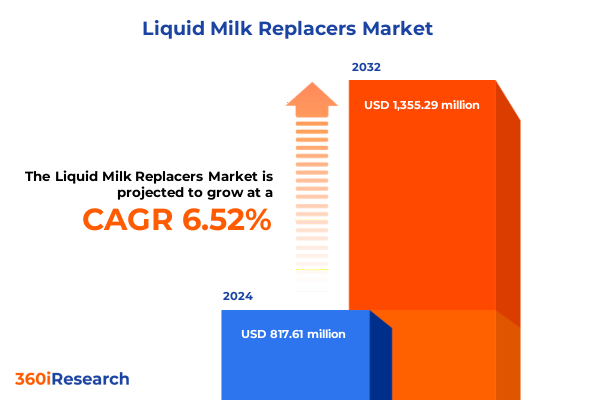

The Liquid Milk Replacers Market size was estimated at USD 872.10 million in 2025 and expected to reach USD 923.60 million in 2026, at a CAGR of 6.50% to reach USD 1,355.29 million by 2032.

Revolutionizing Calf Nutrition through Consistent, Safe, and Cost-Effective Milk Replacer Strategies That Empower Modern Dairy Operations and Enhance Welfare

Milk replacers were initially introduced as a means to spare salable milk, yet they have evolved into indispensable tools for modern dairy operations, delivering consistent, safe, and cost-effective nutrition to pre-weaned calves. This shift reflects a broader recognition of the pre-weaning period as a critical window for influencing lifetime productivity; studies indicate that incremental gains during early stages can translate into significant improvements in first-lactation milk yield. As farms scale and milking herds grow more productive, the challenge of diverting whole milk for calf feeding intensifies, prompting many producers to adopt replacers formulated with targeted nutrient profiles and built-in biosecurity measures to mitigate pathogen risks and enhance feeding consistency.

Contemporary feeding protocols emphasize the importance of precise mixing, appropriate density, and regular feeding schedules to ensure calves receive adequate protein and energy for optimal growth. Approximately half of U.S. dairy farms now rely on milk replacer programs, often choosing formulas containing around 20 percent protein and fat to mimic whole milk’s nutritional composition while reducing pathogen exposure through pasteurization and stringent handling guidelines. Consequently, these milk replacers have become integral to herd health strategies, enabling producers to deliver uniform nutrition across large herds while preserving valuable marketable milk volumes for processing.

Leveraging Breakthrough Nutritional, Technological, and Sustainability Innovations to Redefine Milk Replacer Development and Calf Performance

The liquid milk replacer sector is undergoing a profound transformation driven by breakthroughs in nutritional science, digital technologies, and sustainability imperatives. Recent research in the Journal of Dairy Science has demonstrated the potential of prebiotic galacto-oligosaccharide inclusion rates to bolster neonatal calf health and performance, as well as the critical role of balancing protein, fat, and lactose supplies to optimize growth without excessive fat deposition. Such compositional refinements not only enhance nutrient utilization but also support evolving regulatory requirements around antibiotic stewardship by integrating natural feed additives that promote gut health and disease resistance.

In parallel, precision livestock farming is reshaping calf management protocols. Non-invasive thermal imaging technologies now enable continuous monitoring of heart and respiration rates, reducing stress and enhancing welfare assessments, while accelerometer-based neck collars classify calf behaviors in real time to detect deviations in feeding, resting, and activity patterns. These digital tools deliver actionable data that inform feeding adjustments and early interventions, ultimately improving growth trajectories.

Sustainability considerations are also at the forefront of product innovation. Dairy processing trends point to the integration of renewable energy, circular economy practices, and precision fermentation methods for producing key milk proteins, offering potential pathways for future milk replacer ingredients that minimize environmental footprints. Collectively, these innovations herald a new era for liquid milk replacers, one in which enhanced formulations, data-driven management, and environmental responsibility coalesce to redefine calf nutrition.

Navigating the Multifaceted Effects of United States Tariff Measures Imposed in 2025 on Global Dairy Ingredient Chains and Market Dynamics

In early 2025, the United States imposed new tariffs on dairy imports from Canada, Mexico, and China, triggering retaliatory duties that have reverberated across global dairy ingredient supply chains. The International Dairy Foods Association warned that prolonged trade tensions would damage rural economies and disrupt market access, urging swift resolution to avoid further escalation. Even the specter of heightened tariffs has chilled demand for nonfat dry milk and skim milk powder, with domestic buyers exercising caution amid uncertainty, as highlighted by industry analysts reporting six-month lows in spot prices and weakened futures.

China’s retaliatory measures, which went into effect in March 2025, have levied an additional 10 percent duty on a broad range of U.S. dairy products, including multiple milk and cream classifications, cheese, and casein derivatives, compounding the impact of existing tariffs and escalating costs for exporters. Meanwhile, the U.S. administration announced reciprocal 10 percent baseline tariffs on all trading partners effective April 5, 2025, with higher rates slated for countries with significant trade deficits, further intensifying the complexity of global dairy trade flows and pricing structures.

In response to proposals for a 250 percent tariff on Canadian dairy imports, industry leaders have underscored the protectionist barriers faced under USMCA quotas and advocated for negotiated resolutions to safeguard bilateral access and maintain supply chain resilience. These layered tariff actions have elevated input costs, strained planning horizons for replacer manufacturers, and underscored the necessity for strategic sourcing and risk mitigation measures to preserve the viability of milk replacer formulations.

Uncovering Strategic Segmentation Perspectives That Illuminate Type, Source, Lifecycle Stage, and Distribution Channel Dynamics in Milk Replacer Markets

Liquid milk replacer products are tailored through multiple segmentation dimensions that shape their formulation, functionality, and distribution strategies. Within the medicated versus non-medicated dichotomy, medicated formulations incorporate coccidiostats and targeted antibiotics to manage enteric pathogens and support herd health protocols, whereas the non-medicated category is gaining traction amid antibiotic stewardship policies, driving a pivot toward eubiotic additives and phytogenic compounds to sustain animal wellness.

The source of raw ingredients provides another axis of differentiation, as skim-based replacers leverage casein-rich fractions to deliver balanced protein profiles, while whey-based variants capitalize on lactose and functional peptides to support energy metabolism and gut maturation. Growth in cheese production globally has expanded whey availability, offering cost efficiencies that feed into whey-derived replacer lines.

Application stage segmentation further customizes nutrient densities: neonatal formulas emphasize colostrum analogs and immunoglobulin support for immune system priming; pre-weaning blends focus on optimal protein-to-energy ratios and digestive enzyme supplementation to foster rumen development; and weaning transition replacers modulate macronutrient composition to ease calves into solid feed intake.

Each distribution channel-from traditional farm supply stores and feed mill partnerships delivering bulk formulations, to online retail platforms offering direct-to-farm convenience, to supermarket and hypermarket shelves featuring branded ready-to-mix products, and veterinary clinic channels providing specialized medicated options-carries distinct logistical considerations and customer engagement models, ensuring that milk replacers meet the evolving demands of diverse producer segments.

This comprehensive research report categorizes the Liquid Milk Replacers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Application Stage

- Distribution Channel

Illuminating Regional Dynamics and Insights Spanning the Americas, Europe Middle East Africa, and Asia-Pacific Milk Replacer Environments

Regional dynamics in the liquid milk replacer landscape reflect distinct regulatory environments, consumer behaviors, and supply chain infrastructures. In the Americas, the United States and Canada dominate advanced formulation development and automated feeding research, buoyed by cooperative investments and robust extension services that standardize feeding best practices. Latin American markets, while price-sensitive, are progressively adopting scientifically formulated replacers as dairy cooperatives expand and government programs incentivize productivity improvements.

Europe, the Middle East, and Africa exhibit a mosaic of regulations emphasizing antibiotic reduction, organic certification, and traceability, particularly within the European Union’s rigorous feed additive frameworks. Middle Eastern dairy operations rely heavily on imported replacer powders, leveraging halal-certified and high-stability formulations tailored to arid climates, while emerging African markets display potential for localized production driven by smallholder modernization initiatives.

Across Asia-Pacific, rapid dairy sector expansion in China and India, supported by government-led modernization schemes and rising consumer demand, is stimulating demand for high-quality milk replacers. Regional trade policies and import tariffs shape ingredient sourcing, as manufacturers balance local whey and skim milk powder availability against international procurement channels. In Southeast Asia, integrated dairy clusters are forging partnerships to enhance cold chain logistics, ensuring that full-value replacer products reach farmers swiftly and retain nutritional integrity.

This comprehensive research report examines key regions that drive the evolution of the Liquid Milk Replacers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Participants and Their Strategic Initiatives Shaping the Evolution of the Milk Replacer Sector Globally

Leading global agribusiness firms and specialist nutrition providers are driving innovation and consolidation in the milk replacer industry through strategic product launches, research collaborations, and vertical integration initiatives. Cargill has piloted plant-based calf milk replacer prototypes utilizing soy protein isolates and fermented amino acid complexes, advancing sustainability agendas while exploring cost-effective alternatives in regions lacking reliable dairy ingredient supplies. Concurrently, Land O’Lakes Purina Animal Nutrition and Trouw Nutrition have introduced eubiotic-enriched lines combining probiotics, encapsulated fats, and micro-nutrient fortification to support gut health and immune resilience under automated feeding regimes.

Specialist enterprises such as Calf-Tel and Prince Agri Products focus on high-performance medicated formulations, leveraging deep expertise in coccidiostat integration and trace mineral delivery. Meanwhile, emerging agritech startups are forging partnerships to embed digital monitoring tools into replacer delivery systems, offering software-as-a-service models that tie consumption data to calf growth analytics and predictive health alerts. This ecosystem of legacy players and agile innovators is shaping the sector’s competitive contours, emphasizing collaboration across feed production, veterinary services, and technology deployment to deliver holistic calf nutrition solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Liquid Milk Replacers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer-Daniels-Midland Company

- Calva Products, LLC

- Cargill, Incorporated

- CHS Inc.

- Glanbia plc

- Grober Nutrition

- Kent Nutrition Group

- LaBuddhe, Inc.

- Lactalis Ingredients

- Land O'Lakes, Inc.

- Manna Pro Products, LLC

- Merrick's, Inc.

- Milk Specialties Global

- Nurture Your Health, Inc.

- Nutreco N.V.

- PetAg, Inc.

- ProviCo Pty Ltd.

- Renco, Inc.

- SCA NuTec, LLC

- Volac International Limited

Actionable Strategic Recommendations for Industry Leaders to Enhance Milk Replacer Competitiveness, Resilience, and Sustainability in a Complex Global Environment

Industry leaders should prioritize a multi-pronged strategy that integrates advanced nutritional science with digital monitoring solutions and robust risk mitigation practices. By incorporating evidence-based feed additives such as prebiotics, probiotics, and botanical extracts into both liquid and starter feeds, manufacturers can meet evolving antibiotic stewardship regulations while enhancing calf health outcomes. Investing in thermal imaging and accelerometer-based behavior tracking platforms will enable real-time adjustments to feeding protocols and early detection of health deviations, strengthening animal welfare and performance consistency.

To address the complexities of global tariff fluctuations, companies should develop diversified ingredient sourcing networks, exploring alternative supply corridors and establishing buffer inventories to offset sudden cost escalations. Strategic alliances with local dairy cooperatives and feed mills in emerging regions can reduce dependency on imported inputs and enhance supply chain resilience. Concurrently, embedding sustainability into product design-through reduced carbon footprints, circular economy practices, and renewable energy adoption in processing-will resonate with increasingly environmentally conscious stakeholders and align with regulatory trajectories aimed at methane reduction and resource conservation.

Finally, fortifying distribution channels via e-commerce platforms, veterinary partnerships, and direct farm engagement programs will expand market access and foster brand loyalty. By delivering tailored nutrition solutions that address specific regional, regulatory, and operational needs, industry leaders can secure long-term competitiveness in the dynamic milk replacer marketplace.

Comprehensive Research Methodology Integrating Desk Research, Expert Interviews, Policy Analysis, and Triangulation for Robust Milk Replacer Insights

This report synthesizes comprehensive desk research, expert interviews, policy analysis, and data triangulation to deliver a robust understanding of the liquid milk replacer landscape. Secondary research encompassed regulatory filings, academic publications, extension service guidelines, and industry association statements. Peer-reviewed studies from the Journal of Dairy Science and open-access repositories informed the evaluation of emerging feed additive technologies and precision livestock farming tools.

Primary research was conducted through structured interviews with dairy veterinarians, nutrition specialists, farm managers, and technology providers, ensuring that insights reflect on-the-ground realities and practitioner priorities. Policy analysis incorporated tariff announcements, trade agreements, and standards from agencies such as USDA’s Agricultural Marketing Service and international trade bodies to contextualize market access challenges.

Data were triangulated by cross-verifying secondary sources with expert feedback, iterative validation workshops, and a consensus-building process among stakeholders. This rigorous methodology ensures that the insights presented herein are accurate, actionable, and reflective of the latest developments in milk replacer innovation, market dynamics, and regulatory shifts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Liquid Milk Replacers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Liquid Milk Replacers Market, by Type

- Liquid Milk Replacers Market, by Source

- Liquid Milk Replacers Market, by Application Stage

- Liquid Milk Replacers Market, by Distribution Channel

- Liquid Milk Replacers Market, by Region

- Liquid Milk Replacers Market, by Group

- Liquid Milk Replacers Market, by Country

- United States Liquid Milk Replacers Market

- China Liquid Milk Replacers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Perspectives on the Future of Liquid Milk Replacers Emphasizing Strategic Priorities and Innovation Imperatives for Stakeholders

The liquid milk replacer sector stands at a pivotal juncture, shaped by converging trends in nutritional science, digital transformation, sustainability, and trade policy. As producers seek to maximize calf performance and lifetime productivity, the evolution of replacer formulations toward natural additives and optimized macronutrient balances will play an essential role. Simultaneously, the integration of real-time monitoring technologies and data analytics will redefine calf management practices, enabling proactive health interventions and precision feeding adjustments.

Trade tensions and tariff measures have underscored the importance of agile sourcing strategies and regional partnerships to maintain supply chain continuity. Moreover, the drive toward antibiotic-free production and greenhouse gas reduction is inviting novel collaborations between feed manufacturers, technology providers, and regulatory bodies. Stakeholders who embrace these multifaceted imperatives-prioritizing innovation, sustainability, and risk resilience-will be best positioned to capitalize on emerging opportunities and navigate future uncertainties in the milk replacer landscape.

Connect with Associate Director Ketan Rohom to Secure Your Essential Liquid Milk Replacer Report and Gain Tailored Industry Insights Today

Ready to elevate your strategic understanding of the liquid milk replacer industry and gain a competitive edge through tailored insights, reach out to Ketan Rohom. As Associate Director of Sales & Marketing, Ketan Rohom is equipped to guide you in securing this comprehensive market research report, ensuring that you receive the detailed, actionable analysis needed to inform your business decisions. Contact him today to discuss how our research can align with your organizational goals and provide the depth of knowledge required for sustained success.

- How big is the Liquid Milk Replacers Market?

- What is the Liquid Milk Replacers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?