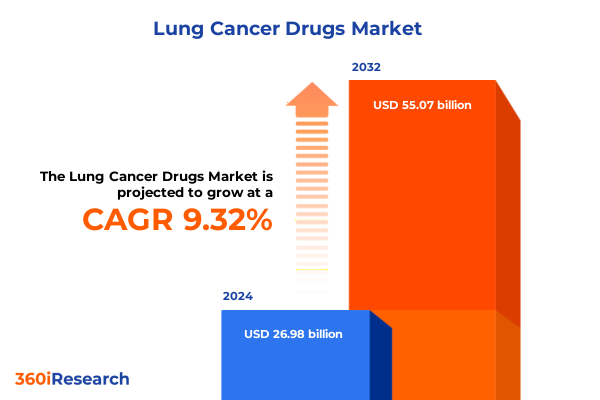

The Lung Cancer Drugs Market size was estimated at USD 29.53 billion in 2025 and expected to reach USD 32.07 billion in 2026, at a CAGR of 9.31% to reach USD 55.07 billion by 2032.

Setting the Stage for a New Era in Lung Cancer Treatment Through Comprehensive Analysis of Emerging Therapies and Market Dynamics

Lung cancer remains the most diagnosed cancer worldwide and the leading cause of cancer-related mortality, with nearly 2.5 million new cases and 1.8 million deaths reported globally in 2022. In the United States alone, approximately 234,580 individuals received a lung cancer diagnosis and 125,070 succumbed to the disease in 2024, underscoring persistent challenges despite declining smoking rates and advances in care.

This heterogeneity reflects two principal disease categories: non-small cell lung cancer, which accounts for roughly 80% to 85% of cases, and small cell lung cancer, representing the remainder. These classifications belie further complexity at the molecular level, where driver mutations and tumor microenvironment interactions demand increasingly targeted and personalized therapeutic strategies.

Against this backdrop, it is critical to synthesize evolving treatment paradigms, regulatory milestones, and external policy shifts into a cohesive narrative. The inaugural 2025 Cancer Immunotherapy Insights + Impact report by the Cancer Research Institute, which analyzed more than 150 FDA immunotherapy approvals since 2011 and highlighted 17 approvals in 2024 alone, offers an instructive precedent for the depth and rigor of analysis required to navigate this landscape effectively. This executive summary sets the stage for a detailed exploration of transformative shifts, trade challenges, segmentation nuances, and actionable recommendations to guide stakeholders in the lung cancer drug ecosystem.

Exploring How Immunotherapy Innovations Targeted Therapies and Personalized Medicine Are Rewriting the Lung Cancer Treatment Landscape

Immunotherapy has progressed from an experimental concept to a cornerstone of lung cancer care. Since the first checkpoint inhibitor approval in 2011, the scope of immune-based treatments has expanded dramatically, encompassing anti-PD-1, anti-PD-L1, and anti-CTLA-4 antibodies, adoptive cell therapies, cytokine agonists, and bispecific constructs. The 2025 Cancer Immunotherapy Insights + Impact report documents more than 150 FDA approvals over the past decade, reflecting a sustained acceleration in clinical integration across early-stage and advanced settings.

Subcutaneous formulations mark the next frontier in patient-centric care, reducing infusion times and shifting administration to outpatient settings. For example, Tecentriq Hybreza, a fixed-dose combination of atezolizumab and hyaluronidase, received FDA approval for both non-small cell and small cell lung cancer in September 2024, offering a two-minute injection alternative to intravenous infusions. Similarly, Merck’s injectable Keytruda is poised for an October 2025 U.S. launch, promising to further enhance access and adherence while extending intellectual property protections.

Concurrently, targeted therapies continue to reshape outcomes for genomically defined subpopulations. Osimertinib, approved in February 2024 for EGFR exon 19 deletion or exon 21 L858R-mutated locally advanced or metastatic non-small cell lung cancer in combination with platinum chemotherapy, demonstrated a median progression-free survival exceeding 25 months in the FLAURA2 trial. Newer agents such as Ensartinib for ALK-positive disease and zongertinib for HER2-mutated tumors delivered unprecedented response rates at recent conferences, underscoring the momentum toward precision medicine.

Analyzing the Far-Reaching Consequences of U.S. Tariffs on Pharmaceutical Imports and Their Disruptive Effects on Lung Cancer Drug Accessibility in 2025

In early 2025, the U.S. administration initiated a Section 232 national security investigation that could impose tariffs on pharmaceutical imports, including finished drugs and active pharmaceutical ingredients. An Ernst & Young analysis commissioned by the Pharmaceutical Research and Manufacturers of America projects that a 25% tariff could raise U.S. drug costs by nearly $51 billion annually and boost retail prices by up to 12.9% if duties are fully passed to consumers.

Patient advocacy organizations emphasize the disproportionate impact on those receiving life-saving therapies. The American Cancer Society Cancer Action Network cautioned that tariffs risk exacerbating existing generic sterile injectable shortages-essential components of many lung cancer regimens-by disrupting fragile supply chains and worsening an economic model already prone to shortages.

Healthcare providers and institutions have urged exemptions for medical products, warning that import taxes could strain hospital budgets and delay critical treatments. A survey of 200 supply chain and pharmaceutical stakeholders predicted a minimum 15% cost increase for hospitals and health systems, with 69% estimating at least a 10% rise in pharmaceutical expenses due to China-specific tariffs on active ingredients.

Taken together, these measures threaten to introduce supply disruptions, elevate out-of-pocket costs, and undermine efforts to expand domestic manufacturing capacity. For lung cancer patients-who often depend on complex combination regimens and biologics-such trade policy shifts pose a direct challenge to both access and affordability.

Unpacking Segmentation Perspectives to Reveal How Therapeutic Class Cancer Type and Administration Routes Inform Critical Insights in Lung Cancer Drug Utilization

Therapeutic class segmentation reveals that chemotherapy, once the backbone of lung cancer treatment, is increasingly supplanted by immunotherapy and targeted therapy modalities. Checkpoint inhibitors targeting CTLA-4, PD-1, and PD-L1 now dominate clinical protocols, while next-generation small molecule inhibitors against ALK, EGFR, and ROS1 mutations provide tailored options for genetically defined patient cohorts.

Partitioning the market by cancer type distinguishes the largely underserved small cell lung cancer segment from the more extensively treated non-small cell lung cancer population. Non-small cell lung cancer benefits from a proliferation of novel agents, whereas small cell lung cancer remains an urgent unmet need, driving accelerated development of immunoconjugates and bispecific antibodies.

Examining molecule type, monoclonal antibodies command premium pricing and are central to combination regimens, while small molecule drugs offer oral administration convenience and broad distribution potential. Route of administration segmentation underscores a migration from intravenous infusions toward subcutaneous injections and oral formulations, facilitating outpatient care and reducing infusion-center burdens.

End-user distinctions-spanning hospital settings, specialty oncology clinics, and homecare environments-highlight varying procurement strategies, reimbursement frameworks, and patient support models. Distribution channel analysis, encompassing hospital pharmacies, retail outlets, and online platforms, illuminates the evolving logistics of drug delivery and the critical role of digital health channels in ensuring uninterrupted patient access.

This comprehensive research report categorizes the Lung Cancer Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapeutic Class

- Cancer Type

- Molecule Type

- Route Of Administration

- End User

- Distribution Channel

Evaluating Regional Variations in Lung Cancer Drug Adoption and Healthcare Dynamics Across the Americas EMEA and Asia-Pacific Markets

In the Americas, the United States leads global R&D investment and regulatory alignment, supported by favorable reimbursement policies and robust clinical trial networks. High healthcare expenditures and well-established specialty care centers drive early adoption of novel immunotherapies and targeted agents, with volume distribution concentrated in hospital pharmacies and large specialty oncology clinics. Latin American markets present divergent access challenges linked to fragmented health systems and variable public funding, prompting strategic partnerships and patient access programs.

Europe, the Middle East, and Africa feature diverse regulatory landscapes and pricing frameworks, characterized by rigorous health technology assessments and reference pricing mechanisms. European countries often leverage compulsory licensing and tender systems to manage costs, influencing manufacturer pricing strategies and fostering value-based contracting. In the Middle East, state-sponsored healthcare schemes accelerate introductions in Gulf Cooperation Council nations, while sub-Saharan Africa remains constrained by infrastructure gaps and limited biosimilar penetration.

The Asia-Pacific region exhibits a dual trajectory: high-income markets such as Japan and South Korea engage in simultaneous global launches and local co-development agreements, whereas emerging markets emphasize capacity building in biomanufacturing and generics supply. China’s rapid expansion in biotechnology investment, accounting for over 38% of global immunotherapy research publications, underscores its growing influence in clinical development and licensing collaborations. Regional variation in intellectual property regimes, regulatory timelines, and distribution networks continues to shape global market entry strategies and patient access dynamics.

This comprehensive research report examines key regions that drive the evolution of the Lung Cancer Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves by Leading Pharmaceutical Players Transforming the Development Manufacturing and Delivery of Lung Cancer Medicines

Merck & Co. remains at the forefront with Keytruda, a flagship PD-1 inhibitor securing multiple NSCLC indications and transitioning to a subcutaneous formulation expected in October 2025. This formulation not only enhances patient convenience but also extends patent life and safeguards revenue streams amid pipeline maturation.

AstraZeneca responded to trade pressures by committing $50 billion in U.S. investments through 2030, expanding manufacturing capabilities across several states and reinforcing its strategic pivot toward localized production to mitigate tariff risks and ensure supply continuity.

Roche has engaged directly with the U.S. government to secure tariff exemptions, arguing that its pharmaceutical exports offset imports and that duties could jeopardize biopharmaceutical supply chains integral to patient care. These negotiations underscore the importance of policy advocacy in preserving cross-border trade in critical therapies.

Amgen’s accelerated approval of Imdelltra, a bispecific antibody for small cell lung cancer, demonstrated a 40% reduction in death risk in phase 3 trials, highlighting the potential of next-generation immunotherapy constructs to address historically neglected subtypes.

Novocure’s Optune Lua device, integrating tumor-treating fields with checkpoint inhibitors, offers an innovative non-pharmacologic adjunct, though adoption hurdles remain given mixed phase 3 results and reimbursement uncertainties.

Boehringer Ingelheim and GSK’s investigational agents, including zongertinib and dostarlimab combinations, continue to generate promising response rates, emphasizing the critical role of early pipeline advancement and differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lung Cancer Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amgen Inc.

- AstraZeneca PLC

- Bayer AG

- BeiGene, Ltd.

- Blueprint Medicines Corporation

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company, Limited

- Eli Lilly and Company

- Genentech, Inc.

- Gilead Sciences, Inc.

- GlaxoSmithKline plc

- Janssen Biotech, Inc.

- Johnson & Johnson

- Merck & Co., Inc.

- Mirati Therapeutics, Inc.

- Novartis AG

- Pfizer Inc.

- Roche Holding AG

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

Actionable Strategies for Industry Leaders to Enhance Resilience Innovation and Patient Access in the Dynamic Lung Cancer Drug Landscape

Industry leaders should proactively diversify supply chains by establishing dual sourcing agreements and onshore manufacturing hubs, thus mitigating exposure to trade policy volatility and API shortages. Partnering with domestic contract manufacturers can accelerate scale-up while preserving global quality standards.

Collaboration across public and private sectors is essential. Engaging policymakers to advocate for targeted exemptions and incentives will help safeguard patient access and encourage investment in advanced therapies. Stakeholders can further influence policy through evidence-based submissions during public comment periods, underscoring the implications of tariffs on patient outcomes and healthcare system sustainability.

Investment in subcutaneous and oral formulations should remain a priority, as these modalities reduce healthcare delivery burdens and improve adherence. Technology partnerships, such as enzyme-facilitated delivery platforms or wearable infusion devices, can unlock new administration pathways beyond traditional infusion centers.

Real-world evidence generation and localized health economic modeling will strengthen value propositions and support value-based contracts. By collaborating with payers on outcomes-based reimbursement schemes, manufacturers can demonstrate clinical impact while aligning price with performance.

Finally, fostering innovation ecosystems through alliances with biotechnology firms and academic centers will sustain momentum. Focused funding for early-stage research in small cell lung cancer and combination immuno-oncology strategies can uncover the next wave of transformative agents.

Detailing Rigorous Primary and Secondary Research Approaches Employed to Derive Comprehensive Insights on Lung Cancer Drug Market Trends

This report leverages a hybrid research methodology combining comprehensive secondary data collection with targeted primary validation. Secondary research drew on public regulatory filings, peer-reviewed literature, company press releases, and government databases to map drug approvals, clinical trial outcomes, and policy developments. Key sources included FDA approval records, international health agency publications, and leading oncology conference proceedings.

Primary insights were obtained through in-depth interviews with oncology thought leaders, regulatory affairs experts, and trade policy advisors. These discussions enriched quantitative findings with real-world perspectives on supply chain challenges, payer negotiations, and patient access strategies.

Data triangulation techniques ensured consistency across multiple information streams. Financial news reports on corporate investments and tariff negotiations were cross-referenced with official statements and position letters from industry associations. Bibliometric analyses clarified research trends, while health economic evaluations contextualized pricing and reimbursement implications.

The resulting synthesis offers a rigorous, multi-dimensional view of the lung cancer drug landscape. Quality assurance measures included peer review by subject matter experts and validation against independent public datasets to ensure accuracy, reliability, and relevance for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lung Cancer Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lung Cancer Drugs Market, by Therapeutic Class

- Lung Cancer Drugs Market, by Cancer Type

- Lung Cancer Drugs Market, by Molecule Type

- Lung Cancer Drugs Market, by Route Of Administration

- Lung Cancer Drugs Market, by End User

- Lung Cancer Drugs Market, by Distribution Channel

- Lung Cancer Drugs Market, by Region

- Lung Cancer Drugs Market, by Group

- Lung Cancer Drugs Market, by Country

- United States Lung Cancer Drugs Market

- China Lung Cancer Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Reflections on the Evolution Challenges and Opportunities Shaping the Global Lung Cancer Drug Ecosystem

In summary, the lung cancer drug ecosystem is experiencing a pivotal confluence of scientific innovation, evolving patient-centric delivery models, and shifting policy landscapes. Immunotherapies and targeted agents continue to displace conventional chemotherapy, driven by robust clinical data and rapid regulatory approvals. Subcutaneous and oral formulations are redefining administration logistics, while precision medicine underscores the necessity of molecularly guided interventions.

Simultaneously, the specter of U.S. tariffs on pharmaceutical imports introduces new complexities, threatening to disrupt supply chains and inflate costs. Stakeholders must navigate these headwinds through proactive policy engagement, supply chain diversification, and investment in domestic manufacturing.

Regional disparities-spanning advanced markets in the Americas and Asia-Pacific to price-sensitive territories in EMEA-require tailored market entry strategies and adaptive reimbursement frameworks. Leading pharmaceutical companies are demonstrating strategic agility through significant capital investments, novel manufacturing partnerships, and direct advocacy.

Looking ahead, the next chapter in lung cancer care will be written by continued collaboration among industry, academia, payers, and regulators. By aligning innovation with access and affordability, stakeholders can ensure that breakthroughs translate into improved patient outcomes worldwide.

Connect Directly with Ketan Rohom to Secure Your Definitive Market Research Report on Lung Cancer Therapies and Gain Unmatched Strategic Insights

For a deep dive into the nuanced dynamics of lung cancer drug development, distribution, and policy impact, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan will guide you through the report’s comprehensive insights and tailor a solution to your strategic needs. Connect today to secure your definitive market research report on lung cancer therapies and gain the competitive edge essential for informed decision-making.

- How big is the Lung Cancer Drugs Market?

- What is the Lung Cancer Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?