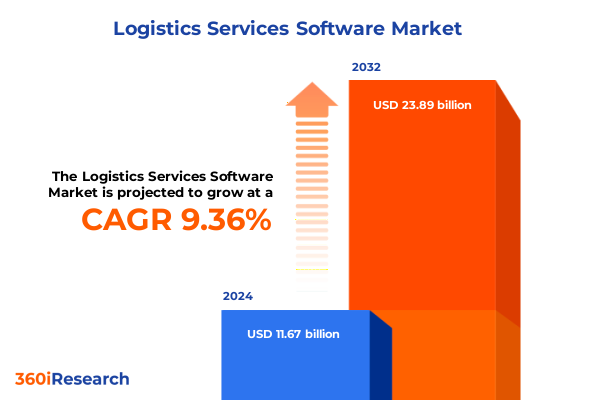

The Logistics Services Software Market size was estimated at USD 12.76 billion in 2025 and expected to reach USD 13.82 billion in 2026, at a CAGR of 9.36% to reach USD 23.89 billion by 2032.

Discover the rapidly evolving logistics software ecosystem driving operational efficiency and strategic advantage across global supply chains

In today’s hyperconnected world, logistics services software stands at the forefront of digital transformation, enabling organizations to navigate complex supply chains with unprecedented visibility and agility. Modern distribution networks demand rapid response to shifting consumer preferences, regulatory shifts, and global disruptions, and innovative software platforms have become indispensable in meeting these demands. As companies across industries strive to optimize processes, reduce operational friction, and enhance customer satisfaction, the adoption of integrated logistics solutions continues to accelerate.

This executive summary synthesizes the key drivers, challenges, and emerging opportunities shaping the logistics services software landscape. By examining the transformative forces propelling digital convergence-from artificial intelligence and Internet of Things integration to sustainability imperatives-this document provides a strategic framework for understanding market dynamics without relying on raw numerical estimates. Stakeholders will gain a clear view of how companies are leveraging software to automate workflows, reduce waste, and fortify resilience against external shocks.

Through an exploration of tariff impacts, segmentation strategies, regional variations, and competitive positioning, readers will emerge with a comprehensive perspective on where the market stands today and how leading players are navigating an increasingly complex environment. The insights presented here are designed to inform decision-makers seeking to align technology investments with broader organizational objectives and to equip industry leaders with the actionable knowledge required for long-term success.

Uncover how digitalization AI driven automation and sustainability mandates are reshaping logistics software to deliver unprecedented supply chain resilience

The logistics services software domain is undergoing profound shifts as emerging technologies redefine traditional operational paradigms. Digitization of paper-based processes has given way to real-time data exchange, enabling cross-functional teams to coordinate shipments, monitor asset health, and predict maintenance requirements before failures occur. Moreover, the integration of machine learning algorithms into freight planning modules has transformed route optimization, allowing companies to balance cost, speed, and reliability with greater finesse than ever before.

Concurrently, the rise of cloud-native architectures is facilitating seamless scalability. Organizations can now deploy modular solutions that evolve in step with fluctuating demand, supporting seasonal peaks and global expansions without significant upfront investments in infrastructure. Additionally, Internet of Things sensors embedded across fleets, warehouses, and yards feed continuous streams of telemetry data into centralized platforms, unlocking new capabilities in inventory visibility and labor efficiency.

Sustainability has also emerged as a critical inflection point. As environmental regulations tighten and corporate social responsibility becomes a boardroom priority, logistics software providers are embedding emissions tracking and carbon-footprint analytics into core modules. These features empower decision-makers to assess the environmental impact of each shipment and to implement greener routing strategies. Ultimately, these transformative trends are converging to create a logistics ecosystem that is not only more efficient and resilient but also more sustainable and transparent.

Analyzing the cumulative effects of new United States tariffs imposed in 2025 on logistics software costs operational strategies and global trade dynamics

The introduction of new United States tariffs in 2025 has created ripples across the logistics services software sector, influencing both cost structures and strategic planning. Tariffs on software-supporting hardware components and related services have necessitated a recalibration of vendor pricing models, driving many providers to revisit service-level agreements and to offer enhanced support packages to mitigate client exposure to increased duties. As a result, contract negotiations have become more complex, with stakeholders seeking clarity on total cost of ownership in an environment marked by evolving trade policies.

In addition, these tariff measures have prompted software vendors and end users alike to reassess their supply chain footprints. Companies are increasingly exploring alternative sourcing strategies, such as nearshoring key manufacturing processes or diversifying hardware suppliers across non-tariffed regions. This reconfiguration extends to logistics software roadmaps, where vendors are accelerating development of compliance modules that automatically flag tariff-relevant transactions, apply accurate duty codes, and generate audit-ready reports. Consequently, tariff-management capabilities are emerging as a differentiator in the competitive landscape.

Furthermore, the broader implications of these policy changes have underscored the value of scenario-planning tools embedded within logistics platforms. By simulating the impact of prospective trade actions on shipment costs and lead times, organizations can make data-driven decisions on carrier selection, routing alternatives, and inventory positioning. As a result, software solutions that integrate tariff analytics with predictive modeling have become essential for companies aiming to sustain profitability while navigating an increasingly volatile global trade environment.

Gaining deep segmentation insights across software types end user industries deployment modes organization sizes and application vectors

A nuanced understanding of market segmentation reveals how tailored software offerings align with distinct operational requirements. Based on Software Type, the landscape is dissected into Fleet Management, Order Management, Transportation Management, Warehouse Management, and Yard Management solutions. Within Fleet Management, functionality spans from driver scheduling and maintenance oversight to advanced telematics, enabling fleets to run safer and more predictably. Order Management platforms cover end-to-end order lifecycle tasks, encompassing everything from capture and confirmation to settlement, ensuring orders flow seamlessly through distribution networks.

Meanwhile, Transportation Management modules emphasize carrier coordination, freight payment accuracy, and dynamic route planning, empowering shippers to adapt on the fly to changing conditions. Warehouse Management systems address granular challenges in inventory accuracy, labor allocation, and slotting tactics, reducing cycle times and human error. Yard Management capabilities round out this suite by orchestrating dock appointments, yard throughput, and resource allocation, creating a more fluid interface between inbound and outbound processes. Transitioning to the demand side, the End User Industry segmentation spans sectors such as automotive, healthcare and pharmaceuticals, manufacturing, retail and e-commerce, and transportation and logistics providers. Each vertical brings unique compliance requirements, volume patterns, and service-level expectations, driving software vendors to embed industry-specific workflows.

Deployment Mode analysis distinguishes between Cloud and On Premise environments. The Cloud category, which includes public, private, and hybrid cloud options, offers elastic performance and rapid feature updates, whereas traditional on-premise deployments may appeal to organizations with stringent data sovereignty or custom-integration needs. In parallel, Organization Size segmentation splits the market into large enterprises and small to medium-sized enterprises, each of which exhibits divergent purchasing behaviors and customization demands. Finally, Application usage differentiates software investments across inbound logistics, outbound logistics, and reverse logistics scenarios, highlighting how extended supply chain stages require specialized functionality. Together these lenses provide a comprehensive blueprint for aligning solution strategies with specific customer profiles and operational objectives.

This comprehensive research report categorizes the Logistics Services Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Software Type

- Deployment Mode

- Application

- End User Industry

- Organization Size

Examining regional dynamics from the Americas through Europe Middle East Africa to Asia Pacific and their strategic implications for providers

Regional characteristics strongly influence how logistics services software is adopted and leveraged across the globe. In the Americas, the proliferation of e-commerce and the emergence of omnichannel retail models have placed a premium on end-to-end visibility, last-mile delivery efficiency, and real-time exception management. Consequently, providers focused on real-time tracking, dynamic route optimization, and integration with digital marketplaces have secured a foothold in North American distribution corridors, while Latin American markets are beginning to follow suit with investments in scalable cloud architectures.

Across Europe, the Middle East, and Africa, regulatory diversity and a patchwork of cross-border trade agreements have made compliance and multi-currency settlement essential features. Software platforms that can navigate complex import-export rules, calculate duties accurately, and adapt to varying documentation standards have gained traction among multinational shippers. Sustainability mandates emanating from European policymakers have further spurred the integration of carbon-emissions analytics into core modules, reinforcing the region’s role as a testbed for eco-driven innovation.

In Asia-Pacific, rapid urbanization and the expansion of manufacturing hubs across Southeast Asia and India have generated demand for highly scalable, modular solutions that can be localized to diverse operating contexts. Providers offering flexible deployment options and rapid on-boarding capabilities have benefited from partnerships with regional carriers and third-party logistics firms. As governments across the region invest in smart-port infrastructure and digital customs initiatives, logistics software that connects directly with emerging data exchanges is poised to capture significant growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Logistics Services Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing strategic moves innovations and partnerships propelling leading logistics software suppliers to new heights in a competitive ecosystem

The competitive architecture of logistics services software is defined by a blend of established incumbents and innovative challengers. Leading global vendors differentiate through comprehensive suites that span core modules while investing heavily in research and development to introduce next-generation capabilities such as prescriptive analytics and autonomous routing. Partnerships and strategic alliances have become central to maintaining market momentum, with software providers collaborating with telecommunications firms, IoT device manufacturers, and cloud hyperscalers to deliver end-to-end solutions.

Mergers and acquisitions have reshaped the competitive fabric, as larger organizations seek to bolster their portfolios with specialized niche technologies. Recent acquisitions of warehouse robotics firms and AI-powered demand forecasting companies illustrate how vendors are layering advanced functionality onto traditional offerings. Meanwhile, emerging startups are carving out positions by focusing on narrow use cases-such as dynamic dock management or tariff-optimization engines-and integrating seamlessly with broader platforms through open APIs.

Furthermore, customer experience enhancements are driving new product capabilities, including low-code configuration tools and intuitive dashboards that democratize data access across non-technical teams. Companies placing emphasis on modular architectures allow clients to adopt individual components iteratively, reducing the risk associated with large-scale digital overhauls. As a result, the industry is witnessing a shift toward ecosystem-based business models, where value is co-created through partner networks and continuous customer feedback loops.

This comprehensive research report delivers an in-depth overview of the principal market players in the Logistics Services Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blue Yonder

- Blume Global, Inc.

- Convoy, Inc.

- Descartes Systems Group Inc.

- Flexport, Inc.

- FourKites, Inc.

- Freightos Limited

- GlobalTranz Enterprises, Inc.

- Infor, Inc.

- Loadsmart, Inc.

- Manhattan Associates, Inc.

- MercuryGate International, Inc.

- Motive, Inc.

- Oracle Corporation

- project44, Inc.

- Samsara Inc.

- SAP SE

- Shipwell, Inc.

- Transplace, LLC

- Trimble Inc.

Actionable strategic recommendations to empower industry leaders drive digital transformation enhance resilience and capture growth in logistics software domain

Industry leaders must prioritize the consolidation of fragmented data sources to unlock actionable insights and drive operational excellence. By centralizing telemetry from fleets, warehouses, and yards within a unified analytics platform, organizations can move beyond descriptive reporting toward predictive and prescriptive decision-making. Investing in machine learning initiatives will enable proactive maintenance scheduling, dynamic demand sensing, and intelligent load balancing, thereby enhancing asset utilization and service reliability.

Simultaneously, executives should embrace hybrid cloud strategies that balance performance needs with regulatory compliance requirements. This approach allows teams to deploy latency-sensitive applications closer to operational sites while leveraging public cloud resources for compute-intensive analytics workloads. Moreover, adopting open integration frameworks will facilitate rapid connectivity with carrier networks, customs portals, and smart-infrastructure ecosystems.

Finally, fostering a culture of continuous improvement will be vital. Organizations must align technology roadmaps with skill-development programs, ensuring that workforce capabilities evolve in tandem with digital investments. Establishing cross-functional governance forums and defining clear metrics for success will support ongoing optimization and reinforce accountability. By following these recommendations, industry leaders can build supply chain agility, maintain resilience in the face of disruption, and position themselves for sustained competitive advantage.

Transparent research methodology detailing primary interviews secondary data sources and rigorous data triangulation for robust market insights

The research approach integrates rigorous primary and secondary methodologies to deliver robust and unbiased insights. Primary research was conducted through in-depth interviews with senior logistics and supply chain executives, technology decision-makers, and solution architects. These qualitative engagements provided firsthand perspectives on operational challenges, technology adoption drivers, and future investment priorities. In parallel, structured surveys were administered to a broad cross-section of end users to validate emerging trends and quantify adoption patterns across key segmentation variables.

Secondary research entailed comprehensive analysis of publicly available data sources, including industry reports, regulatory filings, and company publications. This foundation was supplemented by a review of thought leadership articles, trade association whitepapers, and case studies to ensure a holistic view of technology innovations and market dynamics. Data triangulation techniques were employed to cross-verify findings, ensuring consistency between executive insights, survey outcomes, and documented market developments.

Throughout the process, the research team maintained strict adherence to ethical standards and confidentiality protocols. Information was anonymized where appropriate, and sensitive insights were corroborated through multiple sources. The outcome is a research framework that balances quantitative rigor with qualitative depth, providing a reliable basis for informed decision-making by stakeholders across the logistics ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Logistics Services Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Logistics Services Software Market, by Software Type

- Logistics Services Software Market, by Deployment Mode

- Logistics Services Software Market, by Application

- Logistics Services Software Market, by End User Industry

- Logistics Services Software Market, by Organization Size

- Logistics Services Software Market, by Region

- Logistics Services Software Market, by Group

- Logistics Services Software Market, by Country

- United States Logistics Services Software Market

- China Logistics Services Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Conclusion summarizing transformative trends critical insights and strategic imperatives shaping the future of logistics services software

The logistics services software landscape is marked by rapid innovation and increasing complexity, driven by technological advancements and evolving trade environments. Major shifts in digitalization, cloud adoption, and sustainability compliance have converged to redefine how organizations orchestrate transportation, warehousing, and yard operations. At the same time, external forces such as tariff policies have underscored the importance of agile scenario planning and integrated compliance management.

Segmentation insights reveal that solution strategies must be meticulously aligned with software type, industry vertical, deployment preference, organizational scale, and specific application needs to maximize ROI. Regional nuances from the Americas to Asia-Pacific further accentuate the need for localized capabilities, particularly in areas of e-commerce integration, regulatory compliance, and scalable infrastructure.

As competition intensifies, companies that blend modular architectures with advanced analytics, seamless integrations, and customer-centric design will define the next generation of market leadership. Ultimately, the insights articulated in this summary serve as a strategic compass, guiding stakeholders toward more resilient, efficient, and sustainable logistics ecosystems.

Speak directly with Ketan Rohom Associate Director Sales Marketing to secure your comprehensive logistics services software market intelligence report

Engaging directly with Ketan Rohom will position your organization to unlock the full potential of logistics services software through deep market intelligence and tailored insights. As Associate Director of Sales and Marketing, he brings an insider’s understanding of emerging trends and can guide you through the nuances of selecting, implementing, and maximizing the impact of advanced solutions across your supply chain operations. Reach out to arrange a personalized briefing that addresses your specific challenges and aligns your strategic goals with actionable recommendations. Secure your competitive advantage by leveraging expert guidance and ensure your investment in market research delivers measurable returns. A conversation with Ketan Rohom is the critical next step toward informed decision-making and sustained growth in the rapidly evolving logistics software landscape

- How big is the Logistics Services Software Market?

- What is the Logistics Services Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?