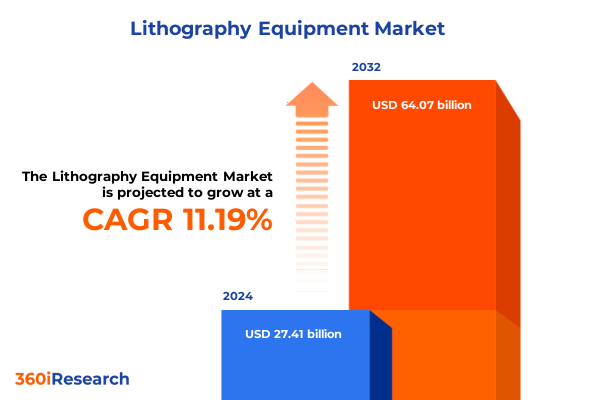

The Lithography Equipment Market size was estimated at USD 30.43 billion in 2025 and expected to reach USD 33.78 billion in 2026, at a CAGR of 11.22% to reach USD 64.07 billion by 2032.

Charting the Critical Role of Lithography Equipment in Semiconductor Fabrication to Illuminate Industry Fundamentals and Emerging Drivers

The semiconductor industry relies fundamentally on lithography equipment to define the microscopic patterns that form the critical circuits within chips. This introduction lays the groundwork by examining how advances in optical and extreme ultraviolet technologies have revolutionized precision, throughput, and scaling capabilities. Emerging lithography techniques are not merely incremental improvements but represent leaps in capability that support the rapid progress of Moore’s Law and the growing demands of artificial intelligence, 5G connectivity, and cloud computing.

Moreover, this introduction highlights the increasing complexity of lithographic processes, wherein multiple patterning and sub-nanometer resolution have become standard requirements for leading-edge node definitions. This complexity has forced equipment suppliers and chipmakers to collaborate more closely, fostering co-development initiatives that accelerate time-to-market and minimize defectivity. Consequently, appreciation of the fundamental mechanisms behind optical projection, mask alignment, and resist chemistry is essential for stakeholders to navigate the evolving landscape.

Furthermore, contextual factors such as supply chain integration, intellectual property portfolios, and capital expenditure cycles influence technology adoption and competitive positioning. This section frames the broader narrative by setting out the technology pillars of ArF, EUV, and beyond, while elucidating the strategic importance of lithography as the cornerstone of high-performance semiconductor manufacturing.

Unveiling Disruptive Forces Redefining Lithography Landscape Through Technological Breakthroughs and Strategic Industry Collaborations

The lithography landscape has undergone seismic shifts driven by breakthroughs in extreme ultraviolet light sources, mirror coatings, and resist materials, effectively redefining what is technologically feasible. As Moore’s Law encounters physical limits in deep ultraviolet wavelengths, EUV lithography has emerged from research to production, enabling sub-7-nanometer and sub-5-nanometer patterning at volumes that were previously unattainable. This transformative journey has required not only optical innovations but also significant enhancements in vacuum environments, pellicle durability, and source power stability.

Additionally, collaboration between equipment vendors and semiconductor foundries has accelerated integration of next-generation tools into advanced fabs. Strategic partnerships have enabled co-optimization of lithography modules, resist chemistries, and computational lithography software to ensure pattern fidelity and defect control. Consequently, boundary-pushing research investments and joint development programs have become essential enablers of technological leaps, sustaining continuous scaling of critical dimensions.

Furthermore, market-facing applications such as high-bandwidth memory, artificial intelligence accelerators, and silicon photonics have exerted directional influence on lithography R&D roadmaps. These end-user demands have fueled exploration of complementary techniques including directed self-assembly, multi-beam writing, and electron-beam mask repair. As a result, the landscape is characterized by a dynamic interplay of scientific innovation and commercial pragmatism, wherein transformative shifts are being propelled by intertwined technical, economic, and collaborative forces.

Assessing the Far-Reaching Consequences of United States Tariffs on Lithography Equipment and Their Ripple Effects Across Supply Chains

United States tariffs enacted in 2025 on critical semiconductor equipment have introduced new cost, supply chain, and strategic dynamics for lithography tools. By imposing duties on imported lithography modules and subsystems, these measures have elevated landed costs for chipmakers and equipment vendors, thereby reshaping procurement strategies. As a direct consequence, several foundries and integrated device manufacturers have adjusted capital expenditure schedules to mitigate tariff exposure while evaluating domestic sourcing alternatives.

In addition, suppliers have responded by qualifying local manufacturing partnerships and seeking exemptions through tariff classification reviews, thereby minimizing fiscal impact. These adaptations underscore how regulatory shifts can stimulate near-shoring initiatives and strengthen domestic equipment ecosystems. Subsequently, tariffs have incentivized suppliers to diversify assembly and testing operations across key geographic hubs, reducing dependency on singular production sites.

Moreover, the broader ripple effects extend into research and development collaborations. Academic institutions and national laboratories have accelerated joint projects aimed at bolstering domestic advanced lithography capabilities, from next-generation light sources to high-precision stage mechanics. Consequently, the long-term implications of the 2025 tariffs could be both constraining in the near term and catalyzing in nurturing localized innovation and supply chain resilience.

Extracting Deep Insights from Core Market Segmentation by Wavelength Technology Wafer Size Industry and Application Dynamics to Drive Strategic Decisions

A nuanced understanding of lithography market dynamics emerges when segmentation is examined through multiple dimensions. Based on wavelength, the landscape spans deep ultraviolet ArF dry and immersion systems, cutting-edge extreme ultraviolet platforms, legacy I-Line steppers, and specialized KrF equipment. Each wavelength band addresses specific resolution requirements, throughput considerations, and resist sensitivities, thereby shaping diverse process windows in semiconductor manufacturing.

Furthermore, technological segmentation differentiates between scanner and stepper architectures wherein scanners enable high-resolution imaging through step-and-scan motion, while steppers offer fixed-field exposures suited to lower-volume or specialized applications. These technology tiers support varied operational profiles, from high-volume logic fabs to niche compound semiconductor facilities.

In addition, wafer size differentiation across 100 millimeter to 300 millimeter substrates influences tool design, throughput targets, and facility scale. Larger wafers facilitate economies of scale in high-volume manufacturing but require more robust stage controls and optics to manage increased field dimensions.

Beyond substrate considerations, end-user industry segmentation highlights distinct lithography requirements for foundry services, logic device fabrication, and memory chip production, each driven by differing defect tolerance, pattern complexity, and volume imperatives. Finally, applications for compound semiconductor manufacturing, integrated circuit production, and microelectromechanical systems fabrication underscore how lithography capabilities must adapt to heterogeneous material stacks and device architectures.

Collectively, these segmentation lenses provide critical insight into technology fit, investment prioritization, and competitive positioning within the lithography equipment arena.

This comprehensive research report categorizes the Lithography Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Wavelength

- Technology

- Wafer Size

- End-User Industry

- Application

Discovering Regional Trends Illuminating Demand Patterns Across Americas Europe Middle East Africa and Asia Pacific Markets for Lithography Equipment

Regional analysis reveals distinct demand drivers and deployment patterns for lithography equipment across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, advanced foundries and integrated device manufacturers have accelerated capacity expansions driven by government incentives aimed at bolstering domestic semiconductor sovereignty. This regulatory support has catalyzed investment in both greenfield fabs and retrofit programs, thereby creating a robust procurement pipeline for cutting-edge lithography tools.

Conversely, Europe Middle East & Africa presents a mosaic of opportunities, where leading research consortia engage in collaborative R&D to advance EUV adoption while established industrial players retrofit existing production lines with ArF immersion platforms. Meanwhile, nascent semiconductor ecosystems in emerging Middle Eastern nations are fostering partnerships to develop workforce capabilities and infrastructure, which will shape future lithography demand curves.

Across Asia-Pacific, the concentration of high-volume foundries in Taiwan, South Korea, and Japan drives sustained uptake of next-generation scanners and EUV systems. These hubs maintain strong supplier ecosystems complemented by vertically integrated materials and equipment providers. Simultaneously, Southeast Asian countries are emerging as assembly and test destinations, requiring mid-tier lithography solutions. Consequently, regional nuances in industrial policy, supply chain maturity, and application focus inform tailored equipment roadmaps for global vendors and end-users alike.

This comprehensive research report examines key regions that drive the evolution of the Lithography Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Players Shaping Lithography Equipment Advancements Through Innovation Competitive Strategies and Collaborative Ecosystem Partnerships

Leading equipment vendors continue to shape the lithography landscape through relentless innovation, strategic alliances, and vertical integration initiatives. Global leaders have advanced EUV light source power and throughput, enabling adoption at sub-5-nanometer nodes, while also enhancing mask defectivity control and pellicle robustness. Consequently, these players maintain technological leadership by investing in co-development programs with chipmakers and component suppliers.

Emerging competitors and niche specialists contribute complementary strengths in areas such as multi-beam writing, high-numerical aperture optics, and directed self-assembly techniques. Their focused R&D pipelines and agile development frameworks challenge incumbents to refine product roadmaps and accelerate time-to-market. As a result, healthy competition fosters continual improvements in tool reliability, performance, and cost-efficiency.

Additionally, equipment vendors leverage software and analytics platforms to deliver integrated lithography control solutions. These platforms harmonize optical, mechanical, and process variables, thereby reducing downtime and enhancing pattern fidelity. Such digital transformation initiatives are critical as fabs transition to immersive Industry 4.0 environments.

Through mergers, acquisitions, and strategic investments, leading firms expand portfolios to include metrology, inspection, and packaging equipment, creating comprehensive offerings that address end-to-end process requirements. Ultimately, the interplay between technology differentiation, ecosystem partnerships, and strategic expansion drives the competitive dynamics of the lithography equipment sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lithography Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ASML Holding N.V.

- Canon Inc.

- EV Group GmbH

- JEOL Ltd.

- NAURA Technology Group Co., Ltd.

- Nikon Corporation

- NuFlare Technology, Inc.

- Shanghai Micro Electronics Equipment Co., Ltd.

- SUSS MicroTec SE

- Veeco Instruments Inc.

Formulating Actionable Strategic Recommendations to Empower Industry Leaders Navigating Technological Evolution and Geopolitical Complexity in Lithography Equipment

Industry leaders should prioritize integrated technology roadmaps that align with long-term node scaling requirements and emerging application trends. By committing to joint development agreements with foundries and research institutes, executives can ensure early access to disruptive capabilities such as high-numerical aperture EUV and adaptive overlay correction. Furthermore, strategic co-investments in pilot line demonstrations will de-risk large-scale deployments and validate performance in production conditions.

Simultaneously, consideration of geopolitical risk factors is essential when evaluating global supply chains and manufacturing footprints. Business continuity strategies should encompass multi-regional sourcing for critical subsystems, alongside localized service and maintenance capabilities. In addition, proactive engagement with policy makers to shape favorable regulatory frameworks will safeguard access to essential equipment markets.

Moreover, companies should harness digitalization efforts by integrating advanced analytics, machine learning, and real-time monitoring into their tool portfolios. Such investments not only improve uptime and yield but also generate valuable data insights for continuous process optimization.

Finally, cultivating talent with expertise in optical engineering, computational lithography, and vacuum systems is key to sustaining innovation momentum. Leadership development programs and cross-functional collaboration platforms will foster the skills and organizational agility required to navigate technological evolution and competitive pressures.

Detailing Rigorous Research Methodologies Employed to Ensure Credible Data Collection Analysis and Interpretation Within the Lithography Equipment Study

This study employs a rigorous multi-phase research methodology to ensure comprehensive and reliable findings. Initially, extensive secondary research was conducted using peer-reviewed journals, patent filings, and industry whitepapers to map the evolution of lithography technologies and identify key innovation milestones. This foundational research provided context for subsequent primary investigations.

Subsequently, in-depth interviews were carried out with senior R&D engineers, fab managers, and technology strategists across leading semiconductor companies and equipment vendors. These expert insights added qualitative depth to quantitative observations, illuminating real-world implementation challenges and strategic prioritization criteria. In parallel, site visits to advanced fabrication facilities enabled direct observation of tool performance metrics and operational practices.

Moreover, a structured framework was applied to categorize market segmentation across wavelength bands, equipment architectures, wafer sizes, end-user industries, and application domains. This segmentation matrix facilitated cross-comparison of technology adoption trends and investment drivers without relying on proprietary data. Analytical rigor was further ensured by triangulating findings across multiple sources and validating assumptions through stakeholder reviews.

Finally, continuous cross-functional validation workshops were conducted with industry experts and academic researchers to refine conclusions and recommendations. This iterative approach strengthens the credibility of the study, ensuring that the insights presented are grounded in current industry realities and technological foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lithography Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lithography Equipment Market, by Wavelength

- Lithography Equipment Market, by Technology

- Lithography Equipment Market, by Wafer Size

- Lithography Equipment Market, by End-User Industry

- Lithography Equipment Market, by Application

- Lithography Equipment Market, by Region

- Lithography Equipment Market, by Group

- Lithography Equipment Market, by Country

- United States Lithography Equipment Market

- China Lithography Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Integrating Comprehensive Conclusions That Synthesize Market Insights Technological Trends and Strategic Considerations for Lithography Equipment Stakeholders

In synthesizing the comprehensive review of lithography equipment dynamics, clear themes emerge around the critical nexus of technology innovation, supply chain resilience, and strategic collaboration. First, advancements in EUV and complementary lithography techniques continue to push the boundaries of resolution, enabling the production of highly complex devices required for next-generation applications. These breakthroughs underscore the necessity for ongoing R&D investment and ecosystem integration.

Second, regulatory and geopolitical developments, particularly pertaining to tariffs and trade policies, have injected new variables into capital planning and procurement strategies. As a result, stakeholders must maintain agile sourcing models and local manufacturing partnerships to mitigate risk and ensure continuity of supply.

In addition, the segmented analysis reveals how distinct wavelength technologies, equipment architectures, wafer formats, industry verticals, and application requirements interact to create a multifaceted market landscape. Understanding these intersections allows decision-makers to tailor technology adoption and investment decisions to specific operational contexts.

Finally, competitive dynamics are being reshaped by digital transformation initiatives and ecosystem partnerships that deliver integrated lithography control solutions. By converging optics, mechanics, software, and analytics, leading players are setting new benchmarks for throughput and yield. Overall, the executive summary highlights the strategic imperatives that will define success in the rapidly evolving lithography equipment market.

Engaging With Associate Director Ketan Rohom to Unlock the Full Potential of the Lithography Equipment Market Research Report and Drive Informed Decisions

Ready to elevate your strategic insights and gain comprehensive access to the full lithography equipment market research report, connect with Ketan Rohom who will guide you through the report features and subscription options to empower your decision making and maximize your competitive advantage

- How big is the Lithography Equipment Market?

- What is the Lithography Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?