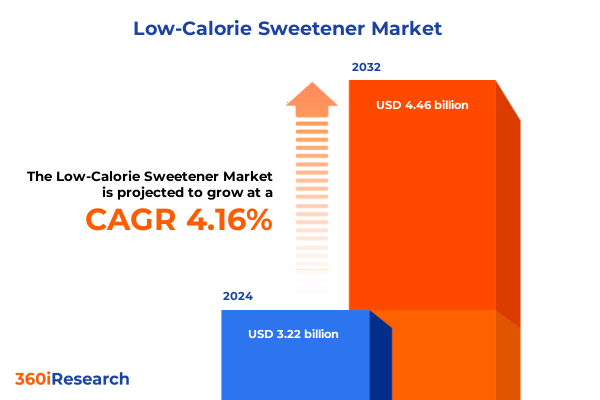

The Low-Calorie Sweetener Market size was estimated at USD 3.36 billion in 2025 and expected to reach USD 3.51 billion in 2026, at a CAGR of 4.14% to reach USD 4.46 billion by 2032.

Unveiling the Strategic Imperative of Low-Calorie Sweeteners in a Health-Conscious Global Food Environment Driving Innovation and Consumer Wellness

The increasing global focus on health and wellness has elevated low-calorie sweeteners from niche ingredients to strategic essentials within food and beverage portfolios. As consumers demand reduced sugar intake without compromising taste, manufacturers are evaluating diverse sweetener technologies to respond to regulatory pressures, evolving labeling requirements, and heightened scrutiny over sugar’s health impacts. This report offers decision-makers a comprehensive view of the current landscape in which low-calorie sweeteners are reshaping formulation, product innovation, and market positioning.

By examining critical drivers and barriers, the introduction lays the groundwork for deeper analysis of how ingredient suppliers, foodservice operators, and retail brands collaborate to capture growth opportunities. The narrative emphasizes the dynamic interplay between consumer preferences for cleaner labels, sustainability considerations, and cost pressures. In doing so, it establishes the strategic imperative for stakeholders to align product development roadmaps and supply chain strategies with emerging industry imperatives, thereby equipping readers with a clear sense of direction as they navigate a rapidly changing sweetener ecosystem.

Exploring the Pivotal Technological and Consumer Behavior Shifts That Are Redefining the Future Trajectory of Low-Calorie Sweetener Markets Worldwide

The low-calorie sweetener market is witnessing transformative advances as novel extraction techniques and biotechnology redefine ingredient purity and performance. Developments in enzymatic refinement, precision fermentation, and membrane separation are enabling producers to deliver stevia glycosides with enhanced flavor profiles and minimal aftertaste. Simultaneously, digital formulation tools are accelerating product development cycles by simulating taste interactions and optimizing sweetness equivalency, allowing R&D teams to experiment with blend ratios more efficiently.

Consumer behavior shifts are reinforcing the impact of these technological breakthroughs. Demand for plant-derived sweeteners has surged in response to clean-label advocacy and skepticism toward artificial ingredients. Real-time social media sentiment analysis is revealing that taste remains paramount, yet health claims and sustainability credentials drive purchase decisions among younger demographics. As a result, brand marketers are crafting narratives that marry authentic storytelling with evidence-based nutrition messaging, reinforcing the shift from mere sugar replacement to holistic wellness.

Regulatory frameworks and environmental sustainability trends are also reshaping industry dynamics. Governments around the globe are implementing sugar taxes and imposing stricter labeling laws, prompting companies to innovate without jeopardizing compliance. Meanwhile, carbon footprint considerations are encouraging manufacturers to adopt green processing methods and renewable energy sources. Taken together, these converging forces are accelerating the evolution of the market structure, prompting stakeholders to reassess procurement strategies, invest in agile manufacturing platforms, and prioritize transparent communication throughout the value chain.

Analyzing the Cascading Effects of Mid-2025 United States Tariffs on Low-Calorie Sweetener Supply Chains Regulatory Costs and Market Accessibility

In mid-2025, the United States implemented a new tariff regime targeting key raw materials and refined sweeteners, significantly impacting global supply chains. Import duties on certain agri-based extracts and high-intensity sweetener concentrates have increased landed costs for manufacturers, compelling procurement teams to explore alternative sourcing strategies. As a result, the logistics footprint has shifted, leading to a rise in near-shoring initiatives and renegotiated contracts with specialty ingredient producers in North and South America.

These tariffs have further triggered downstream ripples across cost structures and pricing models. Food and beverage formulators are absorbing a portion of the added costs through ingredient substitutions, while passing incremental expenses onto consumers in the form of premium product lines and value-added offerings. Retailers have responded by adjusting shelf pricing and emphasizing promotional strategies to maintain volume, prompting sales and marketing functions to refine segmentation tactics and value propositions to protect brand equity.

Amid these headwinds, industry participants are pursuing collaborative approaches to mitigate risk. Long-term supply agreements and co-investment in processing facilities are gaining traction as companies aim to stabilize input costs. Meanwhile, trade associations are engaging policymakers to advocate for harmonized regulations and tariff relief mechanisms. Collectively, these efforts underscore the importance of strategic agility and partnership models in navigating a landscape defined by evolving trade policies and cost volatility.

Illuminating the Diverse Consumer and Channel Segmentation Dynamics That Drive Demand Patterns for Low-Calorie Sweeteners Across Distribution Channel and Product Application Frameworks

Understanding market dynamics requires a nuanced appreciation of distribution channel segmentation, where each channel presents distinct consumer touchpoints and margin profiles. Convenience stores cater to on-the-go snacking occasions, emphasizing single-serve beverage solutions. Foodservice outlets prioritize bulk formulations that balance sweetness, stability, and cost efficiency under high-volume conditions. Online retailers have emerged as a growth engine by offering direct-to-consumer subscriptions for tabletop sweeteners and ingredient kits. Meanwhile, supermarkets and hypermarkets combine scale with brand visibility, driving promotional programs and private-label innovation to capitalize on mainstream demand for reduced-sugar options.

On the application front, each end-use category exhibits tailored requirements. Bakery products demand heat-stable sweeteners that uphold texture and moisture retention. Beverages rely on rapid solubility and clean taste profiles, particularly as functional and sport drink segments expand. Dairy products such as yogurts and ice creams call for creamy mouthfeel enhancement when sugar is reduced. Prepared foods and culinary applications require tunable sweetness levels to accommodate savory-sweet balances. Pharmaceuticals employ low-calorie sweeteners not only to mask bitterness but also to meet the stringent purity and safety standards inherent in medical formulations.

Formulation choices further differentiate product offerings. Liquid concentrates enable precise dosing and rapid integration into beverage lines, whereas powder formats deliver portability and extended shelf life. Tablet products, often found in consumer retail channels, appeal to controlled portioning and convenience. Each formulation variant entails unique manufacturing processes, regulatory filings, and shelf-life considerations, influencing cost structures and channel strategies.

Diversity in sweetener chemistries adds another layer of complexity. Synthetic high-intensity options such as aspartame, saccharin, and sucralose offer decades of safety data and cost competitiveness, while acesulfame potassium blends provide synergistic effects that improve flavor profiles. Natural alternatives like stevia have captured premium positioning through organic and non-GMO credentials, driving investment in cultivation partnerships. Lastly, end-user segmentation reveals that commercial customers demand consistent supply and technical support for large-scale operations, whereas households prioritize ease of use and trusted brand assurances.

This comprehensive research report categorizes the Low-Calorie Sweetener market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Formulation

- Type

- Distribution Channel

- Application

- End User

Evaluating Regional Drivers and Consumption Trends in the Americas Europe Middle East Africa and Asia Pacific Impacting Low-Calorie Sweetener Adoption Worldwide

In the Americas region, health-driven consumption trends and sugar reduction initiatives have gained significant momentum. Regulatory measures such as sugar taxes in select jurisdictions are incentivizing food and beverage brands to reformulate staple products. Major beverage companies are integrating stevia and other natural sweeteners into flagship offerings, while regulators continue to evaluate the scientific evidence underpinning emerging sweetener technologies. Cross-border supply networks within North and Latin America are tightening as manufacturers pursue cost synergies and secure access to critical feedstocks.

The Europe, Middle East and Africa landscape is shaped by a mosaic of regulatory environments and consumer preferences. European Union directives on labeling transparency and health claims guide formulation strategies, encouraging the adoption of plant-derived alternatives. In the Middle East, rising per-capita income and urbanization fuel demand for premium, reduced-sugar beverages and confectionery. African markets present nascent opportunities, with pilot trials for sugar substitutes underway in functional drinks and dairy segments. Supply chain entrants are forging alliances with local partners to navigate import protocols and cultural taste profiles.

Asia-Pacific remains a powerhouse for both production and consumption of low-calorie sweeteners. China and India have expanded capacity for stevia leaf processing, using agricultural optimization and membrane filtration to boost purity. Japan continues to lead in high-intensity artificial sweetener R&D, leveraging advanced fermentation platforms and flavor modulation technologies. Southeast Asian markets are witnessing rapid adoption in ready-to-drink tea and coffee categories, while Australia and New Zealand showcase stringent food-safety standards that influence export dynamics. Taken together, the region’s technological investments and evolving regulatory frameworks are central to global supply stability and innovation trajectories.

This comprehensive research report examines key regions that drive the evolution of the Low-Calorie Sweetener market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Key Industry Players Innovations Partnerships and Strategic Initiatives Shaping the Competitive Landscape of the Low-Calorie Sweetener Market

Leading ingredient suppliers are intensifying research partnerships and technology licensing agreements to refine sweetener functionality. Global agribusiness firms have vested interests in scaling stevia cultivation programs across emerging agricultural hubs. At the same time, multinational specialty chemical producers are expanding capacity for next-generation high-potency sweeteners through joint ventures with biotechnology startups. Such collaborations aim to accelerate commercialization timelines and enhance flavor synchrony with sugar benchmarks.

Beverage and foodservice brands are orchestrating co-development initiatives to tailor sweetener blends for signature products. These strategic alliances often involve shared risk in pilot plant testing and sensory validation processes, enabling swift iteration on taste profiles under real-world production conditions. Through these integrated frameworks, partners achieve cost efficiencies, benefit from consolidated supply commitments, and unlock proprietary distribution channels that differentiate their offerings in crowded marketplaces.

Smaller innovator companies are carving out niche positions by focusing on clean-label, non-GMO certifications and transparent traceability systems. They leverage digital supply chain platforms to provide end-to-end visibility, appealing to conscientious consumers and brand teams that require documentation for regulatory filings. This emphasis on trust and reliability is prompting larger players to pursue acquisitions and minority equity stakes in boutique sweetener developers, further consolidating the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Low-Calorie Sweetener market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Co., Inc.

- Apura Ingredients Inc.

- Archer-Daniels-Midland Company

- Associated British Foods plc

- Baolingbao Biology Co., Ltd.

- Cargill, Incorporated

- Celanese Corporation

- DuPont de Nemours, Inc.

- Evolva Holding SA

- GLG Life Tech Corporation

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Mitsubishi International Food Ingredients, Inc.

- Nantong Changhai Food Additive Co., Ltd.

- NutraSweet Company

- Roquette Frères S.A.

- Südzucker AG

- Tate & Lyle PLC

- Zhucheng Haotian Pharma Co., Ltd.

Crafting Strategic Recommendations to Empower Industry Leaders in Leveraging Innovation and Capitalizing on Emerging Low-Calorie Sweetener Opportunities

Industry leaders must proactively invest in portfolio diversification by integrating both natural and synthetic sweeteners to address diverse consumer segments. By establishing innovation hubs that bring together flavor scientists, regulatory experts, and marketing strategists, companies can streamline the path from concept to commercialization. This integrated approach fosters agility, enabling rapid responses to evolving health trends and emerging regulatory requirements.

Strengthening strategic partnerships across the supply chain is essential to ensure cost stability and consistent quality. By co-investing in processing capacity at origin and negotiating multi-year offtake agreements with agricultural producers, businesses can mitigate tariff impacts and raw material volatility. Collaborative frameworks should also extend to joint research with academic institutions, harnessing advanced extraction and formulation technologies to optimize sensory performance and production efficiency.

Finally, leveraging data-driven insights to refine go-to-market strategies will prove critical. Companies can harness real-time analytics from e-commerce platforms and social listening tools to gauge consumer sentiment and measure the success of reformulation initiatives. By aligning marketing narratives with validated health claims and sustainability metrics, organizations will build stronger brand equity and capture long-term loyalty in an increasingly competitive low-calorie sweetener ecosystem.

Detailing the Comprehensive Research Methodology Combining Primary Interviews Quantitative Data Analysis and Market Validation Techniques for Reliable Insights

The research methodology underpinning this analysis combined rigorous primary and secondary approaches to ensure validity and reliability. On the primary side, a series of in-depth interviews were conducted with senior executives from ingredient manufacturers, food and beverage formulators, and regulatory bodies. These dialogues provided qualitative insights into strategic priorities, innovation pipelines, and supply chain challenges. Simultaneously, structured surveys gathered quantitative data on purchase criteria, pricing sensitivities, and adoption timelines across diverse end-user segments.

Secondary research supported the primary findings by sourcing data from governmental trade reports, regulatory agency publications, and peer-reviewed scientific literature. Trade association statistics offered visibility into global production volumes, while regulatory filings illuminated the evolving compliance landscape. Market validation workshops convened cross-functional stakeholders to test preliminary conclusions and refine scenario analyses. Altogether, these research steps yielded a comprehensive and triangulated view of the low-calorie sweetener domain, empowering stakeholders with actionable intelligence for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Low-Calorie Sweetener market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Low-Calorie Sweetener Market, by Formulation

- Low-Calorie Sweetener Market, by Type

- Low-Calorie Sweetener Market, by Distribution Channel

- Low-Calorie Sweetener Market, by Application

- Low-Calorie Sweetener Market, by End User

- Low-Calorie Sweetener Market, by Region

- Low-Calorie Sweetener Market, by Group

- Low-Calorie Sweetener Market, by Country

- United States Low-Calorie Sweetener Market

- China Low-Calorie Sweetener Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Core Findings and Strategic Imperatives to Illuminate the Path Forward for Stakeholders in the Evolving Low-Calorie Sweetener Ecosystem

The core findings reveal a transforming landscape where technological innovation, consumer preferences, and geopolitical considerations intersect to shape the future of low-calorie sweeteners. Ingredient suppliers must balance the pursuit of novel extraction and fermentation methods with cost optimization and sustainability commitments. Brand owners, in turn, have an opportunity to harness these advancements in formulating products that resonate with health-focused consumers while maintaining sensory excellence.

Strategic imperatives call for collaborative supply models, agile R&D frameworks, and data-driven market engagement to thrive amidst evolving tariff structures and regulatory demands. As the competitive environment intensifies, companies that cultivate flexible ingredient portfolios and robust stakeholder partnerships will be best positioned to capture growth. Ultimately, this report underscores the importance of proactive innovation and integrated strategy development for stakeholders seeking to lead the low-calorie sweetener market into its next phase of evolution.

Connect with Ketan Rohom Associate Director of Sales and Marketing to Secure Your In-Depth Low-Calorie Sweetener Market Research Report for Exclusive Insights

Connect with Ketan Rohom Associate Director of Sales and Marketing to secure your in-depth low-calorie sweetener market research report for exclusive insights

- How big is the Low-Calorie Sweetener Market?

- What is the Low-Calorie Sweetener Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?