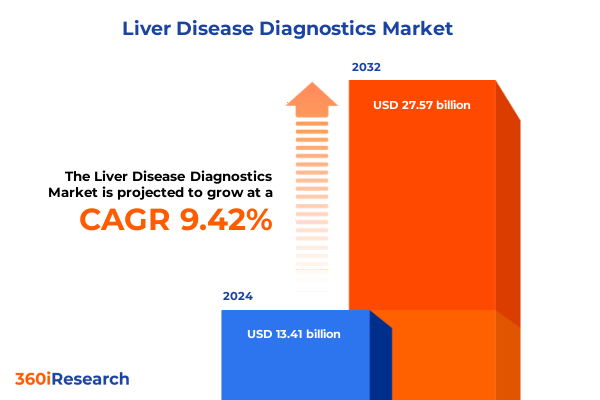

The Liver Disease Diagnostics Market size was estimated at USD 14.60 billion in 2025 and expected to reach USD 15.89 billion in 2026, at a CAGR of 9.51% to reach USD 27.57 billion by 2032.

Elevating Understanding of Liver Disease Diagnostics Through a Comprehensive Overview of Technological Advances, Clinical Applications, and Market Dynamics

Liver disease represents a complex and escalating global health challenge characterized by a wide spectrum of conditions ranging from acute hepatitis to hepatocellular carcinoma. This executive summary begins by setting the stage for understanding how diagnostic innovation underpins effective clinical intervention and patient outcomes. In recent years, the convergence of technological breakthroughs-such as advanced imaging modalities, refined biopsy techniques, and sophisticated blood-based assays-has fundamentally reshaped the way clinicians and laboratories approach liver pathology. By weaving together clinical insights and technological progress, this introduction underscores the critical role that diagnostics play in early disease detection, treatment stratification, and long-term management.

Moreover, the diagnostic landscape for liver disease is influenced by a blend of clinical imperatives and market forces. Heightened awareness of nonalcoholic fatty liver disease, driven by shifting lifestyle patterns and metabolic comorbidities, underscores the need for more accessible, accurate, and patient-friendly diagnostic solutions. At the same time, regulatory agencies worldwide have introduced new guidelines to streamline the approval and reimbursement of novel diagnostic kits and devices. This introduction not only highlights these dual pressures but also frames them within a broader context of healthcare cost containment and the imperative to deliver personalized care pathways. As stakeholders grapple with these complexities, a clear-eyed examination of current market dynamics and future trajectories becomes essential.

Mapping the Transformative Shifts in the Liver Disease Diagnostics Landscape Driven by Technological Innovation, Evolving Clinical Needs, and Regulatory Evolution

Transformative shifts in the liver disease diagnostics landscape have been driven by the seamless integration of digital health tools, artificial intelligence, and automated workflows. Artificial intelligence algorithms now assist in the interpretation of imaging data, enabling more precise quantification of liver fibrosis and steatosis. Additionally, advances in point-of-care testing have brought blood-based biomarkers from centralized laboratories to bedside applications, accelerating diagnostic turnaround times and improving patient engagement. These innovations are not isolated; rather, they represent a systemic reorientation toward minimally invasive, data-rich, and patient-centric diagnostic paradigms.

In parallel, regulatory evolution has played a pivotal role in shaping the pace and direction of these breakthroughs. Expedited pathways for breakthrough devices and real-world evidence provisions have allowed manufacturers to streamline approvals without compromising safety or performance. This regulatory agility has catalyzed collaboration between medical device companies, research institutes, and clinical laboratories, fostering a fertile environment for co-development initiatives. The convergence of these forces has not only elevated the standard of care but has also laid the groundwork for future shifts, including the mainstream adoption of liquid biopsy and multiomic diagnostic platforms.

Assessing the Cumulative Impact of United States Tariff Policies in 2025 on Supply Chains, Pricing Structures, and Diagnostic Accessibility in Liver Disease Testing

In 2025, United States tariff policies on medical devices and diagnostic reagents have had a cumulative impact that extends across supply chains, cost structures, and patient access. Tariffs on select imported reagents have driven up input costs for manufacturers, prompting strategic sourcing shifts toward domestic suppliers and nearshoring of critical reagent production. These adjustments have mitigated immediate disruptions but have also highlighted the vulnerability of highly specialized supply chains when confronted with policy fluctuations.

Furthermore, increased duty rates on key imaging and biopsy equipment have compelled some laboratories and hospitals to reassess capital expenditure plans. To preserve financial stability, many institutions have sought to optimize existing assets through extended maintenance agreements and software upgrades rather than purchasing new systems outright. This recalibration of investment strategy has, in some instances, delayed the adoption of cutting-edge technologies. Nevertheless, forward-thinking organizations have leveraged public–private partnerships and grant funding to offset tariff-driven cost increases, ensuring continuity of advanced diagnostics in areas of greatest clinical need.

Uncovering Critical Segmentation Insights Across Diagnostic Offerings, Disease Types, and End Users to Inform Strategic Positioning in the Liver Disease Diagnostics Market

Key segmentation insights reveal how different diagnostic offerings, disease types, and end users collectively shape market dynamics and strategic priorities. When examining offerings, it becomes clear that biopsy techniques remain foundational, with laparoscopic, percutaneous, and transvenous approaches each playing distinct clinical roles. Blood-based tests such as alanine transaminase, aspartate transaminase, and gamma-glutamyl transpeptidase assays continue to serve as primary screening tools, while endoscopy and imaging diagnostics-including CT scan, MRI, and ultrasound-provide indispensable staging and monitoring capabilities. This multiplicity of modalities highlights the importance of an integrated diagnostics strategy that aligns the sensitivity, specificity, and patient convenience required for comprehensive liver disease management.

Turning to disease type, differentiation across acute hepatitis, alcoholic liver disease, chronic hepatitis, cirrhosis, hepatocellular carcinoma, and nonalcoholic fatty liver disease underscores unique diagnostic trajectories. Acute hepatitis demands rapid, precise molecular and serologic assays to guide antiviral and supportive therapies. Alcoholic liver disease and chronic hepatitis benefit from longitudinal biomarker panels that track disease progression, whereas cirrhosis and hepatocellular carcinoma require advanced imaging and tissue sampling to detect nodular transformation and malignancy. The growing prevalence of nonalcoholic fatty liver disease has placed a premium on noninvasive biomarkers and elastography, prompting market entrants to innovate less intrusive, yet highly informative, diagnostic options.

Finally, insights derived from end-user segmentation-spanning diagnostic laboratories, hospitals, and research institutes-demonstrate divergent purchasing behaviors and value drivers. Diagnostic laboratories prioritize high-throughput automation and multiplex testing capabilities, hospitals focus on integrated care pathways and point-of-care solutions, and research institutes invest in investigational tools that support clinical trials and translational research. Understanding these nuances is critical to tailoring product portfolios, crafting differentiated marketing strategies, and fostering partnerships that meet the distinct needs of each stakeholder group.

This comprehensive research report categorizes the Liver Disease Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Disease Type

- End-User

Elucidating Regional Dynamics in Liver Disease Diagnostics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Guide Market Entry and Expansion

Regional dynamics in liver disease diagnostics reflect the interplay of healthcare infrastructure, epidemiology, and regulatory frameworks across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, the United States and Canada lead adoption of sophisticated imaging and molecular diagnostics, underpinned by robust reimbursement systems and high per capita healthcare spending. Latin America, while challenged by variable access and budget constraints, is witnessing growth in public health initiatives targeting viral hepatitis and nonalcoholic fatty liver disease, creating pockets of demand for scalable diagnostic platforms.

Within Europe Middle East & Africa, European Union nations benefit from harmonized regulatory processes and centralized procurement mechanisms that accelerate the deployment of standardized diagnostic assays. Conversely, Middle Eastern markets are investing heavily in healthcare modernization, often through public–private partnerships, while African regions face ongoing barriers due to infrastructure gaps and workforce shortages. Despite these challenges, emerging programs to combat viral hepatitis are spurring demand for cost-effective rapid tests and telehealth-enabled diagnostic services.

Asia-Pacific remains the fastest-growing region, propelled by high disease burden, expanding hospital networks, and targeted government programs. China and India, in particular, are focusing on noninvasive diagnostics and AI-driven image analysis to monitor liver fibrosis at scale. Southeast Asian markets are also prioritizing affordability and accessibility, fostering the adoption of portable ultrasound devices and point-of-care testing. Across the region, local manufacturers are increasingly collaborating with global technology providers to adapt premium diagnostics to resource-constrained settings.

This comprehensive research report examines key regions that drive the evolution of the Liver Disease Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Collaborations, Innovation Pipelines, and Competitive Positioning of Leading Companies Shaping the Future of Liver Disease Diagnostics

Leading companies in the liver disease diagnostics arena are driving value through strategic collaborations, targeted acquisitions, and robust innovation pipelines. Several multinational corporations have forged partnerships with biotech startups specializing in liquid biopsy and multiomic biomarkers, seeking to strengthen their foothold in noninvasive diagnostic modalities. Concurrently, established device manufacturers have acquired niche imaging software firms to enhance the predictive power of CT and MRI systems through enhanced analytics and machine learning capabilities.

In addition, mid-sized diagnostic developers are differentiating by focusing on point-of-care testing solutions that address unmet needs in community and outpatient settings. These companies are leveraging flexible manufacturing models and cloud-based data platforms to accelerate product iterations and streamline regulatory submissions. Moreover, research institutes and contract research organizations have intensified collaborations with industry stakeholders, facilitating real-world validation studies and creating pathways for early adoption of groundbreaking assays. This mosaic of corporate activity underscores a broader trend toward ecosystem-driven innovation, where cross-sector alliances are essential for achieving scale and navigating regulatory complexity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Liver Disease Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Amgen Inc.

- Argon Medical Devices, Inc.

- Bayer AG

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- BioMérieux SA

- Boston Scientific Corporation

- Cook Medical Incorporated

- Echosens by Astor Partners S.r.l.

- Epigenomics AG

- F. Hoffmann-La Roche Ltd.

- Fujifilm Holdings Corporation

- Hepatiq, Inc.

- Hologic, Inc.

- Horiba, Ltd.

- Koninklijke Philips N.V.

- Laboratory Corporation of America Holdings

- Medtronic PLC

- Merck & Co., Inc.

- Perspectum Ltd.

- Qiagen N.V.

- Quest Diagnostics Incorporated

- Randox Laboratories Ltd.

- Ri.Mos. Srl

- Siemens Healthineers AG

- Thermo Fisher Scientific, Inc.

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in Liver Disease Diagnostics

To capitalize on emerging opportunities and address persistent challenges, industry leaders should prioritize strategic investments in noninvasive diagnostic platforms. By allocating resources toward the development of liquid biopsy assays and elastography technologies, organizations can meet the growing demand for patient-friendly testing and reduce reliance on invasive procedures. Furthermore, diversifying supply chains through regional manufacturing partnerships will mitigate the impact of tariff fluctuations and reinforce continuity of critical reagent and equipment availability.

In addition, forging deeper collaborations with payers and healthcare systems is essential to unlock value-based reimbursement models. Demonstrating real-world clinical and economic benefits through well-designed health economics and outcomes research will facilitate faster coverage decisions and broader market access. Industry stakeholders should also explore co-development agreements with academic research centers to accelerate the translation of early-stage discoveries into validated commercial products. Finally, expanding geographic focus into high-growth emerging markets-supported by tailored pricing strategies and locally adapted service models-will ensure that organizations remain agile and responsive to shifting global epidemiology.

Detailing Rigorous Research Methodologies Employed to Ensure Accuracy, Reliability, and Comprehensive Analysis in Liver Disease Diagnostics Market Study

The research methodology underpinning this market study integrates a rigorous blend of primary and secondary data collection, ensuring both depth and breadth of analysis. Primary research involved structured interviews with key opinion leaders, laboratory directors, and senior executives from leading diagnostic companies to capture firsthand insights on technology adoption, unmet clinical needs, and commercial strategies. Complementing this qualitative approach, survey-based quantitative data were gathered from a cross section of hospitals, diagnostic laboratories, and research institutes to validate market dynamics and adoption trends.

Secondary research encompassed a comprehensive review of peer-reviewed journals, industry white papers, regulatory filings, and conference proceedings to map the competitive landscape and identify emerging technologies. Data triangulation was employed to reconcile discrepancies between primary and secondary sources, enhancing the robustness of findings. Forecast accuracy was further bolstered by scenario analysis, which simulated potential market impacts of regulatory changes, tariff adjustments, and technological disruptions. This methodological framework ensures that the report’s conclusions are grounded in verifiable evidence and industry best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Liver Disease Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Liver Disease Diagnostics Market, by Offering

- Liver Disease Diagnostics Market, by Disease Type

- Liver Disease Diagnostics Market, by End-User

- Liver Disease Diagnostics Market, by Region

- Liver Disease Diagnostics Market, by Group

- Liver Disease Diagnostics Market, by Country

- United States Liver Disease Diagnostics Market

- China Liver Disease Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Synthesizing Key Insights and Future Outlook to Empower Decision Makers in the Evolving Field of Liver Disease Diagnostics

In conclusion, the liver disease diagnostics market is undergoing a period of profound transformation driven by technological innovation, shifting clinical imperatives, and evolving policy landscapes. The maturation of noninvasive testing modalities, combined with the integration of artificial intelligence and real-world evidence frameworks, is redefining the standards of early detection and disease monitoring. Regional disparities present both challenges and opportunities; strategic engagement in emerging markets will be pivotal for sustaining growth and addressing the global liver disease burden.

Looking ahead, industry stakeholders must remain vigilant to regulatory developments and tariff policies that could reshape cost structures and market access. By embracing collaborative innovation models and aligning product development with payer requirements, organizations can deliver value-based solutions that improve patient outcomes and drive commercial success. The insights presented herein serve as a roadmap for decision makers seeking to navigate the complexities of this dynamic market and capitalize on the next wave of diagnostic breakthroughs.

Empower Your Strategic Decisions by Securing the Comprehensive Liver Disease Diagnostics Market Research Report from Ketan Rohom, Associate Director of Sales & Marketing

To take the next step toward unlocking the full spectrum of strategic insights in liver disease diagnostics, reach out today to Ketan Rohom, Associate Director of Sales & Marketing. He will guide you through the detailed offerings of the report and how its findings can be tailored to your organization’s unique objectives. By engaging directly with Ketan Rohom, you gain prioritized access to custom data queries and expert consultation that align with your commercial and clinical priorities. Act now to secure your comprehensive market research report and equip your team with the in-depth analysis necessary to outpace competitors and adapt rapidly to evolving industry trends.

- How big is the Liver Disease Diagnostics Market?

- What is the Liver Disease Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?