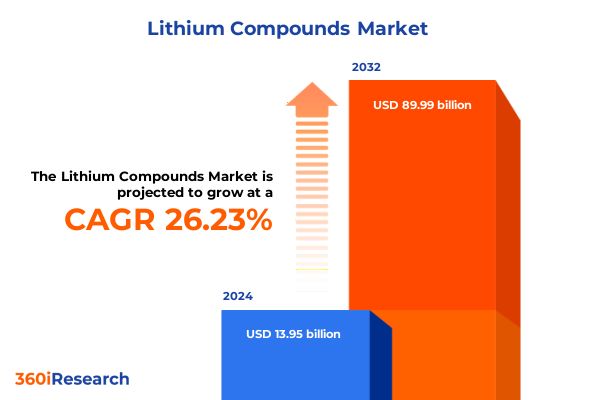

The Lithium Compounds Market size was estimated at USD 17.70 billion in 2025 and expected to reach USD 22.45 billion in 2026, at a CAGR of 26.14% to reach USD 89.99 billion by 2032.

Exploring the Foundational Importance of Lithium Compounds as a Cornerstone for Clean Energy Technologies and Industrial Applications

Lithium compounds have emerged as indispensable assets in the global transition toward cleaner energy and advanced industrial processes. Their unique electrochemical properties are central to the performance of modern rechargeable batteries, which underpin the proliferation of electric vehicles and large-scale energy storage systems. Beyond the automotive and energy sectors, lithium-based materials play pivotal roles in air treatment solutions, specialty greases, and life-saving pharmaceuticals, illustrating a remarkable breadth of application that only continues to expand.

As demand intensifies, industry stakeholders are navigating an increasingly complex landscape shaped by evolving regulatory frameworks, environmental scrutiny, and supply chain realignment. Incentives aimed at reducing carbon footprints have accelerated private and public investments in lithium extraction, processing, and recycling capabilities. Meanwhile, competition to secure reliable raw material sources has prompted strategic alliances across geographies, signaling both opportunity and risk for established producers and emerging entrants.

Examining How Technological Advancements, Regulatory Drivers, and Sustainability Imperatives Are Redefining the Lithium Compounds Industry Landscape

The lithium compounds sector is undergoing profound transformation driven by advancements in battery chemistry, digitalization of supply chains, and sustainability mandates. Breakthroughs in electrode materials and electrolyte formulations are yielding batteries with higher energy density and longer life spans, while novel direct lithium extraction techniques promise to unlock previously inaccessible brine reserves. Concurrently, data-driven traceability platforms are elevating transparency across global supply chains, enabling stakeholders to meet stringent environmental and social governance criteria.

Regulatory incentives and voluntary commitments have further accelerated investments in circular economy solutions, particularly in recycling processes capable of recovering high-purity lithium compounds from spent batteries. As the industry adopts more integrated value chains, capacity expansions are increasingly paired with investments in low-emission technologies and local processing hubs. These shifts collectively redefine competitive positioning and create fresh imperatives for differentiation, cost optimization, and risk mitigation across the lithium value chain.

Assessing the Aggregate Consequences of 2025 U.S. Tariffs on Lithium Compound Imports and Domestic Supply Chain Resilience

In 2025, the United States implemented targeted tariff measures on certain imported lithium compounds, aiming to bolster domestic processing and secure strategic mineral supply chains. These duties have materially altered cost structures, incentivizing end users to evaluate alternative sourcing strategies and downstream partnerships that prioritize home-grown production capacity. The cumulative impact extends beyond price adjustments, influencing procurement policies, contract negotiations, and capital expenditure priorities across the battery and broader manufacturing ecosystems.

While levies on hydroxide, carbonate, and other specialty lithium inputs have created short-term headwinds for import-dependent buyers, they have simultaneously spurred accelerated permitting processes for domestic extraction and processing projects. Industry players are recalibrating investment roadmaps to internalize tariff implications, favor in-region supply alliances, and pursue vertically integrated models. As a result, the overall industry is moving toward greater resilience, albeit with potential trade-offs in near-term cost predictability and operational flexibility.

Deriving Deep Market Intelligence from Multidimensional Segmentation Across Applications, Product Types, End Use Industries, Purity Grades, and Processing Methods

A nuanced view of the lithium compounds market emerges when considering multiple segmentation approaches. Based on application, the industry spans air treatment, battery systems, lubricating grease formulations, and pharmaceutical products, with the battery category further subdividing into consumer electronics, electric vehicles, and large-scale energy storage systems. Segmenting by product type reveals distinct dynamics for lithium carbonate, lithium chloride, lithium fluoride, and lithium hydroxide, each serving specialized processing and performance requirements.

When organized by end use industry, the market encompasses automotive, consumer electronics, energy storage, and industrial users, with the automotive segment differentiating into commercial and passenger vehicles reflecting divergent demand drivers. Purity grade classification isolates battery grade, electronic grade, pharmaceutical grade, and technical grade materials, where battery grade is further delineated into LFP, NCA, and NMC families that dictate performance, cost, and safety trade-offs. Finally, process segmentation spans brine extraction, mineral extraction, and recycling, the latter breaking down into closed-loop and open-loop streams that respectively emphasize material recapture efficiency or wider feedstock flexibility.

This comprehensive research report categorizes the Lithium Compounds market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Process

- Application

- End Use Industry

Illuminating Regional Dynamics by Comparing Market Trajectories and Strategic Priorities across Americas, Europe Middle East & Africa, and Asia-Pacific Territories

Regional markets for lithium compounds are advancing on divergent paths influenced by local resource endowments, policy architectures, and industrial priorities. In the Americas, North American initiatives seek to shrink the supply chain footprint through domestic extraction projects and refinements in downstream processing, while Latin America’s brine-rich basins continue to attract global investment for primary carbonate and hydroxide production. These regional strategies are progressively synchronized with federal incentives geared toward innovation and infrastructure enhancement.

In Europe Middle East & Africa, European Union regulations emphasizing carbon neutrality are fueling demand for sustainably sourced lithium materials, with several pilot initiatives in the Middle East exploring direct extraction from saline aquifers. African nations with nascent hard rock deposits are likewise poised to join global supply networks, though infrastructure and permitting challenges require long-term collaboration to realize potential. Across Asia-Pacific, China remains the dominant processor and consumer, but Australia’s hard rock developments, South Korean battery manufacturing synergies, and Japan’s advanced materials research collectively shape a dynamic competitive landscape.

This comprehensive research report examines key regions that drive the evolution of the Lithium Compounds market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Moves by Leading Lithium Compound Producers and Their Investments in Capacity Expansion, Partnerships, and Technological Innovation

Leading producers of lithium compounds are executing multifaceted strategies to capture growth and mitigate supply risk. Major chemical manufacturers have announced capacity expansions in both established and emerging geographies, often in partnership with technology providers specializing in direct extraction or hydrometallurgical advancements. Strategic joint ventures and off-take agreements with automotive and renewable energy firms are becoming foundational elements of firms’ long-term development frameworks.

Parallel to upstream scaling, several companies are investing heavily in recycling infrastructure intended to close material loops and offset fluctuation in primary resource availability. Technology collaborations between refining specialists and battery manufacturers are producing tailored grades optimized for next-generation chemistries, while digital platform alliances aim to enhance supply chain traceability and environmental compliance. These combined efforts reflect an industry ethos that balances rapid capacity growth with innovation and sustainability objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lithium Compounds market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- Allkem Limited

- American Elements

- AMG Advanced Metallurgical Group N.V.

- Axiom Chemicals Pvt. Ltd.

- Ganfeng Lithium Co., Ltd.

- Jinan Qinmu Fine Chemical Co., Ltd.

- Kanto Chemical Co., Inc.

- Keliber Oy

- Kishida Chemical Co., Ltd.

- Livent Corporation

- Merck KGaA

- Mineral Resources Limited

- Pacific Organics Pvt. Ltd.

- Sichuan Yahua Industrial Group Co., Ltd.

- Sociedad Química y Minera de Chile S.A.

- Suvidhinath Laboratories

- Tianqi Lithium Corporation

- Xi’an Function Material Group Co., Ltd.

Formulating Strategic Actions for Industry Leaders to Enhance Competitiveness through Supply Diversification, Technological Investment, and Regulatory Engagement

Industry leaders are advised to diversify lithium sourcing across both geographic and technological vectors to limit exposure to concentrated supply risks. By integrating primary extraction projects with recycling capabilities, organizations can build closed-loop frameworks that both stabilize feedstock availability and demonstrate environmental stewardship. Prioritizing investments in advanced processing methods, such as solvent extraction or direct lithium extraction, will enhance cost efficiency and recovery rates.

Furthermore, establishing long-term offtake arrangements with battery and automotive OEMs secures demand visibility and can underpin capital commitments for new facilities. Regular engagement with policymakers on trade measures and sustainability regulations helps shape a favorable operating environment and anticipate legislative shifts. Finally, adopting digital traceability solutions fosters end-to-end transparency, enabling companies to meet rising stakeholder expectations for ethical sourcing and carbon neutrality.

Detailing a Rigorous Research Approach Integrating Primary Interviews, Secondary Data Triangulation, and Qualitative Validation to Ensure Analytical Robustness

This research leverages a hybrid methodology that combines expert interviews, proprietary primary data collection, and rigorous secondary source analysis. In-depth discussions with C-suite executives, technology innovators, and supply chain specialists formed the foundational qualitative insights. Concurrently, industry publications, government filings, technical white papers, and trade association reports were systematically reviewed to validate market trends, regulatory shifts, and technological developments.

Quantitative data was triangulated across multiple reputable databases and open-source platforms to ensure accuracy and mitigate bias. An iterative validation process included peer review rounds with external consultants and academic experts, refining analytical frameworks and ensuring the research outcomes reflect applied realities. This robust approach provides a transparent, repeatable model for deriving actionable intelligence in complex commodity markets.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lithium Compounds market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lithium Compounds Market, by Product Type

- Lithium Compounds Market, by Purity Grade

- Lithium Compounds Market, by Process

- Lithium Compounds Market, by Application

- Lithium Compounds Market, by End Use Industry

- Lithium Compounds Market, by Region

- Lithium Compounds Market, by Group

- Lithium Compounds Market, by Country

- United States Lithium Compounds Market

- China Lithium Compounds Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings to Highlight the Strategic Imperatives and Competitive Advantages within the Evolving Lithium Compounds Ecosystem

The lithium compounds industry is at an inflection point defined by accelerated clean energy adoption, evolving trade policies, and a shift toward circular material flows. Key takeaways underscore the transformative impact of evolving battery formulations, the strategic significance of 2025 tariff policies on import-dependent stakeholders, and the critical need for flexible, resilient supply chain architectures. Multidimensional segmentation insights reveal differentiated growth trajectories across applications, product types, end-use sectors, purity grades, and processing methods.

Regional dynamics highlight the strategic interplay between resource-rich supply geographies and high-value processing hubs, while leading companies are forging integrated models that balance expansion with innovation in recycling and digital traceability. Industry leaders are thus positioned to capitalize on diversification strategies, advanced extraction technologies, and policy engagement to secure competitive advantage. The strategic roadmap emerging from this research equips decision-makers to navigate uncertainty and harness opportunity as the global lithium compounds ecosystem evolves further.

Connect with Associate Director of Sales & Marketing for Tailored Insights and Secure the Comprehensive Lithium Compounds Market Research Report Today

To explore the full breadth of strategic insights and data analyses presented within this comprehensive market research study on lithium compounds, you are encouraged to connect with Ketan Rohom, Associate Director of Sales & Marketing, who can facilitate access to tailored reports and bespoke consultation services. Engaging directly will provide an opportunity to receive an executive briefing on the most critical market trends, competitive dynamics, and actionable strategies specific to your organizational objectives.

By reaching out to the Associate Director, you will gain clarity on licensing options, report modules, and complementary advisory support designed to accelerate decision-making and sharpen investment roadmaps. Initiating this dialogue ensures a bespoke client journey that aligns in-depth market intelligence with targeted business imperatives. Secure your organization’s forward momentum by scheduling a consultation to obtain the definitive resource on lithium compounds today

- How big is the Lithium Compounds Market?

- What is the Lithium Compounds Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?