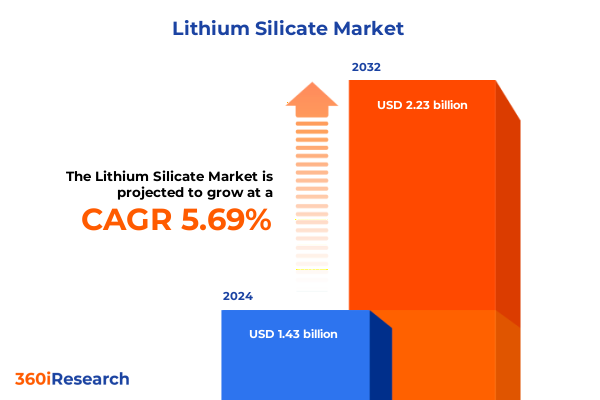

The Lithium Silicate Market size was estimated at USD 1.50 billion in 2025 and expected to reach USD 1.59 billion in 2026, at a CAGR of 5.77% to reach USD 2.23 billion by 2032.

Unveiling the Essential Role of Lithium Silicate in Advancing High-Performance Coatings, Ceramics, and Industrial Applications Today

Over the past decade, lithium silicate has emerged as a critical inorganic binder that enhances thermal stability, mechanical strength, and chemical resistance in a wide array of industrial applications. Its unique molecular structure enables the formation of durable ceramic matrices and high-performance coatings that withstand extreme environments, making it indispensable for sectors seeking both functionality and longevity. As material science continues to advance, lithium silicate occupies a pivotal role in enabling breakthroughs in energy efficiency, corrosion protection, and structural integrity across diverse product lines.

In response to growing demand for high-performance materials, companies and research institutions are intensifying efforts to optimize lithium silicate formulations. This has led to significant improvements in manufacturing processes, from the refinement of sol–gel techniques to the development of novel hybrid composites. Consequently, end users are increasingly adopting lithium silicate solutions to meet stringent regulatory standards and performance benchmarks. With sustainability and innovation at the forefront, industry stakeholders are collaborating to unlock new value chains, ensuring that lithium silicate remains a foundational element in next-generation industrial and consumer applications

Tracking Transformative Technological and Market Shifts Redefining Lithium Silicate Applications Across Industries

Recent years have witnessed transformative shifts that are reshaping the lithium silicate landscape. Technological advancements in nanostructuring and hybrid material integration are enabling unprecedented enhancements in mechanical properties and chemical resilience. In addition, digital manufacturing techniques, such as additive processes and in-line quality monitoring, are accelerating development cycles and reducing production costs. These innovations are not only refining existing formulations but also expanding the potential end uses of lithium silicate across emerging sectors.

Meanwhile, increasing emphasis on environmental sustainability is driving the adoption of greener chemistries and lifecycle assessments. Industry players are exploring low-carbon synthesis routes and leveraging circular economy principles to minimize waste and energy consumption. At the same time, regulatory bodies worldwide are implementing stricter chemical safety standards, prompting manufacturers to prioritize comprehensive testing and certification. Collectively, these shifts are redefining competitive dynamics, encouraging organizations to adopt agile R&D strategies and strategic collaborations to capture value in an increasingly complex market

Evaluating the Cumulative Impacts of 2025 United States Tariffs on Supply Chains and Market Dynamics for Lithium Silicate

In 2025, the United States implemented revised tariffs on certain advanced ceramic precursors, including key lithium silicate feedstocks sourced from major manufacturing hubs abroad. These measures have introduced supply chain complexities, prompting importers to reassess sourcing strategies and consider near-shoring raw material production. As a result, domestic producers are accelerating capacity expansions to capitalize on the evolving policy environment, while downstream processors are negotiating long-term supply agreements to stabilize input costs.

Despite these challenges, the tariffs have also catalyzed investments in alternative sourcing and in-house synthesis capabilities. Companies are forging joint ventures with material science research centers to develop proprietary lithium silicate production routes that reduce reliance on imported intermediates. Although short-term price volatility has affected project timelines and budgeting, stakeholders anticipate that these strategic efforts will yield greater supply chain resilience and foster an ecosystem of innovation within domestic borders

Unlocking Critical Insights Through Detailed Application, End User, and Form-Based Segmentation in the Lithium Silicate Market

Insights drawn from application, end user, and form-based segmentation reveal nuanced market dynamics. In automotive applications, lithium silicate’s superior thermal resistance has driven its adoption in engine coatings and heat shields, where extreme operating temperatures demand materials that maintain structural integrity. Meanwhile, construction material manufacturers have leveraged lithium silicate to enhance flooring durability, grouting adhesion, and tile bonding strength, responding to rising demand for long-lasting infrastructure solutions. Electronics producers are utilizing microelectronic coatings and sensor surface treatments to achieve precise dielectric properties, while healthcare innovators incorporate lithium silicate into dental composites and orthopedic implant coatings to improve biocompatibility and wear resistance.

By end user, the adhesive and sealant segment has seen robust growth in epoxy and silicone formulations, as well as structural adhesives engineered for high-stress environments. Within coatings, decorative finishes and functional surface treatments are gaining traction for their aesthetic appeal and protective performance, and protective coatings are being adopted in industrial equipment to mitigate corrosion. The foundry sector relies on die casting and investment casting binders formulated with lithium silicate to achieve fine detail and minimal contaminants, enhancing operational efficiency.

Form factor insights further underscore the market’s complexity. Powdered lithium silicate remains the dominant medium for high-temperature applications, whereas sol and gel variants offer improved workability and tailored viscosity profiles for precision coatings and adhesives. These segmentation perspectives highlight the importance of aligning product development with specific performance requirements and end-use conditions

This comprehensive research report categorizes the Lithium Silicate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Application

- End User

Revealing Regional Disparities and Growth Drivers Across Americas, Europe Middle East & Africa, and Asia-Pacific Markets for Lithium Silicate

Regional analysis underscores distinct growth patterns and strategic priorities. In the Americas, robust industrial activity and government incentives for domestic manufacturing have fueled demand for lithium silicate in automotive and infrastructure applications. Companies are establishing pilot lines and R&D facilities to optimize formulations that meet North American safety and performance standards, while rising interest in sustainable building materials is stimulating innovations in construction-grade binders.

Conversely, Europe, the Middle East, and Africa exhibit a diversified demand profile driven by stringent environmental regulations and advanced ceramic manufacturing clusters. In Europe, research consortiums are advancing low-emission production methods, while Middle Eastern markets are investing in large-scale infrastructure projects that rely on high-performance coatings. African initiatives are gradually integrating lithium silicate into mining and processing equipment to enhance asset longevity under harsh operating conditions.

Asia-Pacific remains the largest regional consumer, propelled by established chemical production capabilities in China, Japan, and South Korea. Rapid expansion of electric vehicle manufacturing and electronics assembly facilities has created strong downstream demand for lithium silicate binders. Furthermore, regional trade partnerships and free-trade agreements have facilitated streamlined raw material flows, prompting manufacturers to pursue integrated supply chain models and innovation partnerships across the Asia-Pacific corridor

This comprehensive research report examines key regions that drive the evolution of the Lithium Silicate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Companies Driving Innovation, Collaboration, and Competitive Strategies in the Global Lithium Silicate Sector

A competitive landscape dominated by major specialty chemical and advanced material companies is fostering dynamic innovation and strategic alliances. Leading multinationals are investing in proprietary sol–gel technologies and novel catalyst systems to enhance the performance attributes of lithium silicate products. Concurrently, vertically integrated producers are leveraging upstream raw material control to optimize cost structures and ensure supply reliability, enabling them to offer turnkey solutions that span from precursor synthesis to end-use formulation.

Collaborative research partnerships between established chemical manufacturers and specialized equipment providers are driving breakthroughs in application-specific formulations. These alliances are often complemented by targeted acquisitions of regional players, aimed at consolidating market presence and expanding technical service capabilities. As competitive pressure intensifies, companies that demonstrate agility in product customization and regulatory compliance are poised to secure favorable positions in key end-use segments

This comprehensive research report delivers an in-depth overview of the principal market players in the Lithium Silicate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bisley International

- Eastman Chemical Company

- Evonik Industries AG

- Ganfeng Lithium Group Co., Ltd.

- Jiangyin GUOLIAN Chemical Co., Ltd.

- Mapei S.p.A.

- Nippon Chemical Industrial Co., Ltd.

- Noble Alchem Pvt. Ltd.

- NYACOL Nano Technologies, Inc.

- PQ Corporation

- RongXiang Industrial Co., Ltd.

- Shandong Look Chemical Co., Ltd.

- Silmaco NV

- Sterling Chemicals

- W. R. Grace & Co.

Strategic Actionable Recommendations to Empower Industry Leaders in Navigating the Evolving Lithium Silicate Market Landscape

To capitalize on emerging opportunities, industry leaders should prioritize robust investment in advanced R&D platforms that focus on high-performance coatings, hybrid composite formulations, and environmentally sustainable synthesis methods. By establishing cross-functional teams that integrate material scientists, process engineers, and regulatory experts, organizations can accelerate product innovation cycles and ensure compliance with evolving safety standards. Moreover, diversifying supply chains through strategic partnerships or joint ventures with regional producers can mitigate trade risks and enhance access to critical feedstocks.

Simultaneously, companies should adopt data-driven market intelligence tools to monitor end-user requirements and emerging application niches. Leveraging predictive analytics can illuminate areas of unserved demand and guide targeted product development. Finally, fostering open innovation ecosystems-by participating in industry consortia and funding academic collaborations-will enable stakeholders to co-create next-generation lithium silicate solutions and drive sustainable growth across all market segments

Outlining a Robust Research Methodology Combining Primary and Secondary Techniques to Ensure Comprehensive Lithium Silicate Market Insights

This analysis integrates both primary and secondary research methodologies to ensure a comprehensive and objective understanding of the lithium silicate market. The primary phase involved in-depth interviews with key industry executives, material scientists, and supply chain managers to capture firsthand insights on emerging applications and regulatory trends. These qualitative engagements were complemented by quantitative surveys that measured adoption rates, performance criteria, and procurement challenges across various end-use industries.

Secondary research encompassed a thorough review of technical journals, patent filings, regulatory filings, and trade publications to map the competitive landscape and identify innovation hotspots. Market data was triangulated with trade statistics and customs records to validate regional demand dynamics. Throughout the research process, rigorous data validation techniques-including cross-referencing multiple sources and consulting external subject matter experts-were employed to maintain accuracy and reliability, delivering actionable intelligence for stakeholders

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lithium Silicate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lithium Silicate Market, by Form

- Lithium Silicate Market, by Application

- Lithium Silicate Market, by End User

- Lithium Silicate Market, by Region

- Lithium Silicate Market, by Group

- Lithium Silicate Market, by Country

- United States Lithium Silicate Market

- China Lithium Silicate Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Concluding Perspectives on the Future Trajectory and Strategic Importance of Lithium Silicate Across Diverse Industrial Applications

In summary, lithium silicate stands at the convergence of technological innovation and industrial necessity. Its versatile properties are driving new performance benchmarks in coatings, ceramics, adhesives, and specialty applications. The evolving regulatory landscape, characterized by tariff regimes and sustainability mandates, presents both challenges and catalysts for supply chain diversification and process innovation. At the same time, segmentation dynamics and regional disparities highlight the importance of tailored strategies that align product development with specific performance and end-use requirements.

Moving forward, success in the lithium silicate market will depend on the ability of organizations to adapt through collaborative R&D, flexible sourcing models, and data-driven decision-making. By embracing holistic approaches that integrate technical excellence with strategic foresight, industry stakeholders can harness the full potential of lithium silicate and drive long-term value creation across global markets

Secure Personalized Expert Consultation with Ketan Rohom to Acquire Comprehensive Lithium Silicate Market Research Report and Drive Informed Decisions

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this in-depth market research report can inform your strategic planning and operational decisions regarding lithium silicate. By engaging directly with industry experts, you will gain tailored insights into emerging trends, regional dynamics, and advanced application opportunities that can position your organization at the forefront of innovation. To secure personalized guidance and access to the complete analysis, reach out to schedule a consultation and discover how this report can drive measurable results for your business objectives

- How big is the Lithium Silicate Market?

- What is the Lithium Silicate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?