies prompted nations to secure flexible, spot-indexed volumes. The European Union accounted for over 80 percent of US LNG flows in early 2024 and must navigate potential reciprocal tariffs while balancing energy security needs and decarbonization goals.

Describing the rigorous research methodology employed to derive robust, validated insights and ensure analytical integrity in the liquefied natural gas market

Asia-Pacific remains the largest importing region, with China and India at the forefront of demand growth. China’s imports of 78.6 million tonnes in 2024 reflected both long-term contractual commitments and flexible spot cargo acquisitions, although imports dipped sharply in Q1 2025 amid competitive bids from Europe. India’s emerging market, driven by industrial expansion and trade negotiations, is negotiating new supply agreements such as those with Alaska LNG to secure volumes for the Dabhol terminal expansion.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Liquefied Natural Gas market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Liquefied Natural Gas Market, by Infrastructure

- Liquefied Natural Gas Market, by Liquefaction Technology

- Liquefied Natural Gas Market, by Capacity Size

- Liquefied Natural Gas Market, by Application

- Liquefied Natural Gas Market, by Distribution Channel

- Liquefied Natural Gas Market, by Region

- Liquefied Natural Gas Market, by Group

- Liquefied Natural Gas Market, by Country

- United States Liquefied Natural Gas Market

- China Liquefied Natural Gas Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding synthesis of critical findings and future considerations shaping the strategic evolution of the liquefied natural gas market landscape

Industry leadership and competitive dynamics are epitomized by a select group of companies executing high-impact growth strategies. Cheniere Energy approved the final investment decision for Corpus Christi Midscale Trains 8 and 9, part of a plan to double its capacity to approximately 75 million tonnes per annum by the early 2030s. The Port of Corpus Christi’s record LNG exports of 8.5 million tonnes in H1 2025 highlight Cheniere’s operational momentum and pivotal role in U.S. export growth.

Connect with Ketan Rohom to secure comprehensive liquefied natural gas market intelligence and empower strategic decision-making with our detailed report

To explore the full breadth of these insights and equip your organization with actionable market intelligence, reach out directly to Ketan Rohom. As Associate Director of Sales & Marketing, he can guide you through tailored solutions, demonstrate detailed report excerpts, and align our comprehensive liquefied natural gas research with your strategic priorities. Engage now to secure the authoritative analysis that will inform your next strategic move.

- How big is the Liquefied Natural Gas Market?

- What is the Liquefied Natural Gas Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?