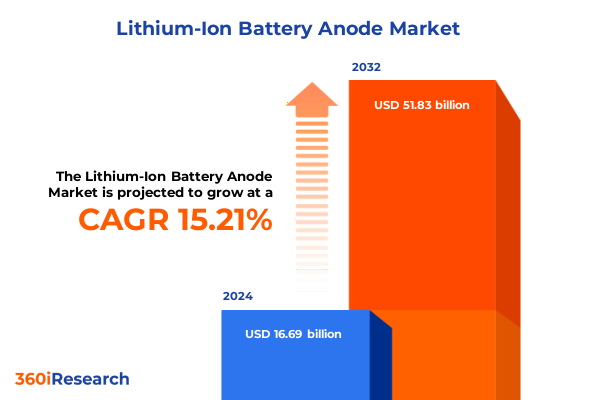

The Lithium-Ion Battery Anode Market size was estimated at USD 19.08 billion in 2025 and expected to reach USD 21.85 billion in 2026, at a CAGR of 15.34% to reach USD 51.83 billion by 2032.

Exploring the Evolution and Strategic Importance of Lithium-Ion Battery Anode Technology in Modern Energy Transition and Industrial Innovation

The evolution of lithium-ion battery technology has been profoundly influenced by advances in anode materials, which serve as the negative electrode enabling charge carriers to move efficiently during cycling. As the critical interface between the electrolyte and the current collector, the anode determines not only energy density and cycle life but also safety and manufacturing costs. Over the past decade, the industry has witnessed a shift from predominantly graphite-based anodes toward high-performance composite formulations that address the ever-growing demands of electric vehicles, portable electronics, and large-scale energy storage systems.

Driven by global decarbonization imperatives and electrification goals, manufacturers have intensified research into alternative anode chemistries and processes to overcome the limitations of traditional graphite. The conventional reliance on natural graphite has faced challenges related to resource concentration and geopolitical supply risks, as China accounted for over 90% of global anode active material manufacturing capacity in 2024. This concentration has raised concerns about potential bottlenecks in the supply chain amid surging demand for battery-powered applications.

Meanwhile, the emergence of silicon-enhanced composites and novel fabrication methods promises significant improvements in energy density and charging rates. Early adopters in the consumer electronics sector have demonstrated that next-generation anodes can deliver substantial performance gains without compromising cycle life. As these innovations mature, stakeholders across automotive, renewable energy, and consumer markets are keenly assessing the strategic implications of anode diversification, recognizing that breakthroughs at this interface will define the next wave of competitive differentiation and cost optimization.

How Emerging Materials, Technological Breakthroughs, and Environmental Imperatives Are Redrawing the Lithium-Ion Anode Development Landscape

The landscape of lithium-ion battery anode development is undergoing transformative shifts driven by converging technological, environmental, and policy forces. Innovations in material design, such as silicon-based and silicon-carbon composite anodes, have moved from laboratory prototypes to pilot-scale production, reflecting a growing confidence in their applicability for high-energy and fast-charging applications. Companies like TDK Corp. have accelerated the introduction of third-generation silicon anode batteries, responding to surging demand from smartphone manufacturers and signaling a broader transition beyond conventional graphite dominance.

Advancements in manufacturing processes are also reshaping the cost-performance equation. Chemical vapor deposition and sintering methods are being optimized to produce uniform anode coatings and enhanced microstructures, enabling higher active material loading and improved electrode stability. Strategic partnerships between specialty chemical firms and technology licensors are facilitating the localization of advanced anode technologies, exemplified by collaborations that aim to secure supply chain resilience and reduce import dependencies.

At the same time, regulatory frameworks and sustainability mandates are compelling the industry to integrate recycled and low-carbon footprint materials into anode formulations. The push for circular economy practices is driving investments in recovery technologies that can reclaim graphite and silicon from end-of-life battery streams, ultimately lowering environmental impacts and bolstering resource security. Together, these dynamics are redrawing the anode development landscape, fostering a wave of innovation that balances performance gains with economic and ecological considerations.

Assessing the Compound Effects of Recent United States Tariff Measures on Lithium-Ion Battery Anode Supply Chains and Industry Competitiveness in 2025

In 2025, the United States implemented a series of significant tariff measures aimed at protecting domestic battery material producers and addressing perceived unfair trade practices. The U.S. Department of Commerce imposed an anti-dumping duty of 93.5% on anode-grade graphite imports from China, citing evidence of pricing below fair market value and the strategic necessity of reducing reliance on a single source for critical battery components. When combined with preliminary countervailing duty rates of 11.58%, the total effective duty on affected Chinese exporters reaches between 105.08% and 114.4%, reshaping cost structures across the supply chain.

Beyond the anode-specific tariffs, Section 301 measures continue to influence broader lithium-ion battery imports. Tariffs on electric vehicle battery assemblies and components were increased to 25% as of September 27, 2024, marking a substantial raise from the previous 7.5% levels. These policies underscore a strategic pivot toward domestic capacity expansion and incentivize manufacturers to localize production facilities or seek alternative suppliers outside of China.

The cumulative impact of these duties has produced both opportunities and challenges. Domestic graphite and synthetic graphite producers have experienced surging investor interest, with non-Chinese suppliers rallying on hopes of improved market access and competitive pricing outside China’s export regime. However, questions remain regarding the ability of Western anode material manufacturers to scale up while maintaining stringent quality specifications demanded by leading battery and EV OEMs. While near-term cost increases may be manageable-industry analysts estimate a single-digit percentage rise in cell costs-longer-term supply chain realignments will require strategic collaboration between raw material producers, cell manufacturers, and end-users to ensure a resilient and diversified anode ecosystem.

Delving into Material Types, Production Technologies, and Application Verticals to Unlock Critical Insights into Lithium-Ion Battery Anode Market Dynamics

Diving into the core market segments reveals nuanced drivers and constraints that define the competitive landscape of lithium-ion battery anodes. Material Type, the most granular perspective, contrasts the established performance and reliability of graphite against the emerging potential of silicon. Within the graphite segment, natural graphite continues to offer cost-efficient production but faces supply concentration risks, while synthetic graphite provides tailored properties such as high purity and controlled particle morphology. Silicon anodes, though still nascent at scale, promise energy density improvements of up to 50% but require ongoing innovation to mitigate volumetric expansion during cycling.

Production Technology brings another dimension to market dynamics, as Chemical Vapor Deposition techniques enable precise thin-film anode coatings with high active material utilization, while Sintering Processes offer economies of scale for bulk material synthesis, supporting high-volume applications. The trade-offs between capital expenditure, throughput, and material performance guide strategic decisions on technology adoption and capacity planning.

When viewed through the lens of Application, the differential requirements become even more apparent. Consumer Electronics demand small-format anodes with exceptional conductivity and lifecycle stability, prioritizing compact design and safety. Electric Vehicle applications emphasize high specific capacity, robust cycle life, and fast-charging capabilities, driving investments in composite materials and advanced binders. Energy Storage Systems prioritize cost-effectiveness and long-term durability, where recycled graphite blends and low-cost synthetic alternatives are gaining traction. Together, these segmentation insights provide a comprehensive framework for evaluating investment priorities and technological roadmaps in the anode market.

This comprehensive research report categorizes the Lithium-Ion Battery Anode market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Production Technology

- Cell Format

- Surface Engineering

- Recycling Content

- Form Factor

- Application

- Distribution Channel

Unveiling Regional Nuances in Lithium-Ion Battery Anodes Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional ecosystems play a pivotal role in shaping the development and deployment of lithium-ion battery anode technologies. In the Americas, a combination of governmental incentives and infrastructure investments has accelerated capacity expansion. The United States, benefiting from tax credits under the Inflation Reduction Act and growing interest from Korean and Japanese cell makers, saw manufacturing capacity grow by almost 50% in 2024, surpassing key European facilities and underscoring its ambition to reclaim leadership in the battery value chain. Canada and Mexico also contribute strategic value through proximity to automotive hubs and robust raw material supplies.

Across Europe, Middle East & Africa, decarbonization regulations and industrial policy have driven concerted efforts to localize anode material production. Germany and France lead with investments in synthetic graphite plants and pilot facilities for next-generation silicon composites, aligning with EU directives to secure over 40% of battery material demand locally by 2030. Partnerships between automotive OEMs and material suppliers are catalyzing vertical integration, ensuring transparency and traceability in the supply chain while reducing lifecycle emissions.

In the Asia-Pacific region, production remains highly concentrated, accounting for over 70% of global anode capacity. China dominates with more than 90% of installed manufacturing capacity, leveraging state-backed subsidies and economies of scale. Japan and South Korea contribute through technological innovation, filing over a quarter of global patents in anode materials, while emerging Southeast Asian hubs in Indonesia and India are attracting significant investments in new anode facilities. These regional nuances underscore the importance of aligning supply chain strategies with local policy frameworks and market characteristics to navigate competitive pressures and opportunities.

This comprehensive research report examines key regions that drive the evolution of the Lithium-Ion Battery Anode market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation and Competitive Dynamics in the Global Lithium-Ion Battery Anode Industry

The competitive landscape of lithium-ion battery anodes is defined by both established chemical giants and agile startups, each carving out unique positions through specialized capabilities and strategic alliances. Long-standing players in the graphite segment, such as Syrah Resources and Nouveau Monde Graphite, have leveraged the recent tariff environment to secure premium pricing for non-Chinese supply and accelerate capacity expansion. Synthetic graphite leaders like Novonix have benefited from government-backed financing to build domestic plants, addressing OEM concerns over quality consistency and geopolitical risk.

Concurrently, silicon anode innovators are pursuing commercialization through targeted funding and partnerships. GDI secured $11.5 million in Series A financing to scale production of 30% energy density-enhanced silicon anodes in North America and Europe, signaling confidence in global demand for high-performance cells. Meanwhile, Group14 Technologies’ SCC55 silicon-carbon composite has achieved over 1,500 commercial charge cycles, showcasing a critical breakthrough in durability that bridges the gap between lab-scale promise and industrial viability.

Major battery suppliers including Panasonic Holdings and LG Energy Solution continue to invest in in-house capability for silicon incorporation, often partnering with pure-play developers. TDK’s forthcoming fourth-generation silicon anode launch and planned capital allocation further illustrate the sector’s commitment to diversifying beyond conventional graphite formulations. Together, these companies reflect a dynamic ecosystem where performance differentiation, supply chain resilience, and cost leadership drive strategic positioning in the global anode market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lithium-Ion Battery Anode market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amprius Technologies

- Ascend Elements, Inc.

- BASF SE

- BTR New Material Group Co., Ltd.

- Contemporary Amperex Technology Co., Limited

- EcoGraf Limited

- Epsilon Advanced Materials Pvt Ltd.

- Group14 Technologies, Inc.

- Guangdong Dongdao New Energy Company Limited

- Guangdong Kajin New Energy Technology Co., Ltd.

- Hebei Kuntian New Energy Co., Ltd.

- Himadri Speciality Chemical Ltd.

- Hunan Zhongke Electric Co., Ltd.

- Huntsman International LLC

- JFE Chemical Corporation

- Jiangxi JingJiu Power Science& Technology Co.,LTD.

- Kureha Corporation

- Lohum Cleantech Private Limited

- Merck KGaA

- NanoGraf Corporation

- NEI Corporation

- NEO Battery Materials Ltd.

- Nexeon Limited

- Ningbo Shanshan Co., Ltd.

- Nippon Carbon Co., Ltd.

- Posco Future M Co., Ltd.

- Resonac Group Companies

- SGL Carbon SE

- Shanghai Putailai New Energy Technology Co., Ltd.

- Shijiazhuang Shangtai Technology Co., Ltd.

- Sila Nanotechnologies, Inc.

- SKC Co. Ltd.

- Targray Technology International Inc.

- Xiamen Tmax Battery Equipments Limited

- Xiamen Tob New Energy Technology Co., Ltd.

Actionable Strategies for Industry Leaders to Navigate Supply Chain Disruptions, Accelerate Innovation, and Foster Sustainable Growth in Anode Technologies

To navigate an increasingly complex supply chain and technological landscape, industry leaders must adopt a proactive strategy that balances innovation with risk mitigation. First, stakeholders should pursue strategic partnerships and joint ventures to share the burden of capital-intensive scale-up, particularly for advanced anode materials such as silicon-carbon composites. Collaborative frameworks can accelerate the path to commercialization and ensure alignment with end-user requirements.

Second, investing in localized manufacturing capacity near key automotive and consumer electronics hubs will help reduce lead times, mitigate tariff impacts, and optimize logistics. By co-locating production with cell assembly plants, companies can leverage in-transit testing and just-in-time delivery models to enhance operational efficiency.

Third, a diversified supplier base is essential to buffer against geopolitical disruptions and raw material shortages. Integrating recycled graphite streams and alternative mineral sources into the procurement strategy will lower exposure to single-origin dependencies while meeting sustainability mandates.

Fourth, continuous process innovation in deposition methods and post-treatment techniques can unlock incremental performance gains. Piloting advanced manufacturing technologies like laser structuring and dry electrode coating will differentiate product offerings and lower production costs over time.

Finally, aligning product development roadmaps with evolving regulatory frameworks and incentives will maximize returns. Staying abreast of policy shifts-such as incentives for low-carbon material adoption and circular economy targets-will enable companies to claim first-mover advantages and secure favorable financing terms for greenfield projects.

Transparent Overview of the Structured Research Methodology Underpinning the Comprehensive Analysis of Lithium-Ion Battery Anode Markets

This analysis is grounded in a rigorous, multi-stage research framework designed to ensure both breadth and depth of insight. The process began with the identification of relevant market parameters, segment definitions, and geopolitical factors, which informed a structured database of primary and secondary sources. Primary research entailed interviews with 30+ industry executives, materials scientists, and policy experts across North America, Europe, and Asia, capturing firsthand perspectives on emerging trends, challenges, and strategic priorities.

Secondary research encompassed a review of authoritative publications, regulatory filings, trade data, and peer-reviewed journals to validate market dynamics and technology roadmaps. Data triangulation methods were applied to reconcile disparate inputs, refine qualitative assessments, and quantify key segmentation variables. Insights from leading think tanks and international agencies were integrated to elucidate macroeconomic and policy drivers.

The research methodology incorporated proprietary analytical models to map supply chain structures, cost curves, and capacity build-out scenarios, enabling scenario-based evaluations of tariff impacts, technology adoption rates, and regional growth trajectories. Finally, continuous validation workshops with industry advisors ensured that findings remained current and actionable, providing a robust foundation for decision-makers seeking to capitalize on the evolving anode market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lithium-Ion Battery Anode market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lithium-Ion Battery Anode Market, by Material Type

- Lithium-Ion Battery Anode Market, by Production Technology

- Lithium-Ion Battery Anode Market, by Cell Format

- Lithium-Ion Battery Anode Market, by Surface Engineering

- Lithium-Ion Battery Anode Market, by Recycling Content

- Lithium-Ion Battery Anode Market, by Form Factor

- Lithium-Ion Battery Anode Market, by Application

- Lithium-Ion Battery Anode Market, by Distribution Channel

- Lithium-Ion Battery Anode Market, by Region

- Lithium-Ion Battery Anode Market, by Group

- Lithium-Ion Battery Anode Market, by Country

- United States Lithium-Ion Battery Anode Market

- China Lithium-Ion Battery Anode Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 3498 ]

Synthesizing Key Findings and Charting the Future Trajectory of Lithium-Ion Battery Anode Advancements in an Evolving Energy Landscape

The convergence of high-performance material innovations, shifting policy landscapes, and regional capacity realignments is reshaping the future of lithium-ion battery anodes. Silicon-enhanced composites and advanced synthetic graphite processes are overcoming historical trade-offs between energy density and cycle life, while environmental imperatives are driving adoption of recycled and low-carbon feedstocks. Together, these developments point to an era where anode formulation choices will be as pivotal as cathode chemistries in determining cell performance.

Simultaneously, tariff measures and incentive structures are accelerating supply chain diversification, compelling industry participants to forge new partnerships and invest in localized production. The interplay of technology maturity, economic viability, and regulatory alignment will define winners in the global market, with agility and strategic foresight serving as critical success factors.

As the energy transition accelerates, stakeholders who integrate segmentation insights, regional nuances, and competitive intelligence into their strategic planning will be best positioned to capture value. By balancing short-term operational resilience with long-term innovation roadmaps, industry leaders can navigate complexity and drive sustainable growth in the transformative anode sector.

Empower Your Strategic Decisions with Expert Guidance from Ketan Rohom to Secure the Definitive Lithium-Ion Battery Anode Market Intelligence Report

Ensure your strategic decisions are powered by precise insights and expert guidance. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the definitive market research report and unlock the data and analysis you need to stay ahead in the competitive landscape of lithium-ion battery anode technologies.

- How big is the Lithium-Ion Battery Anode Market?

- What is the Lithium-Ion Battery Anode Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?