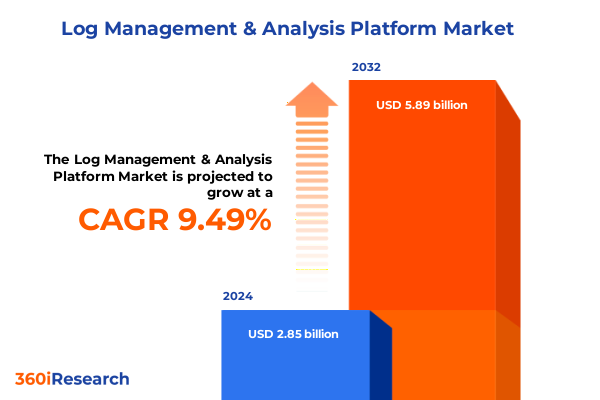

The Log Management & Analysis Platform Market size was estimated at USD 3.11 billion in 2025 and expected to reach USD 3.41 billion in 2026, at a CAGR of 9.55% to reach USD 5.89 billion by 2032.

Discover the strategic significance of log management and analysis platforms in driving operational resilience and security in modern enterprise infrastructures

In today’s digitized economy, the volume and complexity of machine-generated data have grown exponentially, demanding sophisticated log management and analysis capabilities. With IT environments spanning on-premise data centers, cloud services, and edge computing nodes, organizations face unprecedented challenges in capturing, storing, and making sense of vast log streams. Against this backdrop, a robust log management and analysis platform serves as the central nervous system of modern IT operations, offering unified visibility across infrastructure layers and application stacks.

By providing real-time ingestion, normalization, and correlation of log data, these platforms empower IT teams to detect anomalies, respond to security incidents, and optimize performance with precision. Beyond technical operations, insights derived from log analytics fuel data-driven decision-making for compliance reporting, capacity planning, and root cause analysis. As enterprises accelerate digital transformation initiatives, the strategic imperative for scalable, flexible, and secure log management solutions has never been greater. This introduction lays the foundation for understanding why mastering log data is critical to achieving operational resilience, proactive security postures, and sustained business growth.

Explore the dynamic shifts reshaping the log management landscape through cloud adoption, artificial intelligence infusion, and evolving regulatory requirements

The log management and analysis market is undergoing transformative shifts driven by breakthroughs in artificial intelligence, the ubiquity of cloud-based services, and evolving regulatory pressures. As microservices architectures and containers proliferate, the volume of ephemeral logs has surged, requiring platforms to adapt with distributed tracing and high-throughput ingestion engines. Concurrently, the infusion of AI and machine learning capabilities is redefining how organizations detect patterns and predict incidents, moving beyond reactive searches to proactive anomaly detection and autonomous threat hunting.

Furthermore, the migration to public and private cloud environments has prompted vendors to innovate deployment models that balance the agility of SaaS with the governance of on-premise solutions. As regulatory frameworks like the European Union’s NIS2 Directive and expanded data privacy laws take shape, compliance and reporting modules are becoming intrinsic to log analytics suites. Taken together, these dynamics are catalyzing a new era in which scalability, real-time intelligence, and embedded compliance become table stakes for any competitive offering.

Uncover how the 2025 United States tariff revisions are altering supply chains, cost structures, and competitive positioning in the log management technology market

In 2025, revised United States tariff policies have introduced material cost pressures across the technology supply chain, significantly influencing vendors and end users in the log management space. By imposing additional duties on imported networking hardware, servers, and specialized analytics appliances, the new tariff structures have increased capital expenditures for organizations that rely on proprietary, on-premise log collection and storage devices. As a result, many enterprises are reevaluating their total cost of ownership by considering cloud-native or managed service alternatives that offer lower upfront investment and predictable operating expenses.

Moreover, hardware-centric solution providers are adapting their roadmaps to mitigate tariff impacts, moving toward virtualized or software-only deployments that leverage commodity infrastructure. At the same time, service integrators are recalibrating pricing models to reflect higher import costs, passing a portion to customers while absorbing the remainder to stay competitive. These combined effects are accelerating the shift toward flexible delivery formats, underscoring the importance of vendor agility and customer-centric licensing strategies in navigating an increasingly tariff-influenced ecosystem.

Gain deep insights into market segmentation by component offerings, deployment models, organizational scales, industry verticals, and critical use case demands

Insight into the diverse needs of the log management and analysis market emerges most clearly when examining key segmentation dimensions that define buyer requirements and vendor strategies. In the realm of component offerings, the distinction between Services and Solutions illuminates how professional expertise and managed services blend with solutions like analysis and visualization, compliance and reporting, log collection, log storage, and security monitoring to deliver end-to-end value. Transitioning to deployment models, the choice between cloud, hybrid, and on premise reflects varying priorities around scalability, control, and latency, with many large enterprises favoring hybrid architectures to balance innovation and governance.

Organizational size further refines platform expectations, as Large Enterprises demand comprehensive feature sets and global support while Small and Medium Enterprises-encompassing both medium and small organizations-seek ease of use, rapid deployment, and cost-effective subscription plans. Industry vertical considerations also play a critical role, with sectors such as Banking, Financial Services and Insurance; Education; Energy and Utilities; Government and Public Sector; Healthcare; Information Technology and Telecom; Manufacturing; and Retail each exhibiting distinct compliance, performance, and security drivers. Finally, when evaluating use cases, stakeholders prioritize Business Analytics to optimize operations, Compliance Management to meet regulatory mandates, Operational Analytics for performance tuning, and Security Analytics to detect and respond to threats, resulting in tailored platform roadmaps that align tightly with mission-critical objectives.

This comprehensive research report categorizes the Log Management & Analysis Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Type

- Organization Size

- End User

Analyze the distinct regional dynamics driving adoption, investment trends, and regulatory influences across the Americas, Europe Middle East Africa, and Asia Pacific markets

Regional dynamics shape adoption patterns and investment priorities in meaningful ways across the global log management and analysis marketplace. In the Americas, mature digital infrastructures and stringent regulatory frameworks around data privacy have driven widespread adoption of cloud-centric solutions that deliver real-time security analytics and compliance reporting. North American organizations often leverage managed services to offset talent shortages while Latin American enterprises are increasingly exploring hybrid deployments to balance cost and performance considerations in evolving network environments.

Across Europe, the Middle East, and Africa, regulations such as GDPR and the NIS2 Directive have elevated the importance of integrated compliance modules, prompting a rise in demand for platforms that offer granular access controls and data residency options. Western European markets typically favor consolidated vendor suites, whereas emerging markets across Africa and the Gulf Cooperation Council are characterized by greenfield deployments with an emphasis on speed of implementation and localized support. Meanwhile, Asia-Pacific economies display a dual track of rapid cloud adoption-especially in advanced markets like Japan, Australia, and South Korea-and persistent on-premise investments in regions where data sovereignty and infrastructure constraints remain decisive factors. These regional insights underscore the imperative for vendors to tailor offerings to local compliance landscapes, cultural expectations, and maturity levels.

This comprehensive research report examines key regions that drive the evolution of the Log Management & Analysis Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine the strategic initiatives, product innovations, and partnership approaches of leading log management vendors shaping competitive differentiation

A review of leading log management and analysis vendors reveals a marketplace defined by both entrenched incumbents and agile disruptors, each leveraging unique strategies to capture share. Splunk continues to dominate with a broad platform that integrates observability and security, augmented by recent acquisitions focused on AI-driven insights. IBM’s QRadar maintains a strong presence among large enterprises seeking tightly coupled SIEM and analytics capabilities, while Elastic capitalizes on its open source heritage to offer a cost-effective, extensible stack favored by technical teams.

Cloud-native specialists such as Sumo Logic and Devo differentiate through rapid, multitenant architectures that simplify deployment and auto-scale with demand. LogRhythm’s unified approach blends SIEM with advanced threat detection, and SolarWinds appeals to midmarket segments through intuitive interfaces and streamlined onboarding. Additionally, Microsoft’s Sentinel is emerging as a compelling option, harnessing Azure’s global footprint and integrated threat intelligence feeds. Collectively, these vendors demonstrate how platform breadth, delivery flexibility, and ecosystem partnerships are pivotal factors in defining competitive positioning and customer adoption trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Log Management & Analysis Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CrowdStrike Holdings, Inc.

- Datadog, Inc.

- Devo Technology Corp.

- Elastic N.V.

- Google LLC

- Grafana Labs Inc.

- Graylog, Inc.

- IBM Corporation

- Loggly

- LogRhythm, Inc.

- Logz.io Ltd.

- ManageEngine (Zoho Corporation Pvt. Ltd.)

- McAfee Corp.

- Micro Focus International plc

- Microsoft Corporation

- New Relic, Inc.

- Paessler AG

- Rapid7, Inc.

- Sematext Group, Inc.

- Sentry, Inc.

- SolarWinds Corporation

- Splunk Inc.

- Sumo Logic, Inc.

Implement actionable strategies for industry leaders to enhance platform agility, strengthen security postures, and achieve differentiated value in complex IT environments

To thrive amidst intensifying competition and complex IT demands, industry leaders should adopt a set of targeted, actionable strategies. First, centralizing log management under a unified platform will eliminate silos and enhance visibility across distributed environments, enabling faster incident response and more comprehensive compliance reporting. Next, investing in cloud-native analytics and elastic storage architectures will ensure that data ingestion and query performance scale seamlessly with business growth, while also minimizing total cost of ownership through pay-per-use models.

Leaders should also prioritize the integration of AI and machine learning capabilities to automate anomaly detection and facilitate predictive insights, thereby shifting from manual forensics to proactive risk mitigation. In parallel, embedding compliance frameworks directly into workflows will reduce audit overhead and help organizations stay ahead of evolving regulatory mandates. Finally, forging strong partnerships with technology integrators and MSPs can extend service reach, accelerate implementation timelines, and enrich customer support, ensuring sustained value delivery as business needs evolve.

Understand the rigorous research methodology underpinning this study, including data collection techniques, analytical frameworks, and validation processes employed

This research leverages a blend of rigorous primary and secondary methodologies to ensure comprehensive coverage of the log management and analysis domain. Primary data was obtained through in-depth interviews with IT executives, security operations managers, and technology integrators across key industries, providing real-world perspectives on platform adoption drivers and pain points. Secondary research involved systematic review of vendor whitepapers, regulatory filings, industry publications, and publicly available financial reports to capture recent product launches, partnership announcements, and market developments.

To enhance analytical rigor, data triangulation techniques were applied, cross-verifying insights from multiple sources and validating findings with an advisory panel of subject matter experts. Qualitative and quantitative frameworks, including SWOT and PESTLE analyses, were employed to assess competitive environments and external influences. Segmentation models were meticulously defined across component offerings, deployment types, organization sizes, verticals, and use cases to uncover nuanced buyer preferences. Throughout the process, continuous quality assurance checks and peer reviews safeguarded the accuracy and reliability of conclusions, ensuring that the research serves as a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Log Management & Analysis Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Log Management & Analysis Platform Market, by Component

- Log Management & Analysis Platform Market, by Deployment Type

- Log Management & Analysis Platform Market, by Organization Size

- Log Management & Analysis Platform Market, by End User

- Log Management & Analysis Platform Market, by Region

- Log Management & Analysis Platform Market, by Group

- Log Management & Analysis Platform Market, by Country

- United States Log Management & Analysis Platform Market

- China Log Management & Analysis Platform Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesize key findings highlighting critical market dynamics, strategic imperatives, and future trajectories for stakeholders navigating the log management ecosystem

As organizations navigate an ever-evolving digital terrain, the insights captured in this executive summary underscore the pivotal role of log management and analysis platforms in delivering operational resilience, security intelligence, and regulatory compliance. Transformative technological advances, from AI-driven analytics to cloud-native architectures, are elevating performance expectations and redefining vendor competition, while macroeconomic factors such as US tariffs are reshaping cost structures and delivery models. At the same time, segmentation and regional analyses reveal the diversity of use case demands and regulatory requirements that vendors must address through tailored offerings.

Moving forward, success will hinge on the ability to seamlessly integrate advanced analytics, maintain agility in deployment, and foster strategic partnerships that amplify value delivery. By embracing the actionable recommendations outlined herein, stakeholders can optimize platform selection, streamline implementation, and anticipate emerging trends with confidence. Ultimately, those who proactively align their log management strategies with organizational objectives will secure a sustainable competitive advantage in a landscape of relentless change.

Engage directly with Ketan Rohom to secure your advanced copy of the comprehensive log management and analysis platform report and strategic insights

Are you ready to elevate your understanding of the log management and analysis landscape with unparalleled depth and clarity? Connect with Ketan Rohom, Associate Director of Sales & Marketing, who brings deep industry expertise and a consultative approach to help you access the full research report. By engaging directly, you will gain tailored guidance on how to leverage the comprehensive findings to address your strategic priorities, benchmark against peers, and accelerate time to value. Reach out today to secure your advanced copy of this indispensable resource and position your organization for sustained competitive advantage in a rapidly evolving digital environment

- How big is the Log Management & Analysis Platform Market?

- What is the Log Management & Analysis Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?