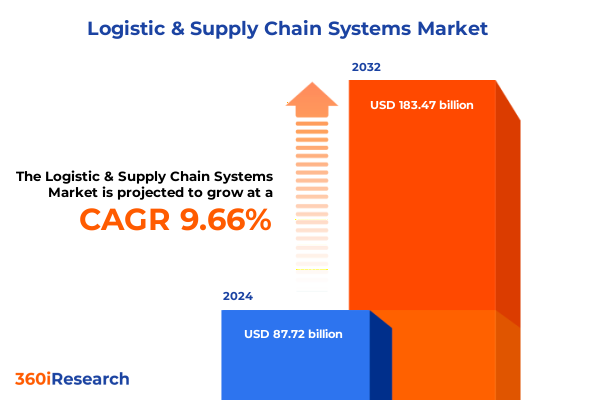

The Logistic & Supply Chain Systems Market size was estimated at USD 96.22 billion in 2025 and expected to reach USD 104.00 billion in 2026, at a CAGR of 9.65% to reach USD 183.47 billion by 2032.

Envisioning Supply Chain Resilience: Setting the Stage for Modern Supply Chain Evolution Amidst Technological Disruption and Operational Complexity

This executive summary introduces the evolving paradigm of logistics and supply chain systems, where digitalization and interconnected platforms have become foundational to operational excellence. As organizations grapple with increasing demand volatility and mounting regulatory complexities, strategic investment in integrated systems is essential to maintain resilience and agility. This section frames the broader context of technological proliferation-from artificial intelligence and Internet of Things to advanced analytics and cloud-based orchestration-and explores how these developments are reshaping planning, execution, and real-time monitoring across the supply chain continuum.

Against the backdrop of intensified global competition, this introduction also underscores the critical need for end-to-end visibility and predictive decision-making. It highlights the shifting expectations of both enterprise stakeholders and end-customers, who now seek seamless order fulfillment, rapid responsiveness to disruptions, and transparent logistics networks. By setting the stage for the detailed exploration that follows, this overview establishes the strategic imperatives that guide investment priorities, partnership models, and the next wave of innovation in supply chain systems.

Mapping the Technological and Operational Shifts Redefining Logistics and Supply Chain Dynamics in the Current Era of Rapid Innovation and Uncertainty

Over the past several years, logistics and supply chain landscapes have been transformed by a convergence of digital, operational, and sustainability imperatives. Artificial intelligence and machine learning algorithms now drive demand forecasting with greater precision, while blockchain prototypes are evolving into practical tools for traceability, ensuring authenticity and reducing fraud. Simultaneously, Internet of Things deployments and advanced sensor networks enable continuous tracking of shipments, inventory conditions, and equipment health, fostering an unprecedented level of visibility across complex, multi-tier networks.

Beyond digital innovation, structural shifts in global trade patterns and environmental mandates are compelling organizations to reimagine traditional models. Companies are reconfiguring supplier footprints to nearshore production and diversify supplier bases in pursuit of risk mitigation. The rise of omnichannel retailing and e-commerce accelerates adoption of agile last-mile solutions, while stricter emissions regulations and circular economy goals are driving investment in green logistics. As a result, the modern supply chain is no longer a linear sequence of handoffs but a dynamic, interconnected ecosystem requiring adaptive strategies and continuous optimization.

Assessing the Comprehensive Consequences of 2025 United States Tariffs on Cross-Border Logistics, Procurement Patterns, and Cost Structures

In 2025, the United States implemented a series of tariff measures on select imported goods, prompting widespread reevaluation of cross-border procurement strategies and cost structures. For many organizations that rely on global sourcing, these duties have elevated landed costs and amplified the complexity of customs clearance processes. As import expenses rise, supply chain leaders are exploring alternative sourcing regions, negotiating long-term contracts to lock in favorable terms, and leveraging trade preference programs to partially offset the impact of enhanced duties.

The ripple effects extend into transportation networks as carriers and freight forwarders adjust surcharges to reflect higher duties and insurance premiums. Some shippers have shifted greater volumes to domestic suppliers or closer trading partners to reduce exposure, while others have invested in more sophisticated trade compliance platforms to streamline documentation and mitigate risk. The cumulative outcome is a recalibration of supply chain footprints, with organizations balancing tariff-driven cost pressures against the need for resilient, diversified supply networks.

Uncovering How Solution, Component, Deployment Mode, Industry Vertical, and Enterprise Size Segmentation Drive Tailored Supply Chain Technology Adoption

A nuanced understanding of market segmentation reveals that technology adoption varies significantly across solution categories. Enterprises are deploying transportation management systems that encompass both domestic and international logistics, while warehouse management systems are tailored for distinct inbound and outbound workflows. Beyond these core modules, fleet management, freight forwarding, and yard management software are gaining traction among organizations seeking granular control over complex operations. Inventory control and order management solutions further extend these capabilities, ensuring seamless data flow from procurement to delivery.

On the component front, software investment is driving a shift away from hardware-centric deployments. Analytics modules are being paired with execution engines and planning platforms to enable predictive, real-time decision support. Within execution software, specialists in transportation execution are collaborating with warehouse execution providers to orchestrate synchronized operations. In parallel, cloud and hybrid deployment models are eclipsing traditional on-premises approaches, with private and public cloud options offering varying balances of performance and security.

Industry verticals display distinct customization requirements. Automotive organizations, whether in aftermarket services or OEM production, demand precise traceability and JIT fulfillment. Healthcare providers in hospitals and pharmaceutical manufacturing emphasize compliance and temperature-controlled transport. Manufacturing firms deploying discrete or process-oriented production systems require seamless integration between shop floors and distribution channels, while retail and e-commerce companies prioritize rapid fulfillment and reverse logistics. Finally, adoption patterns diverge between large enterprises and small-to-medium businesses, with larger organizations often leading in complex, multi-module implementations and mid-market players favoring scalable, turnkey solutions.

This comprehensive research report categorizes the Logistic & Supply Chain Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Industry Vertical

- Enterprise Size

Exploring Regional Variations in Supply Chain System Adoption and Innovation Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the contours of supply chain system adoption. Across the Americas, the push for reshoring and nearshoring is influencing investments in digital transportation management and advanced warehouse automation. Organizations in North and South America prioritize scalability and interoperability across vast geographic territories, integrating real-time tracking and predictive analytics to manage extended lead times and fluctuating demand patterns.

In Europe, the Middle East, and Africa, regulatory complexity and sustainability targets are driving innovation in compliance management and green logistics. Companies contend with cross-border trade nuances, diverse infrastructure maturities, and localized data privacy mandates, which spur demand for adaptable, compliant platforms. Collaboration among stakeholders is increasingly critical, with shared distribution networks and multi-party data exchanges enabling efficient pan-regional flows.

Meanwhile, Asia-Pacific markets are characterized by rapid e-commerce growth, government-led digital initiatives, and dense manufacturing hubs. Mobile-first warehouse solutions and plug-and-play execution software are gaining momentum, especially in markets with high variability in infrastructure. As supply chain ecosystems mature, cross-border corridors within APAC are being optimized through public-private partnerships, advanced port digitalization, and integrated customs management solutions.

This comprehensive research report examines key regions that drive the evolution of the Logistic & Supply Chain Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Positioning and Competitive Advantages of Leading Logistics and Supply Chain Technology Providers in a Dynamic Market

Leading vendors in the logistics and supply chain technology arena are distinguishing themselves through strategic partnerships, platform convergence, and value-added service offerings. Some providers are integrating AI-driven analytics natively within their core suites, while others are forging alliances to embed specialized execution software into comprehensive supply chain management platforms. This collaborative approach enhances end-to-end visibility and streamlines user experiences, positioning these companies as one-stop solutions for complex operational challenges.

Competitive differentiation also emerges from targeted investments in user interface design, preconfigured industry templates, and ecosystem APIs that facilitate rapid integration with existing enterprise resource planning and warehouse control systems. By coupling robust technical roadmaps with consultative services and implementation expertise, these innovators are accelerating time-to-value for their customers. The emphasis on subscription-based pricing models further aligns vendor incentives with client success metrics, underpinning ongoing enhancements and customer-centric roadmaps.

This comprehensive research report delivers an in-depth overview of the principal market players in the Logistic & Supply Chain Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blue Yonder Group, Inc.

- Coupa Software Inc.

- Descartes Systems Group Inc.

- E2open, LLC

- Epicor Software Corporation

- HighJump Software Inc.

- Honeywell International Inc.

- IBM Corporation

- Infor, Inc.

- JDA Software Group, Inc.

- Kewill Systems PLC

- Kinaxis Inc.

- Logility, Inc.

- Manhattan Associates, Inc.

- Omnibus

- One Network Enterprises

- Oracle Corporation

- SAP SE

- ToolsGroup

- Zebra Technologies Corporation

Driving Strategic Decision-Making Through Technology Integration, Risk Mitigation, and Collaborative Partnerships for Sustainable Supply Chain Excellence

To capitalize on emerging opportunities, industry leaders should prioritize the integration of advanced analytics within their execution platforms. By harnessing real-time data streams and predictive algorithms, organizations can preempt disruptions, optimize resource allocation, and enhance network agility. At the same time, supply chain leaders must expand supplier diversification strategies, leveraging dual-sourcing arrangements and nearshore partnerships to mitigate tariff exposures and geopolitical risks.

Collaborative initiatives, such as shared logistics networks and co-innovation labs, can foster collective resilience and drive down unit costs through economies of scale. Additionally, investing in workforce transformation-through targeted training programs on digital tools and process redesign-ensures that human capital aligns with evolving automation and AI capabilities. Finally, organizations should launch pilots for blockchain-based traceability projects and digital twin simulations to validate new operating models before scaling across global networks.

Detailing Rigorous Data Collection, Qualitative Interviews, and Analytical Frameworks That Underpin the Comprehensive Supply Chain Systems Assessment

The research underpinning this report blends rigorous primary and secondary methodologies to deliver a comprehensive perspective on supply chain systems. Primary research included in-depth interviews with industry executives, technology vendors, and logistics service providers, coupled with quantitative surveys of end-user organizations across multiple regions and verticals. This approach captures both strategic vision and operational realities, ensuring that insights reflect real-world challenges and opportunities.

Secondary research involved a detailed review of public filings, regulatory databases, trade publications, and technical white papers, providing context on market drivers, regulatory frameworks, and recent innovations. Data validation and triangulation techniques were employed to confirm findings, while segmentation analyses were crafted using both top-down and bottom-up approaches. The analytical framework integrates qualitative narratives with empirical data, supporting robust benchmarking and scenario planning for key stakeholder groups.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Logistic & Supply Chain Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Logistic & Supply Chain Systems Market, by Solution Type

- Logistic & Supply Chain Systems Market, by Industry Vertical

- Logistic & Supply Chain Systems Market, by Enterprise Size

- Logistic & Supply Chain Systems Market, by Region

- Logistic & Supply Chain Systems Market, by Group

- Logistic & Supply Chain Systems Market, by Country

- United States Logistic & Supply Chain Systems Market

- China Logistic & Supply Chain Systems Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Synthesizing Critical Insights and Anticipating Future Pathways for Resilient, Agile, and Sustainable Supply Chain System Strategies

This report synthesizes critical themes across technology adoption, tariff impacts, and regional dynamics to offer a cohesive view of the evolving supply chain landscape. As organizations navigate increasingly complex networks, the insights presented herein highlight the imperative of end-to-end visibility, modular system architectures, and collaborative ecosystems. By embracing a forward-looking mindset, supply chain leaders can anticipate disruptions, adapt processes swiftly, and maintain competitive differentiation.

Looking ahead, the blend of AI, cloud-native platforms, and advanced execution engines will continue to redefine operational benchmarks. Companies that strategically align their technology roadmaps with sustainability goals and regulatory requirements will be best positioned to lead in this dynamic environment. Ultimately, resilient, agile, and data-driven supply chain strategies will serve as the cornerstone of business growth and long-term success.

Engage With Associate Director Ketan Rohom Today to Access the Full Market Research Report and Unlock Strategic Supply Chain Advantages

To delve deeper into the complex interplay of emerging technologies, regulatory shifts, and competitive landscapes shaping logistics and supply chain systems, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. By engaging with Ketan Rohom today, you gain tailored insights into how this comprehensive study can inform your strategic initiatives, drive operational efficiencies, and uncover new avenues for growth within your organization’s supply chain ecosystem.

Secure immediate access to the full market research report to leverage actionable intelligence on segmentation drivers, regional dynamics, tariff impacts, and best practices from leading providers. Ketan Rohom stands ready to guide you through the report’s rich findings, helping you translate high-level analysis into concrete next steps that fortify your competitive edge and position your business for enduring success.

- How big is the Logistic & Supply Chain Systems Market?

- What is the Logistic & Supply Chain Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?