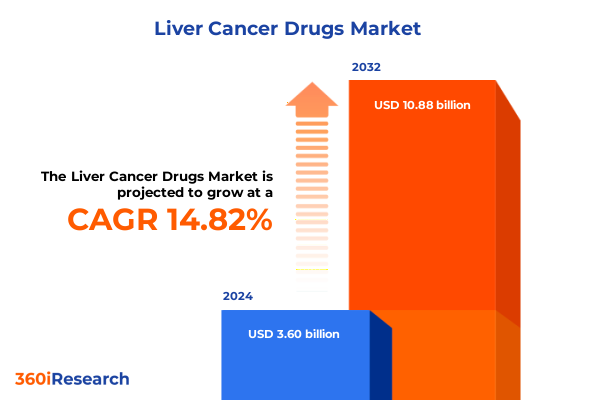

The Liver Cancer Drugs Market size was estimated at USD 4.10 billion in 2025 and expected to reach USD 4.67 billion in 2026, at a CAGR of 14.95% to reach USD 10.88 billion by 2032.

Liver Cancer Drugs Face Intensifying Challenges and Innovations Amid Rising Global Burden and Transformative Therapeutic Advances

Liver cancer remains a formidable global health challenge, with its incidence and mortality continuing to climb despite advances in other oncology areas. According to data from the National Cancer Institute, in 2022 there were approximately 865,269 new cases of liver cancer worldwide, resulting in 757,948 deaths, positioning it as the third leading cause of cancer-related mortality on a global scale. The relentless increase in incidence, particularly in high-risk regions, underscores the urgent demand for more effective therapeutic options.

In the United States, liver cancer accounts for an estimated 2% of all cancer diagnoses and 5% of cancer deaths, yet it stands as the sixth leading cause of cancer-related mortality. Projections for 2025 anticipate 42,240 new diagnoses and 30,090 deaths, reflecting a tripling of incidence rates since 1975 and a more than doubling of mortality rates over the same period. Hepatocellular carcinoma, which constitutes roughly 70% of all primary liver cancers in the U.S., drives a significant portion of this burden, highlighting the critical need for targeted interventions and improved survival outcomes.

The therapeutic landscape for liver cancer has evolved markedly from reliance on traditional cytotoxic chemotherapy and invasive procedures toward a multipronged approach integrating immunotherapy, targeted therapy, and personalized medicine. Landmark clinical trials have established combinations such as atezolizumab with bevacizumab and nivolumab with ipilimumab as new standards of care, extending median overall survival and demonstrating durable responses in patients with advanced hepatocellular carcinoma. These advances, coupled with deeper insights into tumor biology, have ushered in a transformative era of precision oncology for liver cancer, setting the stage for further innovation and improved patient outcomes.

Immunotherapies Combinations, Targeted Agents, and Precision Biomarkers Are Redefining Liver Cancer Treatment Paradigms Across the Industry

Over the past three years, the paradigm for treating liver cancer has shifted dramatically as immune checkpoint inhibitors and targeted agents complement-and in some cases supplant-legacy cytotoxic regimens. The combination of atezolizumab and bevacizumab demonstrated superior overall and progression-free survival compared to sorafenib alone, while first-line approval of nivolumab plus ipilimumab has established immunotherapy doublets as viable standards for unresectable disease, reshaping treatment algorithms and patient expectations. These breakthroughs reflect a broader strategic pivot toward harnessing the immune system’s specificity and synergy with molecular inhibitors, accelerating the shift from one-size-fits-all approaches toward more nuanced, mechanism-based protocols.

Concurrently, precision medicine has gained unprecedented traction through the integration of dynamic biomarkers that guide treatment selection and predict therapeutic response. Early declines in alpha-fetoprotein (AFP) levels measured within weeks of initiating immune checkpoint inhibitors correlate strongly with extended overall and progression-free survival, enabling oncologists to adjust regimens proactively and optimize outcomes. This biomarker-driven roadmap, reinforced by emerging gene-expression signatures and liquid biopsy platforms, underscores a critical inflection point: transitioning from static staging criteria to real-time molecular monitoring for adaptive, patient-centric care strategies.

Technological innovations in artificial intelligence and digital analytics further amplify these shifts by accelerating target identification, streamlining drug discovery, and enhancing clinical trial design. The AI in drug discovery market is expected to surpass $1.74 billion in 2025, reflecting surging adoption of machine learning models for ADMET prediction and virtual screening , while AI in oncology solutions are projected to reach $3.20 billion by 2025 as healthcare providers and pharma companies deploy computer vision and predictive analytics to refine diagnostics, prognostics, and therapeutic planning. Together, these advances are catalyzing a more agile, data-driven ecosystem that promises to compress development timelines and personalize cancer care at scale.

High U.S. Tariffs on Imported APIs and Devices Are Disrupting Supply Chains and Driving Pharma Reshoring Strategies Amid Trade Tensions in 2025

In 2025, the United States enacted sweeping tariff measures under broad trade and national security mandates, imposing levies of up to 245% on Chinese-sourced active pharmaceutical ingredients (APIs) and 25% on medical devices from Canada and Mexico. These tariffs, initially targeting essential inputs for oncology drug production, have significantly increased manufacturing costs and disrupted established supply chains, forcing pharmaceutical companies to reevaluate sourcing strategies and accelerate domestic capacity development.

The 10% blanket tariff on all imported goods further compounds cost pressures across the pharmaceutical value chain, with generic manufacturers bearing the brunt of these increases due to their razor-thin profit margins. As API prices surged, many companies began diversifying suppliers toward India and Germany, though these transitions often entail quality-control challenges and extended lead times, leaving markets vulnerable to interim supply shortages and price volatility.

Retaliatory tariffs imposed by China-reaching as high as 125% on U.S. pharmaceutical exports-have tightened the competitive landscape abroad, compelling multinational firms to allocate production across multiple regions to maintain market access. These cross-border duties exacerbate logistical complexity, elevate inventory carrying costs, and strain relationships with international partners, highlighting the fragility of interdependent pharma supply networks.

To mitigate these risks, industry leaders are doubling down on onshoring initiatives, expanding API and finished-dosage manufacturing within the U.S., and forging public–private partnerships to build resilient domestic supply ecosystems. While these efforts promise long-term stability, the interim period poses a genuine threat of drug shortages and elevated patient costs, underscoring the urgent need for strategic planning and collaborative policy engagement to balance national security goals with healthcare continuity.

Deep-Dive Segmentation Reveals Distinct Therapy Types, Cancer Subtypes, Administration Routes, Drug Classes, End Users, and Distribution Channels Shaping Market Dynamics

Market segmentation reveals pivotal trends that underline how therapeutic choices and delivery mechanisms shape clinical practice and commercial opportunity. When evaluating by therapy type, chemotherapy persists as a foundation for combination regimens, yet the advent of immunotherapy and targeted therapy has shifted prescribing patterns toward treatments that offer durable responses and manageable safety profiles, while radiation therapy maintains its niche role in localized control.

Assessing the market by cancer subtype highlights hepatocellular carcinoma as the predominant indication driving innovation and investment, with less prevalent entities such as cholangiocarcinoma and hepatoblastoma each demanding tailored drug development pathways based on unique tumor biology and patient demographics.

Route of administration segmentation underscores the dominance of intravenous platforms for precise dosing of monoclonal antibodies and combination immunotherapies, whereas oral agents-particularly tyrosine kinase inhibitors-have surged in popularity for their patient convenience and at-home administration. Concurrently, subcutaneous formulations are emerging for select biologics, offering new options for community-based administration.

From a drug class perspective, legacy cytotoxic agents remain integral to multi-modal strategies, while monoclonal antibodies and tyrosine kinase inhibitors have captured significant market traction by delivering targeted interventions against specific molecular pathways implicated in tumor survival and progression.

End-user segmentation illuminates hospitals and specialty clinics as primary points of care for complex infusional protocols, while home care services and outpatient settings increasingly accommodate oral regimens that expand patient access. Finally, distribution channel analysis shows hospital pharmacies preserving their central role in stocking critical oncology drugs, complemented by growing engagement from online and retail pharmacy networks to meet evolving patient and provider preferences.

This comprehensive research report categorizes the Liver Cancer Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Type

- Cancer Type

- Administration Route

- Drug Class

- End User

- Distribution Channel

Regional Market Dynamics Highlight Americas’ Innovation Leadership, EMEA’s Regulatory Nuances, and Asia-Pacific’s Emerging Biotech Growth in Liver Cancer Therapeutics

The Americas lead the charge in liver cancer therapeutic research, with the U.S. Food and Drug Administration approving first-line combination regimens such as nivolumab plus ipilimumab in April 2025 and strong investment in both early-stage and late-stage trials. This innovation leadership is supported by robust biopharma infrastructure, extensive clinical trial networks, and significant venture capital funding for emerging biotech companies focused on immuno-oncology and precision medicine.

In Europe, the Middle East, and Africa, market dynamics are shaped by regulatory harmonization efforts under the European Medicines Agency, diverse reimbursement landscapes, and growing emphasis on health technology assessments. Regionally, approval timelines for novel agents such as tremelimumab in combination with durvalumab have been accelerated through adaptive pathway schemes, yet access remains variable across member states, reinforcing the need for stakeholder collaboration to streamline market entry and optimize patient access.

Asia-Pacific is experiencing a surge in indigenous biotech innovation and strategic partnerships with multinational corporations. High-impact trials-such as the CARES-310 study of camrelizumab plus rivoceranib conducted in China-demonstrate competitive clinical outcomes and underscore the region’s capacity to contribute globally relevant data. Government support through targeted R&D grants and expedited review pathways has positioned Asia-Pacific as a burgeoning hub for liver cancer drug development and commercialization.

This comprehensive research report examines key regions that drive the evolution of the Liver Cancer Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Biopharma Companies Are Advancing Liver Cancer Drug Portfolios Through Strategic Partnerships, Pipeline Innovations, and Targeted Therapy Leadership

Leading biopharmaceutical companies are executing diverse strategies to fortify their liver cancer portfolios and secure long-term growth. Roche, building on the success of its atezolizumab–bevacizumab combination, has invested heavily in domestic manufacturing to mitigate tariff exposure while advancing next-generation checkpoint inhibitor trials across multiple HCC cohorts. Merck & Co. continues to expand pembrolizumab’s indications through global phase 3 trials, exploring combinations with novel agents and refining patient selection via biomarker analyses.

Bristol-Myers Squibb has leveraged its immuno-oncology expertise by positioning nivolumab and ipilimumab as a dual backbone for combination regimens, partnering with biotech firms to co-develop early-stage candidates that target complementary immune pathways. AstraZeneca, following its collaboration on tremelimumab plus durvalumab, is advancing CTLA-4 inhibitors in combination with anti–PD-L1 therapies and exploring subcutaneous formulations to enhance convenience and cost-effectiveness.

On the targeted therapy front, Bayer and Eisai remain pivotal, with Bayer’s sorafenib and Eisai’s lenvatinib maintaining strong market presence while undergoing lifecycle-extension strategies through novel dosing schedules and real-world evidence studies. Novartis and other innovators are pushing the boundaries with next-generation tyrosine kinase inhibitors and bispecific antibodies under early clinical investigation, each aiming to overcome resistance mechanisms and broaden therapeutic windows.

This comprehensive research report delivers an in-depth overview of the principal market players in the Liver Cancer Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agenus Inc.

- AstraZeneca AB

- AstraZeneca PLC

- Bayer AG

- BeiGene, Ltd.

- Bristol-Myers Squibb Company

- Can-Fite BioPharma Ltd.

- Chia Tai Tianqing Pharmaceutical Group Co., Ltd.

- CStone Pharmaceuticals

- Eisai Co., Ltd.

- Eli Lilly and Company

- Exelixis, Inc.

- Hoffmann-La Roche Inc.

- Innovent Biologics, Inc.

- Ipsen SA

- Jiangsu Hengrui Medicine Co., Ltd.

- Merck & Co., Inc.

- Pfizer Inc.

- Roche Holding AG (F. Hoffmann-La Roche Ltd)

- Zai Lab Limited

Strategic Actions for Industry Leaders Emphasize Supply Chain Diversification, Biomarker-Driven Trials, Digital Integration, and Collaborative R&D to Secure Competitive Advantage

Industry leaders must prioritize diversified supply chain strategies that reduce reliance on high-tariff jurisdictions and secure alternative sources for critical APIs, including forging partnerships with suppliers in India and Europe while accelerating onshore manufacturing investments. Aligning with regulatory bodies early in development can expedite approval pathways and optimize market access under adaptive frameworks.

Leveraging biomarker-driven trial designs and dynamic monitoring of response indicators such as AFP kinetics will be essential to maximize clinical benefit and cost-effectiveness. Executing rigorous patient stratification based on molecular signatures and integrating liquid biopsy tools can refine inclusion criteria and enhance trial success rates.

Embracing digital transformation, particularly through AI-enabled drug discovery platforms and predictive analytics for clinical operations, will shorten development timelines and improve candidate selection. Investing in end-to-end data infrastructure and cross-disciplinary expertise will empower organizations to translate real-world evidence into actionable insights for pipeline optimization.

Finally, forging collaborative R&D alliances that bring together large-cap pharmaceutical companies, agile biotech innovators, and academic centers will catalyze co-innovation. Shared risk models and co-development agreements can accelerate access to novel modalities and expand therapeutic reach across diverse patient populations.

Rigorous Multi-Source Research Methodology Combines Secondary Data, Expert Interviews, and Robust Analytics to Deliver Authoritative Insights on Liver Cancer Therapies

This research draws on a multi-layered methodology combining exhaustive secondary research with targeted primary engagements and quantitative analysis to ensure comprehensive coverage of the liver cancer drug landscape. Secondary sources included peer-reviewed literature, regulatory filings, clinical trial registries, and public financial disclosures to map existing therapies, pipeline assets, and market drivers.

Primary research comprised structured interviews with oncologists, supply chain executives, regulatory affairs specialists, and patient advocacy leaders to capture firsthand perspectives on unmet needs, access challenges, and emerging opportunities. These insights were triangulated with proprietary databases tracking clinical trial progress, approval timelines, and M&A activity.

Quantitative analysis leveraged robust statistical techniques, including survival meta-analyses and cost-impact modeling, to assess therapy efficacy, safety profiles, and economic implications. Data quality was ensured through cross-validation across multiple sources and peer review by domain experts.

Our approach adheres to rigorous research standards, encompassing methodological transparency, replicable data extraction protocols, and iterative validation cycles. This framework underpins the reliability and authority of the insights presented, equipping decision-makers with actionable intelligence in a complex, high-stakes therapeutic arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Liver Cancer Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Liver Cancer Drugs Market, by Therapy Type

- Liver Cancer Drugs Market, by Cancer Type

- Liver Cancer Drugs Market, by Administration Route

- Liver Cancer Drugs Market, by Drug Class

- Liver Cancer Drugs Market, by End User

- Liver Cancer Drugs Market, by Distribution Channel

- Liver Cancer Drugs Market, by Region

- Liver Cancer Drugs Market, by Group

- Liver Cancer Drugs Market, by Country

- United States Liver Cancer Drugs Market

- China Liver Cancer Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesis of Market Dynamics and Strategic Insights Underlines Urgent Need for Adaptive Strategies to Navigate Evolving Liver Cancer Therapeutic Landscape

In summary, the liver cancer drug sector is experiencing rapid transformation driven by groundbreaking immunotherapy and targeted therapy approvals, precision biomarker integration, and accelerating digital innovation. While U.S. tariff policies and global trade tensions present tangible supply chain challenges, they also create impetus for onshoring and resilient sourcing strategies.

Segmentation analysis underscores the diverse clinical and commercial landscapes shaped by therapy type, cancer subtype, administration route, drug class, end user, and distribution channel dynamics. Regional disparities further highlight the Americas’ leadership in trial innovation, EMEA’s regulatory complexity, and Asia-Pacific’s emerging biotech contributions.

Key enterprises are advancing multifaceted portfolios through strategic partnerships and pipeline diversification, adopting biomarker-guided development paradigms and pioneering next-generation modalities. To remain competitive, industry stakeholders must embrace agile supply chain management, data-driven trial designs, and collaborative research frameworks.

This comprehensive executive summary provides a cohesive synthesis of market forces and strategic imperatives, equipping leaders to navigate uncertainties and capitalize on evolving therapeutic opportunities in liver cancer treatment.

Unlock Comprehensive Liver Cancer Drug Market Insights Today by Partnering with Ketan Rohom for Exclusive 360iResearch Report Access and Expert Guidance

To explore the full depth of strategic insights, comprehensive data, and actionable intelligence on liver cancer drug development, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Partnering with him ensures personalized support, tailored guidance, and seamless access to the definitive market research report designed to empower your organization’s decision-making and innovation strategies in this rapidly evolving field

- How big is the Liver Cancer Drugs Market?

- What is the Liver Cancer Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?