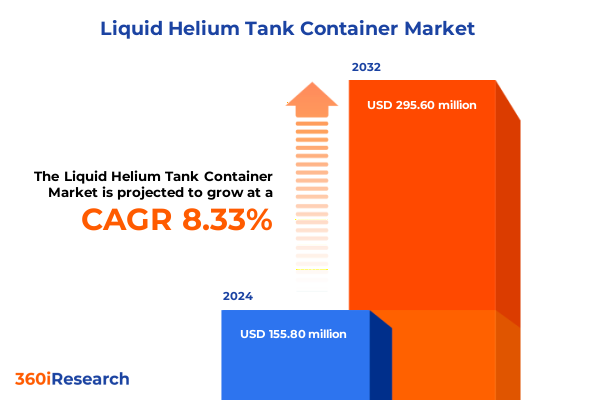

The Liquid Helium Tank Container Market size was estimated at USD 165.25 million in 2025 and expected to reach USD 180.36 million in 2026, at a CAGR of 8.66% to reach USD 295.60 million by 2032.

Unraveling the Vital Importance of Liquid Helium Tank Containers in Navigating Global Shortages While Enabling Cutting-Edge Applications Across Multiple Industries

Liquid helium tank containers occupy a pivotal role in sustaining critical operations across high-technology, healthcare, and energy sectors amidst an enduring global supply crunch. The world has grappled with a decade-long helium shortage, driven by dwindling traditional sources and escalating consumption in semiconductor manufacturing and medical imaging, which has propelled price volatility and supply chain disruptions. Since 2018, prices for helium have surged by as much as 800%, illustrating both the scarcity and strategic importance of this irreplaceable element for cryogenic cooling applications. Moreover, the helium market’s sensitivity to outages is underscored by its reliance on just three primary producing nations-United States, Qatar, and Algeria-where geopolitical tensions and technical setbacks at key plants can trigger immediate global reverberations.

Exploring the Cutting-Edge Innovations and Strategic Partnerships Transforming the Liquid Helium Tank Container Market to Meet Evolving Industry Demands

Recent years have witnessed extraordinary advancements in thermal management technologies that directly enhance the performance of liquid helium tank containers. Breakthroughs in composite insulation materials now deliver markedly lower static boil-off rates by exhibiting superior thermal barriers, while next-generation vacuum insulation systems extend hold times beyond traditional benchmarks, reducing replenishment frequency for critical installations. Concurrently, multilayer insulation solutions enable cost-effective retrofits of legacy stationary vessels, empowering owners to leverage existing infrastructure with significantly improved thermal efficiency.

Assessing the Far-Reaching Ramifications of Newly Imposed United States Tariffs on Liquid Helium Tank Containers and Their Impact on Global Supply Strategies

Effective January 2025, the United States implemented revised import tariffs targeting cryogenic equipment, including liquid helium tank containers, multilayer insulations, and related pressure assemblies. These measures have elevated landed costs for externally manufactured vessels, compelling end users to reassess procurement channels and to factor higher duty expenses into total cost of ownership evaluations. The sudden uptick in tariff classifications has particularly impacted containers sourced from traditional offshore suppliers, prompting many organizations to accelerate domestic manufacturing initiatives to maintain price competitiveness and supply reliability.

Gaining In-Depth Perspectives on How Diverse Segmentation Criteria Shape Demand Profiles and Strategic Priorities in the Liquid Helium Tank Container Sector

A nuanced segmentation framework reveals distinct demand drivers and performance requirements across end-use categories, applications, product designs, and operational parameters. End users span the healthcare sector-where magnetic resonance imaging systems demand uncompromising reliability-to industrial operations including metal manufacturing, oil and gas extraction, and power generation, as well as research institutions and semiconductor fabrication facilities that value purity and precision cooling. Application-based differentiation further clarifies customer priorities, from general cryogenic storage to specialized MRI cooling and the exacting requirements of superconducting magnet environments.

Container architectures exhibit divergence in design philosophy and use cases. Dewar flasks serve laboratory and small-scale research settings with high portability, while portable tanks-available in handheld and wheeled configurations-address on-site mobility for field operations. In contrast, stationary tanks, configured as bulk storage or spherical vessels, underpin large-scale distribution hubs. Capacity segmentation into small, medium, and large containers guides purchasing decisions based on volume throughput and replenishment cadence. Material choices range from lightweight aluminum alloys to advanced composites and traditional stainless steel, each offering distinct trade-offs in weight, corrosion resistance, and durability. High-performance insulation systems vary between foam and ultra-low-pressure vacuum types, with further specification around high-pressure and low-pressure constructs driving safety protocols and containment strategies.

This comprehensive research report categorizes the Liquid Helium Tank Container market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Container Type

- Capacity Range

- Material

- Insulation Type

- Pressure Type

- Application

- End User

Uncovering Regional Nuances and Growth Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific Liquid Helium Tank Container Market

Regional dynamics exert a profound influence on market trajectories. In the Americas, robust domestic helium production coupled with significant investments in semiconductor fabrication facilities and expanded medical imaging networks underpin strong demand for advanced tank containers. U.S. policy support for critical minerals and the strategic importance of onshore manufacturing supply chains provide further impetus for capacity growth, while logistical enhancers such as dedicated cryogenic transport corridors enhance distribution resilience.

The Europe, Middle East & Africa region presents a dual narrative of dependency and opportunity. European end users contend with import reliance amid evolving regulatory frameworks targeting environmental and safety standards for cryogenic operations. Meanwhile, Middle East producers are expanding helium extraction facilities to capture value upstream, and emerging African deposits offer novel supply diversification potential. In the Asia-Pacific, a sweeping expansion of semiconductor fabs in China, South Korea, and Taiwan, combined with healthcare infrastructure growth in India and Japan, is driving surging demand. Regional governments are facilitating local manufacturing clusters and incentivizing technology transfer agreements, further strengthening the Asia-Pacific’s role as both a consumption powerhouse and production base.

This comprehensive research report examines key regions that drive the evolution of the Liquid Helium Tank Container market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategic Approaches, Technological Differentiators, and Market Positions of Leading Liquid Helium Tank Container Manufacturers Worldwide

Leading market participants have adopted differentiated strategies to capture growth and fortify competitive positioning. Chart Industries has focused on modular cryogenic systems incorporating digital monitoring and predictive maintenance capabilities, enabling real-time boil-off analytics and supply chain optimization. Cryofab has invested heavily in composite material research, delivering lightweight, high-strength containers tailored for aerospace and defense applications. Taylor-Wharton leverages a legacy of engineering expertise to offer vertically integrated solutions, encompassing vessel fabrication, pressure relief systems, and turnkey installation services. Global gas majors such as Linde and Air Products have integrated comprehensive after-sales support, specializing in on-site maintenance contracts and helium recovery systems to enhance life-cycle value for end users. These varied approaches underscore a market where technological leadership, service excellence, and supply chain security are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Liquid Helium Tank Container market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide

- Air Products and Chemicals Inc

- AirLife gases

- ASCO CARBON DIOXIDE LTD

- Chart Industries Inc

- CIMC ENRIC

- Cryofab Inc

- FIBA Technologies Inc

- Gardner Cryogenics Inc

- Gazprom

- Gulf Cryo

- HOYER Group

- INOXCVA

- Iwatani Corporation

- Kawasaki Heavy Industries Ltd

- Linde plc

- Messer SE & Co KGaA

- Mitsubishi Heavy Industries Ltd

- Parker Hannifin Corp

- Praxair S.T. Technologies Inc

- Taiyo Nippon Sanso Corporation

- Wartsila Corporation

- Wessington Cryogenics Ltd

- Worthington Industries Inc

Strategic Recommendations for Industry Leaders to Enhance Resilience, Drive Innovation, and Capitalize on Emerging Opportunities in the Liquid Helium Tank Container Sector

Industry leaders should prioritize diversification of sourcing strategies by establishing multi-tiered supplier networks that encompass domestic fabrication and critical component local assembly. Investment in advanced composite and vacuum insulation technologies will unlock performance gains, reduce boil-off losses, and extend operational efficiency. Integrating closed-loop helium recovery and recycling systems into service offerings not only aligns with sustainability goals but also mitigates supply risk, as evidenced by healthcare networks reducing procurement costs by over 40% through on-site liquefaction upgrades. Furthermore, collaborative R&D initiatives aimed at next-generation superconducting materials may decrease long-term helium dependency, while active engagement with policymakers can shape tariff frameworks and unlock incentives for domestic advanced manufacturing.

Detailing the Comprehensive Research Methodology Underpinning the Liquid Helium Tank Container Market Analysis and Ensuring Robust Data Validation and Insights

This analysis synthesizes insights derived from a comprehensive research methodology encompassing extensive secondary research of industry publications, regulatory filings, and financial disclosures, complemented by primary interviews with senior executives, technical experts, and supply chain stakeholders. Data triangulation techniques were employed to validate stakeholder perspectives against trade data, patent filings, and tariff schedules. Segmentation frameworks were developed through comparative analysis of end-user requirements and application profiles. Rigorous data cleansing and peer review processes ensured accuracy and relevance, while continuous engagement with subject-matter authorities provided real-time contextual updates.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Liquid Helium Tank Container market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Liquid Helium Tank Container Market, by Container Type

- Liquid Helium Tank Container Market, by Capacity Range

- Liquid Helium Tank Container Market, by Material

- Liquid Helium Tank Container Market, by Insulation Type

- Liquid Helium Tank Container Market, by Pressure Type

- Liquid Helium Tank Container Market, by Application

- Liquid Helium Tank Container Market, by End User

- Liquid Helium Tank Container Market, by Region

- Liquid Helium Tank Container Market, by Group

- Liquid Helium Tank Container Market, by Country

- United States Liquid Helium Tank Container Market

- China Liquid Helium Tank Container Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Concluding Reflections on the Evolving Liquid Helium Tank Container Landscape and Its Implications for Industry Stakeholders and Future Market Developments

The evolving landscape of liquid helium tank containers is shaped by an intricate interplay of supply constraints, technological innovation, regulatory shifts, and regional dynamics. Stakeholders must balance the imperative for advanced thermal performance against emerging trade barriers and geopolitical uncertainties. The most successful organizations will be those that align product development with nuanced segmentation strategies, harness strategic partnerships to secure resilient supply chains, and leverage data-driven insights to anticipate market fluctuations. As demand intensifies across semiconductors, medical imaging, research, and energy applications, proactive adaptation and strategic foresight will define leadership in this critical cryogenic storage domain.

Connect with Ketan Rohom to Secure Your Copy of the Comprehensive Liquid Helium Tank Container Market Research Report and Gain a Competitive Edge

For decision-makers seeking to navigate the complexities of the liquid helium tank container market with confidence and precision, partnering with Ketan Rohom, Associate Director of Sales & Marketing, presents an invaluable opportunity. He can guide you through the comprehensive market research report’s insights, highlight the strategic imperatives for your unique business context, and tailor solutions to address your most pressing challenges. Engage directly with Ketan to unlock the full potential of this meticulously crafted analysis and position your organization at the forefront of industry innovation and resilience.

- How big is the Liquid Helium Tank Container Market?

- What is the Liquid Helium Tank Container Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?