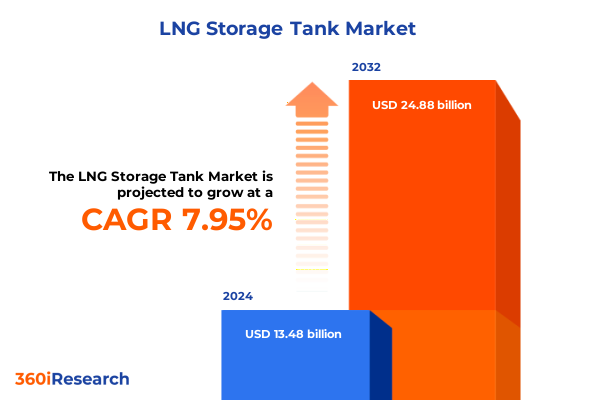

The LNG Storage Tank Market size was estimated at USD 14.49 billion in 2025 and expected to reach USD 15.59 billion in 2026, at a CAGR of 8.02% to reach USD 24.88 billion by 2032.

Introduction to the Evolving Dynamics of Liquefied Natural Gas Storage Tanks Shaping Infrastructure Resilience and Market Trajectories

The liquefied natural gas storage tank sector stands at a pivotal crossroads, shaped by accelerating energy transition imperatives and intensifying infrastructure modernization pressures. As global demand for cleaner-burning fuels escalates, stakeholders are reimagining storage solutions that can accommodate rising capacity requirements while ensuring safety, environmental compliance, and operational efficiency. This dynamic context underscores the criticality of a thorough understanding of current market drivers, technological advancements, and regulatory landscapes to inform strategic decision-making.

Against this backdrop, industry participants-from manufacturers and engineering firms to downstream distributors and regulatory bodies-are seeking a cohesive narrative that elucidates the converging trends redefining the storage tank arena. Technologies such as advanced insulation systems, modular fabrication techniques, and digital monitoring platforms are rapidly maturing, promising to enhance performance and drive cost efficiencies. Concurrently, evolving policy frameworks, both at federal and state levels, are reshaping the risk–reward calculus for new infrastructure investments.

This introduction therefore frames the comprehensive exploration that follows, distilling the essential factors driving competitive differentiation. It emphasizes the necessity for market participants to synthesize technological, economic, and regulatory insights in order to anticipate disruption, capitalize on emerging opportunities, and mitigate potential pitfalls. Ultimately, this section sets the stage for an in-depth examination of transformative shifts, tariff implications, segmentation strategies, and actionable guidance tailored to stakeholders navigating the liquefied natural gas storage tank landscape.

Transformational Shifts Redefining the Liquefied Natural Gas Storage Tank Landscape Amid Emerging Technologies and Regulatory Frameworks

The landscape of liquefied natural gas storage tanks has undergone transformative shifts propelled by a confluence of technological innovation, regulatory tightening, and evolving end-user requirements. Over the past few years, the sector has moved beyond conventional single containment models to embrace a spectrum of containment architectures engineered for heightened integrity and leak prevention. Advanced double containment and full containment configurations have gained traction among project developers seeking to comply with more rigorous safety standards and to mitigate the risk profile of large-scale storage installations.

Concurrent with design evolution, material science breakthroughs-particularly in 9% nickel steel formulations and aluminum alloys-have unlocked new possibilities for cryogenic resilience and long-term durability. These materials not only exhibit superior toughness at sub-zero temperatures but also deliver lifecycle cost advantages through enhanced resistance to brittle fracture. This progress has been further augmented by modular construction methodologies, which facilitate offsite fabrication, reduce onsite assembly timelines, and minimize exposure to weather-related disruptions.

Regulatory developments have also steered the market trajectory, with key jurisdictions tightening emissions and environmental impact requirements for LNG handling facilities. This regulatory impetus has galvanized investments in digital monitoring solutions and predictive maintenance platforms, enabling real-time integrity assessments and streamlined compliance reporting. As the industry looks ahead, stakeholders will remain vigilant in monitoring how these transformative shifts continue to recalibrate risk management practices and capital deployment strategies across the global LNG storage tank ecosystem.

Assessing the Comprehensive Impact of 2025 United States Tariffs on Domestic Liquefied Natural Gas Storage Tank Manufacturing and Supply Chains

In 2025, the United States instituted a suite of tariffs targeting imported components and finished storage tank assemblies, aiming to bolster domestic manufacturing and safeguard strategic energy infrastructure. These measures have precipitated a complex set of direct and indirect effects across the supply chain. On the one hand, domestic fabricators have ramped up production capabilities to capitalize on preferential treatment, leading to enhanced capacity utilization and incremental advancement in localized fabrication techniques. On the other hand, OEMs reliant on specialized foreign inputs have encountered supply bottlenecks, elevating lead times and exerting upward pressure on procurement budgets.

The cumulative impact of these tariffs extends beyond cost inflation. Conventional cross-border procurement models have been reevaluated in light of new duty structures, triggering a shift toward hybrid sourcing strategies that blend domestic and vetted international suppliers. In response, several tier-one tank manufacturers have entered into strategic partnerships with offshore fabricators to negotiate tariff exclusions or to repatriate certain manufacturing stages, thus preserving access to critical components while adhering to regulatory mandates.

Furthermore, end-users across energy, manufacturing, and transportation segments are recalibrating project timelines to mitigate the risk of further trade policy volatility. This cautious stance has manifested in extended contracting windows and greater emphasis on contractual clauses that allocate tariff escalation risks to suppliers. As the dust settles on the initial wave of tariffs, market participants continue to adapt their capital planning and supply chain architectures to ensure resilience in an increasingly protectionist trade environment.

Strategic Segmentation Insights Unveiling Key Dimensions of the Global Liquefied Natural Gas Storage Tank Market Through Type Material and Capacity Lenses

A nuanced understanding of the liquefied natural gas storage tank market emerges through a multidimensional segmentation lens, revealing distinct performance drivers and investment priorities. From the containment perspective, storage solutions bifurcate into non-self supportive tanks-traditionally employed in smaller-scale or portable applications-and self-supportive variants, the latter encompassing advanced double containment, full containment, and single containment structures tailored for large-scale, fixed installations. Each configuration presents unique trade-offs between capital intensity, thermal performance, and site adaptability.

Material selection further delineates market dynamics, with 9% nickel steel commanding preference in ultra-low temperature environments due to its exceptional cryogenic resilience. Aluminum alloys have likewise carved out niches where weight sensitivity and corrosion resistance are paramount, while conventional steel remains a cost-effective option for less demanding applications. The interplay between material costs, fabrication complexity, and operational demands informs procurement decisions at each tier of the value chain.

Capacity tiers introduce another vector of differentiation: smaller vessels under 5,000 liters cater to mobile and decentralized applications, whereas intermediate ranges spanning 5,000 to 100,000 liters serve a mix of industrial and commercial users. Tanks exceeding 100,000 liters are predominantly deployed in large terminal and import/export facilities, balancing economies of scale against enhanced structural safeguards. Simultaneously, installation modalities-fixed above-ground or in-ground tanks versus mobile skidded units-drive site preparation requirements and influence long-term maintenance strategies.

Orientation configurations, whether horizontal cylinders or vertical columns, offer further design flexibility, impacting spatial footprint, filling rates, and integration with ancillary equipment. End-user industries such as energy and power generation, oil and gas, industrial manufacturing, and transportation exert divergent performance criteria, necessitating tailored storage solutions. Finally, the utility segmentation-encompassing storage, transportation, and regasification-underscores the multifunctional roles that tanks perform within the broader LNG value chain. Collectively, these segmentation insights illuminate the intricate matrix of technical, economic, and regulatory considerations shaping investment and development pathways.

This comprehensive research report categorizes the LNG Storage Tank market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Capacity

- Installation Type

- Configurations

- End-User Industry

- Utility

Region-Specific Perspectives Illuminating Growth Drivers and Barriers Across the Americas Europe Middle East Africa and Asia-Pacific LNG Storage Tank Markets

Regional market behavior in the liquefied natural gas storage tank sector exhibits pronounced heterogeneity, driven by distinct demand catalysts and infrastructure imperatives. In the Americas, the confluence of robust shale gas production and expanding LNG export ambitions has spurred significant additions to storage and loading terminal capacities. North America’s focus on resilience and domestic content integration has accelerated the deployment of self-supportive, full containment tanks, while Latin American markets prioritize modular, mid-scale vessels to address emerging distribution networks.

Across Europe, the Middle East, and Africa, geopolitical considerations and energy security objectives underpin infrastructure investments. Western Europe’s progressive decarbonization targets have elevated the role of floating storage solutions and advanced digital monitoring to ensure uninterrupted supply during peak demand cycles. The Middle East maintains its status as a key exporter, emphasizing large-scale, above-ground tanks engineered for high throughput, whereas select African markets are in nascent stages of LNG import infrastructure development, favoring cost-effective, smaller-capacity units.

In the Asia-Pacific region, vigorous industrialization and urbanization trends drive the expansion of both import terminals and downstream regasification sites. China and India, in particular, have prioritized the indigenization of storage tank fabrication, marrying domestic steel production with international design standards. Southeast Asian nations leverage mobile skidded tanks to accelerate project roll-outs, while Oceania’s remote populations utilize a mix of horizontal and vertical configurations to optimize site footprints. These regional narratives collectively underscore the importance of tailored solutions that harmonize local market needs with global best practices.

This comprehensive research report examines key regions that drive the evolution of the LNG Storage Tank market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Corporate Profiles Highlighting the Competitive Strategies Product Innovations and Market Positioning of Leading LNG Storage Tank Manufacturers

Leading enterprises within the liquefied natural gas storage tank ecosystem have distinguished themselves through strategic investments in advanced containment designs, digital innovations, and sustainability initiatives. Several key players have channeled research and development budgets into next-generation insulation technologies that facilitate slimmer tank profiles without compromising cryogenic performance, thereby unlocking new flexibility in site integration. At the same time, collaborative ecosystems among engineering, procurement, and construction partners have matured, enabling streamlined project delivery workflows and knowledge transfers across geographies.

Competitive positioning also reflects diverging approaches to vertical integration. Some manufacturers have extended their service portfolios to encompass end-to-end project engineering and maintenance solutions, strengthening customer relationships and recurring revenue streams. Others have prioritized partnerships with specialty steel and alloy producers to secure privileged access to high-performance materials and to co-develop alloys with tailored mechanical properties. This dual emphasis on service depth and material innovation has heightened barriers to entry and intensified differentiation among tier-one, tier-two, and tier-three enterprises.

Furthermore, sustainability imperatives are reshaping corporate strategies, with an increasing number of manufacturers setting ambitious greenhouse gas reduction targets within their operations and across the lifecycle of their storage solutions. Circular economy principles are being applied to fabrication waste reduction and to the design of decommissioning processes, while digital twins and remote monitoring platforms are enhancing asset reliability and safety. Together, these corporate initiatives exemplify how industry pioneers are sculpting the competitive landscape and raising performance benchmarks for both incumbents and emerging challengers.

This comprehensive research report delivers an in-depth overview of the principal market players in the LNG Storage Tank market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Water Inc.

- Baker Hughes Company

- Chart Industries, Inc.

- China International Marine Containers (Group) Co., Ltd.

- Chiyoda Corporation

- Corban Energy Group

- CRYOCAN

- Cryogas Equipment Private Limited

- CRYOLOR SA by AIR LIQUIDE S.A.

- Doosan Corporation

- Exxon Mobil Corporation

- GTT

- HDR, Inc.

- IHI Corporation

- INOX India Limited

- ISISAN A.S.

- JGC Holdings Corporation

- Kawasaki Heavy Industries, Ltd.

- KBR, Inc.

- Lapesa Grupo Empresarial

- Linde PLC

- McDermott International, Ltd

- Mitsubishi Heavy Industries, Ltd

- POSCO Engineering & Construction Co., Ltd.

- PUNJ LLOYD LTD

- QatarEnergy LNG

- Saipem S.p.A.

- SINOPEC Corporation

- TOYO KANETSU K.K.

- TransTech Energy, LLC

- Vijay Tanks & Vessels (P) Ltd.

- VINCI

- Zhongyou Tongyong Luxi Natural Gas Equipment Co., Ltd

Actionable Strategic Recommendations Empowering Industry Leaders to Navigate Tariff Pressures Supply Chain Disruptions and Technological Transformations in LNG Storage

Industry leaders should focus on fortifying supply chains by cultivating diversified partnerships that blend domestic and international capabilities, thereby mitigating tariff-induced disruptions and lead-time volatility. Embracing modular construction methodologies will not only accelerate project execution but also enhance quality control through offsite fabrication environments. Aligning procurement strategies with early supplier engagement and long-term contracts can secure preferential access to high-performance materials while distributing risk across the supplier ecosystem.

Technology adaptation must be prioritized, with a concerted shift toward integrating digital monitoring and predictive analytics platforms into storage tank operations. By leveraging sensor-enabled diagnostics and advanced data analytics, operators can anticipate maintenance requirements, optimize thermal performance, and ensure regulatory compliance with minimal operational downtime. In tandem, a focus on next-generation insulation materials will help reconcile the dual imperatives of reducing boil-off rates and minimizing structural footprints.

Sustainability objectives should be interwoven into both strategic roadmaps and day-to-day operations. Setting clear decarbonization targets tied to Scope 1 and Scope 2 emissions will galvanize internal innovation, while collaboration with material suppliers and EPC contractors can expand circular economy commitments to fabrication waste reduction and end-of-life tank recycling. Finally, executives should amplify workforce capabilities by investing in specialized training programs that cover both technical competencies-such as cryogenic welding and instrumentation-and digital fluency to ensure that talent pools can effectively deploy and maintain advanced storage solutions.

Comprehensive Research Methodology Detailing Data Collection Analytical Techniques and Validation Protocols Underpinning the LNG Storage Tank Market Study

This study employs a robust, multi-phase research methodology designed to deliver rigorous and transparent insights into the liquefied natural gas storage tank market. The process began with an extensive secondary research phase, drawing on publicly available regulatory filings, trade association reports, industry journals, and peer-reviewed literature to build a foundational knowledge base. This desk research was complimented by proprietary data mining of equipment registries and patent databases to track emergent technologies and innovation trajectories.

Primary research formed the core of the analysis, involving structured interviews and verification calls with key stakeholders, including original equipment manufacturers, engineering consulting firms, terminal operators, and regulatory experts. This qualitative engagement was supplemented with quantitative surveys targeting project developers and end-users to capture decision-making criteria, capital expenditure patterns, and technology adoption rates. All primary respondents were vetted for domain expertise and cross-referenced to ensure data validity.

Analytical frameworks integrated both bottom-up and top-down approaches. The bottom-up analysis synthesized component cost breakdowns and project-level capital expenditure data, while the top-down perspective assessed macroeconomic indicators and LNG trade flow statistics. Triangulation techniques were applied throughout to reconcile divergent data points, and sensitivity analyses were conducted to test the robustness of key insights against variations in material prices, tariff levels, and regulatory scenarios. The result is a comprehensive, validated market study that reflects the nuanced interplay of technological, economic, and policy drivers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our LNG Storage Tank market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- LNG Storage Tank Market, by Type

- LNG Storage Tank Market, by Material

- LNG Storage Tank Market, by Capacity

- LNG Storage Tank Market, by Installation Type

- LNG Storage Tank Market, by Configurations

- LNG Storage Tank Market, by End-User Industry

- LNG Storage Tank Market, by Utility

- LNG Storage Tank Market, by Region

- LNG Storage Tank Market, by Group

- LNG Storage Tank Market, by Country

- United States LNG Storage Tank Market

- China LNG Storage Tank Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Synthesis of Key Findings Underscoring Strategic Imperatives and Emerging Opportunities in the Liquefied Natural Gas Storage Tank Sector

The synthesis of findings from this research underscores the imperative for stakeholders to adopt a holistic approach that integrates advanced technologies, resilient supply chain strategies, and sustainability commitments. The confluence of regulatory tightening, tariff complexities, and rapid material innovations demands agile operational frameworks that can adjust to evolving risk landscapes without sacrificing cost competitiveness or performance integrity.

Segmentation insights reveal that success hinges on matching storage tank configurations-be it containment type, material composition, or capacity-to the specific demands of end-user industries and regional contexts. Moreover, the growing importance of digitalization and predictive maintenance underscores a broader shift toward data-driven asset management.

Ultimately, those enterprises that excel will be the ones that harmonize technical excellence with strategic foresight, leveraging collaborative partnerships and cutting-edge technologies to unlock new efficiencies and market opportunities. By internalizing these strategic imperatives, organizations can confidently navigate the complexities of the liquefied natural gas storage tank landscape and secure sustainable growth trajectories.

Engaging Next Steps Invitation from Ketan Rohom Associate Director Sales Marketing to Secure the Full In-Depth LNG Storage Tank Market Research Report

Elevate your strategic planning with unparalleled insights into the evolving liquefied natural gas storage tank market by securing the comprehensive report today. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored data analyses, proprietary segmentation deep dives, and expert-driven recommendations that will inform your investment decisions and operational frameworks. By initiating this collaboration, you gain privileged access to in-depth coverage of tariff impacts, regional growth dynamics, and competitive positioning that are critical for sustaining a competitive edge. Don’t navigate these complex market currents alone-partner with an industry authority to unlock definitive guidance and actionable intelligence designed to propel your organization forward. Connect now to ensure you’re equipped with the meticulous research report that can transform challenges into opportunities in the LNG storage tank sector

- How big is the LNG Storage Tank Market?

- What is the LNG Storage Tank Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?