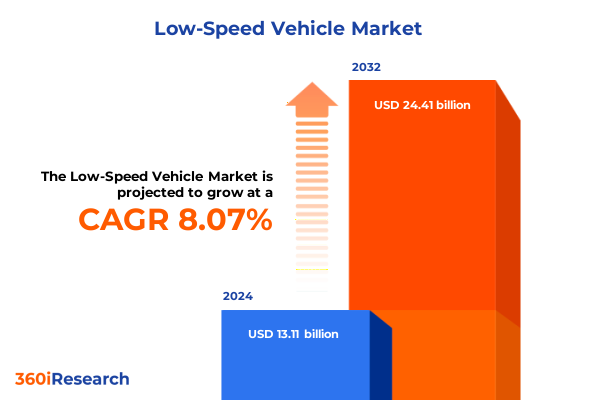

The Low-Speed Vehicle Market size was estimated at USD 14.17 billion in 2025 and expected to reach USD 15.33 billion in 2026, at a CAGR of 8.69% to reach USD 25.41 billion by 2032.

Navigating the Emergent Dynamics of the North American Low-Speed Vehicle Market in an Era of Sustainability and Regulatory Evolution

The evolution of low-speed vehicles (LSVs) has transitioned from niche recreational use into a versatile segment that now plays a critical role across commercial campuses, gated communities, municipal fleets, and recreational venues. As sustainability agendas intensify and stakeholders demand greener, more efficient mobility solutions, LSVs are emerging as a compelling alternative to traditional transport modes for short distances and closed-loop environments. These vehicles blend ease of operation, lower operational expenses, and reduced environmental impact, making them particularly well-suited to applications ranging from logistics support within industrial facilities to personalized transport within residential estates.

Against this backdrop, the low-speed vehicle industry is experiencing a renaissance driven by technological advancements in electric propulsion, emerging regulatory frameworks, and evolving consumer preferences. Government incentives aimed at reducing carbon footprints have accelerated the adoption of battery-based mobility options, while hybrid configurations are finding traction among operators who require extended range without sacrificing sustainability credentials. In parallel, dealerships, aftermarket suppliers, and original equipment manufacturers (OEMs) are innovating distribution and service models to enhance accessibility and total cost of ownership.

This executive summary provides a holistic overview of recent industry developments, transformative shifts, tariff influences, segmentation nuances, regional dynamics, competitive strategies, and actionable recommendations. It is designed to equip decision-makers with the insights necessary to navigate a rapidly maturing market landscape, capitalize on emergent opportunities, and mitigate potential disruptions in the months and years ahead.

Identifying the Transformative Shifts Reshaping Low-Speed Vehicle Innovation Across Technology Adoption, Consumer Behavior, and Infrastructure Integration

Over the last several years, the low-speed vehicle landscape has been reshaped by the convergence of electrification, digitalization, and consumer demand for eco-friendly mobility solutions. Electrification has extended beyond rudimentary battery offerings to encompass fuel cell electric platforms as manufacturers seek to deliver rapid refueling and extended operational windows for high-utilization fleets. Concurrently, advancements in battery chemistry-featuring higher energy densities and faster charging capabilities-have addressed longstanding range limitations and reinforced operator confidence in electric LSV performance. These technology infusions have established a foundation for next-generation powertrain architectures, with hybrid configurations serving as a transitional pathway where pure electric charging infrastructure remains nascent.

Digital integration has emerged as another pivotal shift, introducing telematics, fleet management platforms, and predictive maintenance algorithms that enhance uptime and operational efficiency. Data streams from connected vehicles enable real-time monitoring of battery health, usage patterns, and service requirements, allowing fleet managers to optimize scheduling and reduce unexpected downtime. As these capabilities proliferate, OEMs and channel partners are layering value-added services-ranging from remote diagnostics to subscription-based maintenance packages-to solidify customer loyalty and unlock recurring revenue streams.

On the consumer front, heightened environmental awareness and changing lifestyle preferences have expanded LSV applications beyond traditional campus and resort settings into gated residential communities and tourism corridors. Operators in these domains are prioritizing quiet, zero-emission transport solutions that blend seamlessly with experiential offerings, fostering a more immersive engagement with end users. This broadening consumer base has compelled manufacturers to diversify product portfolios, tailoring vehicle designs to aesthetic and functional requirements across a spectrum of use cases.

Finally, infrastructural developments at both municipal and private levels are setting the stage for accelerated LSV adoption. Investments in charging networks, standardized safety protocols, and streamlined permitting processes have reduced entry barriers and fostered cross-sector collaboration. These interlocking trends underscore the transformative forces at work within the sector, collectively driving an unprecedented phase of growth and innovation.

Assessing the Multifaceted Cumulative Impact of United States Tariffs Implemented in 2025 on Supply Chains, Production Costs, and Market Accessibility

In early 2025, a suite of revised tariff measures was enacted, targeting key components and finished assemblies imported from select international markets. As a result, manufacturers and distributors have encountered material input cost increases, particularly in advanced battery modules, electric drivetrains, and specialized control units that are central to contemporary LSV designs. Many suppliers have been compelled to reassess their sourcing strategies, either by absorbing margin compression or passing incremental expenses to end customers. This cost-pass-through has manifested in upward pressure on vehicle prices, impacting the total cost of ownership for commercial operators and limiting price competitiveness against legacy internal combustion engine alternatives.

Moreover, the cumulative impact of tariffs has prompted a strategic reconfiguration of supply chain geographies. Several prominent OEMs have intensified efforts to localize component production, forging partnerships with domestic battery manufacturers and electronics assemblers to reduce exposure to import levies. While these initiatives promise long-term resilience, they require significant capital investment and extended lead times to scale effectively. In the interim, some industry participants have turned to dual-sourcing agreements, diversifying their vendor base across regions to mitigate tariff volatility and maintain production continuity.

Beyond procurement, the tariff regime has created secondary ripple effects in aftermarket and service segments. Replacement parts that once enjoyed seamless cross-border flows are now subject to additional duties, leading distributors to reevaluate inventory strategies and warranty frameworks. Dealership networks, in particular, have intensified their focus on promoting preventative maintenance programs to offset potential reductions in aftermarket part sales. Simultaneously, direct-to-consumer OEM channels have risen in prominence, leveraging digital sales mechanisms to streamline pricing transparency and reduce distribution overhead.

Looking ahead, the interplay between tariff policy and market adaptation will remain a defining theme for industry stakeholders. While temporary cost escalations have tested the agility of manufacturers and their channel partners, emerging plans for enhanced domestic capacity and collaborative trade agreements offer pathways to mitigate these headwinds. Proactive engagement with policy makers and continued diversification of sourcing footprints will be critical to sustaining competitiveness in an environment shaped by evolving trade dynamics.

Uncovering Segmentation Insights Across Propulsion, Application, Vehicle Type, and Sales Channels to Elevate Positioning in the Low-Speed Vehicle Arena

The propulsion landscape of the low-speed vehicle market has rapidly diversified, with electric configurations now encompassing both battery electric variants optimized for short-range campus operations and fuel cell electric systems that cater to intensive duty cycles requiring minimal downtime. Gas-powered models continue to service applications where refueling speed and established infrastructure offer practical advantages, while hybrid architectures-parallel hybrid systems delivering continuous power boosting and series hybrid units providing extended range through on-board generators-bridge the gap between traditional and fully electric mobility. This multifaceted propulsion matrix enables operators to align vehicle selection with specific performance, regulatory, and budgetary considerations.

Turning to application segments, commercial uses remain a cornerstone of market activity. Vehicles tailored for campus use, government institutions, and industrial facilities are engineered for robustness and ease of integration with existing workflows, featuring customizable cargo modules and safety features compliant with institutional standards. Recreational deployments have expanded beyond golf courses to encompass public parks, hospitality resorts, and venue shuttles, where quiet operation and aesthetic design contribute to guest experiences. In residential environments, especially gated communities and private estates, demand is rising for personalized conveyance solutions that blend seamlessly with landscaping and community planning.

Vehicle type segmentation further refines the competitive landscape. Passenger models range from agile two-seat vehicles ideal for short intra-facility hops to four-seater and multi-seater platforms that support group transport in tourism or senior living contexts. Specialty offerings, including purpose-built golf carts and tourism carts, continue to innovate around comfort, ride quality, and modular accessories. Utility configurations-comprising cargo carriers and maintenance carts-are optimized for load capacity and durability, serving as workhorses in construction sites, agricultural settings, and large event venues.

Finally, distribution channels are evolving to meet shifting customer preferences. Aftermarket sales of accessories and replacement parts are buoyed by customization trends, while branded dealer networks and independent outlets provide localized product expertise and servicing capabilities. Direct OEM channels, both offline showrooms and online platforms, are gaining traction by offering transparent pricing, configurable build-to-order options, and digital sales support. The interplay among these channels shapes competitive dynamics and informs strategic decisions around investment in product lines and service infrastructure.

This comprehensive research report categorizes the Low-Speed Vehicle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion Type

- Vehicle Type

- Application

- Sales Channel

Strategic Regional Perspectives on Low-Speed Vehicle Adoption Trends in the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

In the Americas, the United States leads LSV adoption, driven by robust government incentives for zero-emission vehicles and strong demand within educational campuses, hospitality resorts, and closed community developments. Canada’s stringent environmental regulations have spurred interest in electric charge-based operators, particularly in municipal services and tourism applications. Mexico remains an emerging market, with opportunities concentrated in industrial logistics and agritourism segments as local businesses invest in low-carbon transport options to align with national sustainability goals.

Across Europe, Middle East & Africa, the landscape is shaped by divergent regulatory frameworks and infrastructure maturity. Western European nations have established stringent emissions targets that incentivize electric LSV usage in urban and tourism settings, while government-driven pilot programs in the Gulf region emphasize fuel cell vehicles for high-heat environments and intensive corridor operations. In Africa, market development is nascent, with potential for gradual expansion evidenced by small-scale tourism deployments and campus transport initiatives linked to international development projects.

The Asia-Pacific region encompasses a broad spectrum of maturity levels and growth trajectories. China stands out as both a production hub and a leading adopter, with established electric vehicle manufacturing clusters serving domestic and export demands. Japan and South Korea focus on advanced hybrid and fuel cell research, applying LSV technologies within smart campus projects and hospitality venues. Southeast Asian nations, balancing infrastructure constraints with urbanization pressures, are exploring pilot deployments in gated communities and industrial parks, while Australia’s resort markets continue to favor premium electric and hybrid units tailored to high-end tourism experiences.

Collectively, these regional dynamics underscore the importance of aligning market entry strategies with localized regulatory incentives, infrastructure readiness, and application preferences. Stakeholders who calibrate product development and channel partnerships to specific regional hallmarks stand poised to capture disproportionate value from the unfolding global LSV opportunity.

This comprehensive research report examines key regions that drive the evolution of the Low-Speed Vehicle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Competitive Landscape and Strategic Postures of Pivotal Companies Shaping the Low-Speed Vehicle Ecosystem on a Global Scale

Several leading manufacturers have emerged as trendsetters, combining product innovation with strategic alliances to capitalize on shifting market dynamics. Among passenger LSV firms, those that continuously expand modular design offerings and integrate advanced telematics solutions are setting new performance benchmarks. Companies investing heavily in next-generation battery technologies and alternative hydrogen fuel cell applications are gaining early mover advantages in both high-utilization commercial and high-expectation recreational segments.

In the specialty cart arena, established golf cart providers and tourism cart designers are differentiating through bespoke customization services, enabling operators to tailor vehicle aesthetics and amenity packages to venue branding and guest experience imperatives. At the same time, utility cart manufacturers are bolstering their value propositions by reinforcing durability standards and unveiling smart accessory ecosystems-ranging from IoT-enabled cargo modules to all-terrain kit attachments-that address the nuanced requirements of maintenance, agriculture, and construction applications.

Distribution channel leaders are also recalibrating their strategies. Prominent dealer networks are enhancing customer engagement through virtual configurators and augmented reality showrooms, while aftermarket specialists are growing their footprint by bundling parts and service contracts that promote predictable maintenance costs. Direct OEM sales organizations have gained market share by reducing order-to-delivery cycles through integrated online ordering systems and by offering subscription-style access to maintenance and upgrade services.

Emerging players, particularly those hailing from adjacent micro-mobility sectors, are forging partnerships with charging infrastructure providers and software platform companies to deliver end-to-end solutions. These collaborations are accelerating the development of turnkey packages that include vehicle procurement, charging station installation, fleet management, and data analytics-an offering set that appeals to time-constrained institutional buyers seeking low-risk entry into the LSV space.

This comprehensive research report delivers an in-depth overview of the principal market players in the Low-Speed Vehicle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A BMW Group Company

- ACG, Inc.

- AGT Electric Cars

- American LandMaster

- ATUL Auto Limited

- Bintelli Electric Vehicles

- Club Car, LLC

- Columbia Vehicle Group, Inc.

- Columbia Vehicle Group, Inc.

- COMARTH

- Cruise Car, Inc.

- Estrima S.p.A.

- HDK Electric Vehicle

- John Bradshaw Limited

- John Deere Group

- Kubota Corporation

- MAINI GROUP COMPANY

- Marshell Green Power Co. Ltd.

- MOTO ELECTRIC VEHICLES

- Nebula Automotive Private Limited

- Pilotcar Otomotiv San. and Tic. A.S.

- Speedways Electric

- Star EV Corporation

- Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd

- Textron Specialized Vehicles Inc.

- The Toro Company

- This Kawasaki Motors Corp.,

- Waev Inc.

- Yamaha Motor Co., Ltd.

Delivering Actionable Recommendations to Empower Industry Leaders in Leveraging Emerging Opportunities and Navigating Challenges in the Low-Speed Vehicle Sector

To capitalize on the ongoing electrification wave, industry leaders should prioritize R&D efforts in high-efficiency battery systems and expand fuel cell pilot programs to diversify clean powertrain options. Reduced dependence on imported components can be achieved by establishing strategic partnerships with domestic battery and drivetrain manufacturers, while dual-sourcing strategies can provide interim supply chain flexibility in the face of tariff uncertainties.

Organizations should also invest in digital fleet management tools, integrating telematics and predictive analytics to enhance vehicle uptime and deliver superior service offerings. By bundling data-driven maintenance packages with vehicle sales, providers can create recurring revenue streams and deepen customer relationships. Additionally, exploring subscription-based ownership and short-term rental models can attract new segments-such as residential community operators and event planners-who value operational flexibility over outright purchase.

From a channel perspective, expanding direct online sales platforms will improve pricing transparency and reduce distribution costs, while strengthening branded dealership networks will ensure consistent service quality across geographies. Aftermarket parts businesses should leverage digital marketing and e-commerce capabilities to reach end users directly, offering customizable accessory kits and warranty extensions that enhance user experience and foster brand loyalty.

Finally, geographic expansion strategies must be underpinned by localized go-to-market plans. In mature markets, forging alliances with existing infrastructure providers and regulatory bodies can expedite project approvals, whereas in developing regions, pilot programs with key institutional customers will demonstrate real-world ROI and catalyze broader adoption. By aligning strategic initiatives with the nuanced needs of each region, industry leaders can seize growth opportunities in a market undergoing rapid transformation.

Detailing a Rigorous Research Methodology Designed to Ensure Accuracy, Objectivity, and Comprehensive Coverage of the Low-Speed Vehicle Market Analysis

The research underpinning this report leveraged a multi-faceted methodological approach to ensure depth, accuracy, and objectivity. Primary efforts included in-depth interviews with senior executives at low-speed vehicle manufacturers, component suppliers, and distribution channel leaders to capture firsthand perspectives on technological advancements, operational challenges, and strategic priorities. These conversations were complemented by discussions with fleet operators across commercial campuses, governmental agencies, and residential communities to validate demand drivers and identify emerging use cases.

Secondary research entailed a comprehensive review of public records, regulatory filings, and sustainability policy announcements across major markets. Proprietary databases provided granular data on vehicle registrations, safety compliance certifications, and import-export flows, enabling triangulation of qualitative insights with quantitative trends. Additionally, trade journals and technical whitepapers were analyzed to track the evolution of battery chemistry, fuel cell developments, and telematics innovations.

To refine segmentation and regional analyses, data points were cross-validated through peer benchmarking workshops, where industry stakeholders assessed preliminary findings and provided feedback on market applicability. A rigorous quality-assurance protocol was applied at each stage, encompassing data verification procedures, consistency checks, and methodological audits by independent research reviewers. This layered framework ensured that the insights contained herein reflect the most up-to-date and actionable intelligence available.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Low-Speed Vehicle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Low-Speed Vehicle Market, by Propulsion Type

- Low-Speed Vehicle Market, by Vehicle Type

- Low-Speed Vehicle Market, by Application

- Low-Speed Vehicle Market, by Sales Channel

- Low-Speed Vehicle Market, by Region

- Low-Speed Vehicle Market, by Group

- Low-Speed Vehicle Market, by Country

- United States Low-Speed Vehicle Market

- China Low-Speed Vehicle Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Critical Findings and Forward-Looking Conclusions to Guide Stakeholders Through the Rapid Evolution of the Low-Speed Vehicle Landscape

In sum, the low-speed vehicle industry stands at an inflection point characterized by rapid electrification, digital transformation, and evolving regulatory environments. Strategic responses to the 2025 tariff regime will shape supply chain architectures, pricing strategies, and channel dynamics for years to come. Granular segmentation across propulsion types-including battery electric, fuel cell electric, gas, and hybrid systems-reveals targeted opportunities for product differentiation, while application-based insights underscore the value of tailored solutions for commercial, recreational, and residential end users.

Regionally, market entry priorities must account for the disparate maturity levels of the Americas, Europe Middle East & Africa, and Asia-Pacific, each presenting unique regulatory incentives and infrastructure conditions. Competitive analysis highlights the importance of continuous innovation, partnerships, and digital service extensions to maintain market leadership. The recommendations outlined herein provide a pragmatic roadmap for stakeholders to harness emergent trends-ranging from advanced powertrain R&D to subscription-style ownership models-while mitigating potential disruptions.

As the sector evolves, organizations that adopt a holistic, data-driven approach and foster collaborative ecosystems will be best positioned to thrive in a landscape defined by both opportunity and complexity.

Engage Directly with Associate Director Ketan Rohom to Secure Your Comprehensive Low-Speed Vehicle Market Intelligence Report and Gain Strategic Advantage Today

To gain a competitive advantage and secure comprehensive market intelligence on the low-speed vehicle industry, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating complex research into actionable insights ensures you will receive tailored guidance aligned with your business objectives. By partnering with Ketan, you will access in-depth analysis, strategic recommendations, and ongoing support to help you navigate emerging opportunities and evolving challenges. Don’t miss the chance to leverage his deep industry knowledge-contact him today to purchase the full low-speed vehicle market research report and position your organization at the forefront of innovation.

- How big is the Low-Speed Vehicle Market?

- What is the Low-Speed Vehicle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?