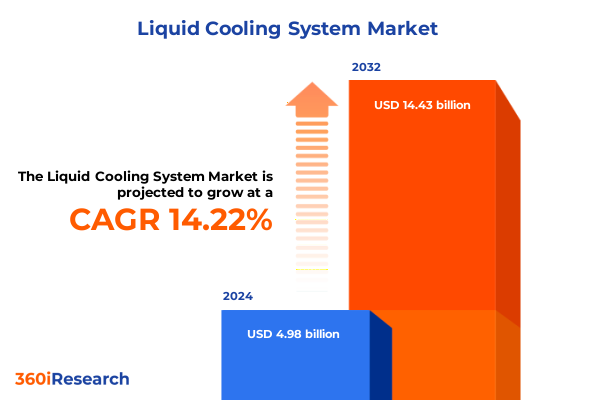

The Liquid Cooling System Market size was estimated at USD 5.66 billion in 2025 and expected to reach USD 6.43 billion in 2026, at a CAGR of 14.30% to reach USD 14.43 billion by 2032.

Understanding How Liquid Cooling Solutions Are Revolutionizing High-Density Computing Environments Through Efficiency and Scalability

Liquid cooling solutions have emerged as a cornerstone of modern thermal management strategies, driven by the unrelenting demand for higher computing densities and energy efficiency. As server racks across data centers push the boundaries of performance, traditional air cooling methods struggle to keep pace, leading to hotspots, throttled processing, and unsustainable operational costs. In contrast, liquid-based systems harness the superior thermal conductivity of specialized coolants to extract heat directly from critical components, ensuring stable performance even under the most extreme workloads.

Transitioning to liquid cooling requires a nuanced understanding of the technological, infrastructural, and organizational factors that influence adoption. From designing cold plates that conform to diverse chip architectures to integrating chillers and pumps within existing facilities, stakeholders face multifaceted challenges. Yet, these hurdles are outweighed by the promise of reduced energy consumption, minimized footprint, and extended equipment lifespan. Today’s market offers a spectrum of liquid cooling configurations-from direct-to-chip cold plate assemblies that attach seamlessly to CPUs and GPUs, to full immersion systems submerging entire electronics in dielectric fluids.

This executive summary provides a strategic overview of liquid cooling’s evolution, highlights pivotal industry shifts, and examines the macroeconomic forces shaping supply chains. Through a lens of segmentation, regional analysis, and competitive dynamics, decision-makers will gain a holistic perspective on how to leverage liquid cooling technologies for sustainable, high-performance computing environments.

Identifying Transformative Technological and Operational Shifts Reshaping the Landscape of Liquid Cooling Infrastructure Globally

Over the past few years, the liquid cooling landscape has undergone transformative shifts driven by the convergence of high-performance computing, artificial intelligence, and the exponential growth of data-intensive applications. Organizations are now deploying custom coolant formulations that balance thermal performance with environmental compliance, responding to stringent regulations on global warming potential. At the same time, modular architectures have gained traction, allowing data center operators to scale deployments in incremental stages, thus aligning capital expenditure with immediate processing demands.

Another seismic change has been the mainstreaming of immersive cooling techniques. Whereas traditional cold plate approaches target discrete hot spots, immersion systems envelop entire server modules in dielectric fluids, enabling uniform heat extraction and unlocking new possibilities in system design. Coupled with advanced monitoring sensors and IoT-enabled distribution units, these solutions deliver granular insights into thermal profiles, predictive maintenance, and energy usage analytics.

Meanwhile, OEMs and hyperscale data center operators are increasingly collaborating on reference architectures that streamline installation and certification processes. This cooperative model accelerates time-to-market, reduces integration risk, and fosters a thriving ecosystem of hardware and coolant suppliers. As edge computing nodes proliferate closer to end-users, compact liquid cooling assemblies for small-form-factor servers have also emerged, reflecting the industry’s commitment to delivering consistent performance across diverse deployment scales.

Evaluating the Cumulative Consequences of Recent United States Tariff Measures on Liquid Cooling System Supply Chains and Cost Structures

In 2025, a fresh wave of United States tariff measures targeting imported thermal management components has reverberated across the liquid cooling ecosystem. Import duties applied to pumps, heat exchangers, and specialized coolant fluids have elevated landed costs, compelling vendors and end users to reexamine their procurement strategies. For players reliant on established supply chains in Asia, immediate impacts include longer lead times, inflated freight rates, and the need to negotiate shared pricing adjustments with original equipment manufacturers.

The imposition of these tariffs has simultaneously incentivized regional diversification. North American producers of chillers and cold plates have seen renewed investment as data center operators seek to localize critical components. This shift is fostering deeper partnerships between component fabricators and integrators, who are jointly exploring cost-offsetting approaches such as volume rebates and just-in-time manufacturing models. At the same time, alternative sourcing from Europe and select Asia-Pacific markets is gaining appeal, creating a more complex, multi-regional procurement landscape.

Cost pressures from tariffs have also highlighted the value of design innovations that minimize reliance on tariff-exposed parts. For instance, some vendors are reengineering distribution units to support a broader range of coolant chemistries, reducing dependency on imported dielectric fluids. This strategic response underscores a broader industry trend: resilience through flexible design and supplier diversification, rather than sole dependence on historical trade relationships.

Unveiling Critical Insights Derived from Multifaceted Segmentation Across Types Components System Types Techniques Installations and Applications

Delving into the distinct categories of liquid cooling reveals differentiated growth vectors and innovation patterns within the market. Systems that affix directly to microprocessors remain a foundational segment, prized for targeted heat extraction from high-density processor arrays, while immersion cooling has emerged as a paradigm-shifting approach that envelops entire server modules in dielectric baths. Elsewhere, rear-door heat exchangers have found a sweet spot for retrofits in legacy air-cooled data centers, offering a non-intrusive pathway to enhanced thermal management.

An examination of individual components further enriches this picture. Chillers and cooling distribution units form the backbone of centralized temperature regulation, complemented by pumps engineered for reliability under continuous operation. Cold plates maintain intimate thermal contact with processors, and heat exchangers facilitate the transfer of heat from coolant loops to ambient environments. Coolants themselves-ranging from traditional water to advanced dielectric fluids-play a pivotal role, with the latter gaining traction in full immersion racks due to their non-conductive properties and compatibility with sensitive electronics.

System classifications underscore divergent engineering philosophies. Closed-loop solutions deliver contained coolant cycles with minimal maintenance, whereas open-loop configurations enable heat rejection into facility chilled-water networks. Each approach carries trade-offs in terms of installation complexity, operational oversight, and integration with existing infrastructure. Similarly, the choice between direct liquid distribution and indirect techniques informs both performance outcomes and retrofit feasibility. Whether integrating OEM-embedded assemblies or installing retrofit modules, end users navigate a spectrum of configurations tailored to their spatial, fiscal, and performance criteria. Across these dimensions, applications span critical sectors from data centers and cloud environments to automotive power electronics, medical devices, industrial automation, and beyond, highlighting the broad relevance of liquid cooling across modern technology ecosystems.

This comprehensive research report categorizes the Liquid Cooling System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- System Type

- Cooling Technique

- Installation Type

- Application

Highlighting Pivotal Regional Dynamics Driving Adoption and Innovation of Liquid Cooling Solutions in the Americas EMEA and Asia-Pacific

Regional dynamics exert a powerful influence on how liquid cooling solutions are adopted and deployed around the world. In the Americas, mature hyperscale data centers and enterprise IT environments are driving demand for integrated OEM solutions that are programmable, energy-efficient, and supported by robust local service networks. Incentives for renewable energy use and sustainability targets are spurring pilot projects in immersion cooling, with early adopters reporting gains in power usage effectiveness and reduced water consumption.

Across Europe, the Middle East, and Africa, regulatory mandates on energy efficiency and greenhouse gas emissions are reshaping design priorities. Data center operators in Western Europe are retrofitting legacy air-cooled facilities with rear-door cooling modules to meet tightening standards, while the Gulf region’s rapid digital infrastructure build-out has created fertile ground for turnkey liquid cooling offerings tailored to emerging hyperscale campuses. In Sub-Saharan Africa, modular closed-loop systems are enabling edge computing nodes to operate reliably in challenging environmental conditions.

Asia-Pacific remains the fastest growing region, anchored by expanding cloud services, telecommunications upgrades, and semiconductor fabrication clusters in East Asia. Governments in China, Taiwan, and South Korea continue to incentivize advanced cooling research, fostering collaborations between equipment vendors and academic institutions. Meanwhile, Southeast Asian data centers are embracing open-loop architectures that leverage abundant grid-supplied chilled water, reflecting the region’s preference for cost-effective scaling and local resource optimization.

This comprehensive research report examines key regions that drive the evolution of the Liquid Cooling System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dissecting the Strategic Postures and Innovation Trajectories of Leading Companies Advancing Liquid Cooling Technology Worldwide

Leading technology providers are shaping the liquid cooling landscape through differentiated strategies that blend organic innovation with strategic alliances. One prominent equipment manufacturer has invested heavily in modular chiller-pump units that can be factory-tested and rapidly deployed in hyperscale environments, enabling customers to compress project timelines by months. Another specialist has deepened its partnership with chip vendors, co-engineering cold plate interfaces optimized for the latest GPU architectures, thereby accelerating adoption among high-performance computing users.

Several global engineering conglomerates are expanding their thermal management portfolios through targeted acquisitions of niche immersion cooling startups. These moves bolster their end-to-end capabilities, from coolant development to rack integration, and enable cross-selling into existing service networks. At the same time, emerging technology pioneers are differentiating through software-defined control platforms that integrate telemetry from pumps, distribution units, and heat exchangers, unlocking predictive maintenance and closed-loop energy optimization.

Collaborative consortia between cloud service providers and component suppliers are also on the rise, focusing on establishing interoperability standards for liquid cooling racks. This cooperative model aims to reduce integration complexity while preserving vendor choice, thus nurturing a vibrant ecosystem of interoperable solutions. Across all these approaches, the common thread is an emphasis on scalability, sustainability, and software-enabled intelligence, underscoring the market’s transition from hardware-centric cooling to holistic thermal management services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Liquid Cooling System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- AMETEK.Inc.

- Asetek A/S

- Aspen Systems Inc.

- Boyd Corporation

- CoolIT Systems, Inc.

- Dell Technologies Inc.

- Dober

- Fujitsu Limited

- GIGA-BYTE Technology Co., Ltd.

- Green Revolution Cooling Inc.

- Hitachi Ltd.

- Hypertec Group Inc

- IBM Corporation

- Intel Corporation

- Koolance, Inc.

- Laird Thermal Systems, Inc.

- Lenovo Group Limited

- LiquidStack Holding B.V.

- Midas Green Technologies LLC

- Mikros Technologies

- Motivair Corporation

- Parker Hannifin Corp.

- Rittal GmbH & Co. KG

- Schneider Electric SE

Formulating Actionable Strategic Recommendations to Enhance Competitiveness and Sustainability in the Liquid Cooling System Industry

To thrive in an increasingly competitive landscape, industry stakeholders must adopt a holistic approach that balances cost, performance, and environmental stewardship. Prioritizing partnerships with component suppliers capable of local production can mitigate the impact of trade barriers and expedite project timelines. At the same time, investing in modular and prefabricated units helps align capital outlays with phased deployment strategies, reducing financial exposure and enabling rapid capacity expansion.

Enhancing resilience through diversified coolant sourcing is equally critical. By qualifying multiple dielectric fluid and water-based formulations, organizations can navigate regional regulatory variations and supply disruptions without compromising thermal performance. Parallel to this, advancing digital monitoring and analytics capabilities enables predictive maintenance, ensuring uninterrupted operation and optimal energy consumption.

Engagement with policy makers and participation in emerging standards bodies can further shape a favorable regulatory environment, promoting market interoperability and reducing compliance overhead. Finally, offering comprehensive service packages that combine installation, performance tuning, and lifecycle support creates differentiated value propositions, locking in long-term customer relationships. This customer-centric model not only drives recurring revenue but also reinforces brand credibility in a domain where reliability and uptime are paramount.

Detailing a Robust Methodological Framework Combining Primary and Secondary Research to Ensure Comprehensive Liquid Cooling Market Analysis

This research synthesized insights from a rigorous, multi-phase methodology designed to capture the full spectrum of market dynamics. The process began with an extensive review of publicly available sources, including patent filings, regulatory filings, white papers, and technical standards. Industry reports and conference proceedings were analyzed to map emerging technologies and vendor roadmaps.

Complementing secondary data, a series of in-depth interviews was conducted with senior executives, R&D heads, and operations managers from leading hyperscale operators, data center service providers, and liquid cooling specialists. These qualitative engagements provided firsthand perspectives on adoption drivers, integration challenges, and performance benchmarks. To validate findings, a quantitative survey was deployed across a broad sample of end users, assessing current usage patterns, future investment intentions, and satisfaction with existing solutions.

Triangulation of primary and secondary inputs ensured a robust analytical framework, with thematic coding applied to interview transcripts and statistical analysis of survey responses. Draft conclusions were then reviewed by an external advisory panel of industry experts to refine assumptions and reconcile divergent viewpoints. This iterative approach underpins the credibility of the report’s insights and ensures they reflect real-world practices and evolving market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Liquid Cooling System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Liquid Cooling System Market, by Type

- Liquid Cooling System Market, by Component

- Liquid Cooling System Market, by System Type

- Liquid Cooling System Market, by Cooling Technique

- Liquid Cooling System Market, by Installation Type

- Liquid Cooling System Market, by Application

- Liquid Cooling System Market, by Region

- Liquid Cooling System Market, by Group

- Liquid Cooling System Market, by Country

- United States Liquid Cooling System Market

- China Liquid Cooling System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Drawing Conclusive Insights to Illuminate the Future Trajectory and Long-Term Value Proposition of Advanced Liquid Cooling Systems

As computational demands continue to accelerate, the trajectory of liquid cooling systems points toward deeper integration of intelligent controls, sustainable coolant chemistries, and modular hardware architectures. Organizations that embrace these innovations can not only unlock superior energy efficiency but also reduce total cost of ownership and support aggressive performance scaling. The shift from air to liquid represents more than a technological upgrade-it marks a strategic pivot toward adaptive thermal management that anticipates future requirements.

Looking ahead, the emergence of standardized rack designs and open fluid interfaces promises to streamline implementation and drive down integration costs. At the same time, ongoing advancements in coolant formulations will reconcile high thermal performance with environmental stewardship, addressing concerns around global warming potential and chemical safety. Combined with the proliferation of edge computing deployments, these trends suggest an expanding addressable market that extends beyond traditional hyperscale environments.

Ultimately, the long-term value proposition of liquid cooling lies in its ability to deliver reliable, scalable, and sustainable thermal management solutions. Stakeholders who leverage the comprehensive insights detailed in this report will be well positioned to navigate complex supply chains, evolving regulations, and shifting competitive dynamics, securing a leadership role in the next era of high-performance computing.

Act Now to Harness Cutting-Edge Liquid Cooling Insights and Connect with Ketan Rohom for Exclusive Access to In-Depth Research Findings

Unlock strategic advantage by ordering the comprehensive Liquid Cooling System report today. To explore how these insights can be tailored to your organization’s unique needs, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He will guide you through the report’s in-depth findings, discuss customized packages, and ensure you gain the actionable intelligence required to stay ahead in this rapidly evolving market.

- How big is the Liquid Cooling System Market?

- What is the Liquid Cooling System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?