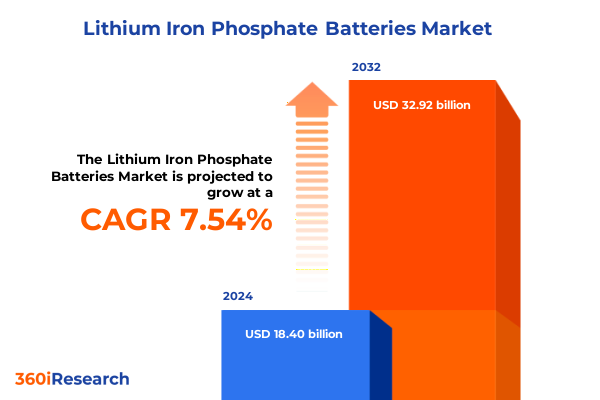

The Lithium Iron Phosphate Batteries Market size was estimated at USD 19.72 billion in 2025 and expected to reach USD 21.14 billion in 2026, at a CAGR of 7.59% to reach USD 32.92 billion by 2032.

Charting the Rise of Next-Generation Energy Storage Through Advanced Safety and Performance of Lithium Iron Phosphate Cells

Lithium iron phosphate battery technology has emerged as a cornerstone of the global energy revolution, offering unparalleled safety, longevity, and environmental benefits that are reshaping power storage applications. This introduction captures how these batteries, distinguished by their robust thermal stability and low risk of thermal runaway, have accelerated their adoption across sectors from consumer electronics to heavy-duty transportation. As concerns mount over supply chain resilience and sustainability, lithium iron phosphate chemistry has gained traction for its reliance on abundant raw materials and superior cycle life. Moreover, the recent breakthroughs in electrode formulation and manufacturing processes have driven down production complexity, positioning these batteries as a cost-competitive and ecologically responsible choice.

Building on this momentum, industry stakeholders are now evaluating lithium iron phosphate batteries as more than a niche alternative; they are being embraced as foundational components of decentralized and grid-scale energy systems. This shift is underscored by strategic partnerships between automakers, energy utilities, and technology innovators seeking to optimize performance and circularity. As we embark on this comprehensive executive summary, we will explore the dynamic shifts shaping the landscape, assess the cumulative effects of recent policy measures, and unlock critical insights across segmentation, regions, and leading organizations.

Advances in Manufacturing and Policy Incentives Have Catapulted Lithium Iron Phosphate Batteries From Niche to Strategic Core of Clean Energy Ecosystems

Over the past two years, lithium iron phosphate batteries have transitioned from specialized applications to mainstream adoption, driven by pivotal technological and regulatory shifts. Notably, advances in high-precision coating techniques and three-dimensional electrode architectures have enhanced energy density and charge rates, blurring the performance gap with alternative chemistries. Concurrently, policy frameworks emphasizing electric mobility and distributed energy have incentivized investments in durable, cobalt-free solutions. This confluence has accelerated integration into electric buses, residential storage systems, and microgrids.

The landscape transformation extends beyond incremental improvements. Strategic joint ventures between battery manufacturers and automakers have forged integrated value chains, enabling rapid scale-up of high-volume production lines. In parallel, digitalization of battery management systems leveraging cell-level analytics has optimized operational lifespan, unlocking total cost of ownership advantages. Together, these transformative shifts have elevated lithium iron phosphate batteries from emerging contenders to strategic pillars of clean energy infrastructures globally. As we continue, the implications of these shifts will be examined through the prism of international trade policies and evolving market segmentation.

Assessment of 2025 US Trade Measures Reveals Strategic Shifts in Sourcing and Supply Chain Resilience for Lithium Iron Phosphate Cells

In 2025, a new tranche of United States tariffs targeting imported battery cells introduced by the latest trade regulations has exerted a notable influence on supply chain economics. These tariffs were enacted to support domestic capacity expansion and secure critical mineral supply chains amid intensifying global competition. While intended to catalyze local manufacturing investments, the duties have also elevated landed costs of key cell components, prompting manufacturers to explore alternative sourcing strategies and accelerate localization initiatives.

The cumulative impact of these measures has manifested in renegotiated supplier contracts and shifts in production footprints. Some global suppliers have redirected high-volume cell assembly to duty-exempt free trade zones within North America, while others have pursued tariff engineering tactics through value-added module integration. End users have adapted by extending inventory planning horizons and leveraging long-term offtake agreements to mitigate cost volatility. Thus, the 2025 tariff landscape has not only reshaped transnational supply chains but also underscored the strategic imperative of diversified sourcing and resilient manufacturing ecosystems.

Insights Into Varied Demand Drivers Across Power Capacity, Application Type, Voltage Spectrum, and Industry Verticals Shaping LFP Market Dynamics

Segment performance in the lithium iron phosphate battery market varies significantly based on power capacity, with the smallest capacity tiers serving portable electronics characterized by rapid adoption in handheld devices, while the mid-range capacities increasingly underpin backup systems and medical equipment that demand reliable performance under variable loads. Higher-capacity batteries are gaining traction in electric transit applications, where extended endurance and consistent discharge profiles are paramount. Meanwhile, the distinction between portable and stationary types highlights divergent design priorities; the portable segment emphasizes form factor and ramp-rate performance for instantaneous power needs, whereas stationary installations focus on thermal management and lifecycle optimization to support grid stabilization and peak shaving services.

Voltage range further refines market dynamics. Low-voltage cells dominate in consumer products that require safety and compactness, medium-voltage modules serve versatile applications from e-bikes to residential storage, and high-voltage systems are increasingly specified for industrial and commercial deployments demanding elevated energy throughputs. End-user industries similarly exhibit distinct adoption patterns: the automotive and transportation sector is driving high-capacity, high-voltage solutions to meet range and charging requirements for electric vehicles; consumer electronics continues to favor lightweight, low-voltage options for wearables and mobile devices; the energy and power industry leverages medium-voltage stationary arrays for renewable integration; and industrial applications select robust, high-voltage battery banks for uninterrupted operations in manufacturing and heavy equipment.

This comprehensive research report categorizes the Lithium Iron Phosphate Batteries market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Power Capacity

- Type

- Voltage Range

- End User Industry

Divergent Regional Priorities Reflect Policy Incentives and Industrial Strengths That Are Redefining Global Lithium Iron Phosphate Deployment

Regional adoption of lithium iron phosphate batteries reveals differentiated growth trajectories and strategic focus areas. In the Americas, the proliferation of distributed energy resources and supportive infrastructure spending has driven accelerated deployment of stationary battery arrays for microgrids and residential applications. Policy stimuli and incentive programs for electric mobility have simultaneously propelled the integration of LFP cells in light-duty and commercial vehicles, reinforcing North America’s position as a critical consumption hub.

Within Europe, the Middle East & Africa corridor, stringent carbon reduction targets and circular economy commitments have spurred significant uptake in stationary storage paired with renewable generation, particularly in off-grid and rural electrification projects. The region’s regulatory emphasis on battery recycling and second-life applications further differentiates market dynamics, enabling operators to optimize lifecycle value chains.

Across the Asia-Pacific, robust manufacturing ecosystems and vertically integrated supply chains have cemented the region’s leadership in LFP cell production. Governments have provided capital incentives for gigafactory expansions and downstream integration, resulting in cost-advantaged module supplies both domestically and for export markets. Consumer uptake in electric two-wheelers and public transit electrification continues to underpin sustained high-volume demand, reinforcing the region’s preeminence in both innovation and scale.

This comprehensive research report examines key regions that drive the evolution of the Lithium Iron Phosphate Batteries market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Alliances and Technological Innovations Are Defining Competitive Leadership and Value Chain Differentiation in the LFP Battery Arena

Leading participants in the lithium iron phosphate battery domain are actively pursuing capacity expansions, vertical integration, and strategic alliances to secure market positioning. Prominent cell manufacturers are investing in next-generation electrode materials research to achieve marginal gains in energy density without compromising the intrinsic safety profile. Equally, significant attention is being directed toward module and pack innovation, with original equipment manufacturers collaborating on tailored system architectures that optimize thermal dispersion and lifecycle management.

Supply chain players are forging partnerships with raw material producers to underwrite mine-to-cell traceability, driven by mounting regulatory requirements and corporate sustainability commitments. Concurrently, energy service providers and technology integrators are unveiling new battery-as-a-service business models that align with evolving procurement preferences, shifting capital expenditure toward operational expenditure structures. These strategic maneuvers underscore a concerted effort by incumbents and new entrants to differentiate through value chain integration, end-to-end quality assurance, and service-driven engagement models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lithium Iron Phosphate Batteries market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A123 Systems LLC

- Bharat Power Solutions

- BYD Company Ltd.

- Canbat Technologies Inc.

- Contemporary Amperex Technology Co. Limited

- Custom Power by Solid State PLC

- DNK Power Company Limited

- Electric Vehicle Power System Technology Co., Ltd.

- Epec, LLC

- EVE Battery

- EverExceed Industrial Co., Ltd.

- Greensun Solar Energy Tech Co., Limited

- K2 Energy Solutions, Inc.

- LG Chem Ltd.

- Lynx Battery

- Mouser Electronics, Inc.

- OptimumNano Energy Co., Ltd.

- Power Sonic Corporation

- Reliance Lithium Werks B.V.

- RELiON Batteries by Brunswick Corporation's Advanced Systems Group

- RJ Energy Co., Ltd.

- Saft Groupe SAS

- Shanghai Electric Group Company Limited

- Shenzhen BAK Battery Co., Ltd.

- Shenzhen BAK Technology Co., Ltd.

- Super B Lithium Power B.V.

- Tycorun Lithium Batteries

- Victron Energy B.V.

- Vision Group

- Zhejiang Narada Power Source Co., Ltd.

Driving Sustainable Growth Through Strategic Partnerships, Digital Innovation, and Circular Economy Initiatives in the LFP Sector

To navigate the rapidly evolving lithium iron phosphate battery landscape, industry leaders should prioritize a multi-pronged approach. First, advancing strategic collaborations with material suppliers and OEMs will be critical to streamline development cycles and secure cost-effective access to high-purity precursor compounds. Concurrently, executing pilot-scale deployments of second-life battery systems can unlock novel revenue streams and mitigate end-of-life liabilities, reinforcing circular economy credentials.

Investment in digital twin technologies and advanced analytics will enable real-time monitoring of cell performance, facilitating predictive maintenance and warranty assurance frameworks that enhance customer value and lock-in long-term relationships. Furthermore, proactive engagement with policymakers and standardization bodies can influence regulatory evolution in favor of harmonized safety and recycling protocols, reducing market fragmentation. Finally, exploring flexible financing mechanisms through battery-as-a-service offerings can lower entry barriers for end users, driving broader adoption and supporting sustained demand growth.

Robust Mixed-Method Research Framework Integrating Primary Expert Interviews and Quantitative Data Analysis Validates Key Insights

A rigorous mixed-method research framework underpins this report, combining primary interviews with battery developers, equipment integrators, and end-user decision-makers, alongside secondary analysis of patent filings, regulatory filings, and technical white papers. Qualitative insights were triangulated with publicly available production data and industry consortium reports to validate emerging trends around capacity expansions, material breakthroughs, and policy impacts.

Quantitative data collection encompassed a review of manufacturing throughput metrics, supplier cost structures, and global trade flows, ensuring a comprehensive understanding of economic levers shaping the value chain. Scenario-based modelling and sensitivity analysis were employed to explore tariff contingencies and technology adoption curves, supporting robust conclusions. The methodology emphasizes transparency, reproducibility, and cross-verification, delivering an authoritative foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lithium Iron Phosphate Batteries market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lithium Iron Phosphate Batteries Market, by Power Capacity

- Lithium Iron Phosphate Batteries Market, by Type

- Lithium Iron Phosphate Batteries Market, by Voltage Range

- Lithium Iron Phosphate Batteries Market, by End User Industry

- Lithium Iron Phosphate Batteries Market, by Region

- Lithium Iron Phosphate Batteries Market, by Group

- Lithium Iron Phosphate Batteries Market, by Country

- United States Lithium Iron Phosphate Batteries Market

- China Lithium Iron Phosphate Batteries Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesis of Technological, Regulatory, and Strategic Trends Underscores Critical Success Factors for LFP Battery Market Leadership

In summary, lithium iron phosphate batteries have transitioned into a maturating but still rapidly innovating segment, anchored by unparalleled safety attributes and increasing cost competitiveness. The interplay of advanced manufacturing techniques, strategic trade policies, and segmentation-specific demand drivers is redefining how stakeholders approach energy storage solutions. Regional dynamics underscore the strategic importance of policy landscapes and industrial capabilities, while leading companies are differentiating through deep supply chain integration and service-oriented offerings.

Looking ahead, the imperative for resilient sourcing strategies, digitalization of performance management, and circular economy deployment will shape the next wave of adoption. Organizations that embrace collaborative ecosystems, invest in predictive analytics, and engage proactively in regulatory discourse will be best positioned to capture the full potential of the lithium iron phosphate revolution. This comprehensive executive summary provides a foundation for informed strategy development in a market poised for sustained transformation.

Unlock Premier Lithium Iron Phosphate Battery Market Intelligence Through Personalized Consultation with Our Senior Sales Leader

To delve deeper into the transformative potential of lithium iron phosphate batteries and equip your organization with actionable market insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engage with an expert who can guide you through the detailed research report and customize insights to your strategic goals, ensuring you stay ahead in the rapidly evolving energy storage landscape.

- How big is the Lithium Iron Phosphate Batteries Market?

- What is the Lithium Iron Phosphate Batteries Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?