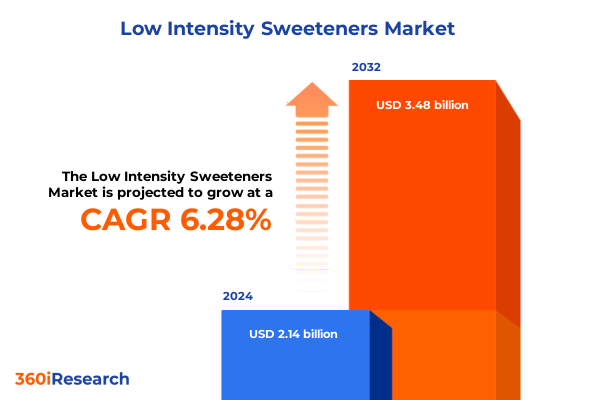

The Low Intensity Sweeteners Market size was estimated at USD 2.27 billion in 2025 and expected to reach USD 2.40 billion in 2026, at a CAGR of 6.26% to reach USD 3.48 billion by 2032.

Emerging Dynamics and Strategic Significance of Low Intensity Sweeteners in the Evolving Food Formulation Landscape and Growth Opportunities

In recent years, low intensity sweeteners have emerged as a pivotal class of ingredients bridging the gap between calorie reduction and functional performance in food and pharmaceutical formulations. Unlike high intensity sweeteners, which excel at delivering sweetness at minute dosages, sugar alcohols and other low intensity alternatives supply both sweetness and bulk, enabling manufacturers to replicate sugar’s textural and moisture-retention properties. Advances in fermentation, enzymatic conversion, and crystallization have enhanced production efficiencies for compounds such as erythritol, xylitol, sorbitol, mannitol, and maltitol, driving down cost and improving sensory profiles. This technological progress has directly contributed to broader adoption of polyols in applications ranging from baked goods and confectionery to dairy products and pharmaceuticals, underscoring their strategic significance in clean-label and reduced-sugar innovations

Consumer Health Priorities Regulatory Measures and Technological Breakthroughs Are Redefining the Low Intensity Sweeteners Ecosystem

As consumer health priorities continue to shape purchasing behavior, regulatory measures and technological innovation are converging to redefine the low intensity sweeteners market. Heightened scrutiny of artificial sweeteners - sparked by concerns such as the World Health Organization’s 2023 advisory on aspartame’s potential carcinogenicity despite FDA assurances of safety - has accelerated the shift toward perceived natural alternatives like stevia, monk fruit, and sugar alcohols. Today, product developers must balance sweetness, mouthfeel, and label transparency, driving rapid formulation experimentation across categories

Concurrently, breakthroughs in rare sugar technologies are unlocking new possibilities for taste and functionality. Allulose, offering approximately 70% of sucrose’s sweetness with minimal caloric impact and negligible glycemic response, has seen a 46% increase in new product launches globally between 2019 and 2024. Tagatose, isomaltulose, and other novel polyols are similarly gaining traction, supported by ongoing R&D investments in optimized enzyme systems and catalyst recovery processes. These innovations not only address sensory limitations of early-generation sweeteners but also expand the toolbox available to formulators targeting low-sugar and ketogenic applications

Moreover, fiscal levers such as sugar-sweetened beverage taxes and voluntary sugar reduction targets are compelling manufacturers to accelerate reformulation initiatives. In five major U.S. cities, excise taxes implemented between 2017 and 2018 generated a 33% decrease in beverage purchases, evidencing both consumer responsiveness and public health impact. Across Europe, tiered soft drink levies designed to incentivize sugar reduction have driven average sugar content declines of up to 31% in the United Kingdom and 6% in France following policy adoption. These regulatory dynamics are intensifying demand for low intensity sweeteners as essential components of sugar reduction strategies

Antidumping and Countervailing Duty Investigations Combined With Harmonized Tariff Schedule Actions Shaping US Sweeteners Trade in 2025

The United States International Trade Commission’s January 2025 preliminary determinations concerning imports of erythritol from China underscore the growing trade scrutiny around polyols. With investigations into allegations of subsidization and dumping (Inv. Nos. 701-TA-751 and 731-TA-1729) indicating a reasonable threat of material injury, the U.S. Department of Commerce’s preliminary antidumping duty findings for China are due by May 22, 2025, while its countervailing duty determination is slated for March 10, 2025. Should these investigations conclude affirmatively, importers may face significant additional duties on erythritol, reshaping competitive dynamics and supply chain strategies for U.S. manufacturers and distributors

Under the Harmonized Tariff Schedule of the United States subheading 2905.49.4000, polyhydric alcohols derived from sugars currently carry a general duty rate of 5.5%, with preferential rates and quotas lowering this to free for many trading partners. However, the potential overlay of Section 301 tariffs, coupled with antidumping and countervailing duties, could yield cumulative duty burdens exceeding 20%, elevating landed costs and incentivizing near-sourcing or domestic scale-up initiatives. Industry stakeholders are closely monitoring these developments to mitigate supply disruptions and maintain cost competitiveness in formulation portfolios

Diverse Formulations and Applications Across Granules Liquids Powders Polyalcohol Types and Distribution Channels Reveal Critical Market Segmentation Patterns

Market participants segment low intensity sweeteners by form across granules, liquids, and powders, each offering distinct functional advantages. Granules provide ease of metering and blending, making them a mainstay in bakery and confectionery processes where flow properties are critical. Liquid formats enable rapid dissolution and homogeneous integration in beverages, particularly functional drinks and syrups, while powders offer versatility in dry mixes and encapsulated formulations where moisture control and shelf stability are paramount.

Product offerings are further classified as blends or single sweeteners. Blends capitalize on synergistic sweetness profiles and mask off-notes, allowing formulators to fine-tune taste and cost parameters. Single sweetener solutions, on the other hand, cater to label-driven clean-label demands, enabling brands to highlight naturally derived erythritol or xylitol without the complexity of multi-ingredient declarations.

Within the polyol family, erythritol remains the leading type for its high purity, noncariogenic profile, and clean cooling effect. Isomalt distinguishes itself in sugar-free hard candies and chewables due to its low hygroscopicity, while lactitol and maltitol are favored for maintaining bulk and texture in baked goods. Mannitol’s stability under high temperatures makes it ideal for melt-in-the-mouth confections, and sorbitol’s humectant properties extend moisture retention in oral care and pharmaceutical formulations. Xylitol’s well-documented dental health benefits continue to support its niche prominence in chewing gum and toothpaste.

Application segmentation reveals diverse usage across bakery, beverages, confectionery, dairy products, and pharmaceuticals. In bakery, polyols contribute critical structural and sensory attributes to breads, cakes, and pastries. In beverages, they augment mouthfeel in alcoholic beverages, dairy-based drinks, functional and soft drinks, and juices. Confectionery uses encompass crystalline candies, chocolates, and gums, while dairy applications leverage polyols to enhance creaminess in cheese, ice cream, and yogurt. Pharmaceutical uses span directly compressible powders, syrups, and tablet coatings, underscoring the versatility of low intensity sweeteners in controlled-release systems.

Distribution channels range from convenience stores catering to impulse purchases and on-the-go snacking to online retail via company websites and third-party e-commerce platforms, which provide curated assortments of premium and niche sweetener products. Specialty retail outlets differentiate through curated clean-label assortments, while supermarkets and hypermarkets remain key volume channels, allocating dedicated shelf space to sugar-reduced and sugar-free alternatives.

This comprehensive research report categorizes the Low Intensity Sweeteners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Product Offering

- Type

- Application

- Distribution Channel

Distinct Regional Drivers and Policy Frameworks Across Americas Europe Middle East Africa and Asia Pacific Inform Low Intensity Sweeteners Demand Variations

In the Americas, shifting consumer preferences toward reduced sweetness and natural ingredients are amplified by local SSB taxes and public health campaigns. The implementation of excise taxes in cities such as Philadelphia, Seattle, and San Francisco between 2017 and 2018 resulted in an average 33% decline in beverage purchases, underscoring strong market responsiveness to higher pricing. This environment has catalyzed the adoption of low intensity sweeteners not only in beverages but also in snacks, bakery, and dairy products, as manufacturers pursue sugar reduction to maintain affordability and label appeal while aligning with weight-management trends

Europe Middle East and Africa markets are likewise being reshaped by targeted levies and reformulation mandates. The United Kingdom’s Soft Drinks Industry Levy drove a 17% to 31% reduction in sales-weighted sugar content between 2016 and 2019, while France’s tiered tax introduced in 2018 produced a 6% reduction shortly after implementation. Voluntary reduction agreements in the Netherlands and the Italian sugar tax scheduled for July 2025 further demonstrate the region’s policy mix. Meanwhile, industry-led initiatives under Unesda have achieved a 7.6% decline in average added sugars across EU-27 soft drinks from 2019 to 2022, reflecting collaborative progress toward pan-European sugar reduction targets

Asia-Pacific continues to register the fastest growth rates for low intensity sweeteners, driven by rising diabetes prevalence and expanding middle-class demand for health-oriented foods. Regulatory measures in Australia and New Zealand, alongside voluntary sugar reduction pledges in emerging markets such as China and India, are compelling product innovation. The region’s functional foods segment, which integrates polyols and rare sugars into nutritional bars and fortified beverages, is experiencing robust expansion, mirroring the global 46% surge in allulose-based NPD. These dynamics underscore Asia-Pacific’s role as both a high-growth market and a proving ground for next-generation sweetening solutions

This comprehensive research report examines key regions that drive the evolution of the Low Intensity Sweeteners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Strategies of Leading Ingredient Providers Emphasize Sustainability Innovation and Custom Formulation Solutions in the Sugar Alcohol Sector

Market leadership in sugar alcohol sweeteners is concentrated among ingredient specialists pursuing differentiated strategies. Roquette Frères leverages vertically integrated production systems and targeted capacity expansions, such as its €50 million investment in sorbitol capacity in China for the Asia-Pacific market, while championing its SweetPearl® erythritol derived from non-GMO corn under clean-label positioning. Its global footprint across Europe, North America, and Asia underpins reliable supply and technical support infrastructure for diverse end-users

Cargill has distinguished itself through strategic co-development partnerships and application-specific platforms. Its Erythritol VP line, created in collaboration with confectionery and bakery manufacturers, addresses crystallization and texture challenges unique to sugar-free products. Cargill’s formulation teams offer customized sweetness optimization and process guidance, enabling rapid time-to-market for new reduced-sugar offerings

ADM and Ingredion are intensifying investments in clean-label sweetening systems and texture enhancement. ADM’s Replace, Rebalance, Rebuild framework couples its extensive sweetening library with application engineering, facilitating sugar replacement, flavor balancing, and functional restoration. Ingredion’s focus on native starch-based modifiers and liquid polyol systems supports formulators navigating cost, stability, and sensory hurdles in beverage and dairy applications

Tate & Lyle and Jungbunzlauer Suisse AG maintain a competitive edge through high-purity product portfolios and sustainability commitments. Tate & Lyle’s stewardship of stevia and sucralose research complements its polyol offerings, while Jungbunzlauer’s emphasis on green chemistry and renewable feedstocks for erythritol production resonates with eco-conscious brands. Both firms prioritize transparent sourcing and environmental stewardship in response to intensifying consumer and regulatory scrutiny on supply chain sustainability

This comprehensive research report delivers an in-depth overview of the principal market players in the Low Intensity Sweeteners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Associated British Foods Plc

- BENEO

- Bonumose Inc

- Cargill Incorporated

- Corbion N.V.

- DSM-Firmenich AG

- DuPont de Nemours Inc

- Foodchem International Corporation

- Gadot Biochemical Industries Ltd

- GLG Life Tech Corporation

- Gulshan Polyols Ltd

- HYET Sweet

- Icon Foods

- Ingredion Incorporated

- International Flavors & Fragrances Inc

- JK Sucralose Inc

- Jungbunzlauer Suisse AG

- Matsutani Chemical Industry Co Ltd

- Mitsui Sugar Co Ltd

- PureCircle

- Roquette Frères

- Südzucker AG

- Tate & Lyle PLC

- Whole Earth Brands Inc

Actionable Strategic Imperatives for Industry Stakeholders to Capitalize on Emerging Opportunities in the Low Intensity Sweeteners Market

Industry leaders must prioritize flexible manufacturing architectures that can pivot across granules, liquids, and powder formats to meet dynamic application requirements. Investing in modular processing lines and rapid changeover capabilities will enable swift response to shifts in segment demand and regulatory thresholds. Supply chain resilience should be fortified through multi-sourcing strategies for key feedstocks, balancing cost optimization with risk mitigation in light of potential duty escalations.

Robust collaboration between ingredient suppliers and consumer packaged goods manufacturers will be essential for co-creating optimized sweetening solutions. Joint development agreements and shared pilot facilities can accelerate the translation of rare sugar innovations and polyol blends into scalable commercial products. Furthermore, leveraging predictive analytics and consumer insight platforms will enhance demand forecasting, ensuring inventory aligns with emerging culinary trends and health mandates.

Sustainability credentials and transparent supply chain practices are increasingly influential purchase drivers. Companies should embed lifecycle assessment frameworks and renewable energy adoption within their production strategies to meet decarbonization goals and satisfy stakeholder expectations. Certification programs such as ISCC Plus and value-chain traceability initiatives will bolster brand integrity and facilitate market access in environmentally regulated markets.

Active engagement with regulatory agencies and standards bodies will ensure that sweetener safety evaluations and labeling requirements remain aligned with scientific consensus. Advocating for harmonized global guidelines on novel sweeteners can reduce compliance complexity, while participating in public–private partnerships can shape pragmatic policies that support innovation and consumer protection.

Rigorous Mixed Methodology Leveraging Primary Interviews Secondary Data and Multivariate Segmentation Analysis Underpins Market Intelligence Insights

This research harnessed a mixed-method approach combining extensive secondary data review with targeted primary stakeholder engagements. Secondary sources encompassed global trade databases, tariff schedules, regulatory filings, and peer-reviewed publications to establish a factual foundation for market dynamics and policy impacts. Key secondary references included U.S. International Trade Commission reports, Federal Register notices, and recognized industry journals.

Primary research involved in-depth interviews and surveys with senior R&D, procurement, and sales executives across global ingredient providers, consumer packaged goods manufacturers, and regulatory consultants. Insights gathered from these discussions informed granular segmentation analyses, validating functional performance criteria and channel preferences.

Data triangulation techniques aligned quantitative import/export statistics, tariff rate data, and consumption trends with qualitative stakeholder feedback, ensuring robust reliability and accuracy. Advanced segmentation modeling and trend extrapolation grounded strategic recommendations, while iterative peer reviews with subject-matter experts refined analytical frameworks and narrative coherence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Low Intensity Sweeteners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Low Intensity Sweeteners Market, by Form

- Low Intensity Sweeteners Market, by Product Offering

- Low Intensity Sweeteners Market, by Type

- Low Intensity Sweeteners Market, by Application

- Low Intensity Sweeteners Market, by Distribution Channel

- Low Intensity Sweeteners Market, by Region

- Low Intensity Sweeteners Market, by Group

- Low Intensity Sweeteners Market, by Country

- United States Low Intensity Sweeteners Market

- China Low Intensity Sweeteners Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Consolidated Perspectives on Market Evolution and Stakeholder Imperatives Underscoring the Future Trajectory of Low Intensity Sweeteners

The low intensity sweeteners market is at an inflection point driven by converging consumer health priorities, regulatory imperatives, and technological breakthroughs in rare sugars and polyols. While U.S. trade actions and evolving tariff landscapes introduce complexity, they also create avenues for domestic capacity expansion and supply chain optimization. Concurrently, segmentation insights reveal nuanced performance requirements across form factors, sweetener types, applications, and channels, guiding more precise go-to-market strategies.

Regional divergences underscore the importance of localized approaches: North America’s tax-driven reformulation, EMEA’s tiered levy and voluntary targets, and Asia-Pacific’s growth momentum shaped by demographic shifts and functional food demands. Leading companies are responding with strategic investments in production flexibility, sustainability, and collaborative innovation platforms, setting new benchmarks for clean-label, taste-optimized solutions.

As the industry navigates these transformative currents, data-driven partnerships and agile operational models will distinguish market winners. Stakeholders who adeptly integrate consumer insights with technical capabilities and proactive regulatory engagement will unlock the maximum potential of low intensity sweeteners as essential ingredients in the global shift toward healthier, more sustainable food and beverage systems.

Engage Directly With Our Senior Sales Expert to Secure Comprehensive Low Intensity Sweeteners Research and Gain a Competitive Edge

To gain an in-depth understanding of the evolving low intensity sweeteners landscape, from regulatory shifts and tariff developments to granular segmentation and regional nuances, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings a wealth of expertise in customized market intelligence solutions and can guide you through how our comprehensive report will empower your strategic decision-making. Reach out today to secure your copy of the definitive research that will fuel growth and competitive advantage in this dynamic sector

- How big is the Low Intensity Sweeteners Market?

- What is the Low Intensity Sweeteners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?