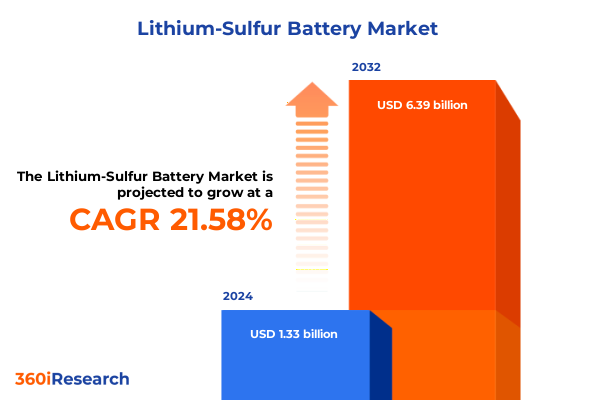

The Lithium-Sulfur Battery Market size was estimated at USD 1.60 billion in 2025 and expected to reach USD 1.93 billion in 2026, at a CAGR of 21.80% to reach USD 6.39 billion by 2032.

Pioneering Tomorrow's Energy Storage with Lithium–Sulfur Batteries: A Deep Dive into Safety, Sustainability, and Performance Innovations

Lithium–sulfur battery technology is rapidly emerging as a cornerstone of the next generation of energy storage solutions, distinguished by remarkable energy density potentials and the promise of reduced reliance on critical raw materials. In laboratory settings, cell energy densities exceeding 380 Wh/kg have been validated, showcasing the chemistry’s capacity to double the energy density of traditional lithium-ion systems in practical formats, and pointing toward a theoretical ceiling well above 600 Wh/kg that could revolutionize portable and vehicular power sources. Beyond energy density, lithium–sulfur systems leverage abundant sulfur in place of scarce, ethically contentious metals, presenting a compelling value proposition for cost-effective large-scale deployment.

Revolutionary Technological and Commercial Transformations Reshaping the Lithium–Sulfur Battery Industry and Accelerating Global Adoption

Recent breakthroughs in materials science and cell engineering are reshaping the lithium–sulfur landscape, shifting the technology from academic curiosity to near-commercial reality. All-solid-state configurations have achieved unprecedented cycle lifetimes, with reports of over 25,000 deep-charge cycles at minute-level charge rates, effectively overcoming the solubility limitations of intermediate polysulfides and paving the way for durable, fast-charging cells. Parallel advances include the development of semi-solid-state cells nearing 500 Wh/kg on first discharge, marking a near two-fold improvement over earlier generations and positioning semi-solid approaches as a bridge between conventional liquid electrolytes and fully solid architectures. In tandem, innovative cathode designs featuring healable, iodine-doped sulfur crystals have demonstrated self-repairing interfaces and enhanced conductivity by orders of magnitude, addressing one of the most persistent challenges for commercial solid-state lithium–sulfur production. These technological shifts are poised to accelerate pilot lines into dedicated gigafactories and drive broader industry adoption across diverse sectors.

Assessing the Aggregate Effects of Elevated United States Tariffs on Battery Imports and Material Costs through 2025 on Lithium–Sulfur Development

The imposition of escalating United States tariffs on battery imports and critical material components through 2025 has introduced a new cost dynamic that industry participants must factor into strategic planning. Battery cells imported from China now face combined duties of nearly 65%, rising to over 80% by 2026 when accounting for reciprocal measures and antidumping penalties, effectively adding billions in costs to automotive and energy storage system supply chains. Furthermore, Section 301 tariffs instituted in 2024 elevated duties on EV battery cell imports from 7.5% to 25%, while non-EV cells and battery parts will see similar hikes through 2026, amplifying the cost pressure on all battery technologies, including lithium–sulfur, which shares key component supply chains with lithium-ion systems. Major suppliers have already begun hedging against this headwind, redirecting production lines to domestic energy storage battery formats and stockpiling critical electrolytes and precursor chemicals to mitigate the impact of rising import levies. These cumulative tariff measures are reshaping the competitive landscape, favoring vertically integrated players with localized manufacturing and secured raw material access.

Unveiling Strategic Insights from Core Market Segmentation Dimensions Spanning Chemistry, Components, Capacity, Physical States, and End Uses

The lithium–sulfur battery market can be examined through multiple intersecting dimensions, each illuminating unique strategic pathways. By energy density classification, high-density chemistries are driving premium applications such as aerospace and defense, while lower-density variants facilitate consumer electronics and stationary storage. Component analysis reveals that innovative anode solutions are emerging alongside conventional lithium metal, whereas cathode research focuses on sulfur–graphene composites and advanced binders; electrolytes span from conventional ether-based formulations to ionic liquids engineered for enhanced stability. Capacity tiers delineate sub-500 mAh cells for niche markets, mid-range modules between 501 and 1,000 mAh for portable consumer devices, and cells above 1,000 mAh targeting electric mobility. Physical state considerations further segregate liquid electrolyte systems vying for immediacy and scalability, semi-solid state platforms enabling incremental performance gains, and solid-state architectures promising ultimate cycle life and safety. Finally, application sectors encompass automotive propulsion, grid-level energy storage, medical instrumentation, industrial power backup, consumer electronics, and specialized defense systems. An integrated understanding of these segmentation axes is critical for stakeholders seeking to align product roadmaps with evolving market demand.

This comprehensive research report categorizes the Lithium-Sulfur Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Components

- Capacity

- State

- Application

Deciphering Regional Dynamics and Growth Drivers across the Americas, Europe Middle East and Africa, and Asia-Pacific Lithium–Sulfur Markets

Regional markets for lithium–sulfur batteries are evolving under distinct economic, regulatory, and innovation frameworks. In the Americas, substantial investments in domestic gigafactories and government grants are catalyzing nascent production hubs, exemplified by a leading startup’s over $1 billion project in Nevada and multi-million-dollar grants supporting pilot lines, underscoring North America’s strategic pivot toward supply-chain independence. Europe, the Middle East, and Africa are benefiting from robust policy initiatives, including the EU’s new Batteries Regulation enforcing recycled content targets, carbon footprint ceilings, and digital battery passports-measures that are accelerating local manufacturing, waste-to-value circularity, and cross-border collaboration among OEMs and material suppliers. Meanwhile, the Asia-Pacific region remains the epicenter of advanced materials research and production scale-up, driven by strategic partnerships between industrial giants and national laboratories, with breakthroughs in solid-state lithium sulphide synthesis and semi-solid formulations positioning the region at the forefront of commercialization efforts. These divergent regional dynamics converge on a shared imperative: to secure resilient, sustainable battery supply chains while capitalizing on local competitive strengths.

This comprehensive research report examines key regions that drive the evolution of the Lithium-Sulfur Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Corporate Profiles and Competitive Differentiators Defining the Leaders in the Lithium–Sulfur Battery Innovation Ecosystem

The competitive landscape for lithium–sulfur batteries is defined by a blend of pioneering startups and established industrial players. One breakthrough company leveraged its 3D graphene expertise to secure a Department of Energy grant, accelerating commercialization of high-capacity, long-cycle cells and forging partnerships with leading universities to refine sulfur–carbon composite cathodes. Another emerging leader announced plans to build a purpose-built gigafactory near Reno, Nevada, aiming for annual output scaling to multiple gigawatt-hours and integrating upstream cathode and anode material production to ensure full domestic traceability. A pioneering firm in Australia showcased semi-solid-state cells delivering near-500 Wh/kg performance, underscoring its position at the technological vanguard. In parallel, a public company validated cell energy densities of 380 Wh/kg through third-party testing, signaling rapid progress toward cost-effective, high-energy deployments. On the materials side, traditional chemical leaders are investing in lithium sulphide and solid electrolyte facilities to support all-solid-state programs, anticipating volume production by the late 2020s. Collectively, these entities represent a dynamic ecosystem where strategic capital investments, proprietary materials, and collaborative R&D remain the key differentiators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lithium-Sulfur Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Gelion PLC

- Giner Inc.

- GS Yuasa International Ltd.

- Hybrid Kinetic Group

- Ilika PLC

- Iolitec Ionic Liquids Technologies GmbH

- Johnson Matthey Plc

- LG Energy Solution Ltd.

- Li-S Energy Limited

- Lyten, Inc.

- NexTech Batteries Inc.

- PolyPlus Battery Company

- Rechargion Energy Private Limited

- Sion Power Corporation

- Solid Power, Inc.

- VTC Power Co.,Ltd

- WAE Technologies Limited

- Zeta Energy LLC

Actionable Strategic Recommendations for Stakeholders to Navigate Competitive, Regulatory, and Technological Shifts in Lithium–Sulfur Battery Markets

To capitalize on the lithium–sulfur value proposition, industry leaders should forge partnerships that integrate advanced materials supply with scalable manufacturing platforms, ensuring vertical integration from sulfur sourcing through cell assembly. Prioritizing localized production hubs will mitigate tariff and trade-risk exposure while enabling swift adoption of evolving regulatory standards such as recycled content mandates and carbon footprint thresholds. Continuous investment in next-generation solid-state and semi-solid-state research, particularly in stabilizing high-energy cathodes and healable interfaces, will be essential to differentiate offerings on cycle life and safety. Companies must also engage proactively with policymakers to shape favorable incentive structures, advocating for targeted grants and streamlined approval pathways. Meanwhile, securing strategic relationships with vehicle OEMs, grid operators, and defense integrators will accelerate commercialization, providing critical application feedback and anchoring long-term offtake agreements. Ultimately, a balanced portfolio approach-spanning high-power, rapid-charge cells for mobility, medium-capacity packs for stationary storage, and specialty formats for aerospace and medical sectors-will position innovators to capture the full spectrum of emerging opportunities.

Robust Research Methodology Framework for Validating Market Insights Through Triangulated Primary and Secondary Data Analysis Techniques

This report’s insights are derived from a rigorous research framework combining primary interviews with industry executives, materials scientists, and end-user procurement managers, alongside comprehensive review of technical literature and government tariff schedules. Key data points were cross-validated through secondary analysis of academic publications, patent filings, and regulatory filings, ensuring consistency across diverse information sources. Trade and tariff impacts were quantified through examination of official U.S. Customs rulings and Section 301 determinations, supplemented by industry press disclosures. Technology performance benchmarks were corroborated via peer-reviewed journal articles and validated by third-party testing results. The segmentation structure reflects iterative feedback from market participants, aligning type, component, capacity, state, and application dimensions with real-world product offerings. Throughout, findings were triangulated to minimize bias, and digital analytics tools were employed to identify emerging patent trends, investor funding flows, and R&D collaborations. This methodology yields a holistic perspective, enabling decision-makers to navigate complexity with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lithium-Sulfur Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lithium-Sulfur Battery Market, by Type

- Lithium-Sulfur Battery Market, by Components

- Lithium-Sulfur Battery Market, by Capacity

- Lithium-Sulfur Battery Market, by State

- Lithium-Sulfur Battery Market, by Application

- Lithium-Sulfur Battery Market, by Region

- Lithium-Sulfur Battery Market, by Group

- Lithium-Sulfur Battery Market, by Country

- United States Lithium-Sulfur Battery Market

- China Lithium-Sulfur Battery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Perspectives on the Transformative Potential and Strategic Imperatives for Lithium–Sulfur Battery Technologies in Energy Transition

Lithium–sulfur battery technology stands at an inflection point, where converging breakthroughs in materials, cell architecture, and manufacturing scale poised to redefine energy storage paradigms. The combination of high theoretical energy density, lower reliance on critical raw materials, and versatility across physical states underscores a transformative pathway toward lighter, safer, and more cost-effective battery solutions. As tariff regimes and regulatory frameworks evolve, stakeholders with integrated supply chains and proactive R&D pipelines will gain competitive advantage. Regional developments-from North American gigafactories and European circularity mandates to Asia-Pacific research-driven production expansion-highlight the global momentum behind lithium–sulfur commercialization. By aligning strategic investments in solid-state innovation, vertical integration, and policy advocacy, industry leaders can accelerate the transition from pilot lines to mass production, unlocking new frontiers in electric mobility, grid resilience, and specialized energy applications. The lithium–sulfur ecosystem is primed to deliver on its promise, contingent on the collective resolve of innovators, investors, and regulators to drive scale and sustainability in equal measure.

Connect with Ketan Rohom to Unlock Comprehensive Lithium–Sulfur Battery Market Intelligence and Drive Strategic Decision Making

For an in-depth exploration of lithium–sulfur battery dynamics and to obtain comprehensive market intelligence that empowers strategic planning and competitive advantage, please reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan can guide you through tailored research offerings, address specific inquiries, and facilitate access to the full market research report. Engaging with this resource will equip your organization with the critical insights required to navigate technological innovations, regulatory changes, and evolving supply-chain dynamics in the lithium–sulfur landscape. Contact Ketan to initiate your subscription and transform data into actionable strategies today

- How big is the Lithium-Sulfur Battery Market?

- What is the Lithium-Sulfur Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?