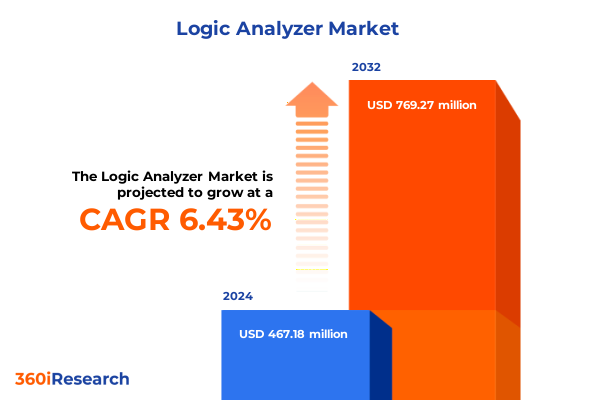

The Logic Analyzer Market size was estimated at USD 492.28 million in 2025 and expected to reach USD 523.62 million in 2026, at a CAGR of 6.58% to reach USD 769.27 million by 2032.

Unveiling the Critical and Expanding Role of Logic Analyzers in Modern Electronics Troubleshooting and System Development Environments

Logic analyzers have emerged as an indispensable instrument in the toolkit of engineers, technicians, and researchers who are designing, troubleshooting, and optimizing increasingly sophisticated electronic systems. Amid the proliferation of connected devices and embedded applications, precise timing analysis and signal integrity validation are critical to ensuring the reliability and performance of digital circuits. Over the past decade, the evolution of semiconductor architectures, the expansion of high-speed interfaces, and the acceleration of product development cycles have transformed the role of logic analyzers from niche laboratory tools into mainstream assets for innovation-driven companies.

As the complexity of digital designs escalates across industries such as automotive, aerospace, and telecommunications, the ability to capture and decode multiple protocols in real time has become a strategic imperative. This study delves into how industry stakeholders can leverage next-generation logic analysis platforms to address emerging challenges, including higher data rates, mixed-signal integration, and power constraints. By examining the current state of the logic analyzer domain and its trajectory, this section sets the stage for understanding how technological breakthroughs and market dynamics are reshaping diagnostic methodologies in modern electronics engineering.

Exploring the Technological Innovations and Paradigm Shifts Redefining the Logic Analyzer Landscape Across Multiple Industry Vertical Applications

The landscape of logic analyzers is undergoing a dramatic transformation driven by advances in hardware architecture, software intelligence, and connectivity paradigms. High-definition capture engines now enable sampling rates well into the multi-gigahertz range, while cloud-native analysis platforms facilitate collaborative debugging across geographically dispersed teams. Transitioning from legacy standalone boxes toward modular, PC-based, and hybrid cloud solutions has allowed organizations to scale their measurement capabilities in alignment with evolving project demands.

Simultaneously, the growing ubiquity of mixed-signal designs has propelled the integration of analog measurement channels, thereby broadening the applicability of logic analyzers in areas such as power integrity testing and electromagnetic compliance validation. In parallel, AI-powered signal classification and anomaly detection algorithms are becoming increasingly prevalent, reducing manual interpretation times and accelerating root-cause analysis. These intersecting innovations have engendered a new generation of intelligent measurement systems that can adapt to diverse industry protocols such as I2C, SPI, CAN, USB, Ethernet, and UART, thereby responding to the needs of complex embedded systems and real-time communication networks.

Amid these shifts, the competitive dynamics within the logic analyzer market have intensified, pushing vendors to differentiate through software ecosystems, extensible hardware modules, and subscription-based feature sets. Forward-thinking organizations are capitalizing on these developments by building integrated debugging suites that connect logic analysis with simulation, performance profiling, and digital twin frameworks, forging cohesive workflows that bridge design and test environments.

Evaluating the Compounding Consequences of United States Tariff Actions Introduced in 2025 on Logic Analyzer Supply Chains and Pricing Structures

In early 2025, the United States enacted a new tranche of tariffs targeting key electronic measurement equipment imports, including components integral to high-performance logic analyzers. Although the tariffs were instituted with the intention of bolstering domestic manufacturing, they have introduced incremental costs that ripple through design labs and production lines. Distributors and OEMs have faced recalibrated procurement strategies, seeking to offset price adjustments without compromising on analysis precision or throughput capabilities.

These levies have had a particularly pronounced impact on configurations dependent on specialized modular instruments sourced from international suppliers. In response, some manufacturers have localized assembly operations or identified alternative supply partners, sparking a wave of strategic realignments within the supply chain. However, the transition is often accompanied by extended lead times for custom modules and firmware updates, potentially delaying time-to-debug and product validation cycles.

Despite these challenges, the tariff-induced environment has also catalyzed innovation among domestic vendors, who are investing in indigenous research and development to close feature gaps and reinforce local value chains. Collaborative initiatives between industry consortia and government agencies aim to streamline component certification and accelerate qualification processes for homegrown solutions, which may ultimately foster a more resilient ecosystem for logic analysis tools. As stakeholders navigate this evolving tariff landscape, agile procurement and a diversified supplier portfolio have emerged as central pillars for mitigating cost pressures and sustaining competitive edge.

Decoding Key Segmentation Perspectives to Reveal How Product Types Protocols Industries Applications and Sales Channels Shape the Logic Analyzer Domain

Dissecting the logic analyzer market through multiple segmentation lenses reveals nuanced demand drivers and innovation hotspots. From a product type standpoint, modular solutions have surged in prominence, appealing to organizations that require flexibility to tailor channel counts and sampling rates, while PC-based systems offer a cost-effective entry point for smaller labs. Portable analyzers are gaining traction among field-service teams tasked with on-site diagnostics, and standalone instruments remain indispensable for high-performance bench applications.

When analyzing protocol support, the proliferation of automotive Ethernet, CAN-FD, and SPI interfaces underscores the growing complexity of in-vehicle networks and industrial control systems, whereas USB and UART maintain broad applicability in consumer electronics and embedded development. I2C and SPI continue to dominate sensor interfacing tasks, reflecting enduring requirements for low-pin-count communication in compact devices. Ethernet-based logic analysis has also evolved to address high-throughput data streams, aligning with the needs of data center validation and next-generation networking equipment.

Examining end-use industries, aerospace and defense programs demand rigorous traceability and data security, elevating requirements for certified instrumentation. Automotive manufacturers are integrating logic analyzers across commercial, electric, and passenger vehicle platforms to validate advanced driver-assistance and infotainment systems. Education and electronics OEMs prioritize affordability and ease of use to equip labs with foundational debugging capabilities, while healthcare and telecommunications sectors emphasize signal integrity and protocol decoding for life-critical applications.

In terms of application, digital communication analysis is at the core of most debugging workflows, complemented by embedded system debugging features that integrate code-triggered captures. Integrated circuit testing and protocol decoding workflows enable deep characterization of semiconductor devices, whereas signal integrity testing addresses jitter and crosstalk challenges in high-speed designs. Sales channel dynamics show that offline distribution remains vital for hands-on demonstrations and service contracts, while online channels-including both e-commerce platforms and vendor websites-accelerate procurement cycles and broaden market reach.

This comprehensive research report categorizes the Logic Analyzer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Protocol

- End Use Industry

- Application

- Sales Channel

Assessing Regional Market Dynamics to Illuminate How Americas EMEA and Asia-Pacific Regions Diverge in Logic Analyzer Adoption and Growth Drivers

Region-specific factors significantly influence logic analyzer adoption patterns and go-to-market strategies. In the Americas, the combination of a robust semiconductor ecosystem, leading research universities, and automotive innovation hubs drives strong demand for advanced logic analysis tools. North American defense programs and aerospace initiatives further reinforce requirements for high-channel-count and secure instrumentation, while South American markets are gradually scaling their testing capabilities amid growing electronics manufacturing investments.

Across Europe, the Middle East, and Africa, regulatory frameworks governing electromagnetic compatibility and data privacy shape procurement decisions, with many firms requiring test platforms that offer advanced filtering and secure data handling. Western Europe benefits from a dense network of specialist resellers and service providers, whereas emerging economies in the Middle East and African regions are demonstrating increasing interest in portable and PC-based logic analyzers to support infrastructure modernization projects.

The Asia-Pacific region represents a dynamic growth frontier, fueled by rapid industrial automation efforts, surging consumer electronics production, and substantial public sector investments in smart city initiatives. China, Japan, and South Korea are hotspots for next-generation semiconductor research, necessitating high-bandwidth capture and comprehensive protocol support. Meanwhile, Southeast Asian nations are embracing online procurement channels to access international vendor catalogs and accelerate project deployment timelines. These divergent regional dynamics underscore the necessity for tailored product portfolios and localized support structures to capture evolving market opportunities.

This comprehensive research report examines key regions that drive the evolution of the Logic Analyzer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Logic Analyzer Providers to Uncover Strategic Differentiators Innovation Trajectories and Competitive Positioning Across the Market

The competitive landscape of the logic analyzer market is characterized by a blend of global instrument manufacturers, specialized niche providers, and emerging startups. Established companies have leveraged decades of measurement expertise to deliver expansive hardware portfolios, integrated software ecosystems, and comprehensive service networks. Their offerings often feature modular architectures, cross-domain analysis suites, and advanced protocol libraries that cater to enterprise-scale deployments.

Conversely, agile entrants are challenging incumbents by introducing disruptive business models such as subscription-based feature sets, community-driven software add-ons, and open API frameworks that facilitate custom integration with continuous integration and continuous delivery pipelines. These innovators frequently emphasize user-friendly interfaces, rapid firmware updates, and cloud-enabled collaboration tools aimed at accelerating time-to-resolution. Strategic partnerships between hardware OEMs and software-focused startups are also common, combining deep domain knowledge with agile development practices.

Intellectual property portfolios, certification credentials, and global distribution agreements serve as key differentiators among leading vendors. Collaboration agreements with semiconductor companies and research institutions further bolster credibility and drive joint development of next-generation probing techniques. In this environment, product roadmaps centered on higher channel densities, intelligent trigger algorithms, and multi-protocol correlation are critical to maintaining technological leadership and meeting the diverging needs of industries spanning automotive to aerospace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Logic Analyzer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anshuman Tech Pvt Ltd

- Applied Digital Micro Systems Pvt Ltd

- B&K Precision Corporation

- Digilent

- Eltech Engineers Pvt Ltd

- FuturePlus Systems

- Hantek

- Keysight Technologies

- Link Instruments

- Logic Power

- National Instruments

- Prodigy Technovations Pvt Ltd

- Rigol Technologies, Inc.

- Rohde & Schwarz

- Saleae Inc.

- Team Solutions, Inc.

- Tektronix, Inc.

- Teledyne LeCroy, Inc.

- Total Phase Inc.

- Zeroplus Technology Corporation

Crafting Strategic Recommendations Designed to Equip Industry Leaders with Actionable Tactics for Navigating Emerging Challenges and Seizing Market Opportunities

To navigate the confluence of technological upheaval and shifting trade landscapes, industry leaders should first invest in modular and scalable platforms that can evolve alongside emerging requirements for higher channel counts and mixed-signal analysis. By adopting open software architectures, organizations can integrate logic analysis seamlessly into broader design and test workflows, thereby reducing manual handoffs and accelerating debug cycles. Further, aligning procurement strategies with a diversified supplier ecosystem will mitigate the impact of tariff fluctuations while enabling access to best-in-class modules globally.

Leaders must also cultivate partnerships with academic institutions and standards bodies to stay ahead of evolving protocol specifications and compliance mandates. Collaborative research initiatives can facilitate early engagement with nascent interface technologies and accelerate validation of next-generation silicon. In parallel, building in-house data analytics capabilities-leveraging AI-based anomaly detection and predictive maintenance models-will transform captured waveforms into actionable insights that drive product quality improvements and lower time-to-market.

Understanding regional nuances is equally critical. Tailoring go-to-market approaches to local regulatory requirements and channel preferences will optimize market penetration, while providing localized training and support services will enhance customer loyalty. Ultimately, organizations that combine technological foresight with strategic supply chain resilience and market-specific agility will be best positioned to harness the transformative potential of logic analyzers.

Detailing the Rigorous Research Methodology Employed to Ensure Data Integrity Comprehensive Analysis and Actionable Insights Within the Logic Analyzer Study

This research employs a rigorous, multi-stage methodology designed to ensure data integrity, comprehensive coverage, and actionable insights. Initially, an extensive secondary research phase was conducted, analyzing technical white papers, industry standards documentation, and patent filings to map the spectrum of logic analyzer capabilities and innovation trajectories. Concurrently, publicly available information from regulatory agencies and trade organizations was reviewed to assess the impact of tariffs and compliance requirements.

Following the secondary phase, primary research interviews were carried out with key stakeholders, including design engineers, quality assurance managers, and procurement executives across diverse end-use industries. These qualitative insights provided first-hand perspectives on emerging pain points, workflow integrations, and future requirements. Quantitative surveys supplemented these conversations, yielding structured input on feature prioritization and procurement preferences.

The data synthesis stage involved triangulation of secondary and primary findings, supported by pattern analysis techniques to identify thematic shifts and growth enablers. Validation workshops were held with industry experts to refine interpretations and ensure that the final recommendations resonate with real-world challenges. Throughout the process, quality controls such as cross-functional peer reviews and data audit trails were implemented to uphold research rigor and reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Logic Analyzer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Logic Analyzer Market, by Product Type

- Logic Analyzer Market, by Protocol

- Logic Analyzer Market, by End Use Industry

- Logic Analyzer Market, by Application

- Logic Analyzer Market, by Sales Channel

- Logic Analyzer Market, by Region

- Logic Analyzer Market, by Group

- Logic Analyzer Market, by Country

- United States Logic Analyzer Market

- China Logic Analyzer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Insights to Highlight Strategic Imperatives and Long-Term Considerations for Stakeholders in the Evolving Logic Analyzer Sector

As the logic analyzer domain continues to evolve under the impetus of technological advancement, tariff realignments, and expanding industry applications, stakeholders must adapt their strategies to thrive in an increasingly complex environment. Key drivers such as AI-enhanced signal analysis, modular hardware architectures, and cloud-based collaboration tools are redefining conventional workloads, while regional policy shifts underscore the value of supply chain diversification and local support.

Insights from the segmentation analysis reveal that no single product archetype can address the varied requirements of sectors ranging from aerospace to consumer electronics, necessitating a portfolio approach that balances performance, affordability, and protocol breadth. At the same time, competitive pressures are intensifying as nimble newcomers introduce subscription-based models and open API ecosystems that challenge legacy players to innovate more rapidly.

Ultimately, decision-makers who embrace flexible, software-driven platforms and form strategic alliances with academic and industry consortia will gain a distinct advantage. By aligning investment priorities with emerging use cases in digital communication analysis, embedded debugging, and signal integrity testing, organizations can unlock new efficiencies and deliver higher-value outcomes. These strategic imperatives will shape the future of logic analysis, enabling stakeholders to push the boundaries of electronic system development with confidence.

Immediate Next Steps for Decision-Makers Interested in Acquiring the Comprehensive Logic Analyzer Market Research Report from Ketan Rohom

To arrange for access to the comprehensive, data-driven logic analyzer market research report and discover how these insights can inform your strategic planning and product roadmaps, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engage with an expert to secure the detailed analysis and customized recommendations essential for staying ahead in this rapidly evolving field. Initiate your consultation today to unlock critical findings, digital resources, and multi-faceted support tailored to your organization’s unique requirements, ensuring confident decision-making and accelerated innovation pathways.

- How big is the Logic Analyzer Market?

- What is the Logic Analyzer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?