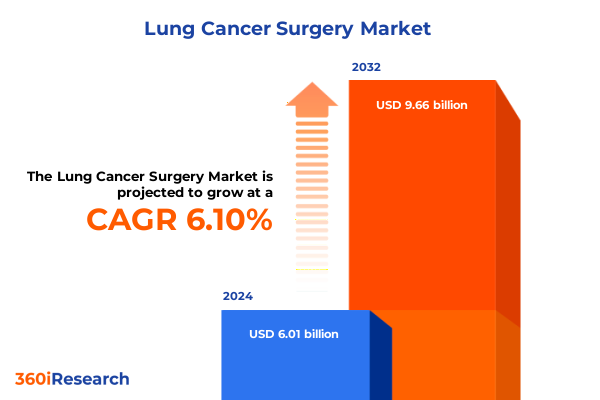

The Lung Cancer Surgery Market size was estimated at USD 6.94 billion in 2025 and expected to reach USD 7.60 billion in 2026, at a CAGR of 10.82% to reach USD 14.25 billion by 2032.

Unlocking the Critical Importance of Surgical Innovation in Lung Cancer Treatment: Introduction to Current Trends and Challenges

Lung cancer remains one of the most pressing public health challenges in the United States, with 218,893 new cases diagnosed in 2022 and 131,584 associated deaths reported in 2023. Early detection and treatment are crucial to improving survival rates, yet nearly half of all lung cancers are still identified at an advanced stage when therapeutic options are limited. Against this backdrop, surgical intervention stands as a cornerstone of curative treatment for localized disease and plays a vital role in multimodal care for earlier-stage tumors. Advances in screening with low-dose computed tomography have begun to shift stage distribution toward earlier detection, but the procedure landscape must continuously evolve to deliver more precise, less invasive, and better-tolerated options for patients.

Charting the Paradigm Shift in Lung Cancer Surgery: How Minimally Invasive Techniques and Robotics Are Transforming Patient Outcomes

The field of lung cancer surgery has undergone a profound transformation over the past two decades, moving decisively from open thoracotomy to video-assisted thoracoscopic surgery (VATS) and, more recently, to robotically assisted thoracic surgery (RATS). VATS initially revolutionized practice by enabling smaller incisions and faster recoveries, but clinical evidence soon highlighted the potential for further optimization. Meta-analyses have demonstrated that RATS can offer lower 30-day mortality, shorter hospital stays, and improved lymph node retrieval compared to VATS, signaling a paradigm shift in surgical standards. Emerging platforms integrate high-definition three-dimensional imaging, haptic feedback enhancements, and artificial intelligence-driven guidance to refine intraoperative decision-making and expand procedural capabilities.

Assessing the Ramifying Effects of 2025 United States Tariff Policies on Lung Cancer Surgical Device Costs and Supply Chain Dynamics

Recent U.S. trade policy developments have intensified volatility across medical device supply chains, creating headwinds for surgical equipment sourcing and pricing. Tariffs on critical components sourced from China-sometimes exceeding 50%-have compounded supply disruptions, prompting device manufacturers and distributors to assess alternative sourcing strategies and absorb incremental costs. At the same time, elevated import duties on steel and aluminum inputs have driven raw material costs upward, as domestic producers still depend on internationally sourced alloys, further pressuring margins. Faced with these challenges, healthcare providers report procurement delays and fluctuating lead times for essential instruments used in minimally invasive surgery. Industry surveys indicate that many organizations are pausing new procurements until tariff implications stabilize, while others are stockpiling high-volume consumables to buffer against price spikes.

Deciphering Segment-Specific Growth Drivers in Lung Cancer Surgery Across Approaches, Products, Cancer Types, and End Users

The lung cancer surgery market can be understood through multiple dimensions of segmentation, each illuminating unique growth drivers and operational imperatives. In terms of surgical approach, minimally invasive modalities are redefining care pathways with robotic-assisted thoracic surgery facilitated by Da Vinci systems and video-assisted thoracoscopic surgery available through both uniportal and multiportal approaches, while open surgery remains the gold standard for complex resections and high-risk cases. Regarding product categories, the ecosystem encompasses access devices and trocars that establish working channels, endoscopes and visualization systems that deliver high-definition intraoperative views, energy devices-ranging from ultrasonic to advanced bipolar and electrosurgical platforms-that optimize hemostasis, and stapling devices offered in manual and powered formats to ensure reliable tissue transection. From the cancer type perspective, the majority of surgical interventions address non–small cell lung cancer subtypes, particularly adenocarcinoma, squamous cell carcinoma, and large cell carcinoma, with a smaller proportion dedicated to less common small cell lung cancer cases where surgery complements systemic therapy. Finally, end-user segmentation reveals a bifurcation between ambulatory surgical centers, which handle selected minimally invasive procedures, and hospitals, which undertake the full spectrum of open, VATS, and RATS interventions.

This comprehensive research report categorizes the Lung Cancer Surgery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Approach

- Product Type

- Cancer Type

- End User

Exploring Regional Dynamics Shaping the Global Lung Cancer Surgery Landscape Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics continue to shape the adoption, reimbursement, and innovation environment for lung cancer surgery across the Americas, Europe, Middle East & Africa, and Asia-Pacific. North America leads thanks to favorable reimbursement frameworks, high screening uptake, and robust hospital infrastructure capable of supporting advanced robotic platforms. In Europe, stringent regulatory oversight and budgetary constraints have moderated capital investments, although targeted government initiatives and EU Medical Device Regulation compliance efforts are driving selective growth in minimally invasive adoption. Within the Middle East & Africa, investment by leading medical centers and a focus on medical tourism are catalyzing pockets of demand for high-end thoracic surgery capabilities. Across Asia-Pacific, rapid procedure volume growth in China, Japan, South Korea, and India-supported by government subsidies for digital health transformation-is fueling one of the fastest regional adoption rates of robotic systems worldwide.

This comprehensive research report examines key regions that drive the evolution of the Lung Cancer Surgery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Competitive Leaders and Innovators Shaping the Future of Lung Cancer Surgery Through Strategic Product and Service Offerings

A cadre of leading medical device companies are propelling advancements in lung cancer surgery through continuous innovation and strategic execution. Intuitive Surgical has maintained its first-mover advantage with the Da Vinci platform, reporting a 17% year-over-year increase in global procedure volume and placements of 395 systems-including 180 da Vinci 5 units-in Q2 2025, underscoring robust demand for its next-generation consoles and lordotic instruments. Medtronic’s integration of Mazor robotics has expanded its footprint in precision navigation, while Johnson & Johnson’s Ethicon division continues to advance powered stapling and hemostasis solutions that integrate seamlessly with both open and minimally invasive workflows. Stryker and Zimmer Biomet are increasingly focusing on single-port robotics and compact platforms to reduce operating room footprints and broaden clinical access. Together, these companies illustrate a competitive landscape defined by hardware evolution, software-enabled value propositions, and comprehensive service ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lung Cancer Surgery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambu A/S

- B. Braun SE

- Becton Dickinson and Company

- Boston Scientific Corporation

- Fujifilm Holdings Corporation

- GE HealthCare Technologies Inc.

- Intuitive Surgical, Inc.

- Johnson & Johnson

- KARL STORZ SE & Co. KG

- Medtronic plc

- Olympus Corporation

- Siemens Healthineers AG

- Smith & Nephew plc

- Stryker Corporation

- Teleflex Incorporated

- Zimmer Biomet Holdings, Inc.

Strategic Imperatives and Action Plans for Industry Leaders to Navigate Emerging Trends and Market Challenges in Lung Cancer Surgery

To stay ahead in an environment defined by rapid technological progression and geopolitical unpredictability, industry leaders must embark on several strategic initiatives. First, investing in structured training and proctorship programs will accelerate surgeon proficiency in complex robotic and uniportal techniques, thereby consolidating clinical outcomes and enhancing return on capital equipment. Second, diversifying supply chains through nearshoring and multi-sourcing agreements can mitigate the impact of tariff fluctuations while preserving quality standards. Third, fostering public–private partnerships to streamline regulatory pathways for next-generation imaging, artificial intelligence guidance, and soft robotics will sustain innovation momentum. Fourth, embracing enhanced recovery after surgery protocols and integrating multidisciplinary approaches-including interventional pulmonology and perioperative oncology-will elevate patient-centric care models. Finally, establishing real-time data sharing initiatives and outcome registries will underpin continuous improvement and strengthen value-based contracting discussions.

Illuminating the Rigorous Multi-Method Research Framework Underpinning This Lung Cancer Surgery Market Analysis

This analysis draws upon a robust, multi-method research framework designed to ensure comprehensive and accurate insights. Secondary research included an extensive review of peer-reviewed literature, regulatory databases, government statistics from agencies such as the Centers for Disease Control and Prevention and the National Cancer Institute, and industry publications. Primary research encompassed in-depth interviews with thoracic surgeons, chief procurement officers, and medical affairs executives to validate procurement dynamics and clinical adoption patterns. Quantitative data were synthesized through cross-validation of device placement metrics, tariff impact assessments, and procedure volume trends reported directly by leading manufacturers. Finally, qualitative triangulation of expert insights and case studies provided context for regional nuances and end-user requirements, ensuring that the findings reflect real-world decision-making processes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lung Cancer Surgery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lung Cancer Surgery Market, by Approach

- Lung Cancer Surgery Market, by Product Type

- Lung Cancer Surgery Market, by Cancer Type

- Lung Cancer Surgery Market, by End User

- Lung Cancer Surgery Market, by Region

- Lung Cancer Surgery Market, by Group

- Lung Cancer Surgery Market, by Country

- United States Lung Cancer Surgery Market

- China Lung Cancer Surgery Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding Insights: Synthesizing Key Findings and Implications for the Future Trajectory of Lung Cancer Surgical Practices

The evolving landscape of lung cancer surgery is characterized by the convergence of technological innovation, shifting trade policies, and dynamic regional ecosystems. Minimally invasive approaches, led by robotic-assisted platforms, are redefining surgical standards for enhanced precision and improved patient outcomes. Concurrently, changing tariff regimes underscore the importance of supply chain agility and strategic procurement decisions. Across segmentation and geography, a common thread emerges: success hinges on the ability to integrate advanced technologies with resilient operational strategies, underpinned by rigorous evidence generation and collaborative stakeholder engagement. As healthcare systems aim to optimize both clinical efficacy and economic sustainability, these insights chart a course for informed investment, adaptive planning, and patient-centered excellence in lung cancer surgical care.

Empowering Your Decision-Making: Connect with Ketan Rohom to Secure the Definitive Lung Cancer Surgery Market Research Report

Securing the insights you need to lead in lung cancer surgery starts here. To obtain the comprehensive Market Research Report that delves deeper into strategies for thriving amid evolving surgical techniques, supply chain complexities, and competitive dynamics, please contact Ketan Rohom. As Associate Director, Sales & Marketing, Ketan will guide you through tailored solutions and exclusive data packages that align with your organization’s objectives. Reach out to arrange a personalized consultation and ensure you have the definitive intelligence to inform your strategic decisions in lung cancer surgical innovation and market engagement

- How big is the Lung Cancer Surgery Market?

- What is the Lung Cancer Surgery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?