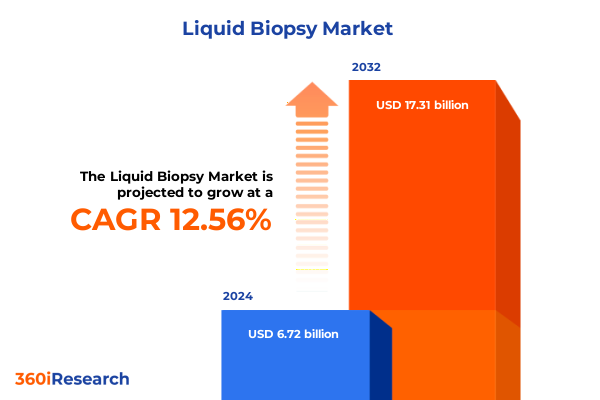

The Liquid Biopsy Market size was estimated at USD 7.52 billion in 2025 and expected to reach USD 8.44 billion in 2026, at a CAGR of 12.63% to reach USD 17.31 billion by 2032.

Pioneering Non-Invasive Diagnostics Through Liquid Biopsy: Revolutionizing Early Disease Detection And Real-Time Cancer Monitoring

Liquid biopsy represents a paradigm shift in diagnostics by offering a minimally invasive window into tumor biology. Rather than relying on traditional tissue biopsies, which can be painful, time-consuming, and sometimes clinically impractical, liquid biopsy analyzes circulating cell-free DNA, tumor cells, and extracellular vesicles in blood and other body fluids. This approach enables clinicians to detect genetic mutations, monitor treatment response, and identify emerging resistance mechanisms in real time, fundamentally transforming patient care pathways and accelerating time to therapeutic decision-making.

As the precision oncology landscape evolves, liquid biopsy technologies have expanded beyond cell-free DNA analysis to incorporate circulating tumor cells, extracellular vesicles, and multi-omic profiling, including methylation and transcriptomic signatures. These advancements improve sensitivity and broaden clinical applications, ranging from early-stage cancer screening to minimal residual disease detection after surgery. Regulatory bodies have begun endorsing these innovations, with the FDA’s approval of multiple next-generation sequencing–based companion diagnostics marking a critical inflection point for clinical adoption.

Beyond oncology, liquid biopsy shows promise in non-cancer areas such as prenatal testing, transplantation monitoring, and infectious disease surveillance. By integrating advanced sequencing platforms with artificial intelligence–driven analytics, developers are creating comprehensive diagnostic solutions capable of delivering rapid and actionable molecular insights. This convergence of technology, computational power, and clinical need positions liquid biopsy as a cornerstone of next-generation diagnostics.

Breakthrough Technological And Regulatory Shifts Catalyzing A New Era In Liquid Biopsy For Personalized Oncology Solutions

The liquid biopsy landscape has been transformed by a confluence of technological, regulatory, and collaborative advances. Next-generation sequencing platforms now deliver multi-gene parallel analysis, driving down costs and turnaround times while supporting the simultaneous detection of dozens of genetic alterations. Concurrently, digital PCR microarrays have refined sensitivity for single-gene targets, enabling the detection of minimal residual disease at ultra-low variant frequencies. These complementary approaches are reshaping assay development and expanding clinical utility in oncology diagnostics.

Regulatory agencies have accelerated approval pathways for liquid biopsy companion diagnostics, reflecting confidence in their clinical validity. The FDA’s Breakthrough Device designations and companion diagnostic clearances for both Guardant360 CDx and FoundationOne Liquid CDx underscore this momentum. Payers are increasingly recognizing the value of non-invasive biomarkers, with Medicare extending coverage for liquid biopsy tests used in recurrence monitoring and treatment selection, thereby reducing financial barriers to adoption.

Strategic partnerships between diagnostics developers, biopharma companies, and academic research centers further catalyze innovation. Collaborations focus on validating novel biomarker panels, co-developing multi-omic assays, and integrating real-world evidence to support clinical guidelines. These alliances not only expand test portfolios but also accelerate clinical trial enrollment by enabling non-invasive patient stratification. The result is a rapidly evolving ecosystem where technological and regulatory shifts are driving liquid biopsy toward mainstream clinical implementation.

Assessing The Ripple Effects Of The 2025 U.S. Tariff Amendments On Supply Chains And Costs In The Liquid Biopsy Sector

In 2025, U.S. tariffs on imported medical devices and raw materials introduced significant cost pressures across the diagnostics sector, including liquid biopsy. Tariffs of up to 145% on select components sourced from China, along with reciprocal levies on steel and aluminum derivatives, contributed to supply chain disruptions and elevated capital equipment expenses. Manufacturers reliant on globalized production networks have faced margin compression, prompting strategic shifts toward domestic manufacturing.

Major diagnostic companies have publicly quantified these headwinds. GE HealthCare projected a $500 million revenue shortfall attributable to tariff-related costs, with a substantial share linked to bilateral China tariffs. Abbott Laboratories warned of nearly $200 million in diagnostic segment impacts, largely driven by duties on imported assay reagents and instruments. Johnson & Johnson estimated a $400 million hit to its medtech business from worldwide tariffs, underscoring the pervasive nature of these levies across diagnostic modalities.

To mitigate these disruptions, industry leaders are diversifying supply chains, investing in regional manufacturing hubs, and renegotiating procurement contracts. Some are accelerating capital projects in tariff-exempt locales, while others are engaging policymakers to advocate for exemptions on critical diagnostic supplies. These adaptive strategies aim to stabilize costs, safeguard innovation pipelines, and preserve patient access to cutting-edge liquid biopsy tests amid an evolving trade policy environment.

Decoding Critical Market Segments In Liquid Biopsy Across Biomarkers, Sample Types, Technologies, Indications, And User Applications

Liquid biopsy market segmentation reveals diverse avenues for innovation and value creation. Technologies centered on cell-free DNA, circulating tumor cells, circulating tumor DNA, and extracellular vesicles cater to distinct clinical needs, from broad molecular profiling to targeted biomarker detection. Sample modalities predominantly encompass blood-based assays, with growing interest in urine-based platforms for enhanced patient convenience and decentralized testing models. Product types span assay kits, analytical instruments, and end-to-end service offerings, reflecting the market’s overlap between reagent developers, equipment manufacturers, and contract testing laboratories. Technological approaches bifurcate into multi-gene parallel analysis using next-generation sequencing and single-gene analysis via PCR-based microarrays, each balancing breadth of coverage against sensitivity and cost considerations. Clinical indications encompass cancer and non-cancer applications, with oncology further stratified into breast, colorectal, lung, melanoma, and prostate cancer profiles. End users include academic and research centers, clinical diagnostic laboratories, hospitals, and physician office laboratories, each leveraging liquid biopsy for unique operational imperatives. Primary applications focus on early cancer screening, recurrence monitoring, therapy selection, and ongoing treatment surveillance, illustrating the continuum of utility from detection through longitudinal management.

This comprehensive research report categorizes the Liquid Biopsy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Biomarkers

- Sample

- Type

- Technology

- Indication

- End-User

- Application

Contrasting Regional Dynamics In Liquid Biopsy Adoption Across The Americas, EMEA, And Asia-Pacific Healthcare Ecosystems

Regional dynamics exert a profound influence on liquid biopsy adoption and market maturation. In the Americas, robust clinical trial activity, concentrated regulatory frameworks, and established reimbursement pathways have enabled rapid integration into oncology care. North American laboratories have spearheaded validation studies for companion diagnostics, setting precedents for payer coverage and facilitating referral networks. Meanwhile, Latin American markets are characterized by emerging public health initiatives and pilot programs aimed at expanding access to non-invasive cancer screening tools. In Europe, Middle East & Africa, regulatory harmonization across the EU and authorization frameworks in the UK have expedited the entry of novel liquid biopsy assays. National healthcare systems in Western Europe are piloting population-scale screening initiatives, while private diagnostic providers in the Middle East are forging partnerships to localize testing capacity. Across Africa, collaborative efforts between NGOs and local laboratories are nurturing foundational infrastructure. Asia-Pacific presents a heterogeneous landscape, with leading healthcare hubs like Japan and South Korea advancing liquid biopsy through precision medicine consortia, while China’s domestic players are rapidly commercializing assays bolstered by government innovation grants. Australia and Southeast Asian markets are progressively integrating liquid biopsy into cancer care guidelines, supported by investments in molecular diagnostics capacity-building.

This comprehensive research report examines key regions that drive the evolution of the Liquid Biopsy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players And Their Strategic Innovations Steering The Competitive Landscape Of Liquid Biopsy Diagnostics

Leading diagnostics and life sciences companies are driving liquid biopsy innovation through differentiated strategies. Guardant Health has expanded its Guardant360 platform with multiomic AI-driven applications that enable tumor subtyping, biomarker confirmation, and molecular tumor origin identification, positioning it at the forefront of precision oncology solutions. Foundation Medicine’s FoundationOne Liquid CDx test offers comprehensive pan-tumor genomic profiling with multiple companion diagnostic indications, leveraging Roche’s global network to scale adoption. Illumina and Thermo Fisher Scientific have integrated advanced sequencing chemistries and microfluidic automation into turnkey instrument solutions, supporting high-throughput clinical and research workflows. Natera and GRAIL (an Illumina company) continue to advance multi-cancer early detection platforms, backed by strategic alliances with health systems and payers to generate real-world evidence. Bio-Rad Laboratories is enhancing digital PCR capabilities for ultra-sensitive detection of rare variants, while QIAGEN and Bio-Techne are co-developing expanded cfDNA enrichment panels and reagents. Contract research organizations and clinical laboratory service providers are bundling assay kits with bioinformatics services, creating end-to-end offerings for biopharma trials and diagnostic labs. This competitive landscape reflects a balance between platform breadth, analytical depth, and service integration, driving differentiated value propositions across market segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Liquid Biopsy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ANGLE PLC

- Bio-Rad Laboratories, Inc.

- Bio-Techne Corporation

- Biocartis NV

- Danaher Corporation

- DiaCarta, Inc.

- Dxcover Limited

- Epic Sciences Inc.

- Exact Sciences Corporation

- F. Hoffmann-La Roche Ltd.

- GENCURIX

- Guardant Health, Inc.

- Illumina, Inc.

- Labcorp Holdings Inc.

- Laboratory Dr. med. Pachmann

- Lucence Health Inc.

- LungLife AI, Inc.

- MDxHealth SA

- Menarini Silicon Biosystems SpA

- Merck KGaA

- Myriad Genetics, Inc.

- Natera, Inc.

- NeoGenomics Laboratories, Inc.

- OncoDNA SA

- PerkinElmer, Inc.

- Personalis, Inc.

- QIAGEN N.V.

- SAGA Diagnostics AB

- Strand Life Sciences Pvt Ltd.

- Sysmex Corporation

- Tempus AI, Inc.

- Thermo Fisher Scientific Inc.

Strategic Imperatives And Actionable Steps For Industry Leaders To Capitalize On Liquid Biopsy Advancements And Market Opportunities

Industry leaders must prioritize the integration of multi-omic approaches and AI-enhanced analytics to differentiate diagnostic offerings and improve clinical decision support. Investing in modular, scalable manufacturing capacities closer to key markets will mitigate tariff exposures and supply chain vulnerabilities. Building strategic partnerships with payers and regulatory bodies is essential to establish favorable reimbursement frameworks and streamline market access. Companies should collaborate with academic and clinical institutions to generate robust real-world evidence supporting clinical utility and cost-effectiveness, thereby accelerating guideline inclusion and payer coverage. Expanding into decentralized testing models, including point-of-care and direct-to-patient services, can broaden market reach and enhance patient engagement. Emphasis on non-oncology applications-such as transplant rejection monitoring and prenatal screening-can unlock adjacent revenue streams. Finally, adopting a flexible commercial strategy that blends direct sales, distributor partnerships, and digital platforms will optimize global market penetration while accommodating regional regulatory and healthcare delivery complexities.

Comprehensive Research Framework Combining Primary Interviews, Secondary Data, And Rigorous Validation To Ensure Insight Accuracy

This market research report is underpinned by a rigorous mixed-methods approach. Secondary research involved systematic review of scientific literature, regulatory databases, industry white papers, and patent filings to map technology trends, competitive landscapes, and regulatory milestones. Primary research comprised in-depth interviews with over 30 stakeholders, including molecular diagnostics leaders, oncologists, lab directors, payers, and regulatory experts, providing qualitative insights into adoption drivers, clinical workflows, and reimbursement dynamics. Data triangulation techniques reconciled secondary and primary findings, ensuring robust validation. Market participants were profiled based on publicly available financial reports, strategic announcements, and proprietary interviews. Quantitative estimates were cross-checked against shipment records, clinical trial registries, and tariff impact disclosures. Finally, a multi-tiered expert review process involving external advisors in clinical oncology, molecular pathology, and health economics was conducted to refine assumptions and validate conclusions, ensuring the highest standard of analytical integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Liquid Biopsy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Liquid Biopsy Market, by Biomarkers

- Liquid Biopsy Market, by Sample

- Liquid Biopsy Market, by Type

- Liquid Biopsy Market, by Technology

- Liquid Biopsy Market, by Indication

- Liquid Biopsy Market, by End-User

- Liquid Biopsy Market, by Application

- Liquid Biopsy Market, by Region

- Liquid Biopsy Market, by Group

- Liquid Biopsy Market, by Country

- United States Liquid Biopsy Market

- China Liquid Biopsy Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Summarizing The Transformative Impact Of Liquid Biopsy And Charting The Future Trajectory Of Non-Invasive Diagnostic Innovation

Liquid biopsy has emerged as a transformative diagnostic modality, shifting the paradigm from invasive tissue sampling to dynamic, real-time molecular profiling. Technological innovations in sequencing, digital PCR, and multi-omic integration have elevated sensitivity and specificity, while regulatory endorsements and payer coverage are catalyzing clinical adoption. Despite cost and supply chain challenges driven by tariff policies, strategic manufacturing diversification and collaborative partnerships are poised to sustain innovation and accessibility. Segmentation analysis highlights diverse value propositions across biomarkers, sample types, and end-user settings, underscoring the field’s multifaceted growth potential. Regional insights reveal tailored adoption trajectories, influenced by healthcare infrastructure, regulatory frameworks, and local innovation ecosystems. Leading companies are leveraging AI, platform consolidation, and service integration to advance precision oncology and expand into new clinical domains. As liquid biopsy continues to mature, its role in early detection, treatment monitoring, and personalized therapy selection will become increasingly central to modern healthcare delivery.

Engage With The Associate Director Of Sales And Marketing To Secure Your Comprehensive Liquid Biopsy Market Research Report Today

For a deeper dive into the market dynamics, technological breakthroughs, and strategic imperatives shaping the liquid biopsy and precision oncology fields, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. With his expertise and personalized service, you can secure the detailed report that equips your organization with actionable insights and a competitive advantage.

- How big is the Liquid Biopsy Market?

- What is the Liquid Biopsy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?