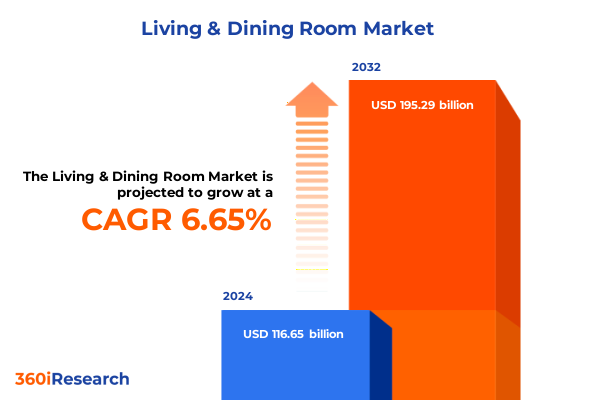

The Living & Dining Room Market size was estimated at USD 124.43 billion in 2025 and expected to reach USD 133.02 billion in 2026, at a CAGR of 6.65% to reach USD 195.29 billion by 2032.

Unveiling the Current Dynamics Transforming Living and Dining Spaces Amid Shifting Consumer Behaviors and Design Innovations

The Living & Dining Room market stands at the cusp of a significant evolution, driven by shifting consumer priorities and a blossoming emphasis on multifunctional home environments. In recent years, homeowners have increasingly blended social and private uses within shared living spaces, prompting a growing demand for designs that harmonize comfort, functionality, and aesthetic allure. This convergence of living and dining activities underscores a broader trend toward adaptable interiors where every furniture piece serves multiple roles, from hosting gatherings to supporting remote work and leisure time.

Amid these dynamics, demographic shifts-such as a rise in dual-income households and urban downsizing-have amplified the need for space-saving solutions without compromising style. Millennials and Gen Z buyers, in particular, prioritize sustainability and personalization, seeking furniture that reflects their values and adapts to evolving lifestyles. At the same time, older generations are upgrading their homes with ergonomic, wellness-focused products, underscoring a cross-generational appetite for designs that enhance both form and function. As digital channels expand, consumers expect seamless omnichannel experiences, integrating virtual design tools with in-store showrooms that inspire and inform.

These intersecting forces have set the stage for unprecedented innovation across materials, technologies, and retail models. In the sections that follow, key shifts in technology, sustainability, trade policies, and segmentation will be explored to illuminate the future trajectory of the Living & Dining Room category, equipping leaders with the insights needed to thrive in this dynamic landscape.

Exploring Pivotal Shifts Redefining How Consumers Engage with Living and Dining Environments through Technology and Sustainability Drivers

Over the past few years, the Living & Dining Room category has undergone a radical transformation propelled by the fusion of smart technologies and consumer expectations for personalized experiences. Smart furnishings-such as connected lounge seating with integrated charging ports, sensor-enabled lighting modules, and voice-activated storage solutions-are no longer niche offerings but essential differentiators. These innovations enable homeowners to curate environments that respond to mood, activity, and even health metrics, creating a seamless interface between digital lifestyles and physical comfort.

Simultaneously, sustainability imperatives are reshaping sourcing and product lifecycles. Industry stakeholders increasingly adopt eco-friendly practices, from incorporating recycled glass tops and reclaimed wood frames to innovating with bio-based plastics and low-impact metal finishes. Circular design principles guide product development, ensuring components can be disassembled, refurbished, or repurposed, thereby minimizing waste and carbon footprint. Brands that embed transparency-providing cradle-to-cradle documentation and certifications-are earning stronger loyalty among conscientious buyers.

Further fueling change is the rise of customizable and modular concepts. Advances in digital visualization, including augmented reality room planners and 3D configurators, empower customers to design bespoke furniture compositions. This shift not only deepens engagement but also streamlines production, enabling on-demand manufacturing with reduced inventory risk. As these transformative shifts converge, the Living & Dining Room landscape is set to be redefined by integrated technology, sustainable stewardship, and hyper-personalization.

Assessing the Ripple Effect of Newly Imposed United States Tariffs on Sourcing, Pricing, and Consumer Behavior in 2025

The introduction of new United States tariffs in early 2025 on imported home furnishings and raw materials has introduced both challenges and strategic opportunities across the Living & Dining Room market. While the increased levy on select wood, metal, and textile imports has elevated input costs for manufacturers reliant on global supply chains, it has concurrently spurred innovation and localization. Domestic producers are accelerating nearshoring efforts, forging partnerships with regional mills and workshops to mitigate exposure to import duties and transportation volatility.

These policy shifts have also prompted retailers to reassess pricing strategies and value propositions. To preserve margins without alienating price-sensitive consumers, many brands are enhancing product differentiation through premium service offerings-such as white-glove delivery, extended warranties, and in-home design consultations-rather than relying solely on cost adjustments. Meanwhile, emerging domestic manufacturers leverage tariff-driven price gaps to compete on both cost and quality, positioning locally crafted collections as both sustainable and economically sound alternatives.

On the consumer front, the tariff impact has subtly shifted purchase behaviors. Some buyers express willingness to invest in higher-end, domestically produced pieces that promise durability and craftsmanship, viewing them as long-term investments. Others respond to targeted promotions and bundle deals that offset incremental costs. As the market adapts to this new trade landscape, agility in sourcing, transparent communication on material provenance, and diversified channel strategies will remain critical for stakeholders aiming to sustain growth and profitability.

Harnessing Detailed Product, Channel, Material, and Style Segmentation to Uncover Consumer Preferences in Living and Dining Furnishings

A nuanced understanding of consumer preferences within the Living & Dining Room segment emerges only when market players examine product typologies, distribution modalities, material selections, and stylistic leanings in concert. By dissecting the category across seating, surface, storage, and lounge offerings, stakeholders can pinpoint which armchairs and bar stools satisfy modern work-from-home needs or how extendable, round, and traditional rectangular tables accommodate evolving social rituals. Simultaneously, recognizing the storage potential in buffet- and console-style sideboards reveals avenues for combining utility with decorative expression, while differentiating among loveseats, sectional configurations, and convertible sofa beds highlights the interplay between spatial constraints and lifestyle versatility.

Parallel insights arise when evaluating how distribution pathways influence buyer journeys. Conventional retail venues-from broad-reach mass merchants to upscale showroom destinations and specialized boutiques-continue to provide tactile brand experiences, even as digital-first platforms, including brand-direct storefronts and leading online marketplaces, democratize design discovery and purchasing convenience. In turn, material preferences spanning glass, metal, engineered plastic, upholstered textiles, and various wood species inform sourcing decisions, with each substrate offering distinct performance, aesthetic, and sustainability profiles.

Finally, the interplay of stylistic categories-industrial frameworks, modern expressions in both contemporary and minimalist idioms, the warm simplicity of Scandinavian influences, classic and vintage nods within traditional schemes, and transitional blends that fuse heritage with current trends-guides product roadmaps and marketing narratives. By overlaying these segmentation dimensions, furniture companies can craft highly targeted offerings, refine channel focus, and optimize supply chains to deliver precisely what end consumers demand.

This comprehensive research report categorizes the Living & Dining Room market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Style

- Distribution Channel

Unveiling How Regional Lifestyle, Regulatory, and Cultural Variations Shape Living and Dining Room Demand Across Key Global Territories

Regional dynamics profoundly shape the Living & Dining Room market, as geographical nuances in lifestyle, regulation, and culture drive divergent growth patterns and design sensibilities. In the Americas, suburban expansions and renovation cycles fuel demand for versatile furniture that balances family-focused comfort with social gathering functionality. North American buyers exhibit strong affinity for upholstered lounge pieces and modular dining configurations, while Latin American markets show elevated interest in artisan-crafted wood items and indoor–outdoor adaptable designs that leverage warm climates.

Across Europe, the Middle East & Africa, urban density and heritage preservation both influence consumer choices. Mature Western European markets lean toward minimalist, sustainability-certified collections and multifunctional furniture optimized for compact living spaces. Meanwhile, emerging regions within EMEA, including parts of the Gulf Cooperation Council, demonstrate a rising appetite for luxury materials and statement furnishings, reflecting buoyant construction trends and affluent demographics. Local regulations around environmental standards further accelerate adoption of eco-certified manufacturing practices throughout the region.

In Asia-Pacific, rapid urbanization and strong e-commerce penetration drive an appetite for space-saving design solutions and digital customization tools. Markets in East Asia prioritize sleek, contemporary aesthetics that integrate smart home compatibility, whereas Southeast Asian consumers seek richly finished wood pieces and versatile seating that accommodate multi-generational households. Australia and New Zealand demonstrate growing engagement with indoor–outdoor hybrids and weather-resilient materials, reflecting lifestyle preferences that span relaxed coastal living and formal entertaining.

This comprehensive research report examines key regions that drive the evolution of the Living & Dining Room market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Top Furniture Brands and Retailers Leverage Omnichannel Strategies, Supply Chain Integration, and Collaborative Design Initiatives

Leading players in the Living & Dining Room space are differentiating through a combination of omnichannel integration, vertical supply chain control, and collaborative innovation. Established furniture manufacturers are investing in proprietary digital tools that bridge online showrooms with in-home AR visualizers, ensuring consistency in brand experience regardless of touchpoint. Simultaneously, several retailers are embracing vertical integration-acquiring component suppliers and logistics providers-to secure raw material access, optimize lead times, and implement just-in-time production models that reduce inventory holding costs.

Strategic alliances and design partnerships further enrich the competitive landscape. Companies are co-creating limited-edition collections with renowned designers and lifestyle influencers, leveraging cross-sector synergies to capture emerging consumer segments. At the same time, mergers and acquisitions within the sector are consolidating niche artisanal brands under larger corporate umbrellas, marrying craftsmanship with economies of scale. Sustainability leadership has become another battleground; forward-thinking firms publish transparent carbon accounting and engage in closed-loop recycling initiatives, setting new benchmarks for circular furnishing economies.

As these corporate maneuvers unfold, agility in responding to tariff changes, material shortages, and shifting consumer tastes will differentiate the winners. Organizations that balance bold innovation with operational resilience-while delivering authentic value propositions-are poised to distill complexity into compelling product offerings and sustain long-term relevance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Living & Dining Room market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arhaus, Inc.

- Ashley Furniture Industries, Inc.

- Bassett Furniture Industries, Inc.

- Big Lots, Inc.

- Bob's Discount Furniture, LLC

- Ethan Allen Interiors Inc.

- Flexsteel Industries, Inc.

- Haverty Furniture Companies, Inc.

- home24 SE

- Inter IKEA Systems B.V.

- La-Z-Boy Incorporated

- Lowe's Companies, Inc.

- MillerKnoll, Inc.

- Natuzzi S.p.A.

- Raymour & Flanigan Furniture, Inc.

- RH

- The Home Depot, Inc.

- Wayfair Inc.

- Williams-Sonoma, Inc.

Driving Market Leadership through Strategic Digital Enrichment, Modular Offerings, and Agile Regional Manufacturing

Industry leaders can capitalize on emerging opportunities by embedding digital innovation at every stage of the customer journey. Implementing immersive visualization platforms-such as augmented reality room planners and VR-enabled showrooms-enables prospective buyers to experience furniture within their actual living environments. This capability not only accelerates decision cycles but also enriches personalized recommendation engines, boosting conversion rates in both online and offline channels.

Meanwhile, optimizing product assortments with modular and customizable options addresses evolving spatial and lifestyle demands. Introducing configurable seating modules and interchangeable table components allows consumers to tailor furnishings to their precise needs, reducing return rates and fostering deeper brand engagement. Integrating sustainable materials-ranging from reclaimed timbers to innovative plant-based composites-further resonates with environmentally conscious audiences and differentiates portfolios in an increasingly competitive landscape.

On the operational front, establishing regional production hubs and nearshore partnerships can alleviate tariff pressures and improve supply chain agility. By localizing manufacturing in key markets, companies shorten lead times, reduce logistics expenses, and enhance responsiveness to demand fluctuations. Coupling these efforts with advanced analytics-monitoring real-time sales performance, inventory levels, and consumer sentiment-enables continuous refinement of product launches and marketing tactics, ensuring that organizations stay ahead of dynamic market currents.

Outlining a Rigorous Multi-Layered Research Framework Incorporating Primary Interviews, Secondary Data Analysis, and Advanced Validation

This research report synthesizes insights gathered through a rigorous, multi-layered methodology designed to ensure accuracy and relevance. Primary research involved in-depth interviews with C-level executives, product managers, and supply chain specialists across the furniture and home décor sectors. These stakeholder conversations were complemented by quantitative surveys of end consumers to capture evolving preferences, purchase drivers, and post-purchase satisfaction indicators.

Secondary research entailed comprehensive analysis of trade publications, industry journals, regulatory filings, and customs data to validate supply chain trends and tariff impacts. Proprietary databases tracking retail channel performance and material cost fluctuations provided historical context and revealed emerging patterns. Competitive intelligence and SWOT analyses of key market participants further enriched the understanding of strategic initiatives and relative positioning.

Data triangulation techniques merged qualitative findings with quantitative metrics, ensuring that insights reflect both empirical evidence and expert perspectives. Geographic coverage encompassed North America, Europe, the Middle East, Africa, and Asia-Pacific, with segmentation by product type, distribution channel, material, and style. Rigorous validation protocols-such as expert panel reviews and cross-verification against multiple data sources-underpin the credibility of the conclusions drawn.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Living & Dining Room market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Living & Dining Room Market, by Product Type

- Living & Dining Room Market, by Material Type

- Living & Dining Room Market, by Style

- Living & Dining Room Market, by Distribution Channel

- Living & Dining Room Market, by Region

- Living & Dining Room Market, by Group

- Living & Dining Room Market, by Country

- United States Living & Dining Room Market

- China Living & Dining Room Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Distilling Key Takeaways to Highlight Imperatives for Agility, Sustainability, and Personalized Engagement in the Evolving Furniture Landscape

The collective analysis underscores that the Living & Dining Room market is in the midst of a profound transformation driven by technological integration, sustainability mandates, and evolving consumer lifestyles. The convergence of multifunctional design, smart connectivity, and circular economy principles is setting new benchmarks for how furniture is conceived, manufactured, and experienced. Stakeholders who embrace these trends will unlock untapped value streams and reinforce brand loyalty in an increasingly discerning market.

Achieving competitive advantage requires a holistic approach: integrating digital and physical retail channels, diversifying supply chains to manage tariff exposure, and offering product portfolios that blend style with personalization. Regional nuances-from the preference for modular lounge solutions in North America to the appetite for luxury materials in EMEA and the digital customization demands of Asia-Pacific-necessitate tailored go-to-market strategies. By leveraging segmentation insights, companies can align product innovation and channel investments with the unique demands of each consumer segment.

Moving forward, agility and transparency will be critical. Companies must continuously monitor regulatory shifts, material cost dynamics, and consumer sentiment to recalibrate strategies in real time. Those that cultivate resilient operations, champion sustainable practices, and deliver immersive, personalized experiences are best positioned to lead the market’s next chapter.

Secure Expert Guidance from the Associate Director of Sales & Marketing to Acquire the Definitive Living & Dining Room Market Research Report

Ready to transform your strategic roadmap with comprehensive insights and actionable intelligence on the Living & Dining Room market for 2025? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the full market research report and gain the competitive edge your business deserves. Elevate your decision-making, align with emerging trends, and capitalize on untapped opportunities today.

- How big is the Living & Dining Room Market?

- What is the Living & Dining Room Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?