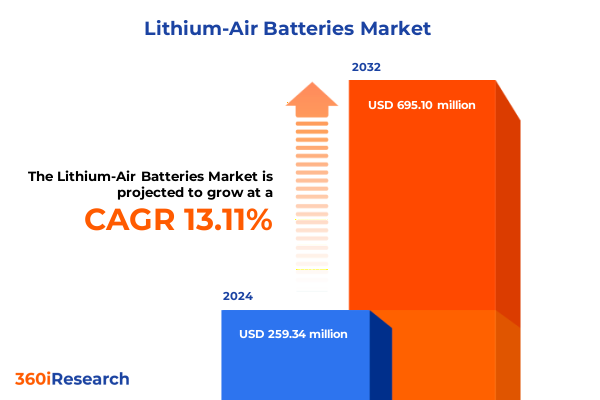

The Lithium-Air Batteries Market size was estimated at USD 291.60 million in 2025 and expected to reach USD 328.19 million in 2026, at a CAGR of 13.21% to reach USD 695.10 million by 2032.

Exploring the Innovative Potential and Rapidly Advancing State of Lithium-Air Batteries Transforming High-Density Energy Storage

Lithium-air batteries present a transformative opportunity to overcome the energy density limitations that have long constrained lithium-ion technology. By harnessing ambient oxygen as the cathode reactant, lithium-air cells can theoretically achieve specific energies approaching 11,400 watt-hours per kilogram, rivaling the energy density of traditional fuels. This conceptual breakthrough has energized researchers and industry stakeholders alike, who view lithium-air systems as the next frontier in high-capacity, lightweight energy storage.

The journey from laboratory proof-of-concept to commercial viability remains complex, yet recent advances in solid composite electrolytes and protective interlayers are rapidly closing the gap. Leading academic institutions and national laboratories have demonstrated rechargeable lithium-oxygen prototypes capable of thousands of cycles, signaling that fundamental challenges in rechargeability and cycle life are increasingly surmountable. As a result, lithium-air technology is attracting heightened investment from automotive OEMs, grid-scale energy integrators, and defense agencies seeking to extend operational range and reduce system weight.

This introduction outlines both the promise and current state of lithium-air battery development, setting the stage for a deeper exploration of the dynamic shifts, regulatory influences, and strategic imperatives that define today’s competitive landscape.

Identifying the Major Technological Breakthroughs and Strategic Collaborations Fueling the Evolution of Lithium-Air Battery Systems

Technological breakthroughs over the past two years have redefined what is possible for lithium-air batteries. Novel aprotic electrolytes based on ionic liquids and ceramic-polymer composites have enabled four-electron oxygen reduction reactions at room temperature, marking a significant leap over early two-electron systems. Concurrently, hybrid aqueous–aprotic designs are leveraging the abundant availability of air-derived oxygen while mitigating the clogging and dendrite risks that historically plagued nonaqueous lithium-oxygen cells.

On the manufacturing front, roll-to-roll processes for porous carbon cathodes with dual-pore architectures have scaled from gram-scale lab prototypes to pilot production, underscoring the accelerating transition from bench to fab. Industry leaders are forging alliances to co-develop advanced cathode catalysts that optimize reaction kinetics and resist byproduct accumulation. This collaborative ecosystem, spanning material suppliers to system integrators, is galvanizing the market through shared intellectual property and risk-sharing frameworks.

Meanwhile, growing interest in solid-state approaches is catalyzing cross-industry partnerships with polymer and ceramic specialists. These alliances aim to deliver thin-film solid electrolytes that enhance safety, reduce flammability concerns, and improve packaging efficiency. As these transformative shifts gain momentum, lithium-air batteries are increasingly poised to compete directly with lithium-ion in applications requiring both high energy density and extended cycle life.

Analyzing the Cumulative Effects of United States Trade Tariff Measures on Lithium-Air Battery Supply Chains and Cost Structures in 2025

The introduction of Section 301 tariffs and subsequent trade measures have materially influenced the cost structure and supply chain strategies for emerging battery technologies in 2025. Non–lithium-ion battery parts imported from China, including critical components for lithium-air cell assembly, have been subject to a 25% tariff rate since September 27, 2024. This foundational increase disrupted existing cost models and prompted domestic producers to reevaluate procurement strategies for cathode host materials and electrolyte precursors.

Following this initial measure, reciprocal tariffs enacted on April 9, 2025, imposed an additional 34% duty on Chinese battery cell imports, escalating total effective rates for cell components to nearly 60% in some cases. Although these tariffs aimed to bolster U.S. manufacturing, they also introduced temporary volatility, with OEMs and tier-1 suppliers stockpiling critical inputs in late 2024 to buffer against price shocks. Throughout early 2025, several major Japanese and South Korean cathode catalyst suppliers accelerated plans to expand U.S. production lines, driven by the need to circumvent punitive duties and secure market access.

While these measures have elevated upfront capital expenditures, they have simultaneously incentivized reshoring initiatives and near-sourcing partnerships. Stakeholders considering new lithium-air cell production facilities are now prioritizing domestic feedstock integration and local catalyst synthesis to mitigate exposure. As such, the cumulative impact of U.S. tariff policies in 2025 is shaping a more resilient, albeit higher-cost, supply ecosystem that redefines competitive advantage in the lithium-air sector.

Uncovering Critical Market Segmentation Insights Across Chemistries, Capacity Bands, Application Verticals, and Distribution Models

The lithium-air battery landscape comprises distinct segments that each exhibit unique drivers and development trajectories. In terms of chemistry, aprotic lithium-air architectures are achieving multi-electron reactions through advanced electrolytes, while aqueous systems are leveraging water-compatible separators to circumvent pure oxygen requirements. Solid-state variants prioritize safety and volumetric efficiency by integrating ceramic-polymer matrices that suppress dendrite formation and enhance ionic conductivity.

Capacity considerations further refine market potential, with sub-10 kWh modules targeting aviation and unmanned aerial systems, mid-range cells between 11 and 100 kWh aligning to electric vehicle applications, and large-format assemblies exceeding 100 kWh tailored for utility-scale and remote microgrid deployments. These capacity tiers each demand tailored thermal management and packaging solutions to optimize performance and longevity.

Application segments drive distinct value propositions. Aerospace and defense stakeholders are drawn to lithium-air’s superior gravimetric energy for mission-critical endurance, whereas electric vehicle OEMs eye commercial and passenger platforms seeking longer range and reduced battery weight. Meanwhile, residential and utility-scale energy storage providers explore hybridized systems where lithium-air integrates with renewable generation to smooth intermittent supply.

Distribution channels have also evolved, with direct sales fostering OEM and system integrator contracts for specialized deployments, and distributor networks supporting broader aftermarket and retrofit opportunities. Online platforms are gaining traction for fast-moving consumer and prototype orders, while offline channels underpin strategic partnerships and complex, project-based procurements.

This comprehensive research report categorizes the Lithium-Air Batteries market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Capacity

- Application

- Sales Channel

Evaluating Regional Dynamics and Growth Drivers Shaping Lithium-Air Battery Adoption in the Americas, EMEA, and Asia-Pacific

Regional market dynamics for lithium-air batteries reflect divergent innovation ecosystems and policy landscapes. The Americas, anchored by the United States, benefit from robust government R&D funding and incentives under the Inflation Reduction Act, which have catalyzed pilot manufacturing lines and domestic material synthesis. Strategic collaborations between federal labs and industrial partners are pushing cell formats beyond laboratory scales, while defense contracts underscore lithium-air’s potential for high-energy mission scenarios.

In Europe, the Middle East, and Africa, regulatory frameworks emphasize circular economy principles and decarbonization targets. European Union research consortia are exploring second-life applications that repurpose lithium-air cells for grid stabilization, and GCC nations are examining utility-scale buffer storage to manage solar intermittency. Local incentives and carbon pricing mechanisms reinforce long-term viability, while nascent manufacturing clusters in Germany and France are set to pilot standardized modules for public infrastructure.

Asia-Pacific remains the preeminent hub for advanced battery research and high-volume cell production. China’s state-owned enterprises and private innovators are investing heavily in both aprotic and aqueous lithium-air variants, signaling a commitment to maintain leadership in next-generation energy storage. Japan and South Korea are advancing solid-state and hybrid designs through partnerships with material science institutes, leveraging legacy expertise in ceramic electrolytes and carbon architectures. Together, this regional trifecta drives global scale-up pathways and competitive pressure that accelerates technology maturation.

This comprehensive research report examines key regions that drive the evolution of the Lithium-Air Batteries market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators, Collaborative Ventures, and Specialized Pioneers Propelling Lithium-Air Battery Advancement

The lithium-air battery sector is propelled by a diverse set of companies spearheading chemistry breakthroughs, cell architecture innovations, and scale-up methodologies. Key developers in the United States are leveraging national laboratory collaborations to transition solid composite electrolyte prototypes toward commercial readiness. These initiatives often focus on achieving multi-electron reaction pathways and robust cycle life under real-world conditions.

In parallel, Japanese and Korean corporations are channeling their solid-state battery expertise into lithium-air research, optimizing ceramic-polymer interfaces and dual-pore cathode designs for manufacturability. European start-ups and consortia emphasize sustainable material sourcing and recycling protocols to align with circular economy mandates, exploring end-of-life recovery processes that preserve critical metals and reduce environmental impact.

Strategic partnerships are reshaping the competitive landscape. Material suppliers, cathode catalyst innovators, and system integrators are forming joint ventures to de-risk scale-up and share intellectual property. Meanwhile, defense contractors and aerospace OEMs are establishing co-development agreements to validate lithium-air cells in extreme environments, from high-altitude flight to urban grid-island scenarios.

This cross-section of established energy storage leaders and agile newcomers reflects an ecosystem where collaboration and specialization drive accelerated progress. The interplay between deep-pocketed corporations and nimble technology firms continues to define the pace of lithium-air commercialization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lithium-Air Batteries market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BMW AG

- Ford Motor Company

- IBM Corporation

- Robert Bosch GmbH

- Sunrise New Energy Co., Ltd.

- Toyota Motor Corporation

Recommending Strategic Imperatives and Collaborative Models to Accelerate Lithium-Air Battery Development and Market Penetration

Industry leaders should actively pursue integrated value chains that align material suppliers, cell manufacturers, and end users under cohesive strategic frameworks. By establishing joint development agreements-particularly with aerospace OEMs and grid operators-organizations can de-risk technology validation while securing early adoption pathways.

Investing in domestic cathode and electrolyte production capabilities will mitigate tariff exposure and strengthen supply resilience. Firms can leverage regional incentives for advanced manufacturing, tapping into government programs that offset capital expenditures. Concurrently, stakeholders should allocate R&D resources toward solid-state and hybrid aqueous–aprotic chemistries to diversify technology portfolios and balance performance with safety considerations.

Cultivating flexible production lines capable of handling capacity variants from sub-10 kWh modules to utility-scale assemblies will position manufacturers to serve emerging applications. Equally important is developing robust end-of-life recovery programs to align with sustainability commitments and circular economy regulations, thereby enhancing corporate social responsibility credentials.

Finally, engaging with regulatory bodies and standards organizations to co-author performance and safety guidelines can shape favorable market conditions. By proactively influencing policy frameworks, industry players can ensure that lithium-air batteries attain appropriate certifications and gain expedited market entry across key regions.

Detailing the Rigorous Multi-Method Approach Combining Primary Interviews, Secondary Analysis, and Strategic Frameworks

This research integrates primary and secondary methodologies to deliver a comprehensive view of the lithium-air battery ecosystem. Primary insights derive from structured interviews with material scientists, cell engineers, and C-suite executives across leading battery manufacturers. These dialogues elucidate technology readiness levels, scale-up challenges, and strategic investment priorities.

Secondary research encompasses an extensive review of academic publications, patent filings, and government policy documents. Key data sources include peer-reviewed journals in electrochemistry, regulatory filings under Section 301 tariffs, and industry consortium reports. Trade data analyses and supply chain reviews further inform cost-structure assessments and tariff impacts.

Analytical frameworks such as SWOT and PESTLE have been employed to evaluate competitive positioning and macro-environmental factors, respectively. A four-segment model based on chemistry, capacity, application, and channel ensures a nuanced understanding of market dynamics without aggregating size or forecast metrics. Gap analyses identify white-space opportunities for technology maturation and partnership formation.

Synthesizing these methodologies provides a balanced mix of qualitative perspectives and quantitative analytics, ensuring that the resulting insights are both actionable and grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lithium-Air Batteries market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lithium-Air Batteries Market, by Type

- Lithium-Air Batteries Market, by Capacity

- Lithium-Air Batteries Market, by Application

- Lithium-Air Batteries Market, by Sales Channel

- Lithium-Air Batteries Market, by Region

- Lithium-Air Batteries Market, by Group

- Lithium-Air Batteries Market, by Country

- United States Lithium-Air Batteries Market

- China Lithium-Air Batteries Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings to Chart the Strategic Trajectory and Commercialization Pathways for Lithium-Air Batteries

Lithium-air batteries stand at the cusp of redefining energy storage, offering unprecedented energy densities that hold promise for long-range electric vehicles, aviation, and resilient grid systems. The convergence of breakthroughs in solid composite electrolytes, dual-pore cathode architectures, and advanced manufacturing reflects an ecosystem ready to transition from lab-scale demonstrations to pilot-scale production.

Regulatory shifts, particularly U.S. tariff measures in 2025, have recalibrated supply chains toward domestic sourcing, catalyzing reshoring and incentivizing localized material supply. Segmentation insights reveal clear value propositions across chemistry types, capacity bands, and application verticals, each presenting unique pathways for early adoption and scale-up.

Regional dynamics underscore a globally competitive landscape, with strong R&D and manufacturing clusters in the Americas, robust policy-driven pilots in EMEA, and expansive high-volume initiatives in Asia-Pacific. Meanwhile, collaborative ventures among startups, established energy storage firms, and defense contractors are compressing development timelines, aligning technical milestones with market requirements.

As the sector evolves, industry leaders must navigate evolving technology paradigms, policy headwinds, and emerging sustainability mandates. By leveraging the insights outlined herein, stakeholders are equipped to make informed decisions that drive the strategic imperatives for lithium-air battery commercialization.

Engaging Direct Dialogue with Ketan Rohom to Secure Customized Lithium-Air Battery Market Research and Tailored Strategic Support

To gain full access to in-depth analysis, proprietary insights, and expert validation across the full spectrum of lithium-air battery market dynamics, reach out directly to Associate Director Ketan Rohom. His expert guidance will ensure your strategic initiatives are bolstered by the most comprehensive and actionable research findings available. Connect today to secure your customized report package and equip your organization with the data-driven intelligence needed to lead in this transformative energy storage revolution.

- How big is the Lithium-Air Batteries Market?

- What is the Lithium-Air Batteries Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?