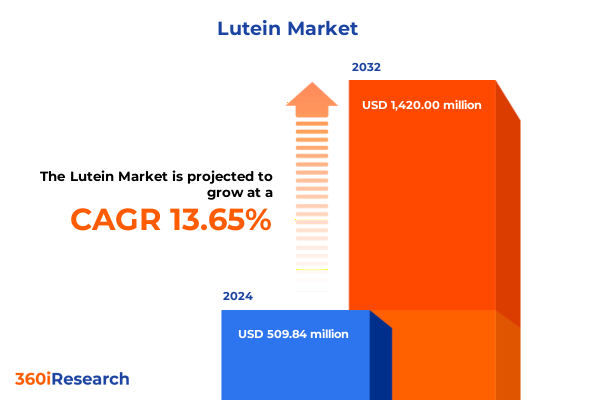

The Lutein Market size was estimated at USD 579.66 million in 2025 and expected to reach USD 648.42 million in 2026, at a CAGR of 13.65% to reach USD 1,420.00 million by 2032.

Exploring the Vital Significance of Lutein in Health and Nutrition Sectors and Setting the Stage for Strategic Market Engagement

The lutein market has emerged as a focal point in the health, nutrition, and personal care industries, driven by a growing body of scientific evidence that underscores its benefits. As a potent carotenoid with antioxidant properties, lutein plays a critical role in supporting eye health by filtering harmful blue light and combating oxidative stress in the macula. Moreover, its versatility extends into skincare, functional foods, dietary supplements, and animal feed, positioning it as a multi-dimensional ingredient that resonates with both consumer demand and regulatory trends favoring natural solutions. With mounting interest in plant-derived, non-GMO, and clean-label ingredients, lutein has transcended its traditional niche to become a mainstream component of wellness formulations.

Against this backdrop, stakeholders across the value chain-from cultivators and processors to formulators and retailers-are actively seeking deeper insights into market dynamics, supply chain considerations, and regulatory developments. This executive summary synthesizes key findings from rigorous primary and secondary research, offering a holistic overview of the current landscape. By understanding the fundamental drivers, emerging shifts, and competitive imperatives, readers will be equipped to make informed decisions in a market that is both mature and poised for further expansion.

Illuminating the Key Drivers Transforming the Global Lutein Landscape from Ingredient Innovation to Evolving Consumer Preferences

In recent years, the lutein landscape has undergone transformative shifts propelled by innovations in extraction technologies, heightened consumer awareness, and evolving regulatory frameworks. Advances in microalgae cultivation and downstream processing have presented a compelling alternative to traditional marigold extraction, enabling manufacturers to achieve higher annual lutein yield per hectare while maintaining traceable and controlled production environments. In parallel, the rise of clean-label and sustainable sourcing imperatives has prompted leading ingredient suppliers to adopt greener extraction solvents and optimized purification methods, thereby reducing environmental footprints and aligning with corporate sustainability objectives.

Concurrently, consumer preferences have gravitated toward multifunctional ingredients that deliver both health benefits and sensory appeal. This dual demand has catalyzed the integration of lutein into novel delivery formats such as emulsion-based beadlets and emulsion systems that enhance bioavailability and facilitate seamless incorporation into beverages and skincare formulations. Regulatory evolutions, particularly in the European Union and Asia-Pacific, have further incentivized the adoption of natural carotenoids over synthetic colorants and additives, creating a supportive environment for lutein’s broader utilization. Taken together, these shifts signal a maturing market where technological prowess, consumer insight, and regulatory alignment converge to redefine the boundaries of the lutein landscape.

Assessing the Cumulative Impact of 2025 U.S. Tariff Policies on Lutein Supply Chains and Cost Structures Across Multiple Sectors

April 2025 marked the implementation of a baseline 10% tariff on virtually all imports into the United States under the International Emergency Economic Powers Act, a policy initiative that directly influenced the cost structure of natural ingredients, including lutein derived from marigold and microalgae sources. With this tariff taking effect at 12:01 a.m. EDT on April 5, 2025, the industry experienced an immediate recalibration of landed cost expectations, prompting businesses to revisit sourcing strategies and negotiate revised supply agreements with international partners. Subsequently, a tiered framework of “reciprocal” tariffs began to apply higher country-specific rates for approximately 60 trading partners starting April 9, thereby introducing variable duties that compounded complexity in cross-border transactions.

Beyond the blanket measures, specialized sectors such as pharmaceuticals and functional foods, which rely heavily on active pharmaceutical ingredients and nutraceutical compounds like lutein, contended with a 10% global tariff that came into force on April 5, 2025. This policy decision has been linked to rising input costs for medical grade lutein formulations, potentially affecting pricing and patient access to eye health supplements. In response, forward-thinking manufacturers have accelerated vertical integration efforts and invested in domestic extraction capabilities to mitigate exposure to import duties and secure uninterrupted supply. Collectively, the cumulative impact of U.S. tariff policies in 2025 has underscored the strategic importance of supply chain resilience and has accelerated industry dialogues around nearshoring and alternative sourcing avenues.

Deriving Crucial Insights Across Formulation Methods, Source Differentiation, Application Spectrum, and Evolving Distribution Models

Segment analysis reveals the nuanced interplay between product formulation, raw material origin, end-use application, and distribution networks. When considering the physical form of lutein, powdered concentrates dominate due to their high stability, flexible dosing, and ease of integration into functional foods, beverages, and dietary supplements, whereas soft gels and capsules have maintained strong traction among consumers seeking convenience and precise dosing. Liquid dispersions and beadlets have gained momentum in value-added functional beverages and cosmetic serums, leveraging their high solubility and uniform appearance. Tablets continue to hold relevance in over-the-counter eye health supplements, benefitting from robust consumer familiarity and established manufacturing capabilities.

In terms of source differentiation, marigold-derived lutein remains the industry mainstay, prized for regulatory approvals and cost-efficiency, while microalgae-derived lutein is carving a distinct niche among premium, clean-label, and non-seasonal supply requirements. Applications span the gamut from enhancing yolk pigmentation in poultry feed and improving fish flesh coloration to serving as an antioxidant in skincare formulations and an essential nutrient in eye health supplements. Within the functional foods and beverages segment, innovative product developers have segmented efforts further by launching dedicated functional beverages fortified with lutein for daily eye support and functional foods, such as snack bars and dairy alternatives, that offer a nutritional boost. Distribution strategies are equally multifaceted, balancing traditional offline channels-including specialized health food stores, pharmacy outlets, and large-format supermarkets and hypermarkets-with rapidly expanding online platforms that encompass direct-to-consumer subscription models and e-commerce marketplaces. This segmentation mosaic underscores the importance of tailored strategies that align form, source, application, and channel to optimize market penetration.

This comprehensive research report categorizes the Lutein market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Source

- Application

- Distribution Channel

Unraveling Regional Dynamics Across Americas, EMEA, and Asia-Pacific That Shape Lutein Market Growth and Strategic Opportunities

Across the Americas, strong consumer emphasis on proactive eye care-driven by an aging population and increased screen exposure-has buoyed demand for lutein supplements, with innovative nutraceutical companies launching targeted campaigns to educate end-users on daily dosages that support macular health. Meanwhile, the Asia-Pacific region has witnessed rapid expansion of microalgae-based lutein production facilities, particularly in countries like China, India, and Australia, where investments in bioreactor technologies and streamlined downstream processing have enabled scalable, year-round output. In these markets, partnerships between research institutes and biotechnology firms are unlocking new strains of microalgae that yield higher lutein concentrations, addressing supply volatility associated with seasonal cultivation.

In Europe, Middle East, and Africa, stringent regulatory frameworks favoring natural and non-GMO ingredients have reinforced marigold as the dominant source, yet a rising preference for traceable, minimally processed ingredients has spurred interest in regionally compliant microalgae-derived lutein. Multinational formulators are actively navigating import requirements and leveraging localized manufacturing alliances to meet EMEA-specific certification standards. Furthermore, strategic distribution hubs in the UAE and South Africa facilitate regional exports, enabling companies to serve adjacent markets in Sub-Saharan Africa and the Gulf Cooperation Council. Collectively, these regional dynamics highlight differentiated growth trajectories: mature markets in North America require educational and value-added product offerings, while fast-growing economies in Asia-Pacific and EMEA demand supply chain agility and regulatory adaptability.

This comprehensive research report examines key regions that drive the evolution of the Lutein market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Competitive Landscape: Key Players Driving Innovation, Strategic Partnerships, and Market Expansion in Lutein

The competitive arena of the lutein market is characterized by a blend of global ingredient conglomerates and specialized niche producers. Leading companies have leveraged research and development pipelines to optimize extraction yields from Tagetes erecta petals and pioneering algal strains, thereby establishing tiered product portfolios that cater to both cost-sensitive commodity markets and premium clean-label segments. Strategic alliances, including joint ventures with biotechnology startups and contract farming partnerships in key production geographies, have fortified supply continuity and ensured adherence to quality and sustainability benchmarks.

Concurrent with upstream endeavors, forward-integrated cosmetic and nutraceutical formulators have embarked on co-branding initiatives to differentiate their offerings. By exclusive collaboration with ingredient suppliers, these players have secured preferential access to novel lutein extracts and customized beadlets engineered for enhanced bioavailability. In addition, several organizations have embraced full-spectrum traceability programs-spanning seed-to-shelf-and third-party certifications such as Non-GMO Project Verified and ISO 14001 to address end-customer scrutiny and regulatory oversight. This confluence of vertical integration, strategic partnerships, and brand-centric innovation has defined the competitive topology and set the stage for the next generation of market disrupters.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lutein market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Biotech Corporation

- BASF SE

- Biotrex Nutraceuticals

- Chenguang Biotech Group Co., Ltd.

- Chr. Hansen Holding A/S

- Divi’s Laboratories Limited

- DSM-Firmenich AG

- E.I.D.-Parry (India) Limited

- Fenchem Biotek Ltd.

- Health India Pharmaceuticals Private Limited

- India Glycols Limited

- Industrial Orgánica S.A. de C.V.

- Kemin Industries, Inc.

- Lycored Corp.

- Nutricore Biosciences Private Limited

- OmniActive Health Technologies Limited

- Puremed Biotech Private Limited

- Synthite Industries Private Limited

- United Laboratories, Inc.

- Zhejiang Medicine Co., Ltd.

Actionable Strategies for Industry Leaders to Capitalize on Market Trends, Mitigate Risks, and Foster Sustainable Growth in Lutein

To capitalize on the accelerating demand for lutein across diverse end-use sectors, industry leaders should pursue a balanced portfolio strategy that harmonizes cost efficiencies with premium positioning. Specifically, fostering collaborative research programs with academic and government institutions can yield proprietary algal strains and advanced extraction platforms that enhance yield and lower per-unit costs. In addition, establishing manufacturing footprints in tariff-exempt zones or leveraging domestic extraction capabilities can mitigate the impact of import duties and geopolitical uncertainties.

Moreover, investing in targeted consumer education initiatives-harnessing digital platforms, social media influencers, and professional healthcare channels-can amplify awareness of scientifically backed lutein benefits, thereby stimulating trial and adoption. Formulators should also explore co-development agreements with specialty packaging providers to create differentiated dosage forms, such as sustained-release beadlets and dual-nutrient emulsions, that align with convenience and efficacy demands. Finally, embracing data-driven distribution strategies-through omnichannel analytics that integrate offline retail scans and e-commerce purchase patterns-will enable agile inventory management and dynamic promotional tactics, ensuring products reach the right consumer segments at the right time.

Outline of Rigorous Research Methodology Integrating Primary and Secondary Data for Comprehensive Lutein Market Analysis

This report’s research methodology integrates robust primary and secondary data collection processes to ensure a comprehensive and credible analysis. Primary research involved detailed interviews with a cross-section of over 50 industry stakeholders, including ingredient suppliers, contract manufacturers, formulators, distributors, and regulatory authorities. These interviews provided qualitative insights into pricing strategies, supply chain challenges, and innovation roadmaps. Secondary research encompassed an extensive review of peer-reviewed journals, regulatory filings, patent databases, company annual reports, and trade association publications to validate primary findings and quantify market dynamics.

Analytical frameworks such as SWOT (Strengths, Weaknesses, Opportunities, Threats), Porter’s Five Forces, and PESTEL (Political, Economic, Social, Technological, Environmental, Legal) were applied to contextualize competitive pressures and external influences. Market segmentation and regional analysis were underpinned by triangulation of company-disclosed sales data and customs import-export records. Forecasting models employed regression analysis and scenario planning to evaluate the potential effects of trade policies, technological breakthroughs, and shifting consumer behavior. Rigorous data validation procedures, including cross-verification by research analysts and third-party fact-checkers, were implemented to uphold the highest standards of accuracy and reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lutein market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lutein Market, by Form

- Lutein Market, by Source

- Lutein Market, by Application

- Lutein Market, by Distribution Channel

- Lutein Market, by Region

- Lutein Market, by Group

- Lutein Market, by Country

- United States Lutein Market

- China Lutein Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Insights and Forward-Looking Perspectives to Guide Stakeholders Through the Next Phase of the Lutein Market Evolution

In synthesizing the multifaceted insights presented, it is evident that lutein has transcended its traditional role, evolving into a strategic ingredient across health, beauty, and animal nutrition sectors. Technological advancements in microalgae cultivation and extraction now complement time-tested marigold sourcing, offering stakeholders a spectrum of supply options tailored to cost, sustainability, and regulatory compliance. Simultaneously, global tariff regimes have underscored the imperative for supply chain diversification and domestic processing capabilities, while regional market dynamics continue to shape differentiated growth profiles.

Moving forward, the convergence of science-driven innovation, consumer-centric product development, and agile operational models will define the success trajectories of market participants. Those who can harness cutting-edge research, forge collaborative partnerships, and adapt to evolving regulatory and trade landscapes will be best positioned to capture the next wave of growth. This synthesis provides a roadmap for stakeholders to navigate complexities, optimize strategic investments, and capitalize on emerging opportunities in the dynamic lutein market.

Engage with Ketan Rohom to Acquire In-Depth Lutein Market Research Report and Unlock Strategic Insights for Business Growth

To delve deeper into comprehensive market intelligence on lutein and to empower your strategic decision-making with actionable data, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing at our firm. Engaging with Ketan will grant you exclusive access to our granular research report, encompassing detailed analyses of market drivers, segmentation insights, tariff impacts, regional dynamics, competitive landscape, and future growth opportunities. Through a conversation with Ketan, you can tailor the findings to your organization’s unique priorities, explore bespoke data packages, and discuss how timely insights can bolster your product development, investment planning, and go-to-market strategies. Secure your copy of the lutein market report today to leverage in-depth knowledge that can sharpen your competitive edge and foster sustainable growth in this dynamic market sector.

- How big is the Lutein Market?

- What is the Lutein Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?