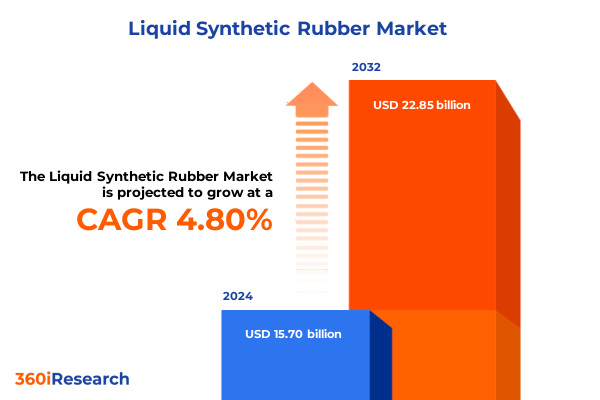

The Liquid Synthetic Rubber Market size was estimated at USD 16.42 billion in 2025 and expected to reach USD 17.18 billion in 2026, at a CAGR of 4.82% to reach USD 22.85 billion by 2032.

Delving into the Evolutionary Journey of Liquid Synthetic Rubber and Its Critical Role in Revolutionizing Modern Industrial Applications Worldwide

Liquid synthetic rubber has undergone a remarkable transformation from an experimental polymer to an indispensable component in numerous industrial applications. Originally developed to mimic the elasticity of natural rubber, advancements in polymer chemistry and catalyst technology have propelled liquid synthetic variants-predominantly based on butadiene, isoprene and nitrile monomers-into high-performance arenas previously dominated by traditional elastomers. As a result, manufacturers have been able to fine-tune polymer chain architectures at the molecular level, delivering tailored viscosity, crosslink density and functionality that unlock new performance thresholds for adhesives, coatings and high-end rubber compounds.

Moreover, the emergence of liquid synthetic rubber addresses critical sustainability and processing challenges. Unlike solid elastomers, its inherent fluidity permits seamless integration into advanced compounding processes, reducing energy consumption and waste generation. Concurrently, research into bio-based feedstocks is forging pathways toward lower environmental footprints, marrying performance excellence with evolving regulatory requirements for carbon intensity and renewable content. Consequently, industry stakeholders are now re-examining product portfolios and supply chains to capitalize on the unique attributes of liquid synthetic solutions, setting the stage for a period of accelerated adoption.

Uncovering the Paradigm Shifts Driven by Sustainability, Technological Breakthroughs and Regulatory Dynamics in the Liquid Synthetic Rubber Landscape

The past five years have ushered in transformative shifts across the liquid synthetic rubber landscape, driven by a confluence of sustainability mandates, advanced processing technologies and dynamic regulatory frameworks. Sustainability imperatives have incentivized the replacement of petroleum-heavy feedstocks with alternative monomers derived from biomass or captured carbon, resulting in novel polybutadiene pathways that balance performance with environmental stewardship. In parallel, digitalization has penetrated compounding facilities, enabling real-time rheology monitoring and predictive maintenance that optimize throughput and elevate quality control.

Additionally, regulatory bodies in major economies have tightened restrictions on volatile organic compounds and heavy metal residues, compelling formulators to adopt functionalized liquid rubbers that facilitate low-emission curing and crosslinking. This trend has accelerated collaborative efforts between polymer chemists and end users to co-develop specialized grades for high-growth applications in electric vehicle tires and lightweight composites for aerospace. As a result, the landscape has shifted from broad commodity supply toward highly differentiated, application-specific solutions, underscoring a new era of innovation where customization and regulatory compliance drive strategic priorities.

Examining the Far Reaching Consequences of the 2025 United States Tariff Measures on the Global Liquid Synthetic Rubber Value Chain

In 2025, the United States implemented a new suite of tariffs on synthetic rubber imports, targeting key polymer intermediates and finished elastomer grades. These measures, intended to bolster domestic production and safeguard critical supply chains, have reverberated across global value networks. Upstream, price volatility in butadiene feedstocks has been exacerbated by tariff-induced cost increases, prompting some processors to renegotiate long-term supply contracts or explore nearshoring options to mitigate exposure.

Downstream, processors reliant on competitively priced imports have had to adjust product formulations to manage cost pressures, occasionally substituting higher-performing specialty grades with more affordable variants. This realignment has accelerated investment in local compounding facilities, reshaping regional capacity footprints and generating new alliances between rubber producers and tier-1 automotive and aerospace manufacturers. Simultaneously, some global suppliers have sought tariff exemptions through anti-dumping petitions or by leveraging free trade agreements with allied partners. The net effect is a more complex trade environment that demands agile sourcing strategies, robust cost modeling and proactive engagement with policy developments to safeguard profitability.

Revealing Deep Insights from Type, Application, End User and Sales Channel Segmentation Driving the Liquid Synthetic Rubber Market Dynamics

A granular examination of liquid synthetic rubber segmentation reveals nuanced drivers shaping supply and demand. From a type perspective, butadiene-based liquid rubbers dominate due to their balanced viscosity and crosslinking adaptability, while isoprene-derived variants are sought for superior aging resistance and resilience. Nitrile-based formulations, on the other hand, have gained traction where oil and chemical resistance are paramount. These distinctions influence raw material sourcing, downstream processing complexity and cost structures.

Application segmentation further deepens strategic considerations. Adhesives and sealants benefit from the low-viscosity grades that enhance substrate wetting and curing speed, whereas asphalt modification relies on mid-viscosity liquid polymers to improve durability and crack resistance under thermal cycling. In paints and coatings, liquid synthetic rubbers act as reactive modifiers that bolster flexibility and chemical resistance. Rubber compounding and tire manufacturing demand high-performance intermediates that integrate seamlessly into masterbatch processes, enabling manufacturers to tune dynamic stiffness and traction characteristics with precision.

End-user insights underscore the automotive sector as a primary driver, bifurcated between electric and fuel-powered vehicle platforms, each imposing distinct thermal and mechanical performance requirements. The aviation segment divides into commercial and military aircraft, both prioritizing weight reduction and durability under extreme temperature cycles. Construction applications differentiate between structural building materials and infrastructure overlays, with liquid rubbers enhancing adhesion and weatherproofing. Packaging reveals a dichotomy between flexible films and rigid containers, the former relying on low-molecular-weight rubbers for seal integrity, the latter integrating higher-strength grades for impact resistance. Sports and recreation split between recreational products and precision sporting goods, each capitalizing on the material’s tunable rebound and energy return properties. Sales channels overlap these end-uses through traditional distribution networks and growing e-commerce platforms, reflecting a dual emphasis on personalized service and digital accessibility.

This comprehensive research report categorizes the Liquid Synthetic Rubber market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- End-User

- Sales Channel

Unearthing the Distinct Regional Patterns Shaping Demand Growth across the Americas, EMEA and Asia Pacific for Liquid Synthetic Rubber

Regional demand patterns for liquid synthetic rubber illustrate divergent growth trajectories anchored in local industry strengths and regulatory landscapes. In the Americas, North American producers have leveraged proximity to butadiene and isoprene monomer suppliers to scale compounding capacity rapidly, while downstream demand has been buoyed by electric vehicle assembly hubs along the U.S. and Canadian heartland. Latin American markets, although smaller, are expanding through infrastructure development projects that rely on polymer-modified asphalt and sealants to extend pavement life under extreme weather fluctuations.

Europe, the Middle East and Africa form a mosaic of mature and emerging markets. Western Europe’s stringent environmental regulations have catalyzed early adoption of bio-based liquid rubbers in paints and coatings, whereas Eastern European nations are upgrading petrochemical complexes to integrate liquid polymer streams into existing rubber manufacturing hubs. The Middle East is capitalizing on its hydrocarbon feedstock advantage to attract greenfield facilities, and several African economies are piloting liquid rubber blends for renewable energy installations and water infrastructure sealing applications.

Asia-Pacific remains the global epicenter for both production and consumption. China has emerged as the largest consumer, propelled by automotive manufacturing clusters and rapid infrastructure expansion, while Japan and South Korea focus on high-value electronics encapsulation and precision adhesives. India’s construction sector is adopting liquid rubber-modified mortars for affordable housing projects, and Southeast Asian nations are collaborating on regional supply consortia to optimize logistics and feedstock procurement. Australia and New Zealand, by contrast, exhibit niche demand linked to mining equipment seals and specialty coatings for agricultural machinery.

This comprehensive research report examines key regions that drive the evolution of the Liquid Synthetic Rubber market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leadership Strategies and Competitive Positioning of Major Players Advancing Innovation in Liquid Synthetic Rubber Production

Leading corporations in the liquid synthetic rubber domain are distinguished by their investments in proprietary catalyst systems, strategic partnerships with end-use innovators and aggressive capacity expansions. Global chemical producers have bolstered R&D centers to refine polymer architectures that strike the optimal balance between viscosity, functional group density and cure kinetics. At the same time, several players have forged alliances with automotive OEMs and coating formulators to co-develop next-generation grades tailored to emerging performance benchmarks.

Competitive positioning has been further influenced by geographic diversification strategies. Some companies have expanded through acquisitions of local compounders in high-growth regions, thereby securing direct access to key end-use markets and local expertise in regulatory compliance. Others have invested in modular, portable production units capable of rapid deployment to customer sites, delivering on-demand volumes and mitigating logistical bottlenecks. In parallel, a handful of specialized firms have carved out leadership niches by focusing exclusively on high-temperature or ultra-low-viscosity rubbers, meeting stringent aerospace and electronics requirements that conventional elastomers cannot satisfy.

Ultimately, the interplay between technological leadership, supply chain adaptability and customer-centric service models defines the competitive landscape. Those organizations that can integrate digital process controls, maintain robust monomer sourcing agreements and nurture deep technical collaborations with end users are best positioned to capture emerging opportunities and maintain sustainable growth trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Liquid Synthetic Rubber market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apcotex Industries Limited

- Avantor, Inc.

- CHT Group

- Dow Chemical Company

- DuPont de Nemours, Inc.

- Elkem ASA

- Evonik Industries AG

- Firestone Polymers, LLC

- JSR Corporation

- Kraton Corporation

- Kuraray Co., Ltd.

- LG Chem Ltd.

- Lion Elastomers, LLC

- Momentive Performance Materials Inc.

- Nippon Zeon Co., Ltd.

- Shanghai Fuyou International Trade Co., Ltd.

- Shanghai Theorem Chemical Technology Co., Ltd.

- Synthomer PLC

- Trelleborg Group

- Wacker Chemie AG

- Zeon Chemicals L.P.

Delivering Strategic Recommendations to Empower Industry Leaders in Capitalizing on Emerging Opportunities within the Liquid Synthetic Rubber Ecosystem

Industry leaders seeking to maximize returns in the liquid synthetic rubber arena should prioritize feedstock diversification by integrating bio-based monomers alongside traditional petroleum-derived streams. This dual approach mitigates price volatility and aligns with evolving carbon intensity regulations. In tandem, companies must enhance their digital infrastructure by deploying IoT-enabled process sensors and advanced analytics platforms that optimize polymerization parameters, driving both quality consistency and operational efficiency.

Furthermore, forging collaborative partnerships with key end-users-particularly in automotive, aerospace and construction-can yield co-development initiatives that unlock novel performance attributes. Such alliances should be structured around joint innovation roadmaps, ensuring alignment on functional requirements and go-to-market strategies. Supply chain resilience is another critical focus; enterprises should conduct rigorous scenario planning to anticipate tariff fluctuations and establish buffer capacities through modular onsite compounding units and strategic warehousing arrangements.

Lastly, executives must cultivate talent pipelines with polymer chemistry expertise and digital process mastery, while promoting a culture of continuous improvement. By combining robust sustainability goals, customer-centric innovation frameworks and agile production models, industry stakeholders can translate technical advances into differentiated offerings that command premium positioning across global markets.

Detailing the Rigorous Research Methodology Underpinning the Comprehensive Analysis of the Liquid Synthetic Rubber Market Landscape

This research leverages a hybrid methodology encompassing primary in-depth interviews with polymer scientists, production managers and procurement executives, complemented by secondary data harvested from technical journals, regulatory filings and trade association reports. To ensure analytical rigor, each data point is triangulated against at least two independent sources, validating accuracy and consistency. The segmentation framework-spanning type, application, end-user and sales channel-was developed in consultation with industry experts and refined through iterative workshops.

Quantitative inputs, including production volumes, import-export flows and feedstock pricing, were synthesized using statistical models that account for historical volatility and supply chain disruptions. Qualitative assessments of emerging trends, such as bio-based monomer adoption and digital integration, were benchmarked through case studies and scenario analyses. Finally, all findings underwent peer review by an advisory panel of academic researchers and senior industry practitioners, assuring methodological transparency and interpretive robustness.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Liquid Synthetic Rubber market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Liquid Synthetic Rubber Market, by Type

- Liquid Synthetic Rubber Market, by Application

- Liquid Synthetic Rubber Market, by End-User

- Liquid Synthetic Rubber Market, by Sales Channel

- Liquid Synthetic Rubber Market, by Region

- Liquid Synthetic Rubber Market, by Group

- Liquid Synthetic Rubber Market, by Country

- United States Liquid Synthetic Rubber Market

- China Liquid Synthetic Rubber Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Future Trajectory of Liquid Synthetic Rubber Fueled by Innovation and Strategic Market Drivers

The trajectory of liquid synthetic rubber is defined by an intersection of technological innovation, regulatory evolution and shifting end-user priorities. As sustainability considerations accelerate the uptake of bio-based feedstocks, and as digital process controls enhance production agility, the industry is positioned for a new era of value creation. Regional demand will continue to diverge, with Asia-Pacific leading in volume and the Americas and EMEA prioritizing specialty grades for high-performance applications.

In this context, success will hinge on the ability to synchronize R&D investments with customer needs, fortify supply chains against geopolitical and tariff risks, and cultivate service models that deliver rapid, customized solutions. Organizations that can seamlessly integrate molecular-level innovation with strategic partnerships, operational excellence and digital dexterity will navigate market complexities with confidence and unlock sustained competitive advantage in the liquid synthetic rubber domain.

Take the Next Step to Unlock Critical Insights and Gain Competitive Advantage by Engaging with Ketan Rohom to Secure Your Liquid Synthetic Rubber Market Report

If the depth of insights and strategic analysis in this executive summary resonates with your needs, connect with Ketan Rohom, Associate Director of Sales & Marketing at our firm, to secure comprehensive research coverage tailored to your objectives. His expertise will ensure you receive a customized briefing encompassing all critical facets of the liquid synthetic rubber landscape, empowering you to make data-driven decisions with confidence. Act now to reinforce your competitive stance and harness the full potential of this transformative material in your operations.

- How big is the Liquid Synthetic Rubber Market?

- What is the Liquid Synthetic Rubber Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?