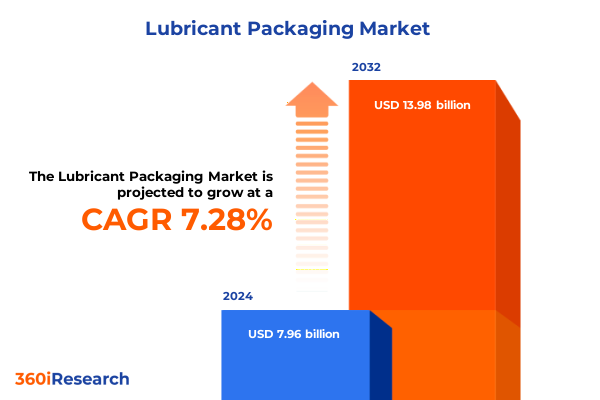

The Lubricant Packaging Market size was estimated at USD 8.46 billion in 2025 and expected to reach USD 8.98 billion in 2026, at a CAGR of 7.44% to reach USD 13.98 billion by 2032.

Unlocking the Evolving World of Lubricant Packaging: Drivers of Innovation, Sustainability and Market Dynamics Shaping the Industry Landscape

Lubricant packaging plays a critical role in preserving the performance, safety, and reliability of fluid formulations across automotive, industrial, marine, aviation, and power generation sectors. Packaging solutions must balance the protection of sensitive lubricant chemistries against oxidation, contamination, and mechanical damage while enabling efficient storage, transportation, and handling. Beyond these functional requirements, brand differentiation and user experience have become increasingly important, prompting packaging designers to integrate ergonomic shapes, clear labeling, and secure dispensing mechanisms.

In recent years, sustainability and digital transformation have emerged as the most significant forces reshaping the lubricant packaging landscape. Companies are actively reducing reliance on virgin plastics by adopting high-density polyethylene and polyethylene terephthalate containers that are easier to recycle, as well as exploring biobased polymers sourced from renewable feedstocks to lower carbon footprints. Simultaneously, smart packaging elements such as RFID tags and QR codes are being embedded into containers to enable real-time supply chain visibility, product authentication, and enhanced post-sale engagement with end users.

This executive summary synthesizes the key drivers, transformative shifts, tariff impacts, segmentation dynamics, regional variations, leading companies, strategic recommendations, rigorous research methodology, and concluding insights essential for decision makers. It provides an authoritative roadmap to navigate the complexities of lubricant packaging in today’s dynamic market and outlines actionable steps to capitalize on emerging opportunities.

Navigating Dramatic Shifts in Lubricant Packaging Fueled by Sustainability Imperatives, Technological Advances and Evolving End-User Demands

The lubricant packaging sector has entered a phase of unprecedented transformation, driven by environmental mandates, technological breakthroughs, and evolving customer expectations. Sustainability imperatives are accelerating the adoption of eco-friendly materials, exemplified by the growing use of mechanically recycled high-density polyethylene and bioplastic blends that decompose more efficiently and reduce dependence on fossil-based resins. Regulatory frameworks in North America, Europe, and key Asia-Pacific markets now require minimum recycled content thresholds, fueling momentum behind innovative material formulations.

Parallel to material evolution, digital integration is redefining how lubricant packages perform in the supply chain. The integration of RFID labels, QR codes, and near-field communication sensors allows manufacturers and distributors to monitor inventory levels, verify product authenticity, and access usage analytics in real time. These smart packaging solutions not only bolster operational efficiency but also foster transparency and trust among automotive, industrial machinery, and aviation customers.

Lightweight and flexible packaging formats, such as stand-up pouches and thin-walled bottles, are gaining traction for their transport cost savings and reduced carbon emissions. Flexible pouches have achieved significant adoption in markets prioritizing spill resistance and portability, particularly within the automotive aftermarket and DIY segments in North America. Meanwhile, bulk and reusable packaging systems-ranging from intermediate bulk containers to metal drums equipped with returnable cores-are being deployed by large-scale industrial users to decrease single-use waste and improve refill efficiencies.

Advances in barrier technologies and modular dispensing designs are further enhancing package performance. Multilayer films and vacuum-sealed closures now provide superior protection against oxidation and moisture ingress, prolonging shelf life for high-precision lubricants. Customizable nozzles, tamper-evident seals, and drip-resistant spouts are also being refined to minimize product loss, strengthen safety protocols, and elevate user experience across diverse end-use applications.

Evaluating the Comprehensive Effects of 2025 U.S. Steel and Aluminum Tariff Increases on Lubricant Packaging Operations and Profitability

In 2025, the U.S. government escalated tariffs on steel and aluminum imports to enhance domestic production, raising rates from 25% to 50% under Section 232 effective June 4, 2025. Earlier in the year, a March 12 proclamation expanded the 25% tariff coverage to all trading partners, terminated general exclusions, and imposed stringent origins criteria for derivative articles made from imported metals. These sweeping measures aim to fortify national security by protecting American steel and aluminum industries but carry profound ramifications for packaging supply chains worldwide.

Metal drums, cans, closures, and aerosol packaging-integral to industrial and specialty lubricant distribution-are directly affected by the heightened duties. The additional costs of imported steel and aluminum components are being transmitted through procurement channels, leading to increased packaging expenses and compressed margins for both lubricant manufacturers and end users. Supply chain complexities have intensified as companies confront lead time extensions, origin verification requirements, and the need for agile multi-sourcing strategies. The elimination of exemptions has further incentivized a shift toward domestic suppliers, straining existing capacities and compelling organizations to invest in local production expansions or alternative material formulations to mitigate financial exposure.

Revealing Critical Segmentation Dimensions That Define Lubricant Packaging Demand Across Types, Industries, Materials and Distribution Channels

Segmenting the lubricant packaging market through multiple dimensions illuminates the nuanced preferences of end users and the competitive strategies of suppliers. Containers range from small bottles for precision dispensing in automotive aftermarkets to large drums and bulk IBCs for industrial machinery and marine applications. Within the automotive segment, packaging choices differ markedly between Original Equipment Manufacturers, who favor standardized metal or high-performance composite drums, and aftermarket distributors, which often utilize ergonomic plastic bottles with tamper-evident features for consumer convenience.

On the materials front, composite containers such as fiber drums and composite IBCs strike a balance between weight reduction and mechanical robustness, whereas steel and aluminum drums ensure chemical resistance and longevity for harsh operating environments. Plastic formats, including PET and HDPE bottles, pouches, and smaller canisters, are valued for their recyclability and versatility in branding. Size preferences align with usage patterns-bulk tanks and IBCs serve large-scale production and maintenance facilities, medium-volume drums and cans support fleet service centers, and small bottles and pouches cater to retail and specialty lubricant segments.

Distribution channel strategies further delineate the market. Direct sales through bulk traders and OEM partnerships facilitate high-volume contracts and tailored packaging solutions, while e-commerce platforms and manufacturer websites extend reach into digital landscapes, offering customizable labeling and subscription models. Traditional retail outlets-auto parts, specialty, and grocery stores-remain vital for aftermarket lubricant sales, prompting suppliers to optimize shelf resilience and on-pack promotional messaging. Finally, closure systems such as pumps, screw caps, spouts, and valves are engineered to address specific user needs: automatic pumps for fast filling in service bays, child-resistant caps for consumer safety, flip spouts for controlled drip dosing, and camlock valves for precise bulk dispensing.

This comprehensive research report categorizes the Lubricant Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- End-User Industry

- Packaging Material

- Packaging Size

- Distribution Channel

- Closure Type

Exploring Divergent Regional Dynamics Shaping the Lubricant Packaging Sector Across Americas, Europe Middle East Africa and Asia-Pacific Markets

Regional market dynamics reflect local regulatory landscapes, infrastructure capabilities, and end-user consumption patterns. In the Americas, North American demand is galvanized by stringent recycling mandates and corporate sustainability commitments, driving the adoption of eco-design bottles and flexible pouches that minimize plastic use without sacrificing barrier protection. Latin American lubricant packaging growth is underpinned by rising automotive sales and infrastructure development, where cost-effective metal drums and mid-size plastic jerry cans remain predominant due to logistical constraints.

Across Europe, Middle East, and Africa, European markets are leading the push for high-recycled content packaging, exemplified by recent launches of plastic bottles incorporating up to 60% post-consumer resin and aluminum cans produced from remelted scrap metal. The Middle East is witnessing increased investment in bulk and IBC systems for its expanding petrochemical and power generation sectors, while African markets emphasize durability and chemical resistance, favoring steel drums and robust valve closures to navigate challenging storage and transport conditions.

In Asia-Pacific, dynamic manufacturing hubs in China, India, and Southeast Asia are driving demand for both large-scale IBC and drum solutions for industrial lubricants, as well as flexible stand-up pouches for consumer and retail segments. Sustainability regulations in developed Asia-Pacific markets have accelerated the rollout of refillable dispensing programs and mono-material pouch substrates designed for easier recycling. Meanwhile, e-commerce expansion in the region is increasing demand for small-format, packaged lubricant SKUs with tamper-evident spouts and on-pack authentication codes.

This comprehensive research report examines key regions that drive the evolution of the Lubricant Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Industry Leaders and Emerging Innovators Driving Advancements in Lubricant Packaging Solutions and Market Competitiveness

Several established packaging providers and emerging innovators are vying for leadership in the lubricant packaging arena. Amcor Plc has expanded its flexible pouch offerings to include high-barrier films and multi-layer laminates optimized for lubricant chemistries, reflecting its commitment to both performance and sustainability. Berry Global and Greif, Inc. have bolstered their portfolios through acquisitions focused on recycled resin technologies and reusable metal container platforms, signaling an embrace of circular economy principles.

Scholle IPN has introduced advanced spout and closure assemblies designed for precision dispensing and leak-proof performance, targeting the automotive aftermarket and specialty lubricant sectors. Mauser Packaging Solutions has invested in regional recycling facilities and innovative composite IBC designs that reduce weight and improve handling ergonomics. Meanwhile, Goodpack’s reusable metal IBC network, which incorporates local depot collection and repair capabilities, exemplifies a scalable circular model that minimizes packaging waste and optimizes logistics efficiency.

In addition to these major players, a cohort of specialty manufacturers and material science companies is collaborating with lubricant formulators to co-develop engineered polymers, nanocoatings, and AI-driven packaging platforms. Their partnerships are pioneering the next generation of smart containers that can monitor viscosity, temperature, and fill levels, further enhancing supply chain transparency and safeguarding product integrity from factory to field.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lubricant Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor PLC

- Ardagh Group S.A.

- Berry Global Inc.

- CCL Industries Inc.

- Greif, Inc.

- Huhtamaki Oyj

- Mauser Packaging Solutions

- Sealed Air Corporation

- Silgan Holdings Inc.

- Sonoco Products Company

Implementing Strategic Initiatives to Enhance Sustainability, Supply Chain Resilience and Innovation in Lubricant Packaging for Long-Term Success

To navigate this evolving landscape, leaders must accelerate the integration of recycled and biobased materials into container designs, setting rigorous sustainability targets that exceed regulatory requirements while reinforcing brand value with eco-conscious customers. Diversifying sourcing strategies is essential to hedge against tariff-induced cost fluctuations; cultivating relationships with domestic and near-shore material suppliers can alleviate supply chain disruptions and long lead times.

Embracing digital transformation through end-to-end smart packaging ecosystems will enhance visibility and operational agility. Implementing serialized QR codes, RFID tracking, and IoT-enabled dispensing units can optimize inventory turnover, mitigate counterfeiting risks, and capture usage data for predictive replenishment. Concurrently, investing in flexible production lines capable of accommodating multiple container formats and closure types will support rapid response to shifts in end-user preferences and market trends.

Collaborating with industry consortia to develop standardized recycled content certification and closed-loop collection infrastructures will underpin circular economy initiatives. Developing turnkey refill and reuse programs-leveraging durable composite IBCs and returnable metal drums-will reduce single-use waste and unlock cost savings. Finally, aligning packaging R&D with emerging nanomaterial and advanced barrier technologies can extend lubricant shelf life, minimize material usage, and strengthen product differentiation in highly competitive segments.

Unveiling Rigorous Research Methodologies Combining Qualitative and Quantitative Approaches to Provide Robust Insights into Lubricant Packaging Trends

Our research combines primary insights from in-depth interviews with senior packaging engineers, procurement heads at leading lubricant manufacturers, and sustainability officers across global regions. These qualitative perspectives were triangulated with secondary data from industry publications, trade associations, and government trade bulletins to ensure comprehensive coverage of material innovations, regulatory changes, and supply chain dynamics.

Quantitative analysis employed a bottom-up approach, mapping production volumes by packaging type, material, size, and distribution channel to identify emerging adoption patterns. Tariff impact assessments leveraged official U.S. proclamations and trade notices to model cost variations for steel and aluminum derivatives, while scenario planning evaluated domestic capacity constraints under elevated duty regimes.

The study also incorporated a rigorous PESTEL framework to examine political, economic, social, technological, environmental, and legal factors influencing market evolution, supported by SWOT analyses of key industry participants. All findings were validated through a round of expert reviews and iterative feedback loops, ensuring both reliability and relevance for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lubricant Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lubricant Packaging Market, by Packaging Type

- Lubricant Packaging Market, by End-User Industry

- Lubricant Packaging Market, by Packaging Material

- Lubricant Packaging Market, by Packaging Size

- Lubricant Packaging Market, by Distribution Channel

- Lubricant Packaging Market, by Closure Type

- Lubricant Packaging Market, by Region

- Lubricant Packaging Market, by Group

- Lubricant Packaging Market, by Country

- United States Lubricant Packaging Market

- China Lubricant Packaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 4134 ]

Synthesizing Key Findings and Strategic Implications to Equip Decision-Makers with Actionable Knowledge for the Future of Lubricant Packaging

This executive summary has illuminated the pivotal trends reshaping lubricant packaging, from the drive toward sustainable materials and smart digital integration to the strategic implications of heightened U.S. tariffs on steel and aluminum. Detailed segmentation analysis revealed how packaging preferences vary across container types, end-user industries, material choices, sizes, distribution channels, and closure systems, providing actionable clarity for market positioning.

Regional insights underscored the distinct dynamics at play in the Americas, EMEA, and Asia-Pacific, emphasizing the importance of tailored strategies that address local regulatory frameworks, supply chain infrastructures, and customer behaviors. Leading companies are responding through innovative portfolio expansions, recycling investments, and advanced dispensing solutions, signaling a competitive environment driven by performance, circularity, and user experience.

In light of these trends, industry leaders must prioritize multi-channel agility, robust sustainability commitments, and digital packaging ecosystems to maintain resilience and capture emerging growth opportunities. This comprehensive understanding sets the stage for informed strategic planning and positions organizations to excel in the next era of lubricant packaging.

Reach Out to Ketan Rohom to Acquire the Comprehensive Lubricant Packaging Market Research Report and Drive Your Business Forward Today

To bring these in-depth findings to your organization and gain a competitive edge, connect with Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the comprehensive market research report. By working closely with Ketan, you can benefit from tailored insights, explore customized data packages, and ensure you have the precise intelligence needed to navigate evolving packaging regulations, sustainability mandates, and supply chain complexities. Don’t miss this opportunity to leverage actionable intelligence and drive strategic decisions in lubricant packaging by reaching out to Ketan Rohom today

- How big is the Lubricant Packaging Market?

- What is the Lubricant Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?