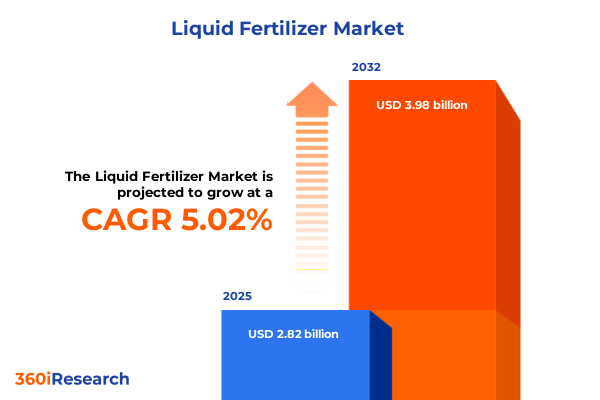

The Liquid Fertilizer Market size was estimated at USD 2.82 billion in 2025 and expected to reach USD 2.93 billion in 2026, at a CAGR of 5.02% to reach USD 3.98 billion by 2032.

Unlocking the Potential of Liquid Fertilizers Through Innovation Efficiency Enhancements and Sustainable Practices Revolutionizing Modern Agriculture

Liquid fertilizers have emerged as a pivotal tool in modern agriculture, offering an efficient means to deliver essential nutrients directly to plant roots and foliage. This approach aligns with the intensifying demand for higher crop yields, reduced environmental runoff and more precise nutrient management. As traditional dry blends face logistical constraints and variable distribution, liquid formulations present a versatile alternative that supports both large-scale row crops and high-value specialty agriculture.

Advancements in formulation chemistry and delivery systems have propelled the liquid fertilizer sector into a dynamic growth arena. For instance, innovations in micronutrient stabilization are enabling more consistent nutrient release profiles. Furthermore, the integration of slow-release additives minimizes leaching risks and enhances nutrient uptake efficiency. These developments support agronomic goals while promoting sustainable practices that meet regulatory expectations.

In addition to technological enhancements, shifting consumer preferences and policy frameworks have intensified focus on sustainable agriculture. This dual impetus drives fertilizer providers to optimize their product portfolios, balancing performance with ecological stewardship. Ultimately, liquid fertilizers are redefining nutrient management strategies, driving a new era of precision, adaptability and environmental responsibility within global food systems.

Emerging Technological Regulatory and Sustainability Trends Driving Rapid Transformation Across the Global Liquid Fertilizer Industry Ecosystem

The liquid fertilizer industry is undergoing transformative shifts fueled by converging technological breakthroughs and evolving regulatory landscapes. Precision agriculture technologies, such as GPS-guided injection systems and real-time soil sensors, are enabling farmers to apply nutrients with unprecedented accuracy. Consequently, these innovations are reducing input waste and delivering measurable yield improvements, creating a compelling value proposition for liquid formulations.

Simultaneously, sustainability mandates and carbon reduction targets are reshaping product development priorities. Biostimulant additives and organic-compatible blends are gaining traction as producers seek to align with circular economy principles. For example, recovered nutrient streams from wastewater treatment plants are being formulated into liquid products, illustrating a circular nutrient approach that addresses both environmental compliance and resource efficiency.

Supply chain resilience has also emerged as a critical focus. The integration of blockchain-based traceability platforms ensures transparent provenance tracking, which is essential for meeting retailer and consumer demands for verifiable sustainability claims. Collectively, these developments are accelerating a paradigm shift in how liquid fertilizers are formulated, distributed and applied, marking a new chapter of innovation and responsibility in the agricultural inputs sector.

Assessing the Comprehensive Ripple Effects of United States 2025 Tariffs on Supply Chains Pricing Structures and Competitive Dynamics in the Liquid Fertilizer Market

The United States’ imposition of additional tariffs on imported feedstocks and intermediate chemical inputs in early 2025 has generated significant reverberations across the liquid fertilizer supply chain. Manufacturers sourcing phosphates, potash derivatives and micronutrient chelates have encountered heightened cost structures, prompting recalibrations of procurement strategies. Domestic producers have responded by diversifying supplier networks and exploring alternative raw materials to mitigate tariff-related disruptions.

These adjustments have reverberated downstream, influencing distributor negotiations and application service agreements. End users have experienced variable pricing dynamics, with some regions reporting tighter supply as manufacturers prioritize allocations for higher-margin contracts. Consequently, growers have intensified collaboration with agronomists to optimize nutrient plans, offsetting cost impacts through enhanced application efficiency and site-specific management tactics.

Moreover, the tariffs have underlined the strategic importance of local value chain development. Investments in domestic processing capabilities and expanded production capacity are now under consideration to bolster supply resilience. As industry participants navigate these constraints, the landscape continues to evolve toward a more self-reliant and cost-stabilized liquid fertilizer ecosystem within the United States.

Dissecting Type Crop Processes Applications and Channel Variations to Unveil Critical Segmentation Insights Shaping Liquid Fertilizer Adoption Patterns

A nuanced examination of product types reveals that nitrogen-based liquid fertilizers remain the backbone of nutrient management, delivering rapid uptake for high-demand growth stages. Meanwhile, formulations enriched with micronutrients are gaining relevance as agronomists address trace element deficiencies in intensive cropping systems. Phosphorous and potash liquid blends serve to complement primary nutrient regimes, ensuring balanced nutrition strategies that support robust root development and stress resilience.

Crop-focused segmentation highlights divergent adoption patterns. Cereals and grains continue to drive baseline volume consumption, whereas fruits and vegetables exhibit a growing preference for precision foliar applications to enhance quality attributes. Oilseeds and pulses, recognized for their rotational benefits, are increasingly targeted with specialized micronutrient-enriched liquids designed to sustain soil health and subsequent crop performance.

When considering production processes, organic liquid fertilizers are carving out a dedicated niche, catering to certified organic operations that prioritize non-synthetic inputs. Synthetic equivalents maintain a broader market appeal due to consistent performance and scalability. In terms of application methods, fertigation leads in irrigation-intensive regions, while foliar sprays excel in responsive nutrient correction and soil treatments remain integral to baseline fertility programs.

Distribution channels also shape market access, with offline sales preserving close technical support relationships between manufacturers, distributors and growers. Online platforms, however, are capturing market share through streamlined ordering processes and targeted digital marketing campaigns that enhance product visibility and convenience.

This comprehensive research report categorizes the Liquid Fertilizer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Crop

- Production Process

- Application

- Distribution Channels

Identifying Distinct Market Dynamics and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific Liquid Fertilizer Markets

Across the Americas, liquid fertilizer adoption reflects diverse agricultural models, from large-scale commodity production in North America to smallholder and export-oriented operations in South and Central America. In the United States, investment in precision irrigation infrastructure bolsters fertigation uptake, while in Brazil, competitive local manufacturing and nutrient recovery initiatives stimulate growth in both synthetic and organic blends.

Within Europe, Middle East and Africa, regulatory complexity drives demand for advanced formulations that comply with stringent environmental regulations. In Western Europe, the focus on nitrate leaching reduction favors slow-release liquid technologies. Meanwhile, emerging markets across the Middle East and North Africa present opportunities for high-efficiency starter fertilizers tailored to arid climates, and South Africa’s fruit export industry relies heavily on foliar-applied nutrition to safeguard crop quality.

In Asia-Pacific, rapid agricultural modernization and government support programs are catalyzing liquid fertilizer utilization. China’s large-scale greenhouse operations demand high-volume fertigation systems, whereas India’s push toward sustainable intensification is fostering interest in micronutrient-enriched and organic liquid products. Southeast Asian rice paddies and orchard systems are likewise exploring tailored application regimes to optimize water and nutrient efficiency.

This comprehensive research report examines key regions that drive the evolution of the Liquid Fertilizer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Initiatives Product Innovations and Competitive Positioning of Leading Global Liquid Fertilizer Providers Transforming the Sector

Leading companies in the liquid fertilizer sector have intensified focus on R&D to differentiate their product portfolios. Yara’s collaborative trials with agricultural institutions have validated new chelated micronutrient blends that improve stress tolerance in row crops. At the same time, Nutrien has invested in digital agronomy platforms that integrate liquid nutrient recommendations with satellite imagery, enhancing prescription accuracy and adoption rates.

Cargill has leveraged its global distribution network to introduce custom-blended solutions that address regional soil deficiencies and crop cycles. Koch Industries’ recent joint ventures in nutrient recovery underscore a strategic pivot toward circular economy principles, transforming industrial by-products into marketable liquid fertilizers. The Haifa Group has further deepened its portfolio through acquisitions of specialty micronutrient manufacturers, strengthening its position in high-value horticultural applications.

Collectively, these strategic initiatives underscore a competitive landscape where product innovation, digital integration and sustainable sourcing are key differentiators. Companies that effectively marry technical support services with tailored liquid formulations stand to capture incremental growth as farmers increasingly prioritize efficiency and environmental stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Liquid Fertilizer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agroliquid

- BASF SE

- BMS Micro-Nutrients NV

- Brandt Co.

- CF Industries Holdings, Inc.

- Compass Minerals International, Inc

- Compo Expert Gmbh

- EuroChem Group AG

- FoxFarm Soil & Fertilizer Company

- Gujarat State Fertilizers & Chemicals Ltd

- Haifa Chemicals Ltd

- ICL Fertilizers

- Indian Farmers Fertiliser Cooperative Limited

- Israel Chemical Ltd.

- K+S Aktiengesellschaft

- Koch Fertilizer, LLC

- Kugler Company

- National Fertilizers Ltd.

- Nortox S/A

- Nufarm Limited

- Nutrien Ltd

- OCP GROUP

- Rural Liquid Fertilizers

- THE MOSAIC COMPANY

- VALAGRO SPA

- WILBUR-ELLIS COMPANY

- Yara International Asa

Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends Navigate Policy Shifts and Drive Sustainable Growth in Liquid Fertilizer Markets

Industry leaders should prioritize the integration of precision agronomy platforms with liquid fertilizer offerings, enabling real-time adjustments based on crop health data and environmental conditions. By partnering with sensor manufacturers and software developers, suppliers can create end-to-end nutrient management solutions that enhance user experience and foster deeper customer engagement.

Furthermore, establishing regional blending facilities and localized production hubs can mitigate tariff-related cost pressures and ensure supply continuity. Collaborating with wastewater treatment plants to recover phosphates and potassium from effluents will not only reduce reliance on imported raw materials but also advance corporate sustainability goals.

To expand market reach, companies must elevate digital marketing strategies that articulate the agronomic and environmental advantages of liquid fertilizers. Educational outreach programs, including virtual demonstration plots and interactive webinars, can accelerate knowledge transfer and drive product adoption, particularly among new-generation farmers.

Lastly, forging strategic alliances with financial institutions to offer flexible credit and subscription models can lower entry barriers for smaller operations. This approach builds loyalty, secures long-term contracts and positions providers as solutions partners rather than mere input suppliers.

Rigorous Mixed Methodology Framework Incorporating Primary Interviews Secondary Data Analysis and Triangulation to Ensure Robust Liquid Fertilizer Market Insights

This research employs a mixed-methods approach, combining qualitative expert interviews with quantitative secondary data analysis to deliver comprehensive market insights. Primary consultations were conducted with agronomists, supply chain specialists and senior executives from fertilizer manufacturers, ensuring firsthand perspectives on product performance and strategic priorities.

Secondary data was meticulously gathered from agricultural research institutions, government databases and industry publications. Each data point underwent triangulation through cross-referencing with publicly available corporate filings and trade association reports to validate accuracy and mitigate biases. The research also incorporates case studies illustrating successful implementations of advanced liquid fertilizer programs, providing pragmatic benchmarks for best practices.

Analytical frameworks, including SWOT and PESTEL assessments, facilitated a structured evaluation of market drivers, challenges and regulatory influences. Geographic and segmentation breakdowns were generated through iterative data modeling to reflect the interplay between product categories, crop types, application methods and distribution channels. This rigorous methodology underpins the integrity of the insights, ensuring they are both robust and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Liquid Fertilizer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Liquid Fertilizer Market, by Type

- Liquid Fertilizer Market, by Crop

- Liquid Fertilizer Market, by Production Process

- Liquid Fertilizer Market, by Application

- Liquid Fertilizer Market, by Distribution Channels

- Liquid Fertilizer Market, by Region

- Liquid Fertilizer Market, by Group

- Liquid Fertilizer Market, by Country

- United States Liquid Fertilizer Market

- China Liquid Fertilizer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesis of Key Findings Highlighting Opportunities Challenges and Strategic Imperatives to Propel the Liquid Fertilizer Industry Forward with Confidence

The convergence of technological innovation, regulatory evolution and sustainability imperatives has positioned liquid fertilizers as a transformative force in modern agriculture. Key findings highlight the critical role of precision application technologies in maximizing nutrient use efficiency, alongside the growing importance of organic-compatible formulations to meet environmental stewardship objectives.

Tariff-induced supply chain realignments have underscored the need for localized production and alternative raw material sourcing, challenging stakeholders to rethink traditional procurement models. Segmentation analysis reveals distinct adoption patterns across nutrient types, crop categories, application methods and distribution channels, informing tailored product development and market entry strategies.

Regionally, the Americas benefit from well-established irrigation infrastructure and recovery-driven production, while Europe, the Middle East and Africa demand compliance-focused innovations and Asia-Pacific embraces rapid modernization and digital integration. Competitive dynamics reflect a shift toward bundled solutions, where leading companies differentiate through R&D, digital agronomy platforms and sustainability collaborations.

Collectively, these insights present a strategic roadmap for stakeholders to navigate the evolving liquid fertilizer landscape with confidence, capitalize on emerging opportunities and drive resilient, sustainable growth.

Secure Exclusive Insights and Customized Consultation with Ketan Rohom to Elevate Your Liquid Fertilizer Strategy and Drive Sustainable Growth

Seize the opportunity to deepen your market understanding and gain a competitive edge by engaging directly with Associate Director, Sales & Marketing, Ketan Rohom. His expertise will guide you through the nuances of the report’s findings, enabling you to tailor strategic initiatives that resonate with your organization’s goals. By connecting with Ketan, you will receive personalized consultation that highlights the most relevant trends, risk factors and regional dynamics for your unique business environment.

This call represents more than a simple transaction; it is a gateway to pragmatic, actionable intelligence that empowers your decision-making process. Ketan’s intimate familiarity with the research methodology and comprehensive data insights ensures you can instantly apply the intelligence to enhance your supply chain resilience, optimize product portfolios and capitalize on emergent market opportunities. His collaborative approach will help translate complex industry insights into clear, executable strategies.

Act now to secure your competitive positioning in the evolving liquid fertilizer landscape. Reach out to Ketan Rohom to schedule an in-depth briefing and unlock tailored recommendations that drive sustainable growth and innovation.

- How big is the Liquid Fertilizer Market?

- What is the Liquid Fertilizer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?