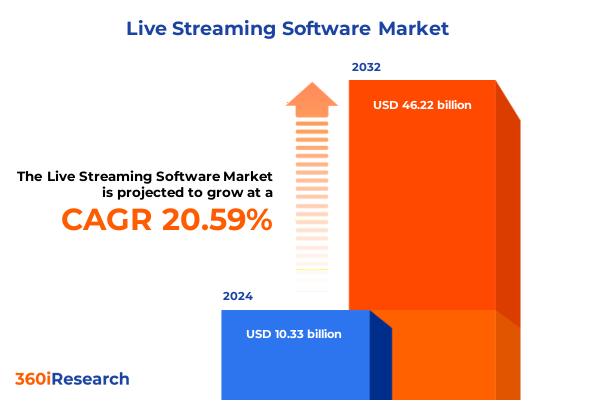

The Live Streaming Software Market size was estimated at USD 2.16 billion in 2025 and expected to reach USD 2.60 billion in 2026, at a CAGR of 20.60% to reach USD 8.04 billion by 2032.

Setting the Stage for Unprecedented Technological Evolution in Live Streaming Software Ecosystems and Emerging Audience Engagement Frameworks Worldwide

Live streaming software has evolved from a niche technology into a critical component of digital engagement strategies across diverse sectors. As enterprises and content creators seek to bridge geographical barriers and cultivate real-time interactions, the underlying software architectures have expanded in complexity and capability. Innovations in encoding and transcoding, coupled with advanced content delivery network management, are enabling seamless high-definition broadcasts that can reach global audiences with minimal latency. This transformation is further propelled by increasing demand for analytics tools that deliver actionable intelligence on viewer behavior and engagement metrics, making the software itself a strategic asset rather than a mere distribution channel.

Against this backdrop, service delivery models have adapted to provide both managed operations and professional consulting support. Organizations now rely on tailored integration plans, comprehensive training modules, and ongoing maintenance to ensure uninterrupted performance. The shift toward cloud-native deployments has introduced scalability and agility, while on-premises options continue to address stringent security and compliance requirements. Through this lens, live streaming software no longer exists within a vacuum; it forms part of an interconnected ecosystem where software, services, and strategic consulting converge to drive unparalleled audience experiences and measurable business outcomes.

Mapping the Transformative Technological and Consumer Behavior Shifts Redefining Live Streaming Software Adoption and Monetization Strategies Across Industries

The live streaming landscape is undergoing fundamental shifts fueled by both technological breakthroughs and evolving consumer expectations. Edge computing is enabling localized processing of video data, reducing latency and enhancing user experience even in bandwidth-constrained environments. At the same time, the integration of artificial intelligence and machine learning into analytics modules is revolutionizing content personalization, with algorithms dynamically adjusting bitrates and suggesting content based on viewer preferences. These developments are complemented by growing adoption of hybrid streaming models that combine live sessions with on-demand libraries, offering viewers the flexibility to engage at their convenience.

Moreover, the convergence of social media platforms with streaming software has transformed passive audiences into active participants. Interactive features such as real-time polls, chat overlays, and gamified elements are no longer optional add-ons but essential engagement tools. As a result, content providers are recalibrating their monetization strategies, shifting focus from traditional pay-per-view systems to subscription tiers, virtual gifting, and embedded commerce. In parallel, enterprises in education, corporate communications, and virtual events are leveraging customized streaming solutions to foster collaboration and knowledge sharing, cementing live streaming software as an indispensable enabler of both consumer entertainment and enterprise productivity.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Live Streaming Software Supply Chains Pricing Models and Competitive Dynamics Globally

The imposition of new United States tariffs in 2025 has introduced a layer of complexity to the global live streaming software supply chain. Components such as hardware-based encoders and specialized server appliances now face elevated import duties, prompting vendors to reexamine sourcing strategies and cost structures. Consequently, many solution providers have accelerated their transition toward software-as-a-service offerings, reducing reliance on physical hardware deployments. This pivot has not only mitigated the immediate financial impact of tariff-induced price increases but also reinforced the industry’s broader shift toward agile, cloud-based architectures that can adapt to fluctuating regulatory landscapes.

Simultaneously, the ripple effects of these tariffs are influencing competitive dynamics among live streaming solution providers. Companies with established regional development centers in tariff-exempt jurisdictions are leveraging localized production to maintain pricing parity. Meanwhile, smaller entrants are exploring partnership models that enable white-label software distribution, circumventing tariff barriers while expanding market reach. On the client side, organizations are balancing the tradeoff between total cost of ownership and performance requirements, often favoring flexible licensing models that can be scaled in line with demand. In aggregate, the cumulative impact of these 2025 tariffs has catalyzed a strategic realignment of both supply chains and go-to-market approaches across the live streaming software industry.

Uncovering Key Market Segmentation Insights by Component Streaming Type Deployment Model and End Use to Drive Targeted Live Streaming Solutions

A nuanced understanding of market segmentation reveals that the live streaming software domain is segmented by component into services and software. Within services, managed operations, professional consulting, and support maintenance each address distinct organizational requirements, while the consulting arm further subdivides into integration, customization, and end-user training offerings. On the software side, platforms for content distribution network management, real-time analytics, encoder transcoding, and comprehensive video management serve as core pillars of modern solutions. This component-level breakdown underscores the importance of end-to-end platforms that seamlessly integrate software capabilities with complementary service offerings.

In parallel, streaming types are categorized across live-only streams, video-on-demand libraries, and hybrid models that merge real-time broadcasts with on-demand content. These options cater to varied audience preferences, from high-engagement live events to flexible on-demand consumption. Deployment models further complicate the landscape, with cloud-based solutions offering elastic scalability, hybrid architectures balancing latency and security, and on-premises installations providing full data control for compliance-sensitive use cases. Finally, the market’s end-use segmentation spans education and training, enterprise communications, gaming and esports, media and entertainment, and social media engagement channels. Each vertical presents unique streaming requirements-whether it’s corporate training modules, competitive esports broadcasts, or interactive social commerce streams-demanding tailored feature sets and support structures.

This comprehensive research report categorizes the Live Streaming Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Model

- Platform

- Streaming Technology

- Pricing Model

- End Use

Exploring Regional Dynamics and Growth Drivers in the Americas Europe Middle East Africa and Asia-Pacific Live Streaming Software Markets

The live streaming software market exhibits distinct regional characteristics driven by regulatory environments, infrastructure maturity, and user behavior patterns. In the Americas, robust broadband penetration and significant investment in media and entertainment have accelerated adoption of high-definition streaming platforms. North American enterprises are prioritizing advanced analytics and low-latency solutions, while Latin American content creators are leveraging cost-effective hybrid deployments to reach growing digital audiences. Across this region, partnerships between global CDN providers and local service integrators have been instrumental in optimizing performance and reducing transmission costs.

In Europe, the Middle East, and Africa, regulatory frameworks such as data sovereignty rules and content licensing regimes shape deployment preferences. European organizations often opt for on-premises and hybrid solutions to comply with stringent privacy regulations, whereas rapidly expanding digital ecosystems in the Gulf Cooperation Council embrace cloud-native streaming architectures to support live sports and large-scale virtual events. Meanwhile, African markets are witnessing grassroots-driven growth, with mobile-first streaming experiences tailored to varying connectivity conditions. In the Asia-Pacific region, accelerated 5G rollouts and a burgeoning influencer economy are fueling demand for interactive live streaming software. From Japan’s advanced technical standards to Southeast Asia’s dynamic social commerce integrations, APAC continues to be a hotbed of innovation and competitive differentiation.

This comprehensive research report examines key regions that drive the evolution of the Live Streaming Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading and Innovative Companies Shaping the Future of Live Streaming Software Through Strategic Partnerships Acquisitions and Product Innovation

Within the competitive landscape, a cohort of leading software vendors and service providers is defining industry benchmarks. Established technology giants are enhancing their live streaming suites with embedded AI-driven moderation and personalization capabilities, leveraging global infrastructure to support large-scale events. Meanwhile, specialized providers are differentiating through vertical-specific feature sets, such as interactive education modules and gaming-centric overlays. Strategic alliances between cloud hyperscalers and niche streaming platforms have unlocked integrated offerings, enabling seamless end-to-end solutions that address both backend orchestration and front-end engagement.

At the same time, emerging disruptors are challenging incumbents by delivering agile, microservice-based architectures that can be deployed in minutes. These entrants emphasize open-source frameworks and community-driven plug-ins, fostering ecosystems of third-party developers. Acquisition activity has further reshaped the market, with major players integrating best-in-class analytics tools and CDN management capabilities into their portfolios. Collectively, these competitive maneuvers are driving rapid feature innovation, pushing organizations to continuously evaluate solution roadmaps and partnership strategies to maintain a technological edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Live Streaming Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Vimeo.com, Inc.

- Brightcove Inc.

- Agora Lab, Inc.

- Zoho Corporation Pvt. Ltd.

- Telestream 2 LLC

- Muvi LLC

- Wowza Media Systems LLC

- Mux, Inc.

- Panopto, Inc.

- Restream, Inc.

- XSplit Ltd. by SplitmediaLabs Limited

- Streamlabs by Logitech International S.A.

- Haivision Systems Inc.

- Dailymotion SA

- BoxCast

- Dacast Inc.

- Blackmagic Design Pty Ltd

- Animatron Inc.

- BeLive Technology

- Castr Technologies, Inc.

- Ecamm Network LLC

- Lightstream Inc.

- MirrorFly by CONTUS TECH

- StreamYard Inc.

- StudioCoast Pty Ltd

- Vbrick Systems, Inc.

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Live Streaming Software Advancements and Optimize Operations

Industry leaders must prioritize interoperability and modularity in their live streaming software investments to stay ahead of evolving market demands. By adopting API-driven architectures, organizations can integrate emerging features-such as real-time translation and augmented reality overlays-without disrupting core workflows. Moreover, investing in scalable cloud and hybrid deployment strategies will ensure that streaming platforms can dynamically adjust to peak load scenarios, minimizing latency during high-traffic events. Equally important is the cultivation of strategic partnerships with CDN operators and analytics specialists to enhance end-to-end performance and insight generation.

From a go-to-market perspective, companies should tailor their offerings to vertical-specific needs, bundling specialized professional services with software licenses to deliver a comprehensive customer experience. Prioritizing continuous training programs for internal teams and channel partners will maximize solution adoption and user satisfaction. Finally, a proactive approach to regulatory compliance-anticipating data privacy changes and tariff adjustments-will mitigate operational risks and protect profitability. By executing these recommendations, industry stakeholders can harness the full potential of live streaming software to create immersive experiences and achieve sustainable growth.

Outlining a Robust Research Methodology Featuring Primary Expert Interviews Secondary Data Analysis and Advanced Analytical Techniques

This research employs a mixed-methods approach to ensure thorough market coverage and analytical rigor. Primary data was collected through structured interviews with senior executives from leading software vendors, service providers, content distributors, and enterprise end users. These conversations provided direct insights into adoption drivers, deployment challenges, and strategic roadmaps. Secondary research involved systematic review of industry white papers, regulatory filings, patent databases, and technology blogs to validate primary findings and uncover emerging trends.

Quantitative analysis was conducted using advanced statistical techniques, including regression modeling and factor analysis, to identify correlations between deployment models, streaming types, and performance outcomes. Data visualization tools were leveraged to map regional adoption patterns and company positioning. Throughout the study, rigorous data triangulation was applied to cross-verify insights, ensuring that conclusions reflect a balanced synthesis of qualitative perspectives and empirical evidence. This methodological framework guarantees that the findings and recommendations presented herein are both robust and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Live Streaming Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Live Streaming Software Market, by Component

- Live Streaming Software Market, by Deployment Model

- Live Streaming Software Market, by Platform

- Live Streaming Software Market, by Streaming Technology

- Live Streaming Software Market, by Pricing Model

- Live Streaming Software Market, by End Use

- Live Streaming Software Market, by Region

- Live Streaming Software Market, by Group

- Live Streaming Software Market, by Country

- United States Live Streaming Software Market

- China Live Streaming Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Drawing Strategic Conclusions on the Future Trajectory of Live Streaming Software Market Evolution Innovation and Industry Adoption Patterns

The collective findings indicate that live streaming software is no longer confined to content distribution but has emerged as a strategic enabler of real-time engagement and operational efficiency. Technological advancements-ranging from edge computing to AI-driven analytics-are converging to deliver richer viewer experiences and deeper behavioral insights. At the same time, evolving business models and tariff landscapes are prompting solution providers to innovate across deployment, pricing, and partnership structures.

As the market continues to mature, differentiation will hinge on the ability to offer modular, interoperable platforms that seamlessly integrate with enterprise ecosystems and consumer engagement channels. Regional nuances and vertical-specific requirements will further drive customization, underscoring the importance of localized expertise and regulatory foresight. Ultimately, organizations that embrace a holistic approach-blending cutting-edge software capabilities with tailored services and strategic alliances-will be best positioned to lead the next wave of live streaming innovation.

Connect with Ketan Rohom to Unlock Comprehensive Live Streaming Software Market Insights and Secure Your Exclusive Research Report Today

Ketan Rohom, Associate Director of Sales & Marketing, invites industry leaders to secure the complete live streaming software market research report to gain exclusive insights and strategic guidance. This comprehensive document offers a deep exploration of market dynamics, segmentation nuances, regional variances, and company strategies that will empower your organization to stay ahead of technological disruptions and competitive pressures. Contact Ketan today to discuss custom research solutions, tailored data analysis, and licensing options that align with your business objectives. Don’t miss the opportunity to leverage validated intelligence and actionable recommendations to drive growth and innovation in your live streaming software initiatives.

- How big is the Live Streaming Software Market?

- What is the Live Streaming Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?