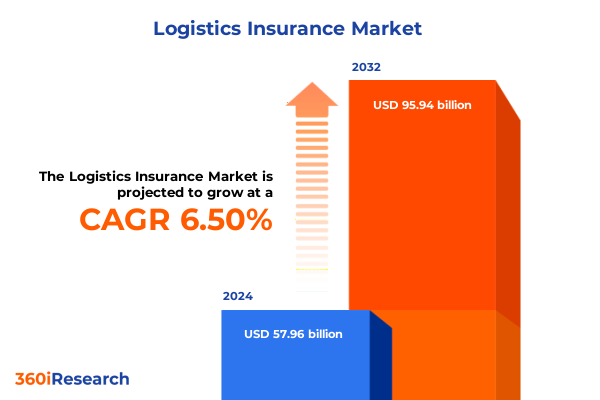

The Logistics Insurance Market size was estimated at USD 61.70 billion in 2025 and expected to reach USD 65.69 billion in 2026, at a CAGR of 6.50% to reach USD 95.94 billion by 2032.

Navigating a Complex Logistics Insurance Environment Marked by Geopolitical Risks Rapid Digitalization and Evolving Regulatory Demands

The logistics insurance landscape is undergoing rapid evolution as the convergence of geopolitical tensions, supply chain disruptions, and regulatory shifts creates new complexities for insurers and policyholders alike. Companies reliant on global trade are seeking greater resilience against unforeseen events, while underwriters face mounting pressure to design policies that balance cost efficiency with comprehensive coverage. Amid rising trade tensions and shifting alliances, the demand for innovative insurance solutions that address emerging risks has never been greater.

Moreover, technological advancements are transforming traditional risk assessment models into dynamic frameworks capable of responding in real time to changes in shipment value, route modifications, and cargo conditions. As logistics networks expand in scope and sophistication, stakeholders must navigate a rapidly shifting terrain of tariffs, environmental regulations, and cyberthreats. This environment calls for a nuanced understanding of risk transfer mechanisms and proactive loss prevention strategies.

In parallel, rising interest in supply chain transparency and stakeholder collaboration is driving insurers to incorporate data-driven insights and predictive analytics into product offerings. These developments underscore the importance of an authoritative market overview that equips decision-makers with actionable intelligence, ensuring that both carriers and shippers can mitigate exposure and optimize coverage terms amidst unprecedented volatility.

Understanding the Major Transformative Forces Revolutionizing Logistics Insurance Through Advanced Technologies and Strategic Sustainability Initiatives

The logistics insurance sector is experiencing a wave of transformative shifts propelled by digital innovation and sustainability imperatives. Artificial intelligence and machine learning are now integral to cargo risk assessment, enabling insurers to analyze large-volume data streams-from IoT sensors to satellite imagery-to forecast potential loss events and calibrate premiums in near real time. AI-driven digital twin platforms allow underwriters and risk managers to simulate disruption scenarios, such as port closures or climate-related incidents, thereby refining coverage parameters and enhancing underwriting precision.

Simultaneously, the proliferation of blockchain technology is fostering greater transparency across the logistics value chain. Immutable ledgers record cargo provenance, movement history, and compliance documentation, reducing fraud and expediting claims settlement processes. This shift toward seamless data exchange is further supported by cloud-native solutions that centralize policy management, automate endorsements, and integrate third-party risk intelligence feeds.

Environmental, social, and governance (ESG) requirements are driving the adoption of green logistics practices, prompting insurers to develop parametric products tied to carbon emissions and adherence to carbon border adjustment mechanisms. As supply chains become more carbon-conscious, policy structures are evolving to reward operators who adopt biofuels, optimize routes for lower emissions, and invest in eco-friendly warehousing infrastructure. These converging trends are reshaping the competitive landscape, compelling insurers to innovate swiftly or risk obsolescence.

Assessing the Cumulative Impact of United States 2025 Tariff Policies on Cargo and Logistics Insurance Cost Structures and Risk Profiles

The cumulative impact of United States tariff policies in 2025 is exerting significant pressure on cargo valuations and insurance cost structures. Since the beginning of the year, average import duties have climbed sharply, with many sectors now facing levies of up to 25 percent on goods ranging from automotive components to electronic devices. These heightened duties inflate the insured value of shipments, compelling policyholders to increase coverage limits and triggering adjustments in premium calculations. For instance, a shipment of industrial machinery previously valued at $100,000 could now carry a landed cost approaching $125,000, directly translating to higher insurance obligations and administrative complexity.

Tariff-induced delays at key ports have led to extended dwell times and accrual of demurrage fees, which cargo insurers must now consider when structuring liability clauses. Underwriters are recalibrating policy wordings to account for prolonged exposure to risks such as spoilage, theft, and port congestion. In parallel, carriers and freight forwarders are seeking tailored indemnity solutions that cover unexpected costs linked to customs bond adjustments and bond procurement challenges under the new tariff regime.

Moreover, ongoing uncertainty around potential tariff extensions and retaliatory measures has elevated geopolitical risk to a top concern for logistics insurers, prompting the introduction of flexible endorsements and trade disruption coverages. These products allow policyholders to adapt swiftly to tariff announcements without renegotiating base policy terms, fostering greater resilience in an environment where trade policy can shift with limited notice.

Deriving Strategic Insights from Diverse Coverage Types Distribution Channels Industry Verticals and Customer Segments in Logistics Insurance

Based on coverage type, the logistics insurance market reveals differentiated demand patterns where traditional marine cargo policies-encompassing bulk cargo shipments, full container loads, and less than container loads-remain foundational. Within this space, dry bulk and liquid bulk cargoes exhibit distinct risk exposures, prompting insurers to tailor indemnity clauses for commodities such as grain and petrochemicals. Meanwhile, freight forwarders indemnity products have grown sophisticated, integrating contingent liability coverages and ICC Institute clauses for comprehensive risk transfer. Transit insurance and warehouse legal liability policies continue to evolve, with underwriters refining terms around transshipment points, inland carriage, and storage conditions to reflect the complexity of multimodal supply chains.

Turning to distribution channels, brokers maintain a pivotal role by offering consultative risk advice and bundling cargo and marine portfolios, whereas digital platforms are gaining traction through aggregators, company websites, and mobile applications that streamline policy issuance and claims filing. Direct sales channels also endure, particularly for large corporate clients seeking bespoke policy structures and captive insurance solutions. The shift toward digital engagement reflects broader consumer preferences for rapid policy customization and real-time certificate issuance.

In the context of industry verticals, automotive supply chains demand specialized coverage for high-value components and just-in-time inventory, while electronics manufacturers require fine-tuned clauses addressing semiconductor theft and warranty risks. Pharmaceutical logistics, segmented into cold chain and standard pharma, underscores the necessity for temperature-controlled cargo insurance, and the retail and ecommerce sector-ranging from brick-and-mortar to online retailers-calls for policies that address return logistics, inventory shrinkage, and last-mile liability.

Customer types span individuals requiring personal effect coverage to large enterprises negotiating global program placements and SMEs, including local logistics firms and owner-operators, which prioritize flexible premiums and parametric endorsements. SMEs often leverage modular policy designs to align coverage limits with variable shipment volumes and seasonal peaks, underscoring the need for underwriting agility.

This comprehensive research report categorizes the Logistics Insurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Coverage Type

- Distribution Channel

- Industry Vertical

- Customer Type

Highlighting Regional Dynamics Shaping Logistics Insurance Across the Americas EMEA and Asia-Pacific Markets and Risk Environments

Regional dynamics are reshaping logistics insurance strategies as stakeholders navigate distinct market drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, infrastructure modernization initiatives and nearshoring trends have increased cargo throughput across key corridors, prompting insurers to develop inland marine products that cover complex multimodal transfers and emerging logistics hubs. This region’s exposure to extreme weather events has also heightened demand for parametric storm and flood solutions that expedite recovery funding.

Across Europe, the Middle East, and Africa, regulatory frameworks-most notably the EU’s Carbon Border Adjustment Mechanism-are influencing policy design, with underwriters integrating ESG-linked premium adjustments and carbon credit endorsements. In parallel, African trade corridors are witnessing growth in intra-continental exports, leading insurers to expand coverage in transit insurance and cross-border bond management, while Middle Eastern logistics players drive innovation in digital certificates and blockchain-enabled cargo tracking.

In the Asia-Pacific region, sustained growth in ecommerce and manufacturing has fueled demand for specialized warehouse legal liability coverages and electronics transit policies. Governments are implementing free trade agreements that reduce duties but introduce new compliance requirements, such as origin verification and documentary inspections. Consequently, carriers and insurers are collaborating to develop value-added services, such as customs advisory and tariff monitoring, that complement traditional cargo coverage and address region-specific complexities.

This comprehensive research report examines key regions that drive the evolution of the Logistics Insurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Key Players Strategies and Innovations Reshaping the Competitive Landscape of Global Logistics Insurance Providers

Leading players in the global logistics insurance market are advancing differentiated strategies to capture emerging opportunities and manage evolving risks. Aon continues to enhance its digital risk platform, integrating predictive analytics and IoT sensor data to deliver dynamic underwriting insights, while Marsh McLennan has expanded its insurtech partnerships to accelerate policy issuance and claims automation. Munich Re has published detailed guidance on tariff-driven insured value adjustments, emphasizing the need for updated valuation methodologies in cargo insurance programming.

Allianz and Zurich are focusing on sustainability-linked insurance structures, offering premium incentives for shippers adopting green fuels and carbon-neutral warehousing solutions. These carriers are also piloting blockchain-enabled policy documentation to streamline endorsements and reduce settlement times. Tokio Marine’s entry into the SMEs segment emphasizes modular policy designs with parametric triggers for weather events, while Chubb has invested in advanced risk engineering services that assess cold chain vulnerabilities and optimize temperature-controlled logistics networks.

In parallel, specialty insurers such as Starr Companies and XL Catlin are deepening their expertise in high-value transit and express delivery markets, providing bespoke liability limits and deferred claims provisions. These initiatives underscore a broader industry trend toward collaboration between underwriters, brokers, and technology partners to co-create products that align with the specific needs of automotive, pharmaceutical, and ecommerce supply chains.

This comprehensive research report delivers an in-depth overview of the principal market players in the Logistics Insurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allianz SE

- American International Group, Inc.

- AXA SA

- Berkshire Hathaway Specialty Insurance Company

- Chubb Limited

- Liberty Mutual Insurance Company

- Lloyd's List Intelligence

- Lockton Companies

- Marsh LLC

- Mitsui Sumitomo Insurance Co., Ltd.

- Munich Reinsurance Company

- Swiss Re AG

- Tokio Marine & Nichido Fire Insurance Co., Ltd.

- Zurich Insurance Group AG

Implementing Actionable Strategies for Industry Leaders to Enhance Resilience Adapt to Trade Disruptions and Leverage Emerging Technologies

To navigate the complexities of modern trade operations, industry leaders should prioritize integration of advanced analytics with traditional underwriting expertise, enabling more nuanced risk segmentation and real-time policy adjustments. By embracing parametric endorsements tied to tariff movements or weather triggers, insurers can expedite claims settlement and reduce administrative overhead while providing clients with transparent, predictable coverage.

Furthermore, collaboration between insurers, brokers, and logistics providers is essential for developing end-to-end risk management frameworks. This includes sharing visibility data via secure digital platforms to enhance loss prevention efforts and embed risk mitigation services directly into cargo operations. Organizations should also explore strategic partnerships with insurtech firms to accelerate digital transformation, from seamless certificate issuance to AI-powered claims triage.

Finally, aligning product portfolios with sustainability objectives and regional policy shifts will differentiate market offerings. Underwriters can leverage ESG metrics to structure premium adjustments, incentivizing clients to adopt low-carbon transportation modes and invest in resilient infrastructure. This strategic approach not only addresses regulatory requirements but also creates new value propositions in a competitive marketplace.

Exploring a Rigorous Research Framework Leveraging Primary Interviews Secondary Data and Advanced Risk Modeling Techniques

The research methodology underpinning this analysis combines rigorous primary and secondary data collection with advanced risk modeling techniques. Primary insights were derived from in-depth interviews with senior executives at insurance carriers, global logistics providers, and regulatory bodies, ensuring a comprehensive understanding of market needs and emerging trends. These qualitative findings were complemented by a structured survey of freight forwarders, cargo underwriters, and risk managers, capturing perspectives on tariff impacts, digital platform adoption, and sustainability requirements.

Secondary research encompassed analysis of regulatory filings, tariff announcements, and published guidelines from institutions such as the Federal Maritime Commission and financial communications by major insurers. To quantify the implications of trade policy changes, scenario-based simulations were conducted using proprietary risk models that account for variations in import duties, demurrage costs, and cargo value inflation. The triangulation of qualitative interviews, quantitative survey data, and simulation outputs offers a robust, multilayered view of the logistics insurance ecosystem.

This methodology ensures that the findings reflect the latest industry developments, regulatory contexts, and technological innovations, providing decision-makers with a reliable foundation for strategic planning and product development.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Logistics Insurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Logistics Insurance Market, by Coverage Type

- Logistics Insurance Market, by Distribution Channel

- Logistics Insurance Market, by Industry Vertical

- Logistics Insurance Market, by Customer Type

- Logistics Insurance Market, by Region

- Logistics Insurance Market, by Group

- Logistics Insurance Market, by Country

- United States Logistics Insurance Market

- China Logistics Insurance Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing Critical Insights into Logistics Insurance Market Trends Regulatory Shifts and Strategic Imperatives for Stakeholders

In conclusion, the logistics insurance market stands at an inflection point where evolving trade policies, technological advancements, and sustainability imperatives converge to reshape risk landscapes. Insurers must adopt dynamic underwriting frameworks that integrate real-time data, advanced analytics, and parametric coverage mechanisms to address tariff volatility and emerging operational risks.

By tailoring products to distinct segmentation categories-including coverage types, distribution channels, industry verticals, and customer profiles-carriers can unlock new growth opportunities and enhance client satisfaction. Regional nuances in the Americas, EMEA, and Asia-Pacific further underscore the importance of localized expertise and innovative product design.

Ultimately, stakeholders who align strategic initiatives with market shifts-partnering across the value chain and embedding risk management services into logistics operations-will secure competitive advantage and drive long-term resilience in an increasingly complex global trade environment.

Taking Action with Ketan Rohom Associate Director Sales & Marketing to Secure the Comprehensive Market Research Report on Logistics Insurance

To explore the full depth of analysis, actionable recommendations, and strategic insights covered in this market research report, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy and gain the competitive advantage your organization needs.

- How big is the Logistics Insurance Market?

- What is the Logistics Insurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?