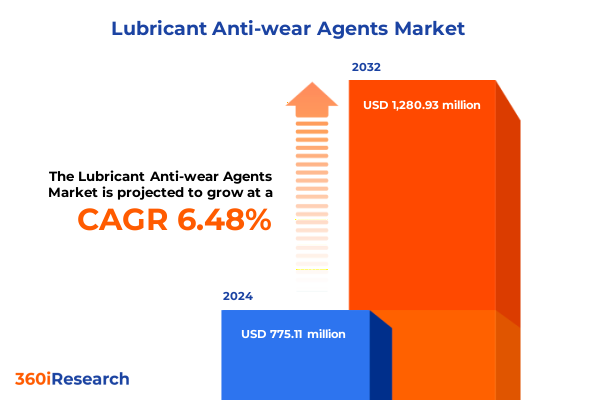

The Lubricant Anti-wear Agents Market size was estimated at USD 817.51 million in 2025 and expected to reach USD 864.77 million in 2026, at a CAGR of 6.62% to reach USD 1,280.92 million by 2032.

A rigorous framing of lubricant anti-wear agent strategic importance across formulation, regulatory drivers, and performance integration in modern powertrains and industrial equipment

The lubricant anti-wear agent landscape sits at the intersection of chemistry, equipment reliability, regulatory compliance, and global supply-chain dynamics. Anti-wear chemistries-ranging from zinc- and phosphorus-based packages to molybdenum and boron technologies-serve as foundational enablers of equipment longevity across automotive powertrains, industrial gearboxes, hydraulics, and specialized metalworking processes. Because these chemistries are performance-critical yet often low-volume relative to base oils, their strategic value derives from the ability to protect moving surfaces under extreme pressure, reduce maintenance frequency, and enable manufacturers to meet tighter fuel-economy and emissions requirements.

In this context, technical stewardship and commercial strategy must operate in tandem. Formulation scientists, production planners, procurement teams, and end-user reliability engineers must align on product specifications, raw-material sourcing and substitution pathways to sustain performance while meeting evolving regulatory constraints. The interplay between base stock selection, additive solubility, and the targeted application environment means that anti-wear agents are rarely plug-and-play: they require co-optimization with viscosity modifiers and detergent-dispersant systems. Transitioning to bio-based oils or synthetic chemistries intensifies this need for integrated formulation approaches. As a result, decision-makers should treat anti-wear chemistries as strategic assets rather than commodity inputs, prioritizing resilience, traceability, and validated performance across representative use cases.

How performance requirements, supply concentration, regulatory shifts, and sustainability imperatives are jointly transforming anti-wear agent development and supply strategies

The industry is undergoing several transformative shifts that are reorienting product development, procurement, and commercialization strategies. First, the push toward lower-emission powertrains and higher-efficiency equipment has accelerated demand for advanced anti-wear solutions that enable thinner fluids, extended drain intervals, and compatibility with aftertreatment systems. These performance requirements are prompting more sophisticated chemistries and tighter specifications from OEMs, which in turn raise the bar for additive purity, thermal stability and ash management.

Second, raw-material and feedstock dynamics are changing how formulators design packages. Supply concentration for critical elements such as zinc, molybdenum and certain sulfurized precursors has increased vulnerability to geopolitical and logistics disruptions, encouraging formulators to diversify sources, test alternative chemistries, and invest in supply-security strategies. This trend is accompanied by an uptick in demand for bio-based and synthetic base oils that offer improved solvency and oxidative stability, necessitating additive optimization for different base oil matrices.

Third, regulation and sustainability imperatives are reshaping product roadmaps. Environmental classification regimes and emissions standards are driving reformulation efforts to reduce ash-forming components and to replace substances that face scrutiny under chemical-management frameworks. These regulatory pressures are prompting parallel investments in performance validation and communication, so that downstream buyers and OEMs can certify compatibility and warranty compliance.

Finally, the commercial landscape is evolving with supply-chain localization, strategic inventory buffering, and contract redesigns becoming more common. Companies are experimenting with blended sourcing models that combine domestic production for critical chemistries and targeted imports for specialty feedstocks, while also expanding technical collaboration with base oil producers and OEMs to lock in specification compliance. Taken together, these shifts are creating a more resilient, technically sophisticated, and sustainability-conscious market environment for anti-wear agents.

Evaluating the aggregated operational, sourcing, and formulation consequences of the United States tariff actions in 2025 on lubricants, base oils, and additive supply chains

Recent United States tariff measures and trade policy actions in 2025 have produced tangible implications for the lubricant value chain, altering cost structures, supplier selection and routing decisions. Tariff adjustments and broader trade measures have been applied across multiple product categories that intersect with additive and base-oil supply flows, creating both near-term cost pressure for import-dependent formulators and medium-term incentives for supply diversification and regional sourcing.

In practice, the tariff environment has had three observable effects on the anti-wear segment. First, price differentials and landed-cost volatility have encouraged buyers to re-evaluate incumbent sourcing relationships and to accelerate qualification of alternate suppliers outside high-tariff jurisdictions. For example, where Group III base oils historically flowed from East Asian producers, tariff escalation has prompted increased interest in Middle Eastern and domestic alternatives, with commercial negotiations reshaping volume allocations and logistics routes. Evidence from trade and industry reporting shows that Group III import patterns shifted notably as buyers sought lower-tariff origins and re-routed flows to mitigate additional duties.

Second, the tariffs have amplified the case for closer vertical collaboration between additive manufacturers and regional base-oil producers. When duty structures increase the cost of imported base stocks or intermediates, formulators seek to co-develop packages tuned to alternative base oils and to secure upstream capacity through contractual commitments. Industry commentary and market analysis have highlighted an acceleration in such commercial alignment as firms hedge tariff exposure by locking in feedstock partnerships with low-duty jurisdictions.

Third, there are downstream ripple effects for OEMs, aftermarket distributors and industrial end users. Higher landed costs for finished lubricants or specialty greases can translate into renegotiated maintenance budgets, changes in fluid-consolidation strategies, or extended drain-interval validations to offset cost increases. Moreover, tariff-driven supplier shifts sometimes extend lead times as alternative suppliers complete technical approvals, affecting production planning for equipment manufacturers. Journalism and analysis covering the 2025 tariff landscape indicate these themes are already influencing procurement and pricing conversations across several industrial sectors.

Taken together, the cumulative effect of the 2025 tariff landscape is not limited to a single cost metric: it reshapes procurement logic, accelerates regional sourcing patterns, and elevates the strategic importance of formulation flexibility and supplier partnerships. Companies that proactively invest in qualification of alternate base-oil and additive producers, that strengthen technical dossiers for substitution, and that model the operational impact of longer approval cycles will be better positioned to absorb tariff volatility while preserving product performance and customer confidence.

In-depth segmentation intelligence highlighting formulation, base oil, distribution, end-use, application, and product-type nuances that dictate additive design and go-to-market strategy

A segmentation-aware view of the market reveals differentiated technical and commercial dynamics across formulation, base oil, distribution, end-use, application, and product-type axes. When looking at formulation type, fluids-including engine fluids, gear fluids, hydraulic fluids and metalworking fluids-exhibit distinct additive demands driven by viscosity, solvency and service conditions, while greases such as calcium sulfonate, lithium and polyurea grades require thickener-compatibility and shear-stability considerations that alter additive selection and package design.

Base oil type is an equally determinative axis: bio-based oil families-comprising animal oils, synthetic esters and vegetable oils-offer sustainability credentials but demand anti-wear chemistries that are stable in polar matrices and able to manage hydrolytic or oxidative vulnerabilities; mineral oils segmented into Group I, Group II and Group III present progressively cleaner feedstock backbones with differing solvency and low-temperature performance that influence additive loading and dispersancy strategies; synthetic oils such as esters, polyalkylene glycol and polyalphaolefin deliver superior thermal and oxidative resistance but require anti-wear agents that maintain film-forming efficacy at lower viscosities.

Distribution channels influence how product innovation is commercialized and supported: aftermarket channels frequently emphasize broad-spectrum compatibility and price competitiveness, while direct sales and OEM channels prioritize bespoke formulations certified for warranty and system-level performance; distributors play a bridge role by combining technical stocking with localized customer support. End-use industries-automotive, aviation, industrial machinery, marine and power generation-each carry unique regulatory, performance and certification demands that shape additive specification and testing protocols.

Applications cluster around engine oils, gear oils, hydraulic fluids and metalworking fluids. Engine applications subdivide into commercial vehicle, passenger vehicle and two-wheeler engines, each with specific thermal cycles and wear mechanisms that influence additive selection. Gear applications in automotive, industrial and marine contexts require anti-wear and extreme-pressure chemistries that account for sliding and scuffing regimes. Hydraulic fluids split into industrial and mobile hydraulics, where contamination control and fluid-film robustness under varying loads are critical. Finally, product types-boron-based, molybdenum-based, phosphorus-based and zinc-based chemistries-present trade-offs between friction modification, wear protection and compatibility with emissions-control equipment. Understanding these interlocking segmentation layers enables more precise product positioning, targeted R&D investments and tailored go-to-market strategies that reflect both technical fit and commercial channel expectations.

This comprehensive research report categorizes the Lubricant Anti-wear Agents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Formulation Type

- Base Oil Type

- Product Type

- Distribution Channel

- End-Use Industry

- Application

Regional strategic implications and differentiated playbooks across the Americas, Europe, Middle East & Africa, and Asia-Pacific that influence sourcing, formulation, and compliance choices

Regional dynamics create differentiated strategic priorities for suppliers, blenders and end users across the Americas, Europe, Middle East & Africa and Asia-Pacific. In the Americas, buyers often balance strong aftermarket demand with localized production capacity and a rising interest in domestic sourcing for critical base oils and additives, influenced by supply-security and tariff considerations. This market tends to favor formulations that prioritize wide-ranging OEM compatibility and robust field service support.

Across Europe, Middle East & Africa, regulatory intensity and energy-cost differentials shape formulation economics and supply choices. European regulatory frameworks and emissions standards exert strong influence on additive composition, driving reformulation to meet environmental constraints. The Middle East operates as an important base-oil supplier and a hub for Group III capacity, which affects global routing decisions and pricing dynamics, while parts of Africa can be sensitive to logistics and trade-friction impacts that create localized supply constraints.

In Asia-Pacific, the landscape is defined by a strong manufacturing base, significant additive and base-oil production, and evolving quality gradients across suppliers. Supplier ecosystems in this region have long been central to global flows of Group II and Group III base stocks as well as specialty additive intermediates. At the same time, rising regional demand driven by automotive production, industrialization and shipping routes creates both opportunities for capacity expansion and pressure on upstream feedstocks.

Because each region presents distinct regulatory, logistical and commercial dynamics, firms should adopt differentiated regional playbooks that combine local technical support, targeted inventory strategies and supplier diversification. Cross-regional coordination-for example leveraging Middle Eastern base-oil capacity to offset East Asian tariff exposure while supporting regional formulation adjustments in the Americas or Europe-can materially reduce operational risk and enhance responsiveness to sudden trade-policy shifts.

This comprehensive research report examines key regions that drive the evolution of the Lubricant Anti-wear Agents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive posture and partnership models among leading additive and specialty chemical providers driving technical differentiation, vertical integration, and service-led commercial advantage

Competitive dynamics among key companies in the anti-wear agents space are shaped by capabilities in R&D, manufacturing scale, regulatory compliance and commercial reach. Leading players that maintain vertically integrated supply chains or long-term alliances with base-oil producers benefit from improved feedstock visibility and can more rapidly co-develop formulations tuned to evolving base-stock mixes and regulatory expectations. Others have focused on specialty niches-such as bio-based additive chemistries, ultra-low-ash formulations, or tailor-made packages for electrified powertrains-that allow premium pricing and deeper technical lock-in with OEMs.

Partnership models are gaining traction: additive houses are collaborating with base-oil refiners, OEMs and testing laboratories to accelerate validation cycles and to provide documented compatibility statements that reduce approval friction for customers. Strategic M&A and manufacturing investments aimed at localized production capacity are also notable behaviors, particularly where trade policy and tariff risks make proximity to end markets commercially attractive. In parallel, some players prioritize a modular commercial approach-offering standard base packages with add-on modules for specific performance attributes-so that distributors and blenders can adapt more rapidly to customer requirements without extensive requalification.

Across the commercial spectrum, service and technical support differentiate premium suppliers. Rapid root-cause diagnostics, multi-profile lab validation and lifecycle-cost modeling are the types of value-added services that drive procurement preference among large fl eets and industrial operators. Firms that pair deep formulation expertise with consultative commercial engagement are better positioned to convert technical superiority into durable commercial relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lubricant Anti-wear Agents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Afton Chemical Corporation

- Arkema S.A.

- BASF SE

- BRB International

- Chevron Oronite Company LLC

- Clariant International Ltd

- Croda International Plc

- Evonik Industries AG

- Infineum International Limited

- King Industries, Inc.

- King Industries, Inc.

- The Lubrizol Corporation

Practical and prioritized actions for leaders to secure supply, enhance formulation agility, align commercial contracts, and protect product performance under trade and regulatory stressors

For industry leaders aiming to preserve performance, control costs and build resilient supply chains, a set of actionable priorities emerges. First, accelerate supplier qualification programs to include alternative base-oil origins and non-traditional additive feedstocks; proactive qualification reduces single-source risk and shortens approval cycles when trade conditions change. Second, invest in formulation flexibility by developing modular additive architectures that can be tuned to mineral, synthetic and bio-based oils without extensive revalidation; this technical adaptability is a hedge against both regulatory change and tariff-driven sourcing shifts.

Third, strengthen commercial contracts to include clauses for tariff pass-through, supply continuity, and collaborative inventory management. Structuring agreements to share upside and downside risks-through options, rollover volumes or joint obligation models-can stabilize supply while preserving commercial relationships. Fourth, deepen OEM and end-user collaboration by offering performance validation packages that include field trials, warranty-alignment documentation and lifecycle-cost analyses; these services accelerate adoption of optimized formulations while reducing technical objections during approvals.

Fifth, prioritize regional capacity and logistics playbooks that match sourcing strategies to duty regimes and transport risk; consider small-scale localized production or toll-blending arrangements in high-risk markets to maintain continuity. Finally, build a cross-functional trade and tariff intelligence capability that integrates policy monitoring, landed-cost modeling and scenario planning; this capability will help the enterprise move from reactive procurement to strategic sourcing and pricing decisions. Executing on these priorities requires disciplined investment in technical talent, analytical tools and collaborative commercial models, but the result is a more resilient cost structure and a stronger value proposition for OEM and aftermarket customers.

Transparent multi-method research approach combining primary technical interviews, laboratory dossier reviews, and trade-flow synthesis to produce actionable scenario analysis and risk mapping

The research underpinning this report combines primary engagement with industry stakeholders, laboratory validation review, and secondary-source synthesis to ensure transparent, reproducible conclusions. Primary inputs included structured interviews with formulation scientists, procurement leads at blenders and OEM raw-material managers, and technical service personnel from aftermarket distribution channels. These conversations focused on performance priorities, qualification hurdles, regional sourcing constraints and supplier risk mitigation tactics.

Lab validation inputs involved review of cross-checked technical dossiers, compatibility studies and wear-test data from accredited laboratories, concentrating on film-formation behavior, scuffing and scoring resistance, and ash-management parameters across representative base-oil matrices. Secondary-source synthesis drew on trade data, customs flow analysis and reputable industry reporting to contextualize supply shifts and origin changes for base oils and key additive precursors. Where contemporaneous trade policy developments affected the analysis-particularly tariff changes in 2025-publicly available trade reporting and major business journalism sources were used to document policy timelines and likely operational impacts.

The analysis balanced qualitative insights with technical validation, but intentionally avoided speculative market-sizing or forecast projections. Instead, the approach prioritized scenario analysis, supplier-risk mapping and application-level performance correlation to inform robust commercial decisions. Limitations of the research include variable transparency in supplier production capacities and the inherent lag between policy announcements and observed trade-flow adjustments. All methodological choices were documented to enable clients to replicate or extend the study within their specific procurement and product-development contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lubricant Anti-wear Agents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lubricant Anti-wear Agents Market, by Formulation Type

- Lubricant Anti-wear Agents Market, by Base Oil Type

- Lubricant Anti-wear Agents Market, by Product Type

- Lubricant Anti-wear Agents Market, by Distribution Channel

- Lubricant Anti-wear Agents Market, by End-Use Industry

- Lubricant Anti-wear Agents Market, by Application

- Lubricant Anti-wear Agents Market, by Region

- Lubricant Anti-wear Agents Market, by Group

- Lubricant Anti-wear Agents Market, by Country

- United States Lubricant Anti-wear Agents Market

- China Lubricant Anti-wear Agents Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Concise synthesis of technical, commercial, and policy imperatives that determine resilience and competitive advantage in the evolving lubricant anti-wear agent landscape

In summary, lubricant anti-wear agents remain a critical yet evolving part of equipment reliability and fleet economics. Technical progress and regulatory pressure are driving more demanding performance and purity requirements, while 2025 trade-policy shifts have highlighted the fragility of concentrated sourcing and the value of formulation adaptability. Segmentation nuances-from fluid and grease distinctions to base-oil chemistry and application-specific needs-define both opportunity spaces and executional risk for suppliers and end users.

Market resilience will come from a blended set of capabilities: flexible formulation platforms, diversified and regionally aware sourcing strategies, deeper OEM and end-user technical collaboration, and governance mechanisms that integrate trade intelligence with procurement execution. Companies that pursue these capabilities in a prioritized, measurable manner will not only mitigate the immediate operational impacts of tariffs and supply shocks but will also position themselves to capture premium value as industries electrify, decarbonize and demand higher equipment uptime. The operational and commercial choices made now-around supplier qualification, modular additive design and regional capacity-will determine who captures long-term advantage in a market that is technical, tightly specified, and increasingly shaped by policy and sustainability drivers.

Direct commercial engagement instruction to connect with the Associate Director for purchasing the full proprietary lubricant anti-wear agent market research report and tailored briefings

To acquire the full market research report and a tailored executive briefing, contact Ketan Rohom (Associate Director, Sales & Marketing) to arrange a commercial discussion and secure access to the proprietary dataset and strategic appendices. Engage Ketan to review the report’s methodological annexes, obtain license options for enterprise use, and schedule a customized webinar walkthrough of findings and scenario planning. For teams requiring rapid integration, request a tailored one-page executive heat map and prioritized action checklist derived from the report’s insights. Early engagement will also allow you to nominate priority supplier or technology tracks for deeper due-diligence addenda and extended consulting support.

- How big is the Lubricant Anti-wear Agents Market?

- What is the Lubricant Anti-wear Agents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?