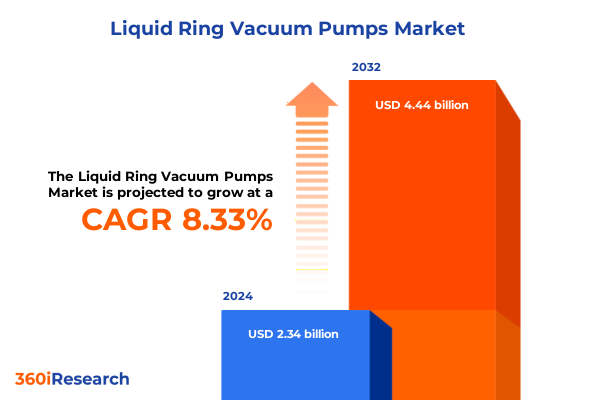

The Liquid Ring Vacuum Pumps Market size was estimated at USD 2.53 billion in 2025 and expected to reach USD 2.74 billion in 2026, at a CAGR of 8.35% to reach USD 4.44 billion by 2032.

Exploring the Pivotal Role of Liquid Ring Vacuum Pumps in Modern Industry Through Operational Principles, Applications, and Value-Driving Efficiencies

Liquid ring vacuum pumps have emerged as indispensable workhorses across a spectrum of industrial sectors, delivering reliable vacuum generation for processes ranging from material handling to degassing, drying, and distillation. These machines operate on a simple yet ingenious principle, leveraging the formation of a liquid seal within a rotating eccentrically mounted impeller to create zones of low pressure. As a result, they maintain smooth, pulsation-free performance that can handle wet, saturated, and vapor-laden gases without risk of damage or performance loss. This operational flexibility has solidified their reputation as versatile vacuum solutions in demanding environments.

In today’s industrial landscape, these pumps not only drive critical processes in chemical manufacturing, food and beverage production, and pharmaceutical development but also support environmental compliance efforts through their ability to manage water and wastewater treatment applications effectively. As energy efficiency and sustainability have become central to corporate agendas, the inherent design simplicity and reliability of liquid ring vacuum pumps have translated into reduced downtime and lower maintenance costs. Consequently, businesses seeking to optimize operational continuity, safeguard product quality, and minimize environmental impact have increasingly turned to these robust systems.

Unveiling Technological, Regulatory, and Sustainability-Driven Shifts Reshaping the Liquid Ring Vacuum Pump Market Landscape for Growth and Resilience

Over the past decade, the liquid ring vacuum pump landscape has undergone transformative shifts driven by technological innovation, tightening regulatory requirements, and evolving sustainability mandates. Manufacturers have embraced advanced materials such as duplex steel and high-grade stainless steel to improve corrosion resistance, extend service life, and enable operation under increasingly aggressive process conditions. Concurrently, variable speed drive integration has become more prevalent, allowing operators to finely tune pump performance to fluctuating process demands, thereby reducing energy consumption and improving overall plant efficiency.

Regulatory bodies have also raised the bar for emissions control, prompting suppliers to develop water-sealed variants and closed-loop cooling technologies that minimize vapor release and liquid discharge. At the same time, digitalization has enabled predictive maintenance frameworks, with sensors monitoring parameters like seal temperature, vibration, and flow rate to forecast potential failures before they impact production. These advances have redefined reliability expectations and have positioned liquid ring vacuum pumps not merely as mechanical components but as strategic enablers of resource conservation and operational resilience.

Analyzing the Comprehensive Impact of 2025 United States Tariffs on Liquid Ring Vacuum Pump Trade Dynamics and Domestic Manufacturing Operations

The imposition and continuation of United States tariffs in 2025 have exerted tangible influence on the liquid ring vacuum pump value chain, particularly for equipment and components sourced from regions subject to Section 301 measures. Many industrial flow-control products, including specialized pumps, have faced a tariff rate of 10 percent, elevating landed costs and compelling importers to reassess their procurement strategies. In response, end users have explored domestic manufacturing partnerships and diversified sourcing to mitigate cost increases while preserving supply continuity.

In anticipation of such trade friction, several pump manufacturers accelerated expansion of North American fabrication facilities, enabling them to deliver competitively priced units with shorter lead times. Concurrently, distributors have leveraged inventory financing and hedging strategies to stabilize pricing for critical spare parts. Although these measures have absorbed some of the tariff impact, the cumulative effect has been felt through marginally higher procurement budgets and extended payback periods for capital investments. Nonetheless, the industry’s ability to adapt through localized production and agile supply-chain practices has underscored its resilience amid shifting trade dynamics.

Deciphering Segmentation Insights Revealing End User Industries, Pump Types, Sealing Media, Operating Parameters, Materials, and Distribution Channels

Examining segmentation reveals that end user industries remain the cornerstone for targeted value propositions, with chemical plants-ranging from bulk chemical and petrochemical complexes to specialty chemical facilities-demanding pumps capable of handling corrosive, vapor-laden flows. In parallel, food and beverage operations, including breweries, dairy processors, and large-scale packaged food manufacturers, require sanitary liquid sealing media and compliance with hygienic standards. Upstream, midstream, and downstream oil and gas sectors necessitate rugged units for gas gathering and processing, while pharmaceutical production prioritizes contamination control and precision vacuum levels. Outside of these, power generation facilities and water/wastewater treatment plants emphasize long lifecycle costs and reliable performance under continuous duty cycles.

Further granularity emerges when segmenting by pump type, where multi-stage configurations cater to applications demanding higher vacuum depths, while two-stage and single-stage variants optimize capital expenditure for moderate vacuum requirements. The choice between oil-sealed and water-sealed pumps reflects a trade-off between lubrication regimes and environmental discharge considerations. Similarly, segmenting by vacuum range distinguishes high vacuum systems common in specialty chemical distillations from low and medium vacuum setups found in more generalized dehydration processes. Operating speed segmentation underscores the growing adoption of variable speed units to align energy usage with real-time demand, contrasting with constant speed models that continue to serve legacy installations. Material segmentation differentiates pumps manufactured from cast iron, which deliver cost advantages for standard services, from duplex steel and stainless steel designs engineered for corrosive and hygienic conditions. From a market-access perspective, direct sales partnerships, distributor networks, and online sales platforms each present distinct value, with distributors offering aftermarket support and digital channels facilitating rapid procurement and traceability. Finally, motor type segmentation highlights the benefits of open drip proof designs for ease of maintenance and totally enclosed fan cooled units for operation in dusty or moisture-rich environments.

This comprehensive research report categorizes the Liquid Ring Vacuum Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pump Type

- Sealing Medium

- Vacuum Range

- Operating Speed

- Material

- Motor Type

- End User Industry

- Sales Channel

Highlighting Regional Variations in Demand Patterns, Competitive Dynamics, and Growth Drivers Across Americas, EMEA, and Asia-Pacific Markets

Across the Americas, project-driven investments in petrochemical expansions, renewable energy plants, and municipal water treatment upgrades continue to fuel demand for liquid ring vacuum pumps engineered for high throughput and minimal downtime. North America, in particular, has seen a pivot toward domestically produced equipment, propelled by tariff-driven cost considerations and a strategic focus on supply-chain security. Latin American markets, meanwhile, are benefiting from multilateral infrastructure initiatives and foreign direct investment in energy and mining sectors, elevating interest in corrosion-resistant materials and localized maintenance capabilities.

In Europe, Middle East, and Africa, regulatory pressures around emissions and waste management have accelerated adoption of water-sealed pumps with closed-loop cooling, enabling operators to comply with stringent environmental directives. The Middle East’s petrochemical hubs demand high-capacity systems tailored for continuous operation in high-temperature conditions, whereas European industrial centers emphasize digital integration for predictive maintenance and remote monitoring. Africa’s emerging economies are gradually upgrading legacy pump fleets, prioritizing robust designs capable of handling variable power quality and limited service infrastructure.

Meanwhile, the Asia-Pacific region remains the fastest-growing market, buoyed by expanding chemical and pharmaceutical manufacturing in China and India, as well as surging water treatment projects across Southeast Asia. In these markets, cost competitiveness and lead-time reliability drive the uptake of regional pump production, supported by joint ventures between global suppliers and local engineering firms. The region’s broad spectrum of industrial maturity has fostered both demand for standardized, turnkey pump packages and advanced, customized solutions for niche applications.

This comprehensive research report examines key regions that drive the evolution of the Liquid Ring Vacuum Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategies and Competitive Positioning of Leading Manufacturers Driving Innovation, Service Excellence, and Market Expansion Efforts Globally

Leading manufacturers in the liquid ring vacuum pump arena have sharpened their strategic focus on product innovation, service excellence, and geographic footprint expansion to capture evolving market opportunities. Established players have introduced next-generation materials-such as high-nickel alloys and composite coatings-to extend component longevity and bolster resistance to aggressive chemicals. At the same time, companies are embedding connectivity features into new pump lines, enabling cloud-based analytics and condition monitoring that supports predictive maintenance programs and remote diagnostics.

Beyond product evolution, providers have forged partnerships with engineering firms and EPC contractors to integrate vacuum pump packages into turnkey process solutions, offering end-to-end project execution from conceptual design through commissioning. This integrated approach reinforces customer loyalty and creates recurring revenue streams through aftermarket service agreements. Additionally, acquisitions and joint ventures have accelerated market entry in high-growth territories, particularly within Asia-Pacific and Latin America, ensuring that local service hubs and spare parts inventories are positioned to meet rising demand. These strategic moves underscore the industry’s commitment to delivering differentiated value while maintaining operational agility in a dynamic global environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Liquid Ring Vacuum Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlas Copco AB

- Becker GmbH & Co. KG

- Busch Vacuum Solutions GmbH & Co. KG

- Ebara Corporation

- Flowserve Corporation

- GEA Group Aktiengesellschaft

- Ingersoll Rand Inc.

- Osaka Vacuum Co., Ltd.

- Pfeiffer Vacuum GmbH

- Pfeiffer Vacuum Technology AG

- SPX Flow, Inc.

- Tsurumi Manufacturing Co., Ltd

Outlining Actionable Strategic Recommendations for Industry Leaders to Optimize Operations, Enhance Value Propositions, and Mitigate Emerging Market Risks

To navigate the evolving complexities of the liquid ring vacuum pump market, industry leaders should adopt a multifaceted strategy that emphasizes operational excellence, collaborative innovation, and strategic risk mitigation. First, investing in digital transformation initiatives that integrate IoT-enabled sensors, advanced analytics, and cloud-based platforms will empower organizations to transition from reactive to proactive maintenance models, thereby minimizing unplanned downtime and optimizing energy consumption. Next, strengthening local production and service capabilities through selective partnerships or greenfield facilities can safeguard against trade disruptions and absorb cost pressures stemming from tariff fluctuations.

Concurrently, developing sustainable sealing medium technologies-such as closed-loop water systems with zero-discharge designs-will align product offerings with tightening environmental regulations and corporate sustainability targets. Furthermore, cultivating end user relationships through dedicated application engineering support and customized maintenance contracts will differentiate service portfolios and foster long-term loyalty. Finally, diversifying the product lineup with modular, scalable pump architectures can address the broad spectrum of vacuum ranges, operating speeds, and material requirements across diverse industries, ensuring that potential clients can adopt tailored solutions without excessive configuration costs.

Detailing Rigorous Research Methodologies Incorporating Primary Interviews, Secondary Data Analysis, and Cross-Validation to Ensure Robust Insights

This research integrates both primary and secondary data collection methods to deliver a comprehensive market perspective. Primary insights were gathered through in-depth interviews with C-level executives, plant engineers, maintenance managers, and procurement directors from leading end user organizations and key equipment manufacturers. These discussions provided firsthand intelligence on technology adoption trends, procurement decision drivers, and maintenance practices. Complementing these viewpoints, secondary research encompassed a review of industry white papers, technical standards, patent filings, and regulatory documents, as well as analysis of trade publications and corporate disclosures.

Cross-validation across data sources was performed to ensure accuracy and consistency, with quantitative assessments of trade flow data, tariff schedules, and supply-chain metrics triangulated against qualitative insights. The methodological framework adheres to rigorous protocols, including data normalization, outlier detection, and peer reviews by subject matter experts. This structured approach ensures that the findings presented are robust, defensible, and aligned with the strategic needs of stakeholders seeking to navigate the liquid ring vacuum pump market successfully.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Liquid Ring Vacuum Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Liquid Ring Vacuum Pumps Market, by Pump Type

- Liquid Ring Vacuum Pumps Market, by Sealing Medium

- Liquid Ring Vacuum Pumps Market, by Vacuum Range

- Liquid Ring Vacuum Pumps Market, by Operating Speed

- Liquid Ring Vacuum Pumps Market, by Material

- Liquid Ring Vacuum Pumps Market, by Motor Type

- Liquid Ring Vacuum Pumps Market, by End User Industry

- Liquid Ring Vacuum Pumps Market, by Sales Channel

- Liquid Ring Vacuum Pumps Market, by Region

- Liquid Ring Vacuum Pumps Market, by Group

- Liquid Ring Vacuum Pumps Market, by Country

- United States Liquid Ring Vacuum Pumps Market

- China Liquid Ring Vacuum Pumps Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings and Strategic Imperatives Underscoring the Value and Future Directions of Liquid Ring Vacuum Pumps in Evolving Markets

In synthesizing the key insights, it is evident that liquid ring vacuum pumps will continue to play a critical role in driving process efficiency, regulatory compliance, and sustainability initiatives across industries. Technological evolutions in materials and digital enablement are redefining performance benchmarks, while segmentation analysis underscores the importance of tailored solutions for varied end user requirements. Regional dynamics further highlight the necessity for manufacturers to balance global capabilities with localized responsiveness to meet diverse market demands.

Strategic priorities for stakeholders include enhancing operational agility through digital maintenance platforms, mitigating tariff and supply-chain exposures via localized production, and aligning product portfolios with environmental imperatives through sustainable sealing and cooling systems. By embracing these imperatives, industry participants can secure a competitive edge, foster customer loyalty, and effectively navigate the complex interplay of technological, regulatory, and market forces shaping the future of liquid ring vacuum pumps.

Engaging Directly with Ketan Rohom to Unlock Tailored Insights and Secure the Definitive Liquid Ring Vacuum Pump Market Research Report

To explore comprehensive insights, I invite you to connect with Ketan Rohom, Associate Director of Sales and Marketing, who can provide personalized guidance and detailed explanations of our in-depth market research report. By engaging directly, you will gain access to exclusive data-driven recommendations, tailored benchmarking analyses, and the strategic intelligence needed to drive competitive advantage in the liquid ring vacuum pump industry. Ketan’s expertise will ensure that your specific operational challenges and business objectives are addressed with precision and relevance.

Seizing this opportunity to collaborate with a seasoned industry specialist will empower your organization to make informed decisions backed by robust evidence and forward-looking analysis. Reach out today to secure the definitive liquid ring vacuum pump market research report and transform insights into impact.

- How big is the Liquid Ring Vacuum Pumps Market?

- What is the Liquid Ring Vacuum Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?