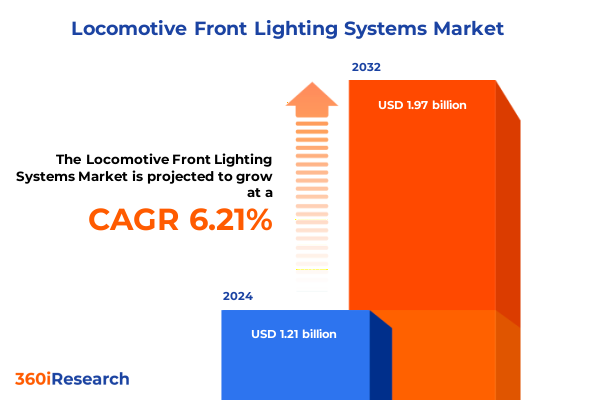

The Locomotive Front Lighting Systems Market size was estimated at USD 1.29 billion in 2025 and expected to reach USD 1.37 billion in 2026, at a CAGR of 6.23% to reach USD 1.97 billion by 2032.

Pioneering the Evolution of Locomotive Front Lighting Systems Amidst Technological Innovation and Regulatory Change for Enhanced Safety and Efficiency

Effective locomotive front lighting systems are indispensable for ensuring rail safety, operational reliability, and regulatory compliance across freight, passenger, and shunting operations. As rail networks expand and speeds increase, the demand for high-intensity beam performance, uniform illumination, and robust design resilience has intensified. In addition to enhancing visibility for train crews, lighting modules now interface with collision avoidance sensors and camera-based detection platforms to form an integrated safety ecosystem. Front lighting has thus evolved from a basic visibility aid into a critical component supporting predictive maintenance, remote diagnostics, and asset tracking initiatives.

Building on this foundation, recent years have witnessed a dramatic shift from traditional halogen and high-intensity discharge configurations toward advanced LED solutions capable of delivering greater lumen output with significantly lower power consumption. The modular design of projector LEDs, combined with sealed beam LED options, offers operators the flexibility to tailor illumination profiles while reducing maintenance intervals and minimizing downtime costs. Meanwhile, halogen variants continue to provide cost-effective solutions for legacy fleets seeking incremental performance improvements without full system overhauls, especially in regions where initial capital expenditure constraints remain a primary consideration.

Moreover, evolving regulatory frameworks across key markets are exerting pressure on manufacturers and operators to meet stringent energy efficiency and environmental standards. Emission reduction targets in North America, Europe, and Asia-Pacific have broadened in scope to include ancillary systems such as lighting, driving the adoption of low-carbon materials, recyclable components, and end-of-life management programs. Compliance requirements for electromagnetic compatibility, ingress protection, and crashworthiness further underscore the need for holistic design approaches. Against this backdrop, strategic investments in front lighting innovation are now central to fleet modernization programs and long-term asset optimization strategies

Navigating a Landscape Transformed by Digitalization Platform Integration and Sustainability Demands in Locomotive Lighting Solutions

Digital transformation has reshaped the locomotive lighting landscape, ushering in a new era where connectivity and data analytics augment traditional illumination functions. Integrated control units now enable real-time monitoring of bulb performance, beam alignment, and thermal load. This connectivity facilitates predictive maintenance scheduling, reducing unexpected service disruptions and extending component lifecycles. Manufacturers are leveraging Internet of Things platforms to gather field performance data, feeding back into design refinements that optimize lumen efficiency and power consumption under varying operational conditions.

In particular, the convergence of lighting systems with onboard diagnostics and remote asset management tools has unlocked opportunities for OEMs and fleet operators to deliver value-added services. Lighting-as-a-service models, underpinned by cloud-based analytics, allow for usage-based pricing and proactive component replacement. As a result, procurement strategies are shifting away from outright purchases toward service-oriented contracts that align incentives across the value chain. Simultaneously, enhanced data transparency fosters collaborative innovation among equipment suppliers, signaling technology firms, and rail operators, driving bespoke solutions tailored to specific route profiles and environmental challenges.

Sustainability mandates and corporate responsibility goals are further propelling the adoption of energy-efficient lighting technologies and circular economy principles. Lifecycle assessments now account for end-of-life recycling, material sourcing, and carbon footprints, prompting manufacturers to explore bio-based polymers and modular architectures that simplify disassembly. Meanwhile, emerging standards for light pollution and glare control are influencing headlight beam patterns and shielding designs, ensuring minimal ecological impact on surrounding habitats. Collectively, these transformative shifts underscore the necessity for stakeholders to embrace holistic, technology-driven strategies that balance performance, regulatory compliance, and environmental stewardship

Assessing the Far-Reaching Effects of 2025 United States Tariff Adjustments on Supply Chains and Cost Structures in Front Lighting

In early 2025, the United States implemented a new tariff regime targeting a range of imported locomotive lighting components, with the objective of bolstering domestic manufacturing capacity and safeguarding strategic supply chains. These duties, levied on essential materials such as high-grade aluminum housings, specialized optics, and semiconductor chips, have introduced significant cost pressures for international suppliers and rail operators alike. As tariffs increased input pricing by double-digit percentages, procurement teams were compelled to revisit sourcing strategies and evaluate the financial viability of existing supplier contracts.

Consequently, many OEMs and component manufacturers accelerated efforts to localize production, investing in U.S.-based assembly lines and strategic partnerships with regional foundries. This pivot, while mitigating exposure to import fees, has necessitated capital-intensive facility upgrades and workforce training programs to meet stringent quality and compliance requirements. At the same time, reduced dependence on cross-border logistics has delivered ancillary benefits in terms of lead time reduction and inventory optimization, although these gains have been partially offset by the learning curve associated with domestic manufacturing scale-up.

As a result, front lighting system assemblers are exploring design modifications to accommodate alternative materials and modular architectures that simplify assembly and reduce reliance on tariff-affected components. Innovative approaches include the integration of standardized optical modules and interchangeable LED arrays sourced from diversified supplier networks. While end-users may experience incremental cost pass-through in the short term, the broader industry outlook anticipates long-term resilience gains through supply chain agility, enhanced quality control, and reduced geopolitical exposure

Unveiling Critical Segmentation Insights for Front Lighting Markets Across Diverse Light Sources Locomotive Types and Installation Variants

An in-depth examination of light source typologies reveals nuanced performance characteristics and application suitability across halogen, high-intensity discharge, and LED technologies. Legacy fleets often rely on incandescent and sealed beam halogen fixtures for their proven reliability and ease of integration, whereas metal halide and xenon high-intensity discharge systems deliver higher luminous efficacy and color rendering capabilities suitable for high-speed operations. Conversely, projector LED modules and standard LED arrays have emerged as the preferred option for new-builds and retrofit projects owing to their modular design, superior energy efficiency, and extended operational lifespans.

Differentiating locomotive types further clarifies market dynamics, with heavy and intermodal freight applications demanding durable lighting solutions capable of withstanding substantial vibration and heavy load profiles. High-speed and regional passenger services prioritize optics that optimize beam distribution to enhance passenger comfort and track visibility under varying ambient conditions. Industrial and yard shunting locomotives require lighting systems engineered for low-speed maneuvering and confined yard environments, balancing concentrated illumination with robust housing that resists impact and contaminants.

Installation type segmentation highlights distinct procurement pathways and lifecycle considerations between aftermarket solutions and original equipment manufacture. Replacement and retrofit offerings provide economically attractive upgrade paths for aging fleets, leveraging plug-and-play interfaces and minimal modification requirements. In contrast, new-build programs integrate lighting assemblies at the OEM stage, benefiting from harmonized electrical architectures and streamlined validation processes that reduce installation costs and facilitate regulatory certification.

Examination of mounting configurations and distribution channels underscores additional layers of complexity. Center nose and side nose mountings serve as the primary interface for forward illumination on the locomotive’s leading edge, while front roof and top cab positions offer alternative vantage points for optimized beam spread on high-clearance units. Manufacturer-direct and OEM-direct sales channels afford end users direct engagement with original producers, whereas authorized dealers and independent distributors extend reach into aftersales markets, offering localized support and flexible inventory solutions

This comprehensive research report categorizes the Locomotive Front Lighting Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Light Source Type

- Locomotive Type

- Installation Type

- Mounting Type

- Sales Channel

Highlighting Regional Dynamics Shaping Front Lighting Adoption Trends Across the Americas Europe Middle East Africa and Asia Pacific

In the Americas, robust investment in rail infrastructure modernization and stringent safety regulations have driven demand for advanced front lighting technologies. North American Class I railways prioritize LED conversions to achieve energy savings and comply with Federal Railroad Administration visibility mandates. Meanwhile, emerging markets in Latin America pursue retrofit programs to upgrade aging fleets, spurred by government-backed financing initiatives that emphasize operational resilience and cross-border freight coordination. This regional focus on cost-effective, durable solutions has catalyzed a vibrant aftermarket ecosystem, with distributors and service providers collaborating to deliver turnkey upgrade packages.

Europe, the Middle East, and Africa present a diverse regulatory mosaic, where European Union directives on energy performance and waste management propel lighting system innovation, and Gulf Cooperation Council nations invest heavily in rapid passenger transit projects. In Sub-Saharan Africa, electrification efforts and urban rail expansions create nascent opportunities for lighting suppliers capable of tailoring solutions to variable power infrastructures. Across this combined region, operators place a premium on modular designs that facilitate incremental upgrades, while multilateral trade agreements influence component sourcing strategies and regional manufacturing footprints.

Asia Pacific stands out for its dynamic growth in high-speed rail networks, particularly in China and India, where front lighting systems incorporate adaptive beam control and smart diagnostics features. Japan’s Shinkansen and South Korea’s KTX fleets leverage LED projector assemblies optimized for minimal glare and resilience against seismic disturbances. Rapid industrialization in Southeast Asia also elevates demand for high-efficacy lighting on shunting locomotives serving bustling port complexes. Collectively, these markets prioritize integration with digital asset management platforms and favor suppliers offering broad service networks to support extensive rail corridors

This comprehensive research report examines key regions that drive the evolution of the Locomotive Front Lighting Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Innovators and Strategic Partnerships Driving Advancements in Locomotive Front Lighting Technologies and Integration Solutions

Major original equipment manufacturers and specialized lighting firms are at the forefront of introducing cutting-edge illumination solutions tailored to the rail sector. Industry veterans have expanded product portfolios to include smart LED modules, integrated sensor arrays, and cloud-enabled control systems. Collaborative ventures between lighting specialists and rail signaling companies have yielded adaptive lighting platforms that respond to track conditions and ambient environments, enhancing safety and operational efficiency. Moreover, strategic alliances with semiconductor suppliers have enabled rapid scaling of next-generation LED chips, addressing both luminous performance and thermal management challenges.

Emerging players and tier-two suppliers contribute to market dynamism by focusing on niche applications and rapid prototyping. These firms often partner with research institutions to accelerate the development of novel materials, such as advanced optics coatings and lightweight composite housings, which improve beam quality and reduce unit weight. Additionally, service providers specializing in retrofit and maintenance have established cross-industry partnerships to deliver turnkey roll-out programs, integrating installation services with performance analytics. Such collaborative ecosystems facilitate knowledge exchange and accelerate the adoption of modular architectures that can be readily customized to diverse locomotive platforms

This comprehensive research report delivers an in-depth overview of the principal market players in the Locomotive Front Lighting Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alstom SA

- Amglo Kemlite Laboratories, Inc.

- Construcciones y Auxiliar de Ferrocarriles, S.A.

- CRRC Corporation Limited

- General Electric Company

- Hitachi Rail Ltd.

- Hyundai Rotem Company

- J.W. Speaker Corporation

- PESA Bydgoszcz S.A.

- Railhead Corporation

- Siemens Mobility GmbH

- Signify Holding

- Stadler Rail AG

- Toshiba Infrastructure Systems & Solutions Corp.

- TransLight Corp

- Wabtec Corporation

Strategic Recommendations Empowering Industry Leaders to Capitalize on Emerging Trends and Optimize Front Lighting Performance and Compliance

To secure competitive advantage, industry leaders should prioritize transitioning legacy fleets toward modular LED-based lighting architectures that offer plug-and-play retrofit compatibility. Investing in research collaborations to develop standardized optical and control interfaces can reduce time to market and facilitate aftermarket service offerings. Additionally, operators and suppliers should cultivate strategic relationships with regional assembly partners to mitigate tariff impacts and optimize supply chains, leveraging local manufacturing incentives and workforce expertise to drive cost efficiencies.

Furthermore, embedding connectivity features directly into lighting modules enables the capture of granular performance and environmental data, laying the groundwork for predictive maintenance and usage-based service contracts. By aligning incentives across OEMs, service providers, and end-users, stakeholders can unlock new revenue streams while minimizing unplanned downtime. Simultaneously, dedicating resources to lifecycle sustainability-through recyclable materials, energy-efficient designs, and end-of-life recovery programs-will not only fulfill regulatory obligations but also enhance brand reputation in an increasingly environmentally conscious market

Comprehensive Research Methodology Detailing Data Collection Analytical Frameworks and Validation Processes Underpinning the Front Lighting Study

This analysis is grounded in a rigorous mixed-methods approach, combining primary interviews with locomotive operators, component suppliers, and regulatory authorities with extensive secondary research from technical publications, industry standards, and engineering white papers. Qualitative insights were enriched through in-depth consultations with subject matter experts in rail safety, optical engineering, and supply chain management, ensuring that emerging trends and innovation drivers were accurately captured. Quantitative data was sourced from trade association reports, patent databases, and publicly available financial disclosures to provide a multifaceted understanding of market dynamics.

Data validation was achieved through a triangulation process, where disparate information streams were cross-referenced to verify consistency and reliability. A structured scoring framework assessed technology readiness levels, regulatory alignment, and cost implications across various scenarios. Case studies of locomotive front lighting retrofits and new-build implementations were analyzed to extract best practices and performance benchmarks. Finally, all findings underwent peer review by an independent advisory panel comprising rail infrastructure specialists, materials scientists, and digital systems integrators to ensure methodological integrity and practical relevance

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Locomotive Front Lighting Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Locomotive Front Lighting Systems Market, by Light Source Type

- Locomotive Front Lighting Systems Market, by Locomotive Type

- Locomotive Front Lighting Systems Market, by Installation Type

- Locomotive Front Lighting Systems Market, by Mounting Type

- Locomotive Front Lighting Systems Market, by Sales Channel

- Locomotive Front Lighting Systems Market, by Region

- Locomotive Front Lighting Systems Market, by Group

- Locomotive Front Lighting Systems Market, by Country

- United States Locomotive Front Lighting Systems Market

- China Locomotive Front Lighting Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Synthesis of Critical Insights Reinforcing the Strategic Imperatives and Future Outlook for the Locomotive Front Lighting Ecosystem

The locomotive front lighting ecosystem stands at a pivotal juncture, shaped by the confluence of advanced LED technologies, digital integration, and evolving regulatory imperatives. Across diverse locomotion segments-from heavy freight to high-speed passenger services-the shift toward modular, energy-efficient lighting platforms resonates with broader industry objectives around safety, sustainability, and lifecycle optimization. Meanwhile, the 2025 tariff adjustments have expedited localization trends, prompting stakeholders to balance cost pressures with supply chain agility and quality control.

Looking ahead, the integration of smart diagnostics, adaptive beam control, and circular economy principles will define competitive differentiation. Companies and operators that embrace collaborative innovation, invest in resilient manufacturing footprints, and align lighting strategies with digital asset management stand to realize substantial operational efficiencies. As regulatory frameworks continue to advance, the capacity to anticipate compliance requirements and leverage emerging standards will become increasingly strategic, underscoring the need for agile, data-driven decision-making across the rail lighting value chain

Secure Your Access to In-Depth Locomotive Front Lighting Analysis by Connecting with Ketan Rohom to Elevate Strategic Decision Making

For organizations seeking to navigate the complexities of locomotive front lighting technologies and capitalize on emerging market opportunities, the full market research report offers unparalleled insights and practical guidance. From detailed segmentation analysis to regional dynamics and competitive intelligence, this comprehensive study equips decision-makers with the knowledge required to make informed investments and optimize operational performance.

To explore how these findings can inform your strategic initiatives and to obtain complete access to the data-rich report, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engaging directly will enable tailored discussions around your specific challenges and ensure timely delivery of actionable intelligence to support your planning and procurement objectives.

- How big is the Locomotive Front Lighting Systems Market?

- What is the Locomotive Front Lighting Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?