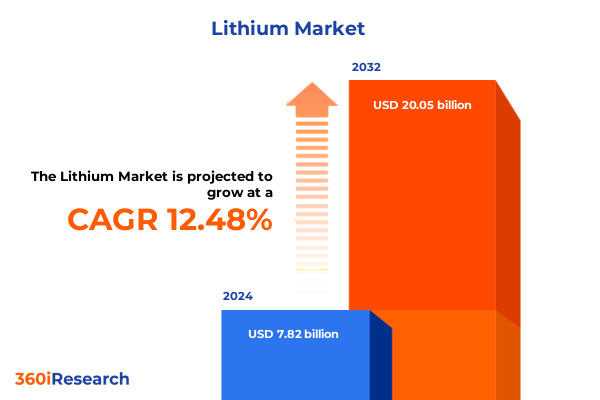

The Lithium Market size was estimated at USD 8.72 billion in 2025 and expected to reach USD 9.72 billion in 2026, at a CAGR of 12.62% to reach USD 20.05 billion by 2032.

An Engaging Overview of the Evolving Lithium Market Dynamics and Their Implications for Strategic Decision Making Across Industry Verticals

Lithium has emerged as a pivotal resource underpinning modern technological advancements and sustainable energy transitions. Its role extends far beyond traditional applications, influencing sectors as diverse as automotive propulsion, consumer electronics, and renewable energy storage infrastructures. With the electrification movement gaining momentum worldwide, lithium’s strategic significance has become more pronounced than ever, positioning it at the forefront of global industrial transformation.

As stakeholders grapple with increasingly complex supply chains and fluctuating policy environments, understanding the core drivers of lithium demand and supply dynamics is essential. From the extraction of spodumene to the final integration of lithium compounds into high-performance batteries, this report offers an unbiased and thorough overview of market forces. By contextualizing current trends against historical developments, this foundational section provides an indispensable starting point for executives seeking clarity in an otherwise intricate landscape.

Key Catalytic Transformations Redefining Global Lithium Production Processes Supply Chain Resilience and Technological Innovation Trajectories

The lithium industry is experiencing transformative shifts driven by rapid advancements in battery technology and evolving regulatory frameworks. Emerging direct lithium extraction methods are poised to upend conventional mining paradigms by enabling more efficient resource recovery while minimizing environmental footprints. Concurrently, the growing emphasis on circular economy principles has accelerated innovation in lithium-ion battery recycling, fostering closed-loop systems that reclaim valuable metals for redeployment in new cells. Together, these technological breakthroughs are reconfiguring production pathways and paving the way for a more sustainable value chain.

Meanwhile, supply chain resilience has become a strategic imperative as geopolitical tensions and resource nationalism threaten to disrupt raw material flows. Companies are increasingly pursuing diversified sourcing strategies and establishing long-term offtake agreements to mitigate exposure to critical bottlenecks. In parallel, partnerships between mining firms and battery manufacturers are proliferating to secure upstream raw materials and downstream processing capabilities. These combined developments are reshaping how organizations approach risk management, capital allocation, and collaborative ventures in an era defined by rapid change.

Assessing the Multi-Faceted Consequences of 2025 United States Tariff Measures on the National Lithium Value Chain Competitiveness and Cost Structures

The imposition of United States tariffs on key lithium raw materials and downstream intermediates in early 2025 has introduced significant complexity to the domestic lithium ecosystem. By raising import costs for both concentrate and precursor compounds, these measures have compelled manufacturers to reassess supply sources and realign procurement strategies. While intended to bolster domestic production capacity, the levies have concurrently elevated cost structures for battery cell assemblers, compelling them to seek cost savings through operational efficiencies and localized partnerships.

Over the past months, companies have accelerated investments in stateside extraction and chemical processing facilities in response to these tariffs. This shift is fostering greater self-sufficiency, yet it has also highlighted the challenge of scaling up production to meet surging demand. In addition, downstream battery manufacturers have begun negotiating collaborative frameworks with regional suppliers to share cost burdens and streamline logistics. As a result, the tariff landscape has catalyzed a broader reevaluation of the entire U.S. lithium value chain, driving innovation in both process optimization and strategic alliance formation.

Insightful Dissection of Lithium Market Segmentation Across Multiple Dimensions Including Form Grade Application and End User Characteristics

A nuanced understanding of the lithium sector requires dissection across multiple segmentation dimensions, beginning with physical form. Granular feedstocks often underpin large-scale industrial processes due to their ease of handling, while powder variants support precision applications in high-purity environments. Meanwhile, solution-based lithium derivatives enable seamless integration into chemical synthesis pipelines, catering to specialized end uses. These form distinctions shape downstream processing routes and influence logistical considerations across the supply chain.

Grade classifications further refine market perspectives, with battery grade materials commanding the highest technical specifications for energy storage applications. In contrast, food and pharmaceutical grade lithium compounds adhere to stringent purity standards tailored to consumable and medical use cases. Reagent and technical grades occupy intermediate tiers, serving research laboratories and industrial catalysts. When overlaying application lenses, battery demand emerges as a dominant driver, notably within lead acid, conventional lithium-ion, nickel metal hydride, and burgeoning solid-state systems. Beyond energy storage, lithium’s versatility extends to ceramics and glass manufacturing, air treatment solutions, lubricating greases, polymer enhancements, and active pharmaceutical ingredient formulations. End user segmentation reveals diverse consumption profiles: automotive OEMs pursue high-performance cell chemistries, consumer electronics brands demand compact and high-density sources, energy storage projects across commercial, residential, and utility scale seek stability and lifecycle efficiency, industrial processes leverage lithium catalysts, and pharmaceutical producers rely on ultra-pure grades. This layered segmentation framework provides stakeholders with a granular lens to align product offerings with evolving market needs.

This comprehensive research report categorizes the Lithium market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Grade

- Application

- End User

In-Depth Exploration of Lithium Market Regional Dynamics Uncovering Contrasting Drivers and Growth Patterns in Key Global Territories

Regional dynamics in the lithium market are defined by distinct supply sources, regulatory environments, and demand trajectories. In the Americas, North and South American producers have ramped up capacity through joint ventures and greenfield projects, capitalizing on abundant spodumene reserves and favorable trade accords. Policy initiatives in certain jurisdictions are incenting local processing hubs to strengthen domestic supply chains, while end market growth is fueled by a thriving electric vehicle industry and large-scale battery storage installations.

Across Europe, the Middle East, and Africa, strategic alliances between governments and private enterprises are promoting development of integrated lithium value chains. European Union directives on battery sustainability have heightened emphasis on recycling infrastructures, prompting investment in circular economy technologies. Meanwhile, Middle Eastern nations are diversifying away from hydrocarbon dependence by exploring lithium extraction from brine resources, and African mining regions are attracting global partners eager to unlock vast untapped reserves. Asia-Pacific remains the preeminent consumer region, driven by leading manufacturing hubs in China, South Korea, and Japan that dominate cell production. Government subsidies and industrial policy frameworks continue to accelerate capacity additions, shaping a robust ecosystem of refining, cathode manufacturing, and battery assembly.

This comprehensive research report examines key regions that drive the evolution of the Lithium market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Intelligence on Leading Lithium Industry Players Spotting Competitive Strengths Collaborative Ventures and Market Positioning Trends

Leading lithium producers are differentiating through strategic partnerships, technological investments, and geographic diversification. Several established mining and chemical firms have reinforced their upstream positions via long-term agreements with battery manufacturers, ensuring secure supply while aligning production with evolving quality requirements. Investments in research and development are unlocking proprietary extraction methodologies and advanced purification systems, conferring competitive advantages in both cost-efficiency and environmental compliance.

Concurrently, new entrants and mid-sized players are capturing niche opportunities by specializing in high-purity reagent and pharmaceutical grades, catering to sectors where regulatory oversight demands uncompromising consistency. Collaboration agreements with technology providers are enabling faster deployment of next-generation extraction plants, and joint ventures with recycling specialists are forging the initial blueprints for closed-loop supply systems. Across the board, corporate strategies emphasize agile capacity scaling, vertical integration, and sustainable practices as key levers for maintaining market resilience amid intensifying competition.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lithium market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- Allkem Limited

- Altura Mining Limited

- Arcadium Lithium plc

- Bacanora Lithium PLC

- Century Lithium Corp.

- Ganfeng Lithium Co., Ltd.

- Ioneer Ltd.

- Lithium Americas Corp.

- Lithium Power International Limited

- Livent Corporation

- LSC Lithium Corporation

- Mineral Resources Limited

- Neo Lithium Corp.

- Pilbara Minerals Limited

- Sayona Mining Limited

- Sichuan Yahua Industrial Group Co., Ltd.

- Sociedad Química y Minera de Chile S.A. Wikipedia+2s25.q4cdn.com+2

- Tianqi Lithium Corporation Wikipedia+1

- Zhejiang Huayou Cobalt Co., Ltd. Wikipedia

Action-Oriented Strategic Recommendations Empowering Industry Leaders to Navigate Disruption Drive Sustainable Growth and Secure Competitive Advantage

Industry leaders should prioritize diversification of supply chains by securing raw material sources across multiple geographies and adopting dual sourcing strategies to mitigate geopolitical risks. Parallel to this, adopting cutting-edge extraction techniques such as direct lithium recovery will enhance operational efficiency and reduce environmental impacts. By integrating recycling capabilities into core operations, organizations can create closed-loop models that recover valuable metals, lower dependency on virgin resources, and reinforce sustainability credentials.

Strategic collaboration agreements with battery producers and end users will streamline product specifications and optimize logistics, driving down total landed costs. Continuous monitoring of regulatory developments-particularly in tariff policy and environmental standards-will enable proactive adjustments to procurement and production planning. Finally, leveraging advanced data analytics and digital supply chain management tools will fortify forecasting accuracy and responsiveness, empowering decision-makers to navigate the dynamic lithium landscape with confidence.

Transparent Exposition of Rigorous Research Methodology Underpinning Lithium Market Analysis Ensuring Data Integrity and Analytical Reliability

This analysis is informed by a blend of comprehensive secondary research, including scientific publications, industry journals, and publicly available corporate disclosures. Rigorous data triangulation methods were applied to validate quantitative findings, ensuring consistency across multiple sources and adjusting for temporal variations. Primary research incorporated in-depth interviews with senior executives, technical experts, and policy analysts, providing qualitative insights into emerging trends and strategic priorities.

Methodological rigor was maintained through systematic supply chain mapping exercises, proprietary cost modeling frameworks, and scenario analyses that stress tested key assumptions under various regulatory and market conditions. Quality assurance protocols included peer reviews by independent subject matter experts and iterative feedback loops with industry stakeholders. This transparent approach underpins the reliability of the insights presented and the strategic implications drawn throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lithium market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lithium Market, by Form

- Lithium Market, by Grade

- Lithium Market, by Application

- Lithium Market, by End User

- Lithium Market, by Region

- Lithium Market, by Group

- Lithium Market, by Country

- United States Lithium Market

- China Lithium Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Consolidated Synopsis Highlighting Critical Takeaways and Strategic Imperatives Shaping the Future Trajectory of the Lithium Market Landscape

The lithium market is at an inflection point, shaped by rapid technological progress and evolving policy landscapes. The convergence of advanced extraction methods, circular economy initiatives, and strategic tariff measures has recalibrated supply chain dynamics and competitive positioning. Meanwhile, granular segmentation and regional contrasts reveal tailored opportunities for participants with differentiated product portfolios and strategic partnerships.

Moving forward, industry participants must remain vigilant in adapting to regulatory shifts and technological breakthroughs, while fostering collaborations that enhance resiliency and sustainability. The strategic recommendations outlined herein provide a roadmap for navigating uncertainties and capitalizing on emerging value pools. By synthesizing the insights across thematic, geographic, and competitive dimensions, this report equips decision-makers with a holistic perspective to inform robust strategies in the ever-evolving lithium landscape.

Compelling Invitation to Engage with Expert Associate Director of Sales Marketing to Acquire Comprehensive Lithium Market Research Insights

We invite you to seize a strategic advantage in the rapidly evolving lithium sector by acquiring our comprehensive market research report. This meticulously compiled publication delivers unparalleled insights into market dynamics, transformative industry shifts, regulatory implications, and competitive benchmarking. By engaging directly with Ketan Rohom, Associate Director, Sales & Marketing, you will receive a personalized overview of the report’s extensive findings, ensuring that your organization can leverage these actionable intelligence to outperform competitors and navigate future uncertainties with confidence

Our exclusive offering includes in-depth analyses of supply chain disruptions, tariff impacts, segmentation valuations, regional demand landscapes, and emerging technological innovations. With a direct consultation, you will gain clarity on how to integrate these observations into your strategic planning process. Don’t miss the opportunity to secure a vital resource that will empower your team to make data-driven decisions, mitigate risks, and capitalize on lucrative growth prospects across the global lithium ecosystem. Reach out to Ketan Rohom today and take the first step toward transforming market complexities into strategic advantages

- How big is the Lithium Market?

- What is the Lithium Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?