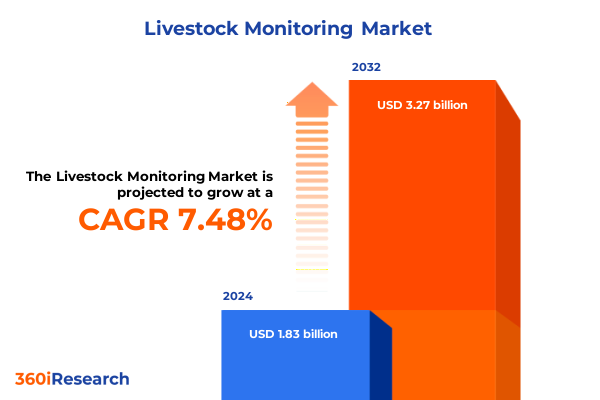

The Livestock Monitoring Market size was estimated at USD 1.96 billion in 2025 and expected to reach USD 2.10 billion in 2026, at a CAGR of 7.55% to reach USD 3.27 billion by 2032.

Harnessing Precision and Connectivity to Optimize Livestock Health and Productivity through Advanced Monitoring Technologies

The landscape of modern livestock farming is being redefined by the advent of precision monitoring systems that harness real‐time data capture and analysis to deliver critical insights into animal health and behavior. These innovative approaches leverage sensor technologies, such as thermal imaging and computer vision, to noninvasively measure vital signs like heart rate and respiration in young calves, reducing stress and improving accuracy in health assessments.

Despite the proven potential of these technologies, adoption among producers varies widely, with surveys indicating that only a small fraction of farms have integrated multiple precision tools into their operations. Recent Agricultural Resource Management Survey data found that wearable livestock technologies were adopted by just 1% of small farms and 12% of large farms in the United States, highlighting disparities in resource allocation and technical capacity across different scales of production.

In response to global pressures-from emerging zoonotic diseases like avian influenza to mounting labor shortages-dairy and beef operations are increasingly turning to continuous monitoring platforms to detect anomalies in animal behavior and health before they escalate into costly outbreaks. Companies at the forefront of this movement have reported measurable gains in disease prevention, milk yield optimization, and labor efficiency, underscoring the transformative promise of next‐generation livestock monitoring solutions.

Converging IoT, Artificial Intelligence, and Cloud Platforms to Revolutionize Livestock Monitoring and Data-Driven Decision Making

The confluence of Internet of Things infrastructures, cloud‐native platforms, and artificial intelligence algorithms is reshaping livestock monitoring from isolated sensor networks into integrated, predictive ecosystems. Recent studies illustrate how sensor miniaturization and advanced analytics have enabled the transformation of raw telemetry into decision‐ready intelligence, empowering farm managers to anticipate health issues and optimize feeding schedules at the individual animal level.

Wearable biometric devices, GPS‐enabled ear tags, and implantable chips are extending the reach of monitoring systems by tracking behavioral patterns, environmental exposures, and physiological metrics in real time. These modalities reduce manual oversight, enabling proactive interventions that safeguard animal welfare and enhance productivity while minimizing resource waste.

Public‐private partnerships between technology providers, animal health specialists, and academic institutions are accelerating standardization efforts and establishing interoperability frameworks to reduce implementation complexity. Collaborative initiatives are also promoting cybersecurity best practices and user‐centric interfaces, ensuring that livestock monitoring platforms deliver actionable insights with reliability and ease of use across diverse farming contexts.

Analyzing the Far-Reaching Consequences of 2025 U.S. Tariff Policies on Technology Adoption, Supply Chains, and Livestock Monitoring Economics

In 2025, the United States introduced comprehensive tariffs on key electronic components and finished goods vital to livestock monitoring equipment, imposing heightened duties on imports from major manufacturing hubs such as China, Canada, and Mexico. Farmers and agritech firms have experienced immediate cost pressures, with increased prices for sensors, microchips, and GPS modules directly impacting the affordability of monitoring deployments.

Beyond escalating component costs, unpredictable tariff schedules have disrupted established supply chains, forcing providers to seek alternative sourcing strategies. Extended lead times, elevated logistics expenses, and potential quality variances have delayed product rollouts, compelling manufacturers to reengineer solutions or pivot to higher‐cost domestic suppliers to maintain continuity of service.

The cumulative effect of these trade measures has tempered investment in research and development, as a larger share of budgets is allocated to offsetting material price inflation. While some domestic manufacturers view the tariffs as an opportunity to strengthen local production, the broader industry faces a period of measured growth, as end‐users weigh the long‐term benefits of enhanced monitoring against the immediate financial constraints imposed by shifting trade policies.

Uncovering Critical Insights across Offerings, Livestock Types, Applications, End-Users, and Farm Sizes in Livestock Monitoring Markets

Comprehensive analysis of the livestock monitoring sector requires a deep understanding of its service and technology offerings. The market research disaggregates solutions into hardware, services, and software categories, recognizing that non‐wearable systems and wearable devices form the backbone of sensor‐based hardware applications. Service offerings span installation, maintenance, data analytics, and full monitoring‐as‐a‐service models, while software platforms drive advanced data visualization and predictive analytics capabilities.

Diversity in livestock types further influences solution design, with distinct requirements emerging for beef and dairy cattle, equine, poultry, sheep, goats, and swine operations. Each species presents unique behavioral, physiological, and environmental monitoring needs, compelling solution providers to tailor sensor configurations, analytical algorithms, and user interfaces to address specific animal husbandry practices.

Application segmentation underscores the multifaceted value of monitoring technologies, spanning behavior tracking, environmental condition assessment, feeding and nutrition management, and specialized processes such as milking optimization and reproductive monitoring. These diverse application domains empower producers to optimize welfare, enhance resource utilization, and comply with stringent regulatory or quality standards across different end‐users, from small to large commercial farms and public institutions.

This comprehensive research report categorizes the Livestock Monitoring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Livestock Type

- Application

- End-User

- Farm Size

Regional Dynamics and Comparative Adoption Patterns Shaping the Future of Livestock Monitoring across the Americas, EMEA, and Asia-Pacific

In the Americas, robust digital infrastructure and early investments in agritech have positioned the region at the forefront of livestock monitoring innovation. Commercial producers benefit from economies of scale that support extensive pilot programs and rapid adoption of advanced sensing platforms. Strategic partnerships between technology firms and leading agricultural cooperatives further reinforce the region’s leadership, enabling seamless integration of monitoring solutions into existing farm management practices.

Europe, the Middle East, and Africa are experiencing a distinct regulatory-driven momentum, as governments enact traceability mandates and animal welfare standards that mandate comprehensive monitoring. The European Union’s identification and registration requirements for goats and sheep exemplify this trend, driving demand for interoperable technologies that can satisfy cross-border compliance while supporting emerging markets in the Middle East and North Africa.

Asia-Pacific markets are witnessing an unprecedented surge in adoption driven by rising demand for meat and dairy products, coupled with government-led digitization initiatives. Key economies such as China, India, and Australia are investing in IoT-enabled livestock health platforms to boost productivity and sustainability. Collaborative ventures with local technology incubators and rural broadband programs are overcoming connectivity challenges, setting the stage for a rapid expansion of monitoring solutions across diverse agricultural landscapes.

This comprehensive research report examines key regions that drive the evolution of the Livestock Monitoring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Disruptors Driving Technological Advancements in Livestock Monitoring Solutions Worldwide

Merck Animal Health has emerged as a leader in deploying internet-connected wearable devices that continuously track bovine health and movement, unlocking early-warning capabilities for diseases such as H5N1 avian influenza. By integrating these platforms with remote advisory services, the company is driving measurable labor efficiencies and supporting dairy farmers in managing herd health in challenging rural environments.

Nedap’s SmartTag and Afimilk’s AfiAct II highlight the evolution of hardware solutions that monitor fertility cycles, feeding patterns, and milk production in real time. These systems enable timely interventions that enhance reproductive efficiency and optimize lactation outcomes, aligning with broader sustainability goals and stringent food safety regulations.

Innovative technology providers such as Connecterra, Cainthus, Vence, and Quantified Ag are embedding AI-driven analytics and computer vision into cloud platforms, while agricultural enterprises like Cargill and GEA are leveraging their global networks to offer integrated, end-to-end farm management suites. This dynamic ecosystem of disruptors and incumbents fosters continuous innovation and expands the scope of livestock monitoring beyond point solutions to comprehensive digital farm orchestration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Livestock Monitoring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accent Advanced Systems, SLU

- Afimilk Ltd.

- BouMatic

- Cisco Systems Inc.

- Dairymaster

- DeLaval

- Fancom BV by CTB, Inc.

- Fullwood Ltd.

- Gallagher Group Limited

- GEA Group AG

- HID Global Corporation by Assa Abloy

- Hokofarm Group

- Lely International N.V.

- Merck Animal Health

- Microsoft Corporation

- MooCall

- Nedap N.V.

- Peacock Technology Ltd

- Sum-It Computer Systems Ltd.

- Telefonaktiebolaget LM Ericsson

- Telit Corporate Group

- Zoetis Inc.

Strategic Imperatives and Practical Recommendations to Navigate Disruptions and Accelerate Growth in the Livestock Monitoring Industry

To navigate the current tariff-induced cost pressures, industry leaders should diversify their supply portfolios by qualifying multiple component vendors across geographies and developing modular hardware architectures that accommodate alternative sensors without major redesigns.

Collaborative partnerships with telecommunications providers and participation in government broadband expansion initiatives can accelerate connectivity in rural regions, unlocking the full potential of real-time monitoring data and enhancing the reliability of critical alerts for on-farm decision making.

Finally, investing strategically in integrated solutions that bundle hardware, software, and professional services can maximize value for end users by simplifying procurement, accelerating deployment timelines, and creating recurring revenue streams through subscription-based analytics and maintenance offerings.

Robust Research Framework Combining Primary Insights and Secondary Data Sources to Ensure Comprehensive Livestock Monitoring Analysis

This research synthesizes primary insights obtained through structured interviews with livestock producers, technology vendors, and regulatory bodies, ensuring that on-the-ground perspectives inform the analysis framework.

Secondary data sources include peer-reviewed academic studies, industry whitepapers, government regulations, and open-access technical repositories, which provide empirical validation of technological capabilities and adoption patterns.

Quantitative analyses are supplemented with triangulation workshops involving subject-matter experts to reconcile conflicting data points and to calibrate narrative findings against real-world implementation challenges, securing a robust basis for the report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Livestock Monitoring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Livestock Monitoring Market, by Offering

- Livestock Monitoring Market, by Livestock Type

- Livestock Monitoring Market, by Application

- Livestock Monitoring Market, by End-User

- Livestock Monitoring Market, by Farm Size

- Livestock Monitoring Market, by Region

- Livestock Monitoring Market, by Group

- Livestock Monitoring Market, by Country

- United States Livestock Monitoring Market

- China Livestock Monitoring Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings and Implications to Chart the Next Phase of Innovation and Adoption in Livestock Monitoring Solutions

The executive summary distills the critical role of precision monitoring technologies in addressing pivotal industry challenges, including disease mitigation, resource optimization, and regulatory compliance, illustrating how data-driven insights are reshaping livestock management paradigms.

By elucidating the transformative shifts in IoT, cloud computing, and AI-driven analytics, the analysis highlights both the strategic opportunities and the resilience imperatives required to thrive amidst evolving trade policies and market dynamics.

As stakeholders chart their next steps, this report underscores the need for targeted investment in interoperable platforms, agile supply chains, and collaborative innovation to sustain the momentum of technological adoption and foster long-term competitiveness.

Engage with Our Associate Director to Secure the Definitive Livestock Monitoring Market Research Report for Informed Decision Making

To secure a comprehensive and actionable market research report that will empower your strategic decisions in livestock monitoring, contact Ketan Rohom, Associate Director of Sales & Marketing, to discuss your specific needs and obtain a tailored research package today.

- How big is the Livestock Monitoring Market?

- What is the Livestock Monitoring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?