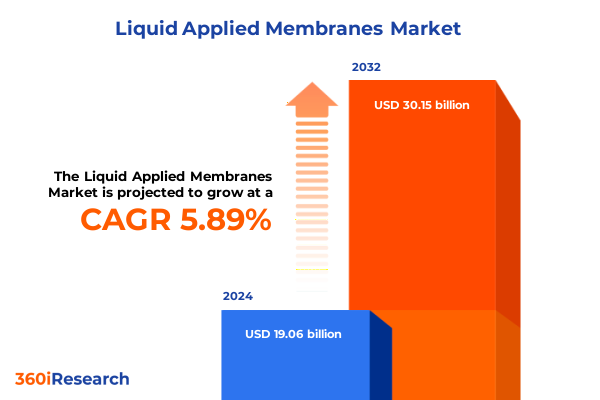

The Liquid Applied Membranes Market size was estimated at USD 20.14 billion in 2025 and expected to reach USD 21.28 billion in 2026, at a CAGR of 5.93% to reach USD 30.15 billion by 2032.

Exploring the Dynamic Terrain of Liquid Applied Membranes Unveiling Innovations Shaping Protective Coatings in Diverse Industries

Liquid applied membranes represent a critical class of protective coatings engineered to deliver seamless, monolithic barriers against moisture intrusion and chemical ingress. These coatings, applied in liquid form and cured in place, have emerged as versatile solutions across roofing systems, foundation waterproofing, and containment structures. Their adaptability to irregular substrates and ability to form fully adhered membranes make them indispensable for modern construction and infrastructure projects.

As industry stakeholders seek enhanced durability, improved sustainability, and streamlined application processes, liquid applied membranes have evolved to incorporate advanced polymer chemistries and performance additives. In parallel, growing awareness of environmental regulations and building certification standards has driven manufacturers to explore water-based formulations and low-VOC alternatives. This introduction sets the stage for a deeper exploration of regulatory shifts, tariff impacts, segmentation insights, and regional variations that collectively shape the trajectory of the liquid applied membrane market.

How Transformative Technological and Regulatory Shifts Are Redefining Liquid Applied Membrane Solutions Across Industries

The landscape of liquid applied membranes is undergoing profound transformation driven by both technological advancements and evolving regulatory mandates. In response to tightening environmental regulations, manufacturers are innovating water-based and bio-derived formulations that significantly reduce volatile organic compound emissions without compromising performance. These eco-friendly alternatives are rapidly replacing solvent-based systems, aligning with the broader shift toward sustainable construction materials and green building certifications.

Concurrently, multifunctional membrane architectures are emerging, offering combined waterproofing, air barrier, and thermal insulation properties within a single application. This integrated approach not only simplifies construction workflows but also enhances building envelope performance. Digitalization has also begun to influence the sector; advanced software tools and mobile platforms now enable real-time monitoring of membrane thickness and curing progress, driving quality assurance and reducing rework. Additionally, nanotechnology enhancements are pushing the boundaries of membrane resilience, providing superior UV resistance, self-cleaning surfaces, and improved adhesion under extreme weather conditions.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Liquid Applied Membrane Supply Chains and Costs

The tariff environment in 2025 has introduced a complex web of duties affecting key raw materials and finished components in the liquid applied membrane supply chain. A universal 10% reciprocal tariff on all imports (excluding Canada and Mexico) took effect in early April, elevating costs for polymers and specialty additives frequently sourced from global suppliers. In addition, a 30% tariff on goods originating from China and a 25% levy on imports from nations purchasing Venezuelan oil have further exacerbated procurement challenges, particularly for resin producers dependent on petrochemical feedstocks.

Tariffs on primary metals such as steel and aluminum-imposed at rates up to 50%-have also driven up the cost of ancillary equipment like spray rigs, mixing vessels, and storage tanks integral to liquid membrane application. This multidimensional tariff landscape has compelled regional manufacturers to reevaluate sourcing strategies, accelerating nearshoring initiatives and prompting strategic stockpiling ahead of duty escalations. Ultimately, these measures have translated into upward cost pressures across the value chain, encouraging end users to renegotiate contractual terms and consider alternative membrane technologies with lower exposure to imported inputs.

Unlocking Critical Segmentation Perspectives Through Resin Types Technologies and End-Use Industry Applications in Liquid Applied Membranes

The market’s segmentation reveals nuanced performance characteristics based on diverse resin types, application technologies, and end-use industries. When assessed by resin chemistry, acrylic formulations deliver rapid curing and color retention for exposed roofing membranes, while bituminous systems offer exceptional adhesion and moisture resistance in subterranean applications. Epoxy membranes bring high chemical resistance to industrial containment, and polyurethane variants balance flexibility with tensile strength for dynamic substrates. Silicone membranes, known for their UV stability and hydrophobic properties, are increasingly specified for high-performance roofing and facade coatings.

Evaluating application technology highlights a critical dichotomy between solvent-based and water-based systems. Solvent-based membranes often offer lower viscosity and deeper substrate penetration but face regulatory constraints due to VOC emissions. Conversely, water-based membranes align with stringent air quality standards, providing safer working environments and simplified site approvals, albeit sometimes requiring longer curing cycles.

The analysis of end-use industries underscores a broad spectrum of demand drivers. Construction applications span commercial developments, industrial facilities, and residential developments, each with unique performance criteria. Infrastructure projects such as bridges, roads, and tunnels emphasize durability under heavy traffic and environmental exposure. Marine uses cover offshore platforms and shipbuilding, demanding superior resistance to saltwater corrosion. In the oil and gas sector, downstream, midstream, and upstream operations require membranes capable of withstanding aggressive chemicals and pressure cycles. Water and wastewater utilities, including distribution systems and treatment plants, depend on membranes that can endure continuous exposure to water and corrosive waste streams.

This comprehensive research report categorizes the Liquid Applied Membranes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End Use Industry

Comprehensive Regional Analysis Revealing Growth Drivers and Market Nuances Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a pivotal role in shaping market growth and competitive strategies. In the Americas, mature markets in the United States and Canada prioritize compliance with rigorous building codes and sustainability standards, fostering demand for low-VOC water-based membranes and advanced monitoring solutions. Latin American economies, fueled by infrastructure modernization and public-private partnerships, are increasingly adopting liquid applied membranes to enhance asset resilience in environments prone to extreme weather.

The Europe, Middle East & Africa region exhibits diverse market drivers. Western European countries emphasize energy efficiency and green building certifications, driving R&D investments in bio-based formulations and multifunctional membranes. Meanwhile, the Middle East’s expansive infrastructure projects and harsh climatic conditions underscore the need for high-performance coatings with exceptional thermal and UV resistance. In Africa, growing urbanization and water management initiatives are spurring interest in durable waterproofing solutions for both new construction and retrofits.

Asia-Pacific emerges as the fastest-growing region, propelled by rapid urbanization, smart city initiatives, and large-scale infrastructure programs. China and India lead adoption, deploying membranes across residential and commercial developments to address monsoon-related challenges and aging water infrastructure. Government incentives for green construction in Japan, South Korea, and Australia further accelerate the uptake of eco-friendly membrane technologies.

This comprehensive research report examines key regions that drive the evolution of the Liquid Applied Membranes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Entities Driving Innovation Operational Excellence and Competitive Dynamics in Liquid Applied Membranes

Leading industry participants are leveraging strategic investments in innovation, manufacturing capacity expansion, and collaborative ventures to maintain competitive positioning. Some players have significantly increased R&D spending to develop next-generation resin chemistries that offer enhanced durability, lower environmental impact, and faster curing profiles. Others are expanding production footprints closer to key end markets, enabling rapid response to localized demand spikes and reducing exposure to tariff-induced cost volatility.

Partnerships with raw material suppliers and technology licensors have enabled the co-development of proprietary membrane systems, delivering differentiated performance attributes. Companies with vertically integrated supply chains are capitalizing on their ability to source critical monomers and additives internally, thereby insulating themselves from fluctuating commodity prices. In parallel, targeted acquisitions of regional coating specialists are broadening product portfolios and bolstering distribution networks in high-growth territories.

Across the competitive landscape, agility and service excellence have emerged as differentiators. Firms offering integrated technical support, on-site training, and digital application monitoring tools are strengthening customer relationships and securing long-term contracts in both public and private sector projects.

This comprehensive research report delivers an in-depth overview of the principal market players in the Liquid Applied Membranes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Bostik by Arkema S.A.

- Bronco Buildsmart LLP

- Carlisle Companies Incorporated

- Chembond Chemicals Limited

- CICO Technologies Limited

- Compagnie de Saint-Gobain S.A.

- Copernit S.p.A.

- Dow Chemical Company

- GAF Materials Corporation

- H.B. Fuller Company

- Henkel Polybit LLC

- ISOMAT S.A.

- Johns Manville Corporation

- Kemper System Inc.

- Knickerbocker Roofing & Paving Co. Inc

- Mallard Creek Polymers

- Mapei S.p.A.

- MC-BAUCHEMIE MÜLLER GmbH & Co. KG

- Pidilite Industries Limited

- Sika AG

- Siplast, Inc.

- SOPREMA S.A.S.

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in Liquid Applied Membranes

To navigate the evolving market landscape, industry leaders should prioritize investment in advanced water-based membrane technologies while accelerating the commercialization of bio-derived and low-VOC formulations. Strengthening collaborations with petrochemical and specialty polymer suppliers can secure preferential access to critical feedstocks and mitigate tariff-driven supply disruptions. Furthermore, investments in regional manufacturing hubs will reduce logistical complexities and improve responsiveness to shifting demand patterns.

Implementing digital quality assurance platforms across the application process can drive efficiency gains, minimize rework, and enhance traceability. Enterprises should also explore the integration of multifunctional membrane systems to offer bundled solutions that consolidate waterproofing, insulation, and air barrier functions. Engaging with regulatory bodies to anticipate environmental standards will ensure product compliance and facilitate market entry. Finally, developing flexible pricing strategies and long-term supply agreements will help buffer against input cost fluctuations and safeguard margins in a volatile trade environment.

Rigorous Research Methodology Emphasizing Data Integrity Qualitative Insights and Comprehensive Market Intelligence in Liquid Applied Membrane Analysis

This report combines a robust blend of primary and secondary research methodologies to deliver comprehensive market insights. Primary research involved in-depth interviews with industry experts, membrane manufacturers, technology developers, and key end-users across construction, infrastructure, marine, oil & gas, and water & wastewater sectors. These engagements provided qualitative perspectives on product performance, application challenges, and emerging needs.

Secondary research encompassed extensive analysis of global trade data, regulatory filings, patent databases, and peer-reviewed literature. Industry association publications, government reports, and third-party technical papers were cross-referenced to validate market drivers and technological trends. Competitive intelligence was gathered through company disclosures, investor presentations, and press releases to profile leading players and strategic initiatives.

Data triangulation techniques were employed to reconcile discrepancies between disparate information sources, ensuring the highest level of accuracy. Market segmentation, regional modeling, and scenario analyses were underpinned by proprietary databases and corroborated by expert opinion to generate actionable, reliable findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Liquid Applied Membranes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Liquid Applied Membranes Market, by Product Type

- Liquid Applied Membranes Market, by Technology

- Liquid Applied Membranes Market, by Application

- Liquid Applied Membranes Market, by End Use Industry

- Liquid Applied Membranes Market, by Region

- Liquid Applied Membranes Market, by Group

- Liquid Applied Membranes Market, by Country

- United States Liquid Applied Membranes Market

- China Liquid Applied Membranes Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Key Market Trends Competitive Landscapes and Strategic Imperatives Shaping the Future of Liquid Applied Membrane Solutions

The liquid applied membrane landscape is characterized by rapid innovation, evolving regulatory frameworks, and dynamic regional growth drivers. Advanced resin chemistries and eco-friendly formulations are reshaping product offerings, while digital tools are enhancing application precision and performance monitoring. At the same time, the interplay of tariff measures and global supply chain shifts underscores the importance of strategic sourcing and manufacturing localization.

Segmentation analysis reveals that resin chemistry, application technology, and end-use industry each present unique growth opportunities and technical requirements. Regional insights emphasize the need to tailor solutions to diverse climatic conditions, regulatory environments, and infrastructure priorities. Competitive activity highlights the value of integrated service models, collaborative innovation, and agile operational structures.

By synthesizing these insights, stakeholders can identify pathways to maximize return on investment, strengthen market positioning, and drive sustainable growth in the liquid applied membrane arena.

Secure Your Competitive Advantage by Engaging Ketan Rohom for In-Depth Liquid Applied Membrane Market Intelligence and Strategic Guidance

To delve deeper into the complexities of liquid applied membrane technologies, pricing dynamics, and competitive strategies, reach out to Ketan Rohom, Associate Director of Sales & Marketing. By partnering with Ketan, you gain immediate access to a meticulously crafted market research report that offers unparalleled depth on resin formulations, application methods, and regional demand drivers. Schedule a personalized briefing to explore proprietary data visualizations, expert commentaries, and scenario analyses tailored to your organization’s needs. Elevate your strategic decision-making with direct guidance from an experienced industry professional who can align insights to your business goals and ensure you stay ahead in a rapidly evolving market.

- How big is the Liquid Applied Membranes Market?

- What is the Liquid Applied Membranes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?