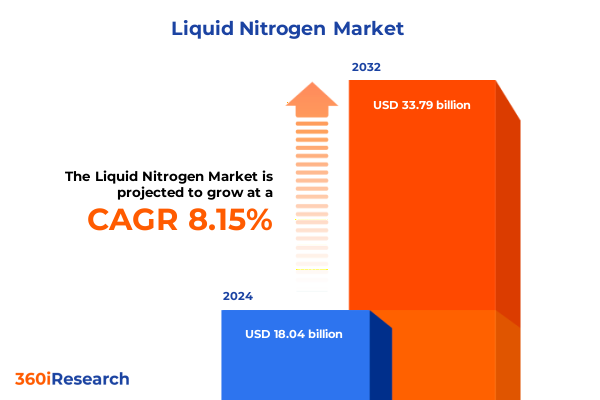

The Liquid Nitrogen Market size was estimated at USD 19.34 billion in 2025 and expected to reach USD 20.74 billion in 2026, at a CAGR of 8.29% to reach USD 33.79 billion by 2032.

Understanding the Strategic Importance and Applications of Liquid Nitrogen Across Key Industries and Emerging Technological Frontiers

Liquid nitrogen remains one of the most versatile cryogenic fluids, valued for its inert properties and extreme cold that facilitate precision processes across multiple industries. Its ability to rapidly lower temperatures enables critical functions such as material contraction, cryopreservation, and controlled freezing without introducing chemical contaminants. As a result, it has emerged as an indispensable utility for manufacturing, research, and healthcare sectors that require both reliability and purity in extreme temperature applications.

Over recent years, the strategic role of liquid nitrogen has expanded beyond traditional freezing and chilling operations to include advanced uses in semiconductor fabrication, cryogenic battery testing, and emerging biotechnology protocols. Stakeholders have increasingly recognized that the unique physical characteristics of this fluid-chiefly its low boiling point and nonreactive nature-offer a competitive edge by enhancing product quality, maximizing process control, and reducing equipment wear. Consequently, leading organizations now integrate liquid nitrogen solutions into their core operational frameworks to drive innovation and efficiency.

Given this backdrop, it is essential for decision-makers to understand both the broad reach of liquid nitrogen applications and the specific factors shaping its adoption. The sections that follow will explore the transformative shifts redefining the landscape, assess policy-driven impacts, and highlight critical segmentation, regional patterns, and corporate strategies, culminating in actionable recommendations to guide industry leadership.

Examining the Transformational Forces Reshaping the Liquid Nitrogen Industry Through Technological Innovation and Regulatory Evolution

The landscape of the liquid nitrogen market is undergoing profound transformation as technological advances and evolving regulations converge to reshape supply chains and end-use paradigms. Innovative cryogenic storage solutions now incorporate digital monitoring systems that track temperature, pressure, and fill levels in real time, reducing downtime and enhancing safety. At the same time, next-generation production techniques are being piloted to lower energy consumption, responding to stakeholder demands for carbon footprint reduction and aligning with corporate sustainability goals.

Regulatory frameworks have also intensified, with authorities globally adopting stricter guidelines to ensure safe handling, transportation, and environmental compliance. These measures span enhanced packaging standards, more rigorous training requirements for handling cryogens, and updated emission reporting protocols for production facilities. As a result, organizations must invest in robust compliance strategies and leverage automated logging systems to mitigate risk and maintain uninterrupted operations.

In parallel, the proliferating use of liquid nitrogen in cutting-edge applications-from cryo-electron microscopy in pharmaceuticals to high-capacity superconducting tests-continues to drive diversification in demand profiles. Transitional dynamics are evident as established manufacturers form strategic partnerships with technology developers, integrating modular production units and digital analytics to offer tailored solutions. These collaborative models are unlocking new pathways for cost reduction and performance optimization across the value chain.

Assessing the Cumulative Impact of United States Tariff Measures Introduced in 2025 on Liquid Nitrogen Supply Chains and Market Dynamics

In 2025, a series of tariff adjustments introduced by the United States government has created ripples across the global liquid nitrogen ecosystem. These measures, aimed at protecting domestic producers, have elevated import costs for cryogenic equipment and raw feed gases, compelling end users to reevaluate supply chain configurations. Companies that once relied heavily on cross-border sourcing are now incurring higher landed expenses, driving a concerted push toward local production partnerships and regional stockpiling strategies.

Consequently, domestic production facilities have seen renewed investment as stakeholders seek to insulate themselves from volatile international trade dynamics. This shift has encouraged the deployment of midstream nitrogen liquefaction units closer to major end-use clusters, reducing dependency on long-haul transportation and mitigating exposure to fluctuating tariff rates. As a result, resilience has become a core theme, with firms prioritizing flexibility in contractual terms, multi-sourcing agreements, and capacity ramp-up provisions that can be activated when global trade tensions intensify.

Moreover, the tariff landscape has spurred dialogue between industry associations and regulatory bodies, resulting in targeted petitions and requests for exemptions on essential cryogenic components. This active engagement underscores the critical importance of liquid nitrogen to sectors such as healthcare and advanced manufacturing, and it highlights the need for policy frameworks that balance trade protection with the imperative to maintain uninterrupted access to strategic industrial inputs.

Unlocking Critical Insights Through Segmentation By Purity Level Supply Mode Application and Distribution Channel for Liquid Nitrogen

Insight into purity segmentation reveals that biological grade liquid nitrogen remains pivotal for life sciences and research institutions where microbial integrity and cellular preservation are non-negotiable. Meanwhile, electronic grade variants are increasingly adopted by semiconductor foundries and electronic component manufacturers that demand ultra-high purity levels to prevent particulate contamination during critical cooling and freeze-thaw cycles. Industrial grade liquid nitrogen, with its broader impurity tolerance, continues to satisfy large-scale applications in metal fabrication, chemical processing, and oil and gas operations where cost-efficiency and bulk availability take precedence.

Supply mode analysis underscores the enduring relevance of bulk cryogenic tankers, which serve major manufacturing hubs by delivering large volumes directly to on-site storage dewars. At the same time, the rising popularity of packaged dewars, including cylinder dewars and portable cryo shippers, caters to smaller laboratories, mobile service providers, and specialty logistics requirements. This shift toward modular, on-demand delivery formats reflects the need for enhanced flexibility and rapid deployment in applications ranging from field research to emergency medical deployments.

Diverse application segmentation further illuminates market dynamics. In automotive sectors, shrink fitting of precision components and the inflation of specialized tires illustrate how low-temperature nitrogen supports both assembly line efficiency and safety standards. The electronics industry leverages component-level cooling for high-performance computing tests and sophisticated semiconductor manufacturing processes. Within food and beverage, blast freezing, carbonation techniques, and cold storage systems deliver product consistency and extended shelf life. Healthcare uses span hospital cryotherapy, cutting-edge medical research, and secure pharmaceutical storage, while industrial segments employ cryogenic flows in chemical manufacturing, metal fabrication, and oil and gas extraction to optimize reaction kinetics and material properties.

Finally, the distribution channel landscape is anchored by direct sales relationships for large account management and contract services, complemented by an extensive network of distributors servicing regional markets, emergency replenishment needs, and logistical support across diverse end-user segments.

This comprehensive research report categorizes the Liquid Nitrogen market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity Level

- Supply Mode

- Application

- Distribution Channel

Evaluating the Unique Regional Dynamics and Emerging Opportunities for Liquid Nitrogen Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in the Americas are driven by the coexistence of mature industrial bases in North America and rapidly expanding cryogenic applications in South American markets. The United States continues to lead in technology deployment and infrastructure development, bolstered by proximity to major end users in healthcare and electronics. Meanwhile, emerging economies in Brazil and Argentina are increasing investments in food processing and petrochemical installations, harnessing liquid nitrogen to extend product shelf life and enhance production safety protocols.

Across Europe, the Middle East, and Africa, regulatory alignment toward environmental sustainability has stimulated the adoption of energy-efficient liquefaction and storage systems. Major manufacturing clusters in Western Europe prioritize compliance with stringent safety standards, leading to widespread upgrades in handling equipment and automated monitoring. In the Middle East, diversification strategies are propelling investments in modular cryogenic plants to support petrochemical complexes, while select African markets are accessing packaged dewar solutions to serve remote healthcare and agricultural research initiatives where on-site infrastructure remains limited.

In the Asia-Pacific region, dynamic growth patterns are evident as leading economies in China, South Korea, and Japan drive demand from semiconductor, automotive, and specialty chemicals sectors. Concurrently, Southeast Asian nations are embracing liquid nitrogen for cold chain logistics in food and pharmaceuticals, often partnering with global suppliers to establish localized distribution hubs. Together, these cross-regional developments underscore the necessity for agile strategies that align supply capabilities with rapidly evolving end-user requirements.

This comprehensive research report examines key regions that drive the evolution of the Liquid Nitrogen market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders Driving Innovation Operational Excellence and Competitive Strategies Within the Liquid Nitrogen Industry Landscape

Leading gas suppliers and industrial conglomerates continue to define the competitive contours of the liquid nitrogen industry through strategic investments in liquefaction capacity, digitalization, and customer-centric service models. These global players have enhanced their market positioning by integrating advanced analytics into supply chain operations, offering predictive delivery scheduling, and deploying modular plant solutions that can be scaled rapidly to meet surges in demand. Additionally, mid-tier producers are carving niches by specializing in high-purity grades and offering targeted support for research institutions and niche manufacturing segments.

Equipment manufacturers are also shaping the industry’s evolution by developing next-generation refrigeration units and cryogenic pumps that lower total cost of ownership through improved energy efficiency and reduced maintenance cycles. Collaboration between these manufacturers and logistics providers has given rise to innovative packaging solutions and mobile cryo transport units, further extending the reach of liquid nitrogen into remote or temporary installations.

Service organizations have responded by diversifying their portfolios to include turnkey cryo infrastructure projects, comprehensive training programs, and emergency response services focused on leak containment and rapid system restoration. This holistic approach to value delivery is enabling customers to mitigate operational risks while maximizing return on investment. Collectively, the concerted efforts of these companies are driving continuous performance improvements and fostering the next wave of application breakthroughs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Liquid Nitrogen market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Air Water Inc.

- Bhuruka Gases Limited

- CanAir Nitrogen Inc.

- Chengdu Taiyu Industrial Gases Co., Ltd.

- Cudd Energy Services, Inc.

- Ellenbarrie Industrial Gases Ltd.

- EPC Engineering & Technologies GmbH

- F-DGSi SAS

- Gulf Cryo Holding Company

- Haldor Topsoe A/S

- INOX Air Products Private Limited

- Iwatani Corporation

- Linde plc

- Matheson Tri-Gas, Inc.

- Messer SE & Co. KGaA

- nexAir LLC

- Nippon Steel Corporation (industrial gases division)

- Parker-Hannifin Corporation

- Southern Industrial Gas Sdn Bhd

- Taiyo Nippon Sanso Corporation

- Universal Cryogenics, Inc.

- Universal Industrial Gases, Inc.

- Yingde Gases Group Company Limited

Formulating Actionable Strategies for Industry Leaders to Navigate Challenges Enhance Value Chains and Capitalize on Emerging Liquid Nitrogen Opportunities

To thrive in this dynamic environment, industry leaders should prioritize a multipronged approach that balances innovation, operational resilience, and stakeholder alignment. First, investment in research and development for ultra-high purity production processes and modular plant architectures can create a sustainable differentiation in quality and responsiveness. By exploring advanced liquefaction techniques and integrating closed-loop control systems, businesses can reduce energy intensity and secure premium applications in electronics and biotech sectors.

Simultaneously, companies must strengthen supply chain agility by diversifying sourcing channels and establishing strategic buffer inventories in key consumption regions. Collaborations with regional logistics partners and third-party maintenance providers can minimize lead times and enhance emergency replenishment capabilities for both bulk and packaged delivery formats. Such initiatives will safeguard operations against trade disruptions and fluctuating demand cycles.

Engagement with regulatory authorities and participation in industry consortia are critical for shaping evolving safety and environmental guidelines. By proactively contributing to standards development and sharing best practices in handling, packaging, and emissions management, organizations can influence policy outcomes that balance compliance burdens with operational continuity. Furthermore, a robust sustainability framework-emphasizing carbon footprint reduction, renewable energy integration, and lifecycle analysis-will resonate with end-user mandates and investor imperatives.

Finally, leveraging segmentation insights through tailored value propositions for each end-user cluster, along with customized service agreements, will unlock deeper customer relationships and reveal latent growth pockets. By aligning commercial strategies with the specific purity, delivery, application, and channel preferences identified earlier, businesses can optimize revenue streams and reinforce their competitive positioning.

Detailing Rigorous Research Methodology Data Collection Framework and Analytical Approaches Underpinning the Liquid Nitrogen Market Study

This study employs a mixed-methods research framework that begins with an exhaustive review of publicly available literature, industry reports, and regulatory documents to establish a comprehensive baseline of the liquid nitrogen ecosystem. Secondary data sources include peer-reviewed journals, technical white papers, and corporate sustainability disclosures, which together provide insights into production technologies, supply chain structures, and end-use applications.

Primary research consisted of in-depth interviews and structured discussions with more than twenty senior executives, technical experts, and regulatory representatives from across the value chain. These engagements were designed to validate secondary findings, uncover emerging trends, and assess qualitative factors such as customer preferences, risk perceptions, and technology adoption drivers. Key informant feedback was systematically triangulated with quantitative indicators to ensure robust analytical outcomes.

Analytical approaches included thematic coding of qualitative data, comparative benchmarking of commercial models, and scenario analysis to explore the implications of policy shifts and technological advances. Segmentation frameworks were developed by mapping purity levels, supply modes, application categories, and distribution channels against stakeholder priorities and operational constraints. Rigorous internal reviews and validation workshops with industry participants ensured that the final report reflects a consensus-driven understanding of market dynamics and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Liquid Nitrogen market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Liquid Nitrogen Market, by Purity Level

- Liquid Nitrogen Market, by Supply Mode

- Liquid Nitrogen Market, by Application

- Liquid Nitrogen Market, by Distribution Channel

- Liquid Nitrogen Market, by Region

- Liquid Nitrogen Market, by Group

- Liquid Nitrogen Market, by Country

- United States Liquid Nitrogen Market

- China Liquid Nitrogen Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings Strategic Imperatives and Future Outlook for Stakeholders in the Evolving Liquid Nitrogen Ecosystem

In synthesizing the findings, it becomes clear that liquid nitrogen’s strategic relevance will continue to expand as innovation accelerates across high-value applications and sustainability imperatives drive efficiency improvements. The interplay between technological breakthroughs, such as digitalized cryogenic systems, and regulatory developments aimed at ensuring safe and low-emission operations, is creating both opportunities and complexity for market participants.

Key imperatives for stakeholders include building scalable production and distribution networks, deepening engagement with policy frameworks, and tailoring solutions to the nuanced requirements of each segment and region. By harnessing segmentation insights, companies can focus their investments on the most promising applications and optimize service models to foster long-term customer loyalty.

Looking forward, the ability to adapt to dynamic tariff regimes, embrace modular supply architectures, and collaborate across the ecosystem will distinguish the most successful leaders. Those who align operational excellence with strategic foresight and active stakeholder engagement will be best positioned to capture emerging value and shape the future course of the liquid nitrogen landscape.

Empowering Informed Decisions and Strategic Partnerships Through Direct Engagement with Ketan Rohom for Comprehensive Market Intelligence

Engaging with Ketan Rohom provides a direct pathway to secure comprehensive market intelligence that equips your organization to make informed strategic decisions in the rapidly evolving liquid nitrogen space. Through personalized consultations and tailored briefings, you can uncover critical insights into supply chain optimization, segmentation-driven growth pockets, and regulatory navigation strategies. This direct engagement ensures you gain access to the latest qualitative analyses and benchmarking against industry best practices, empowering your team to identify operational efficiencies and competitive differentiators.

To initiate a customized discussion or schedule a detailed walkthrough of the full report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. By partnering closely with this experienced lead, you will receive guidance on how to apply the research findings to your unique business context, unlock hidden opportunities, and mitigate emerging risks. Seize this opportunity to transform raw data into actionable intelligence and drive sustained value in your liquid nitrogen initiatives.

- How big is the Liquid Nitrogen Market?

- What is the Liquid Nitrogen Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?