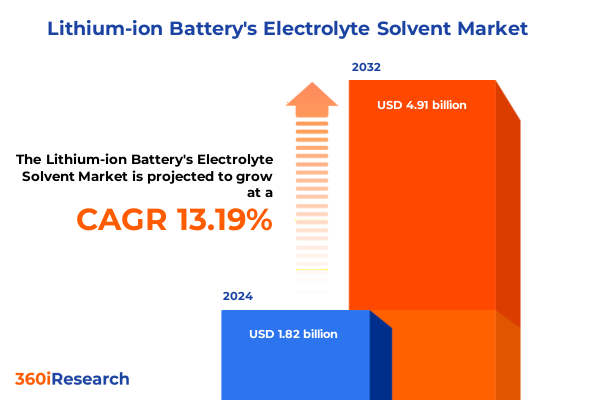

The Lithium-ion Battery's Electrolyte Solvent Market size was estimated at USD 2.06 billion in 2025 and expected to reach USD 2.33 billion in 2026, at a CAGR of 13.21% to reach USD 4.91 billion by 2032.

An In-Depth Overview Highlighting Electrolyte Solvent Innovations That Are Shaping the Future of Lithium-Ion Battery Performance, Safety, and Sustainability

As global demand for lithium-ion batteries continues to accelerate across electric vehicles, consumer electronics, and stationary energy storage systems, the role of electrolyte solvents has become more critical than ever. These chemical compounds serve as the medium for lithium-ion transport between electrodes, directly influencing energy density, cycle life, safety, and operating temperature range. With the push toward higher-voltage cathodes and next-generation anode materials, the performance parameters required of solvent systems have grown increasingly stringent. Consequently, researchers and producers are focusing investments on novel solvent chemistries and additive technologies to bridge the gap between laboratory breakthroughs and commercial deployment.

Over the past decade, the evolution of solvent formulations has mirrored broader shifts in the battery ecosystem. Early-generation solutions prioritized basic conductivity and compatibility, but as end-users demanded greater longevity and reliability under diverse operating conditions, solvents had to adapt. Innovations such as high-dielectric cyclic carbonates and low-viscosity linear carbonates began to emerge, opening pathways for enhanced ionic mobility and improved low-temperature performance. At the same time, concerns around thermal runaway risk prompted the incorporation of flame-retardant and nonflammable solvents, reflecting a paradigm shift toward safer cell architectures.

This executive summary distills the latest developments shaping electrolyte solvent research and commercialization. It outlines key technological transitions, examines the effects of recent regulatory changes, dissects market segmentation under four critical lenses, and provides region-specific perspectives. Additionally, the report profiles major industry participants, offers strategic recommendations, and details the research methodology used to ensure analytical rigor. By setting the stage with this comprehensive introduction, stakeholders can better navigate the complexity of the electrolyte solvent landscape and identify pathways to innovation and growth.

Critical Technological, Regulatory, and Market Shifts Redefining the Electrolyte Solvent Landscape for Next-Generation Lithium-Ion Batteries

The landscape of electrolyte solvents for lithium-ion batteries is in the midst of a profound transformation driven by technological breakthroughs, evolving regulatory requirements, and shifting customer expectations. In recent years, the adoption of high-voltage cathode materials such as nickel-rich layered oxides has created a demand for solvents that can maintain stability at higher potentials. This has catalyzed the emergence of advanced additives like vinylene carbonate and proprietary multi-component blends that reinforce the solid electrolyte interphase, thereby extending cycle life and mitigating capacity fade.

Regulatory dynamics have also played a pivotal role in reshaping the market. Stringent safety standards in key jurisdictions have accelerated the phase-out of traditionally used flammable carbonates, fostering the development of nonflammable alternatives and flame-retardant additive packages. At the same time, environmental directives targeting volatile organic compounds have incentivized low-emission solvent formulations, further diversifying the technological base. As a result, manufacturers are collaborating more closely with raw material suppliers to co-develop tailor-made solutions that align with both regulatory milestones and end-user performance criteria.

Meanwhile, end markets such as electric vehicles and grid-scale storage are imposing new criteria for reliability and total cost of ownership. The requirement for extended operating temperature windows has driven research into mixed-solvent systems that balance ionic conductivity with thermal resilience. Concurrently, the push toward faster charging capabilities has highlighted the need for low-viscosity chemistries that can sustain high current densities without compromising electrode integrity. Taken together, these converging forces are redefining success metrics for solvent development, turning what was once a commodity-driven segment into a hotbed of innovation and differentiation.

Examining the Comprehensive Effects of 2025 United States Tariffs on Electrolyte Solvent Imports, Supply Chains, and Competitive Dynamics

The introduction of new tariffs by the United States in 2025 has had a sweeping effect on the electrolyte solvent sector, influencing cost structures, supply chain configurations, and competitive positioning. With levies imposed on a range of imported carbonate solvents originating from key manufacturing hubs, domestic producers have seized opportunity to capture incremental market share. This shift has prompted a recalibration of procurement strategies among battery makers, who now balance price sensitivity with the imperative to maintain consistent supply and quality.

As duties increased, logistics routes were reassessed to minimize tariff burdens. Some companies explored transshipment through tariff-exempt jurisdictions, while others pursued near-shoring initiatives by establishing production facilities closer to North American customers. These adjustments have, however, introduced complexity to inventory management and forecasting, as firms navigate differing regulatory thresholds and shipment classification rules. The net result has been heightened collaboration between battery manufacturers and solvent suppliers to synchronize production schedules and mitigate the risk of stockouts.

In parallel, the tariffs have fueled renewed interest in domestic research collaborations aimed at reducing reliance on imports. Public funding and private partnerships are actively supporting pilot-scale demonstration projects for locally sourced solvent precursors and sustainable synthesis routes. Moreover, the prospect of retaliatory measures in foreign markets has encouraged multinational players to diversify end-market exposure, reinforcing the strategic importance of tariff risk assessment in long-term planning. Ultimately, the 2025 tariff landscape has underscored the interdependence of trade policy and technology development within the electrolyte solvent ecosystem.

Unveiling Key Segmentation Insights Into Solvent Types, Applications, Grades, and Sales Channels Driving Industry Customization

Insights derived from market segmentation reveal that solvent type remains a primary driver of functional differentiation. Aromatic carbonate variants, exemplified by alkyl benzoate and vinylene carbonate, have demonstrated exceptional oxidative stability, making them indispensable for high-voltage cathode systems. In contrast, cyclic carbonates such as ethylene carbonate and propylene carbonate continue to underpin a majority of cell formulations due to their high dielectric constants and robust film-forming capabilities. At the same time, linear carbonates including diethyl carbonate, dimethyl carbonate, and ethyl methyl carbonate have gained prominence for their low viscosity and favorable low-temperature performance, enabling faster charge acceptance and improved cold-start behavior.

When assessing application-based segmentation, the automotive sector commands significant attention due to electric vehicle adoption curves and stringent OEM qualification processes. Within this arena, the proliferation of battery electric vehicles, hybrid electric vehicles, and plug-in hybrids has driven diverse solvent requirements, from high-energy formulations to long-cycle platforms. Consumer electronics, encompassing laptops, smartphones, tablets, and wearables, demands ultra-stable solvent systems that can endure miniaturized form factors and rigorous safety testing. Meanwhile, large-scale energy storage, covering both grid storage and residential batteries, prioritizes cost efficiency, thermal tolerance, and long-lifespan solvent solutions designed for stationary environments.

Grade segmentation highlights a clear dichotomy between battery-grade specifications, which mandate stringent purity thresholds and controlled impurity profiles, and industrial-grade solvents that serve lower-sensitivity applications such as electrolyte recycling and niche downstream processes. Sales channel segmentation underscores evolving procurement preferences, with direct sales channels increasingly favored for bespoke formulations and collaborative R&D engagements, while distributors play a key role in regional penetration. The rise of e-commerce platforms has expanded access to standardized solvent products for smaller-scale consumers and research institutions, further broadening market reach.

This comprehensive research report categorizes the Lithium-ion Battery's Electrolyte Solvent market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solvent Type

- Application

- Grade

- Sales Channel

Exploring Regional Demand Drivers and Growth Opportunities Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

The regional landscape for electrolyte solvents is shaped by a combination of technological maturity, regulatory frameworks, and local manufacturing capabilities. In the Americas, a robust domestic chemical industry and strong policy support for electric vehicle adoption have bolstered investment in homegrown solvent production. This region benefits from close proximity to automotive OEMs and a well-established supplier network, facilitating rapid qualification cycles and logistics efficiencies.

In Europe, Middle East and Africa, stringent environmental and safety regulations drive demand for nonflammable and low-VOC solvent formulations. European battery producers often collaborate with local research institutes to co-develop next-generation solvents that align with the EU’s Green Deal targets and circular economy principles. Middle Eastern nations are beginning to explore strategic partnerships to build downstream battery value chains, while select African markets show nascent interest in stationary storage solvents linked to renewable energy projects.

Across Asia-Pacific, the market is dominated by leading solvent manufacturers and battery cell producers leveraging integrated supply chains. The region’s concentration of advanced chemical facilities and close ties between electrolyte suppliers and cell assemblers creates a fertile environment for rapid innovation and scale. China, Japan, and South Korea continue to spearhead high-purity carbonate production, while emerging economies in Southeast Asia are attracting investment to establish regional production hubs and diversify global capacity.

This comprehensive research report examines key regions that drive the evolution of the Lithium-ion Battery's Electrolyte Solvent market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants Shaping Electrolyte Solvent Innovations, Collaborations, and Competitive Strategies Worldwide

Leading industry participants are leveraging a combination of strategic partnerships, vertical integration, and targeted R&D to maintain their competitive edge. Major global chemical companies have expanded their electrolyte solvent portfolios through acquisitions of specialized additive researchers and collaborations with battery OEMs. These alliances have enabled them to bundle solvents with proprietary additive packages, offering turnkey solutions that accelerate cell development timelines.

At the same time, regional specialists in Asia-Pacific maintain an advantage through deeply ingrained supply chains and scale economies. By controlling both precursor synthesis and solvent blending operations, these firms achieve high throughput with stringent quality control. Western entrants have responded by forging joint ventures with local partners to navigate regulatory landscapes and secure feedstock access while preserving intellectual property.

A growing number of agile start-ups and material innovators are also entering the fray, focusing on bio-derived and fluorine-free solvents that aim to reduce environmental impact. While these newcomers have yet to displace established formulations at scale, their niche successes in specialized applications highlight shifting priorities toward sustainability and regulatory compliance. Collectively, the dynamic interplay of global majors, regional champions, and disruptive new entrants is driving an increasingly diversified competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lithium-ion Battery's Electrolyte Solvent market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- Asahi Kasei Corporation

- BASF SE

- Central Glass Co., Ltd.

- Daikin Industries, Ltd.

- Dongying Hi‑Tech Spring Chemical Industry Co., Ltd.

- Jiangsu Guotai Huarong New Material Co., Ltd.

- Jiangsu Guotai Super Power New Materials Co., Ltd.

- Kindun Chemical Co., Ltd.

- LG Chem Ltd.

- Lygend New Material Co., Ltd.

- Merck KGaA

- Mitsubishi Chemical Corporation

- Mitsui Chemicals, Inc.

- Panax‑Etec

- Shandong Lixing Advanced Material Co., Ltd.

- Shandong Shida Shenghua Chemical Group Co., Ltd.

- Shenzhen Capchem Enterprise, Inc.

- Solvay S.A.

- Soulbrain Co., Ltd.

- Stella Chemifa Corporation

- UBE Industries, Ltd.

- Zhengzhou Meiya Chemical Products Co., Ltd.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends in Electrolyte Solvent Development

To capitalize on the evolving electrolyte solvent market, industry leaders should prioritize investment in next-generation solvent chemistries that address both performance and safety imperatives. Developing customizable additive platforms tailored to specific cathode and anode pairings will enable faster cell qualification and differentiation in crowded end markets. Moreover, establishing modular production lines capable of switching between aromatic, cyclic, and linear carbonate blends will provide the agility needed to respond to sudden shifts in raw material availability or regulatory requirements.

Strengthening vertical collaboration along the value chain is equally critical. Co-innovation partnerships with battery cell manufacturers, materials suppliers, and academic research centers can accelerate the translation of novel solvent formulations from pilot stage to commercial production. This collaborative R&D approach also facilitates shared risk in scale-up investments and supports the development of common performance benchmarks across industry stakeholders.

Finally, mitigating tariff exposure and supply chain disruptions requires a comprehensive risk management strategy. Diversifying procurement across multiple regions, exploring toll-manufacturing agreements, and integrating circular economy principles for solvent recycling can enhance resilience. By combining technological foresight with supply chain flexibility and strategic alliances, solvent providers and battery makers can secure a sustained competitive advantage over the next decade.

Comprehensive Research Methodology Detailing Data Sources, Expert Engagement, and Analytical Frameworks Underpinning Market Insights

This market research report is grounded in a rigorous methodology combining primary and secondary research, ensuring a robust foundation for all insights. Primary data sources include in-depth interviews with leading executives at electrolyte solvent manufacturers, battery producers, and key OEMs across automotive and energy storage sectors. These stakeholder interviews provide qualitative understanding of technology roadmaps, pain points, and strategic priorities.

Secondary research encompasses a thorough review of patent filings, technical journals, industry whitepapers, and regulatory filings to capture the latest advancements in solvent chemistry and additive technologies. Additionally, corporate presentations and investor reports were analyzed to contextualize competitive positioning and growth strategies. All data points were cross-validated through triangulation, leveraging multiple independent sources to ensure accuracy and reduce bias.

Quantitative analysis was applied to compile solvent production capacities, regional trade flows, and technology adoption rates, serving as the basis for qualitative trend extrapolation. A comprehensive framework of evaluation criteria-covering performance metrics, safety attributes, cost considerations, and environmental impact-guided the assessment of various solvent classes. This methodological approach underpins the report’s strategic recommendations and segmentation insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lithium-ion Battery's Electrolyte Solvent market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lithium-ion Battery's Electrolyte Solvent Market, by Solvent Type

- Lithium-ion Battery's Electrolyte Solvent Market, by Application

- Lithium-ion Battery's Electrolyte Solvent Market, by Grade

- Lithium-ion Battery's Electrolyte Solvent Market, by Sales Channel

- Lithium-ion Battery's Electrolyte Solvent Market, by Region

- Lithium-ion Battery's Electrolyte Solvent Market, by Group

- Lithium-ion Battery's Electrolyte Solvent Market, by Country

- United States Lithium-ion Battery's Electrolyte Solvent Market

- China Lithium-ion Battery's Electrolyte Solvent Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Synopsis Emphasizing Strategic Imperatives and Future Outlook for Electrolyte Solvent Innovations in Lithium-Ion Batteries

In closing, the electrolyte solvent landscape stands at a pivotal juncture, shaped by advancements in high-voltage stability, safety regulations, and supply chain realignments. The complexity of solvent chemistry now demands an integrated approach that balances ionic conductivity, thermal resilience, and cost efficiency. Stakeholders who embrace collaborative innovation and deploy targeted R&D investments will position themselves to capture value across diverse battery applications.

The impact of the 2025 tariff regime underscores the need for agility in manufacturing and procurement strategies, while regional dynamics continue to favor localized production supported by strong regulatory and academic ecosystems. As segmentation insights reveal, a one-size-fits-all approach is no longer viable; customization across solvent types, application requirements, and distribution channels is paramount. By adhering to best practices in methodology and leveraging the strategic imperatives outlined herein, decision-makers can confidently navigate the evolving market.

Ultimately, sustained success will hinge on the ability to anticipate performance requirements, mitigate supply chain risks, and foster partnerships that accelerate innovation. As lithium-ion batteries serve as the backbone of electrification initiatives worldwide, the role of advanced electrolyte solvents will remain central to unlocking the next wave of energy storage breakthroughs.

Secure Your In-Depth Market Research Report Today by Connecting with Ketan Rohom to Gain Actionable Insights on Electrolyte Solvent Trends

For decision-makers seeking to gain a competitive edge, securing this comprehensive market research report on electrolyte solvents is the first step toward strategic leadership. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to explore customized licensing options and investment packages tailored to your organizational objectives. Engage directly with an expert who can guide you through the report’s detailed findings and clarify how the latest insights in solvent innovation can be applied to your product roadmap. Take decisive action now to transform uncertainty into opportunity and reinforce your position at the forefront of lithium-ion battery development.

- How big is the Lithium-ion Battery's Electrolyte Solvent Market?

- What is the Lithium-ion Battery's Electrolyte Solvent Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?